Steve Jennings/Getty Images Entertainment

Thesis

We are less than a month away from the critical shareholder vote on Unity Software Inc.’s (NYSE:U) planned merger with ironSource Ltd. (IS) to strengthen its ad tech. AppLovin’s (APP) “threat” to thwart the proposed union was rejected by Unity’s Board, even as all three players have seen their stock performance crumble in 2022.

U has collapsed nearly 30% from its post-earnings August highs, following the broad market pullback. Its momentum spike leading to its August top was a sign of caution as the market digested the optimism of these investors who chased the summer rally. Given its meaningful retracement, we believe it’s appropriate to update investors on whether the current levels are suitable to add exposure heading into the shareholder vote.

We surmise that Unity’s proposal to merge with ironSource should lift its profitability remarkably as it gains a leading ad mediation platform. However, whether the $4.4B all-stock transaction (valuing IS at 16.3x NTM EBITDA) is appropriate would likely depend on whether CEO John Riccitiello & team can deliver the synergies leading to its estimated combined $1B adjusted EBITDA run rate by the end of 2024.

Notwithstanding, the market seems ready to re-rate U moving forward, as it’s holding its recent pullback above its May/June lows. Therefore, buying sentiments could return decisively even if potential downside volatility could hamper its near-term upside as U closes in on its shareholder vote.

Accordingly, we revise our rating on U from Hold to Speculative Buy, with a price target (PT) of $55 (an implied upside of 33%).

Unity: Less Challenging Comps From H2 Could Be A Tailwind

Even without the accretion from the potential union with ironSource, management highlighted in its Q2 release that it was confident of turning the corner. Investors should recall from Unity’s Q1 malaise that saw its ad monetization underperformed significantly, impacting the performance of its Operate solutions segment.

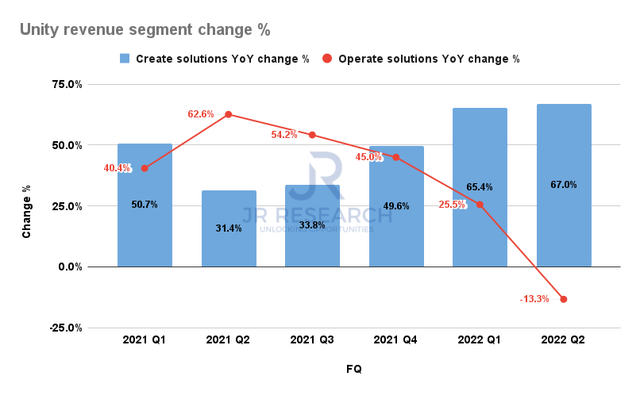

Unity revenue segment change % (S&P Cap IQ)

As seen above, its Operate segment posted a revenue decline of 13.3% in Q2, down markedly from Q1’s 25.5%. It also continued a fourth consecutive quarter of revenue growth moderation from its peak in Q2’21, consistent with the impact seen in other ad tech players. However, Unity’s ad tech problems were likely “self-inflicted,” coupled with the effects of worsening macro headwinds, and less likely due to Apple’s (AAPL) ATT framework. Stratechery also highlighted in a recent commentary:

As for ATT, both Unity and ironSource are not nearly as impacted as a company like [Meta] given that their ads are much more driven by contextual data. This is why ironSource in particular has continued to show strong growth throughout the rollout of ATT: not only is the impact less, but the opportunity to gain market share is correspondingly higher. The key thing about probabilistic targeting based on context, though, is that it very much relies on having a whole lot of data to better refine the machine learning models that place ads; this merger lets Unity and ironSource combine their data. – Stratechery

Management highlighted that it has already “fixed” its data problem and looks forward to sequential revenue acceleration moving ahead as it laps a challenging H1.

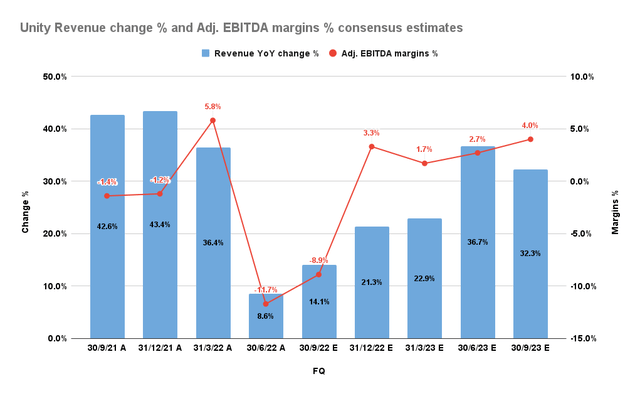

Unity revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

The consensus estimates (bullish) also concur with management’s guidance that it’s on track to improve its revenue and adjusted EBITDA sequentially from Q3.

