Bill Pugliano/Getty Images News

A Simple Idea, A Generational Company

What makes Apple (NASDAQ:AAPL) a generational and untouchable company is not its marketing, management, or even brand, but its craftsmanship. When Apple’s founder Steve Jobs was just a teenager, his father taught him a lesson that would build an empire. While building a fence with Steve, he said:

“You’ve got to make the back of the fence, that nobody will see, just as good looking as the front of the fence. Even though nobody will see it, you will know, and that will show that you’re dedicated to making something perfect.”

The idea stuck with Jobs, and with the culture at Apple to this very day. Whether it be an Apple phone, tablet, or computer, consumers know that it’s built to last. We have a 2010 Mac computer that works better than almost anything you could buy today, in 2022. This is how you build brand loyalty: Quality over everything.

The Thesis

Apple is a phenomenal business, and Buffett’s proclaimed that many times himself. The problem is, the price has run up too far. As Burry is short, we project returns of just 2% per annum.

Apple’s Untapped Potential

For a company as large as Apple, the phrase untapped potential may sound strange. But, we think many underestimate Apple’s future growth.

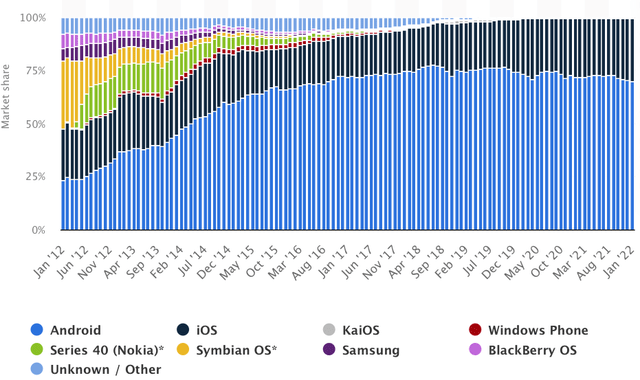

Many in North America think of Apple’s iPhone as the dominant player. But, globally, Android’s share of the smart phone market dwarfs Apple’s iOS:

Mobile Operating System Global Market Share (Statista)

Apple currently has a 29% market share vs. Android’s 70% share. But, Apple has been gaining ground on Android since 2018. Many emerging market consumers do not yet own an iPhone, which in our opinion, is the premium product.

