Sundry Photography

Software stocks have been absolutely obliterated in 2022, both from slowing growth expectations, as well as highly compressed multiples. The threat of a prolonged recession and higher rates is a nasty combination for growth stocks, and it has cost shareholders dearly this year.

However, conditions such as these do create value for those willing to take the risk, and one such stock I find attractive today is Unity (NYSE:U). The company is involved in a three-way merger/acquisition mess at the moment, but on its own, I see Unity as having a very favorable risk/reward for the bulls.

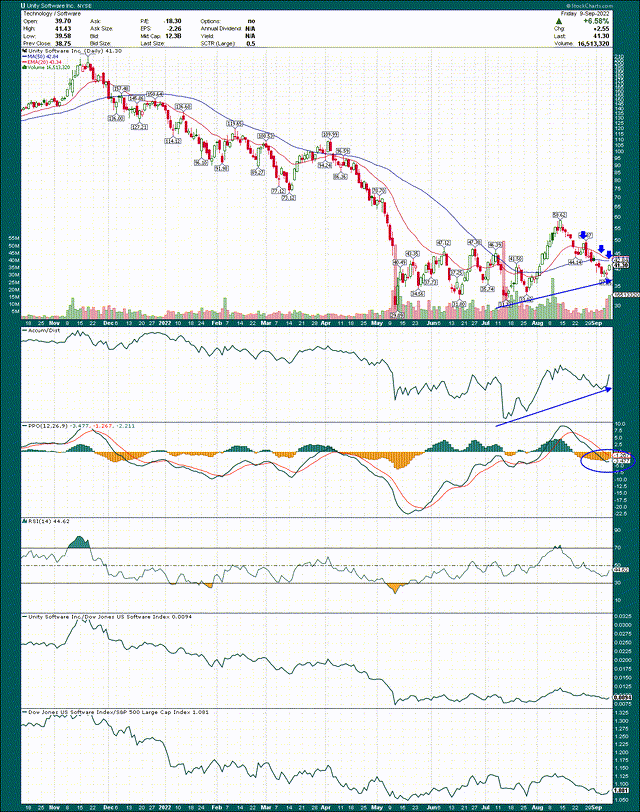

The stock made a higher low in July, the first clue that the worst was over for Unity. It then rocketed from $33 to $58 in a straight line, but has since pulled back. The stock bottomed a few days ago at $38, and finished a very nice Friday last week at $41.

All this whipsaw means shares are below the key 20-day exponential moving average and 50-day simple moving average, and those levels loom just overhead. They are both in the same area as well at $43, so that may prove to be a temporary headwind. However, so long as the next pullback ends above the $38 low set a few days ago, Unity is still in its next uptrend.

The accumulation/distribution line is moving higher nicely as the stock rallies, which means there’s intraday buying. That’s a good sign because investors are adding on weakness rather than selling on strength.

The PPO looks good as well, and while I would have liked to have seen the PPO bottom on the centerline, it is in the process of turning higher. The PPO shows the stock was way overbought and needed to come down, but come down it has and I see this indicator as another feather in the cap of the bulls at the moment.

I’ve shown relative strength in the bottom two panels only to show that, well, there is no relative strength. Software, in general, has been awful and Unity is keeping pace. Not a huge amount to like there so that’s one cause for caution.

On the whole, however, so long as Unity’s next pullback is to someplace higher than $38, this thing looks like it wants to go higher.

Let’s take a look at the fundamental situation to see what’s what.

Strong growth remains

I mentioned that growth stocks have had estimates trimmed all over the place in 2022, and perhaps nowhere is that more palpable than in advertising-related growth stocks. If we cast our minds back to last year, Snap (SNAP) and Meta (META) both set the stage for what was an epic decline in ad-related stocks. Unity is certainly one of those, and it has suffered along with the group. However, with the stock having fallen from $200 to $40, one could argue an enormous amount of pain is now priced in. I’m one of those that would make that argument.

Part of that optimism is because Unity does a lot more than generate ad revenue. Its platform allows creators of just about any kind to generate 2D and 3D interactive content. This can certainly be used for gaming – and is – but there are enterprise applications aplenty as well. For instance, companies that design furniture, or do interior design, or manufacture just about anything can use Unity’s technology to more efficiently design/build/run their processes. There’s an endless list of applications for Unity’s products, and it continues to diversify away from ads.

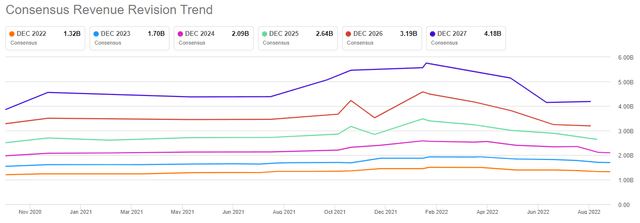

In addition, the pessimism that saw the company’s revenue estimates decline precipitously earlier this year appears to have been worked off at this point.

