AlexLMX

The earnings of Unity Bancorp, Inc. (NASDAQ:UNTY) will most probably surge this year on the back of moderately high loan growth. Further, the top line will benefit from a rising rate environment. On the other hand, inflation-driven provision expenses will restrict earnings growth. Overall, I’m expecting Unity Bancorp to report earnings of $3.66 per share for 2022, up 7% year-over-year. Compared to my last report on the company, I’ve increased my earnings estimate because I’ve revised upwards both the loan growth and margin estimates. For 2023, I’m expecting earnings to increase by a further 7% to $3.92 per share. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Unity Bancorp.

Strong Job Markets to Keep Loan Growth from Slowing Down too Much

Like many peer banks, Unity Bancorp’s loan growth during the second quarter of 2022 was exceptionally high. The portfolio grew by 5.9% during the quarter, or 24% annualized, which beat my expectations. The high growth was partly attributable to borrowers pulling their borrowing requirements to an earlier time to lock in rates before they increase too much. Such preemptive borrowing will make loan growth significantly slow down in future quarters.

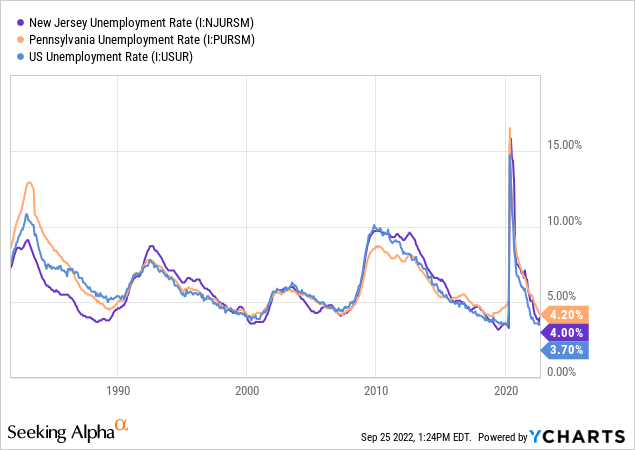

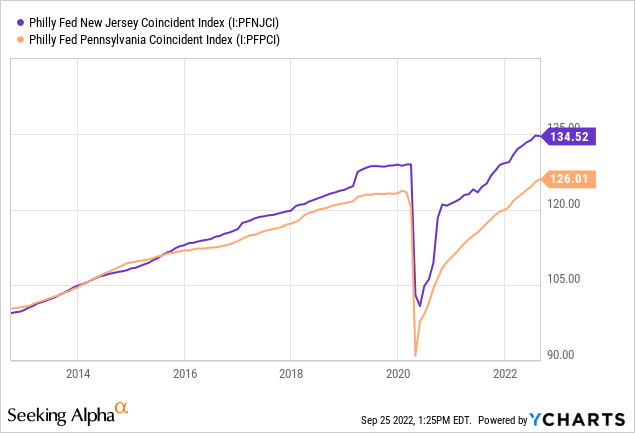

Nevertheless, I’m optimistic about loan growth because of strong job markets. Unity Bancorp serves businesses and individuals across New Jersey and some parts of Pennsylvania. Further, the loan portfolio is well diversified across segments ranging from commercial real estate loans to residential mortgages. Therefore, broad-based, state-wide economic metrics are appropriate gauges of Unity Bancorp’s product demand. The states’ unemployment rates continue to remain near record lows from a historical perspective, which bodes well for loan growth.

Further, the coincident indices show a satisfactory level of economic activity.

Considering these factors, I’m expecting the portfolio to grow by 2% every quarter till the end of 2023. This will lead to loan growth of 13.7% for 2022. In my last report on Unity Bancorp, I estimated loan growth of 11.1% for 2022. I’ve increased my loan growth estimate mostly because of the second quarter’s outstanding performance. Meanwhile, I’m expecting deposits to mostly grow in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 1,289 | 1,409 | 1,605 | 1,627 | 1,851 | 2,003 |

| Growth of Net Loans | 11.4% | 9.3% | 13.9% | 1.4% | 13.7% | 8.2% |

| Other Earning Assets | 189 | 203 | 244 | 298 | 227 | 232 |

| Deposits | 1,208 | 1,250 | 1,558 | 1,759 | 1,767 | 1,912 |

| Borrowings and Sub-Debt | 220 | 293 | 210 | 50 | 177 | 181 |

| Common equity | 138 | 161 | 174 | 206 | 239 | 276 |

| Book Value Per Share ($) | 12.7 | 14.6 | 16.1 | 19.5 | 22.3 | 25.8 |

| Tangible BVPS ($) | 12.5 | 14.4 | 15.9 | 19.4 | 22.2 | 25.6 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Margin’s Rate-Sensitivity to Fall