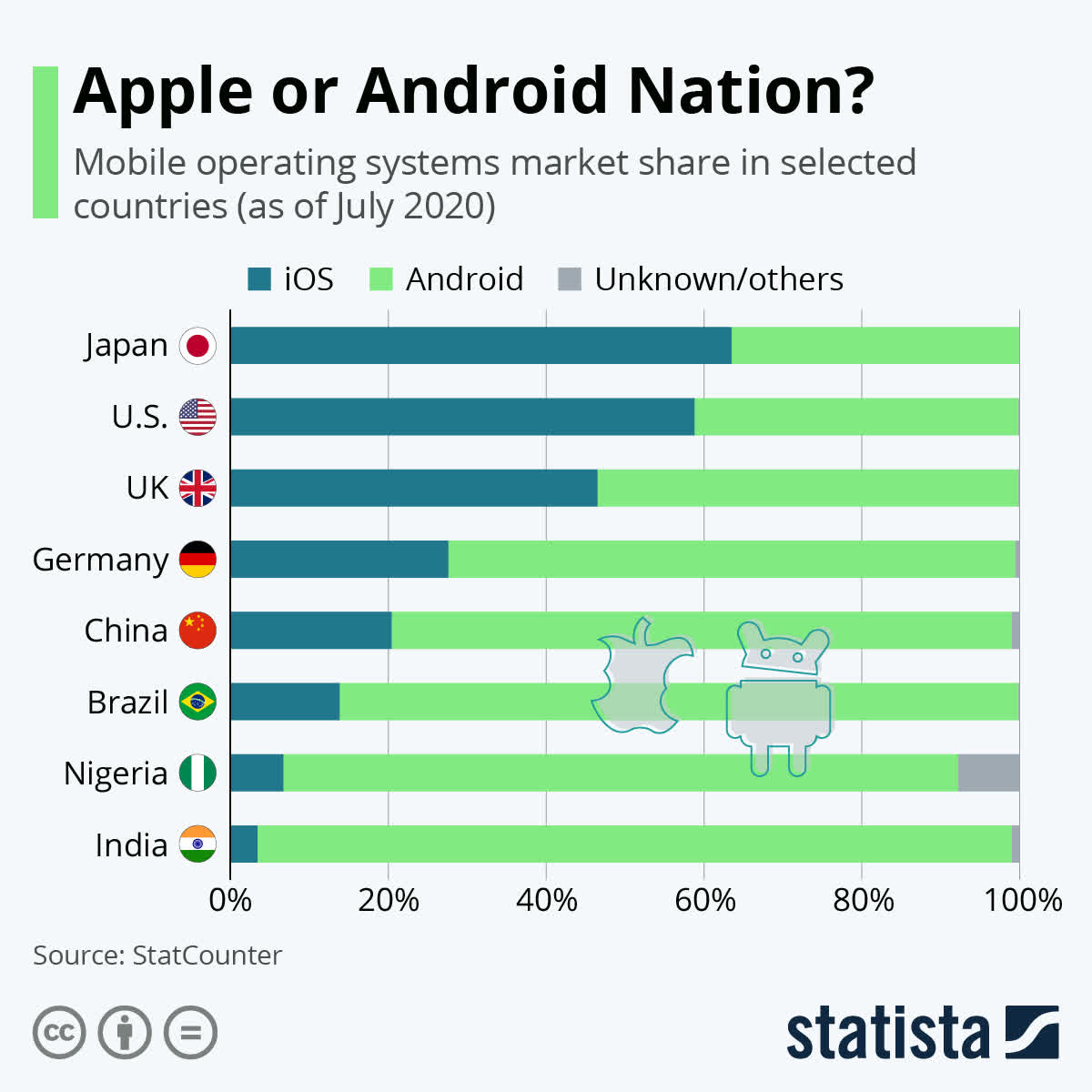

Android vs. iOS by country:

Market Share By Country (Statista)

As these emerging market consumers continue to scale their wealth at a rapid pace, we expect more and more consumers to gravitate towards the premium product, benefiting Apple.

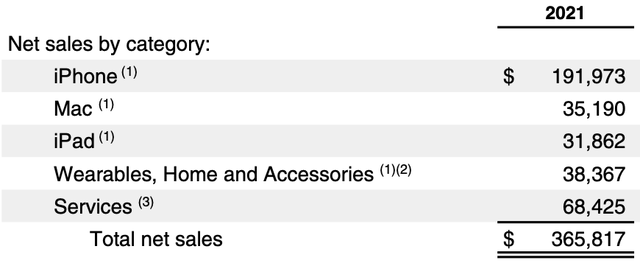

As you can see, iPhone makes up 52% of Apple’s sales, and, there’s more room to grow. Mac, iPad, and Services will also grow over time as long as Apple maintains its position as the premium product.

Apple Pay (PYMNTS.com)

Apple’s fastest growing category is “Wearables, Home and Accessories,” which has been growing at a clip North of 20% per annum on the back of new innovations like AirPods, Apple TV, and Apple Watch. Apple’s entrance into the television market has scary potential. Over time, smart TV’s could develop App Store like profitability as they are the gatekeeper for apps like Netflix (NFLX), Disney+, and YouTube. There are still too many players in the smart TV arena, but there could be huge rewards for the winners. Apple faces competition in this area from Amazon (AMZN) Fire TV, Google (GOOG) (GOOGL) Chromecast, and Roku (ROKU).