The out years, in particular, have leveled off, which is a great start for the stock making a bottom. When Unity was $200, estimates continued to grow and with them, the multiple shareholders were willing to pay. But when an unprofitable company sees lower growth estimates, multiples get annihilated, and that’s exactly what happened to Unity.

It’s clear the estimates we saw earlier this year were excessively high, but on this evidence, it looks like we’re at or near a bottom. Once estimates start moving higher again, this stock could move up in a hurry.

Plus, even at current estimates, analysts expect ~20% top line growth for years to come. That’s not too shabby, but you’d never know it looking at the share price chart.

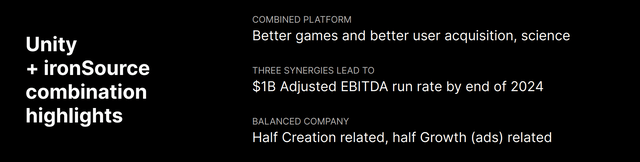

The drama surrounding the company’s proposed takeover of ironSource (IS) continues to get juicier as shareholders are set to vote in a month’s time on the takeover. AppLovin (APP), for its part, has seen its bid rejected by Unity, which is unsurprising. How it turns out is anyone’s guess, but if I had to guess, my base case is that AppLovin loses out and ironSource does indeed get acquired by Unity.

ironSource has struggled this year as well in terms of creating value for shareholders, so I’m not sure management has a huge amount of credibility with shareholders on that front. If the company is acquired, shareholders will get a premium on their shares to then hold Unity stock, which looks to my eye to have better upside potential.

That’s particularly true if Unity’s projections come to fruition. The company reckons that not only will the products be better together, but that there are significant cost savings to be had. Cost savings are something Unity could do with given it perpetually loses money, so I like the deal from that perspective. We shall see.

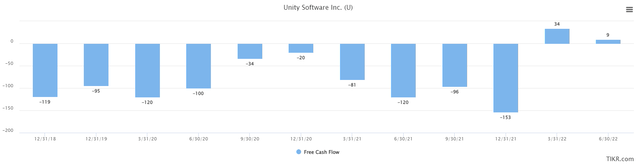

I mentioned losing money, and that generally means cash burn as well. Unity is no stranger to burning cash, as we can see with trailing-twelve months free cash flow data for the past couple of years below.

The past two quarters have seen TTM FCF just above zero, which is great. However, as Unity is investing heavily in future growth, it eventually needs to generate something on a sustainable basis because this cannot continue indefinitely. The ironSource purchase would – according to Unity management – help greatly in terms of adding revenue with the benefit of cost savings. That should theoretically keep a lid on cash burn.

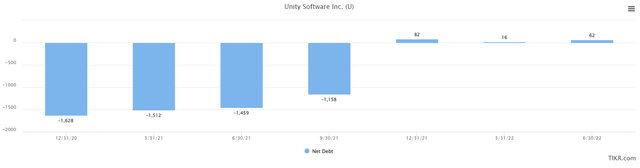

Unity has taken to issuing debt recently in order to help with this situation, which is unsurprising given its FCF history.

Net debt is essentially nothing, so there is hardly a cash crisis coming for Unity. However, I highlight this to show that Unity’s financial flexibility is suffering a bit at the moment given it has already taken a net cash position to even from issuing debt. There’s a bit more debt it can issue but that well will run dry at some point as well.

If you’re holding the stock longer-term, cash burn is probably the biggest threat to shareholders at the moment. If that’s enough to keep you out of it or not is up to you, but something we should all be aware of.

Let’s value this thing

Obviously, we cannot value Unity on its earnings because there aren’t any. However, we can value it based upon sales, so let’s do that.

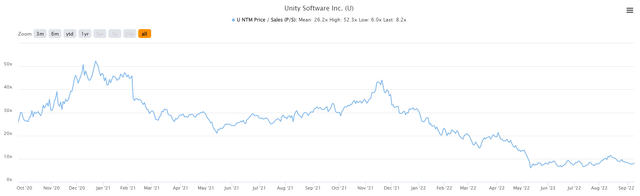

Unity’s forward P/S ratio has seen a spectacular decline from more than 50X in late-2020 to 8X today. We can argue all day about the efficacy of 50X sales but the fact is that Unity is cheaper today than just about any other period in its existence as a public company. Even if we take its average P/S multiple and cut it in half, that’s still 13X forward sales, and we are at 8X today.

Unity is still growing at 20% annually, it has a very attractive platform, and gross margins are excellent. Plus, if it can acquire ironSource and achieve its stated cost savings goals, profitability could be closer on the horizon.

At 8X sales, Unity is priced for a prolonged recession, in my view, which means the odds are firmly in favor of the bulls at this point.

If we use prudence in terms of stop losses below prior support, we can further limit risk, and that’s how I think you play this one. Current evidence suggests Unity is starting a new uptrend, and I see the fundamental picture as supportive of a higher valuation. That’s a good combination, and I’m bullish on Unity for it.

Be the first to comment