Unity guided to a much stronger H2, which expects Q4’s revenue growth to accelerate to 21%. Hence, if Unity could execute well, its Q2 malaise could be its near-term nadir.

Hence, we believe the question facing investors now is whether they have faith in management to execute this critical turnaround as it looks to consummate its proposed merger with ironSource. Given its growth premium, we have undoubtedly lost confidence with management after its ad tech fumbles in Q1.

Therefore, if we were to add exposure, it would be predicated on a highly speculative basis, given its battered valuation and more constructive price action. As a result, we are unlikely to hold U for the long-term and would prefer to use opportunities to buy/sell or even cut potential losses short.

Stratechery was also concerned about Unity’s Weta acquisition. It questioned whether “it would be a distraction from Unity’s core business.” Barron’s also highlighted Riccitiello’s fumbles in his previous dealings, as it accentuated:

So far, Unity has offered little evidence to show that the Weta deal is paying off. The lack of deal success might also not come as a surprise to those who have followed the career of Unity CEO John Riccitiello. He joined Unity as a private company in 2014, after serving as the CEO of videogame publisher Electronic Arts (EA) from 2007 to 2013. Riccitiello made numerous deals during his tenure there that didn’t work out. EA’s stock also fell by more than 60% during his time as CEO. – Barron’s

Is U Stock A Buy, Sell, Or Hold?

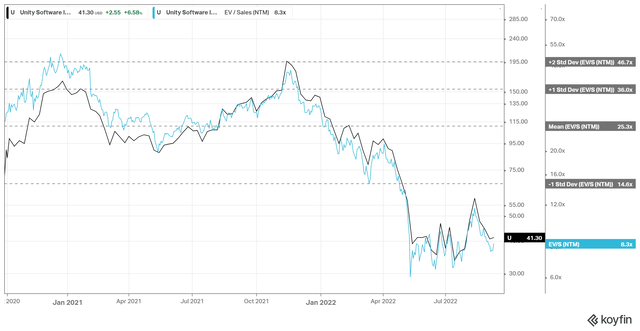

U NTM EBITDA multiples valuation trend (Koyfin)

The battering of U has sent it well below the one standard deviation zone below its NTM Revenue multiple mean, as seen above. Given Unity’s unprofitability, we believe it’s challenging to assess objectively whether U represents a considerable discount despite its battering.

Despite that, we deduce it’s constructive that the market has supported U above its June lows multiple of 6.7x revenue. Therefore, it appears that the downside volatility at the current levels seems limited if U could reaccelerate its revenue growth moving ahead.

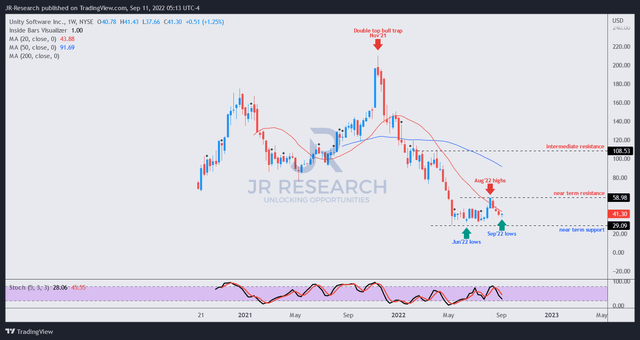

U price chart (weekly) (TradingView)

The market has robustly supported U’s May/June bottom, leading to the momentum spike that formed its August highs.

Therefore, we surmise that the consolidation zone in May/June could be an accumulation phase if U could continue to demonstrate a robust bottoming process moving ahead.

Given the meaningful pullback from its August highs, we postulate the current opportunity to add exposure in U seems appropriate from a speculative framework.

Therefore, investors are urged to consider risk management strategies if U breaks decisively below its May/June lows, which could invalidate our accumulation thesis.

Accordingly, we revise our rating on U from Hold to Speculative Buy.

Be the first to comment