The Bear Case

The Macro

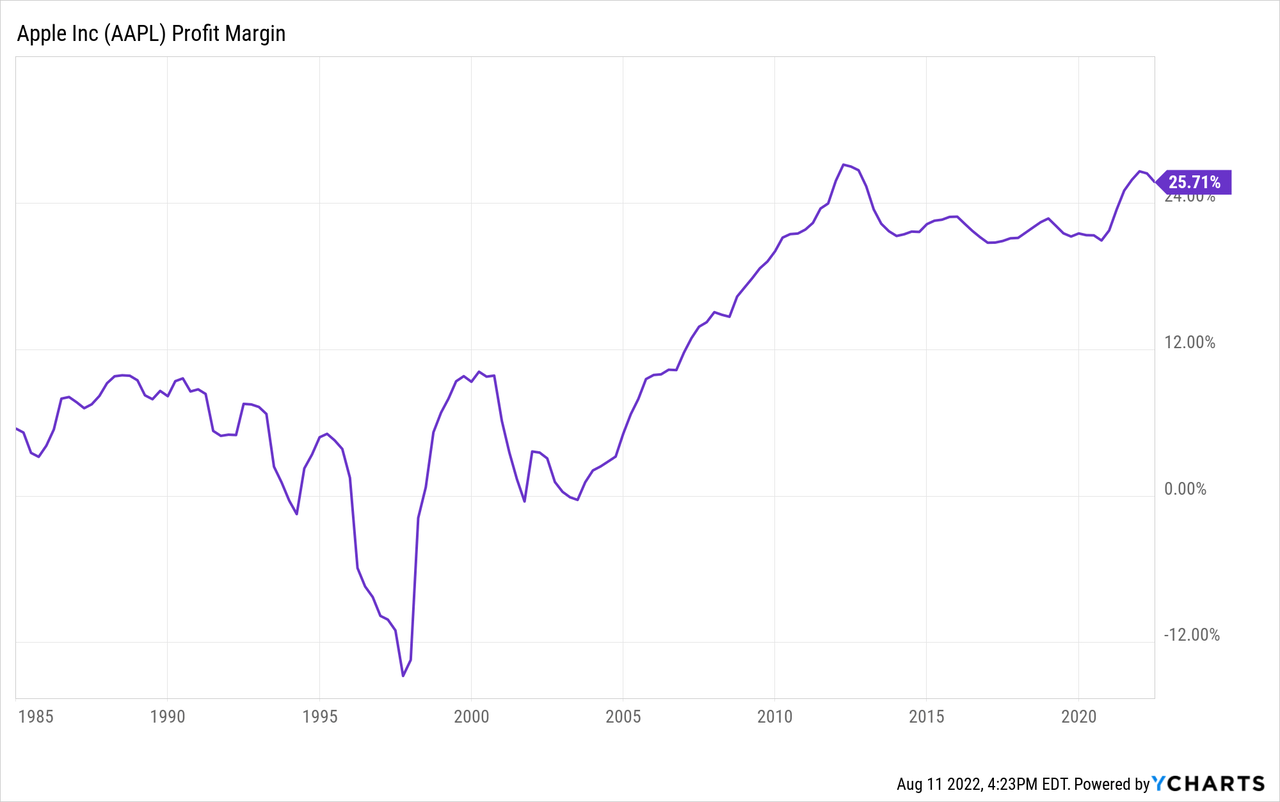

Michael Burry is extraordinarily bearish on the S&P 500, and we can see why. The index has a price to book, price to sales, and CAPE ratio all reminiscent of the Dot Com bubble of 2000. Apple is the largest component of the index and is benefiting from record low unemployment in the U.S., 2020 and 2021 stimulus, low corporate taxes, and record profit margins:

If funds flow out of the S&P 500, they’re likely to flow out of Apple as well.

In the meantime, U.S. and China tensions are on the rise around Taiwan. China’s military encircled the island of Taiwan, causing the Taiwanese to say it was practice for invasion. Taiwan houses Apple’s most important partner, TSMC. The Information reported:

“Taiwan Semiconductor Manufacturing Co. [TSMC] has become one of Apple’s most crucial technology partners, producing the cutting-edge chips that are the brains behind iPhones, iPads and now Macs.”

On the invasion of Ukraine, U.S. companies pulled their businesses out of Russia. 21% of Apple’s operating income comes from China, and Apple’s iPhones are assembled in the country.

Lastly, Apple has such a dominant market position that it has a huge target on its back from governments and regulators around the world. There’s essentially nothing that can hold back monopolistic companies like Apple and Google aside from government regulation. This is a risk that has been quietly growing for large cap tech.

The Micro

From a micro standpoint, Apple needs to maintain its culture of craftsmanship and adapt to changes in consumer taste. Many technology companies such as General Electric (GE), Nokia (NOK), GoPro (GPRO), and Panasonic (OTCPK:PCRFY) have deteriorated over the years. So far, we see no deterioration for Apple.

Our Valuation

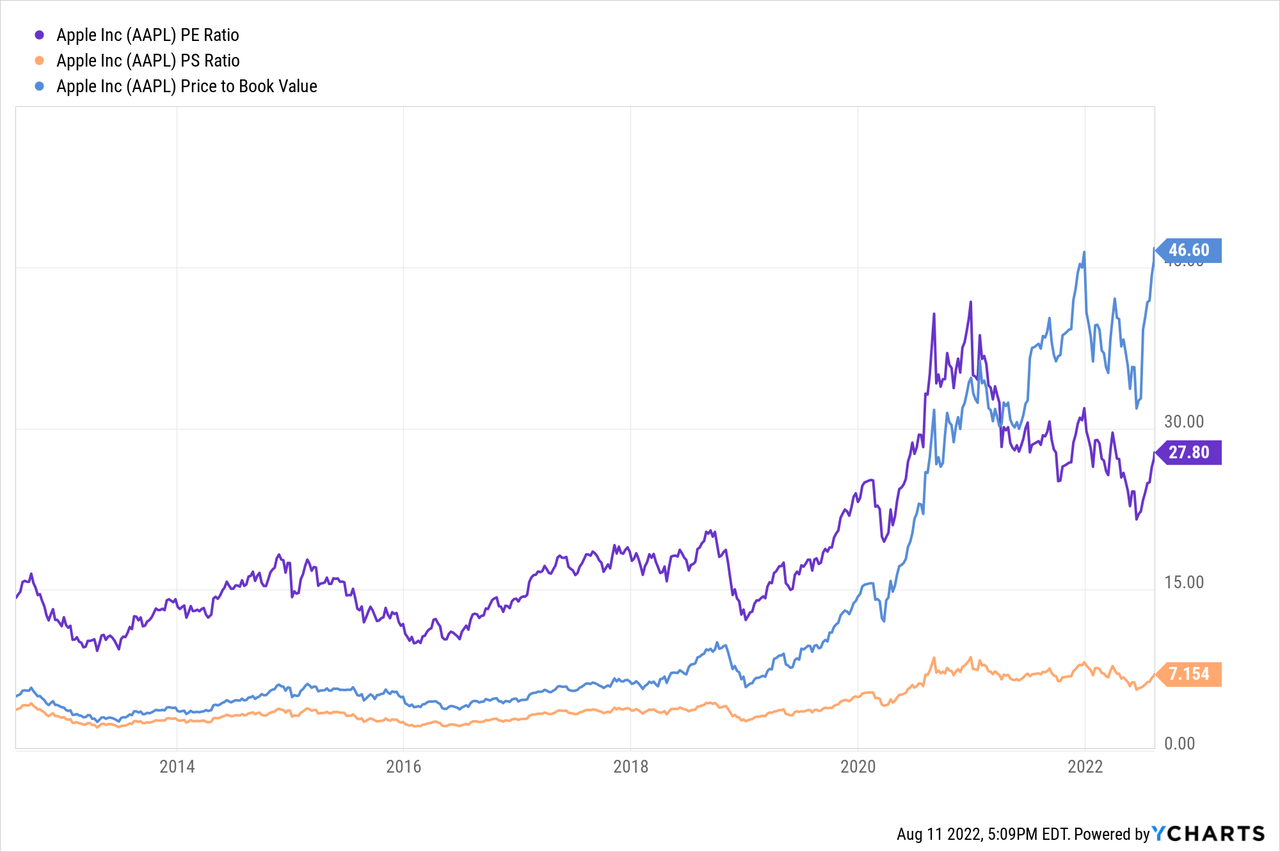

Apple’s Become More Expensive Over The Years:

As the valuation stretches, so does the risk for Apple shareholders.

Here’s how fast Apple’s product categories have grown of late:

| Product Line | Revenue (2021) | Per Annum Growth Rate | Revenue (2017) |

| iPhone | $191.973 billion | 8.3% | $139.337 billion |

| Mac | $35.190 billion | 8.3% | $25.569 billion |

| iPad | $31.862 billion | 14% | $18.802 billion |

| Wearables | $38.367 billion | 31.5% | $12.826 billion |

| Services | $68.425 billion | 20.3% | $32.700 billion |

| Total | $365.817 billion | 12.4% | $229.234 billion |

We believe recent revenue growth is exaggerated due to a hot economy and the effects of COVID-19 lockdowns. With many staying at home, awash with stimulus cash, sales for personal devices went through the roof. Consumers are likely to spend more on experiences and necessities in the years ahead, and less on Apple products. Once you buy a new iPad, Mac, Apple TV, or iPhone, you don’t need another for at least a couple years. Global smart phone sales are projected to grow at 7.4% through to 2030.

Our 2032 price target for Apple is $200 per share, indicating returns of 2% per annum with dividends reinvested.

- We think Apple can grow its revenue at 8% per annum, reaching $837 billion in sales by 2032. Given the myriad of Macro risks, we’ve assigned a net margin of 20%, resulting in 2032 net income of $167.4 billion. Apple has favorable economics and should be able to buy back shares at 2.5% per annum. This gives you 2032 earnings of $13.34 per share. We’ve assigned a terminal multiple of 15.

Conclusion

We side with Burry when it comes to Apple. Founded by Steve Jobs on a simple principle, Apple may be the best business in the world. With an enormous brand and emerging market tailwinds, this isn’t a bet against the business itself. But, with prospective returns of 2% per annum, we have a “strong sell” rating on the shares. If Buffett could sell without influencing the price or paying taxes, we believe he would. Would you?

Be the first to comment