Unity Bancorp’s net interest margin grew by 28 basis points in the second quarter, which is higher than what I anticipated. Looking at the movement in asset yields and the cost of the funds given in the 10-Q filing, it’s apparent that the management was successful in holding down deposit costs even as interest rates increased. This success is unsustainable as the management cannot postpone passing on the impact of higher interest rates to depositors forever. If it holds the rates on deposits any longer then it will start losing its depositors to other banks. Therefore, the deposit beta (rate-sensitivity) is bound to increase in the second half of this year. As a result, I’m expecting the margin’s rate sensitivity to be lower in the third and fourth quarters of this year compared to the second quarter.

I’m expecting the Fed Funds rate to increase by 150 basis points till the end of 2023 from the current level of 3.25%. Considering these factors, I’m expecting the margin to grow by 20 basis points in the second half of 2022 and a further five basis points in 2023. Compared to my last report on Unity Bancorp, I’ve increased my margin estimate as my interest rate outlook is now more hawkish than before.

Provision Normalization Ahead

Unity Bancorp reported above-average provisioning for the second quarter of 2022, in tandem with the outstanding loan growth. Allowances were 1.27% of total loans, while non-performing loans were 0.43% of total loans at the end of June 2022. This coverage seems barely comfortable considering the prolonged high-interest-rate environment that will soon start affecting the solvency of many already-stretched borrowers. Therefore, I’m expecting inflation to pressurize provisioning for expected loan losses in the coming quarters.

However, as I’m expecting loan additions to decline from the second quarter’s level, the provisioning will also be lower than in the second quarter. Further, around 94% of the company’s loan portfolio was backed by real estate at the end of June 2022, as mentioned in the 10-Q Filing. This collateral makes the overall portfolio’s credit risk low.

Overall, I’m expecting normalized provisioning in every quarter till the end of 2023. I’m expecting the net provision expense to make up around 0.18% of total loans annualized till the end of next year, which is the same as the average for the last five years.

Expecting Earnings to Grow by 7%

The anticipated loan additions and margin expansion will drive earnings growth in the next year and a half. On the other hand, normalization of provisioning will likely restrict earnings growth. Further, earnings will suffer this year because of a decline in mortgage income from refinancing activity. Mortgage refinancing activity had been elevated in the last two years because of the interest rate cuts and is likely to return to a normal level this year.

Overall, I’m expecting Unity Bancorp to report earnings of $3.66 per share for 2022, up 7% year-over-year. For 2023, I’m expecting earnings to grow by a further 7% to $3.92 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 54 | 58 | 64 | 77 | 89 | 100 | ||||

| Provision for loan losses | 2 | 2 | 7 | 0 | 3 | 4 | ||||

| Non-interest income | 9 | 10 | 13 | 12 | 10 | 9 | ||||

| Non-interest expense | 33 | 35 | 39 | 41 | 44 | 49 | ||||

| Net income – Common Sh. | 22 | 24 | 24 | 36 | 39 | 42 | ||||

| EPS – Diluted ($) | 2.01 | 2.14 | 2.19 | 3.43 | 3.66 | 3.92 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Unity Bancorp, I estimated earnings of $3.44 per share for 2022. I’ve increased my earnings estimate mostly because I’ve revised upwards both my loan growth and margin estimates.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

High Price Upside Calls for a Buy Rating

Unity Bancorp regularly increases its dividend, usually in the second quarter of the year. Given the earnings outlook, I’m expecting the company to increase its dividend by $0.01 per share to $0.12 per share in the second quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 12% for 2023, which is close to the five-year average of 14%. Based on my dividend estimate, Unity Bancorp is offering a forward dividend yield of 1.8%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Unity Bancorp. The stock has traded at an average P/TB ratio of 1.34 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 12.5 | 14.4 | 15.9 | 19.4 | ||

| Average Market Price ($) | 22.3 | 20.9 | 15.3 | 22.8 | ||

| Historical P/TB | 1.78x | 1.45x | 0.96x | 1.18x | 1.34x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $22.2 gives a target price of $29.8 for the end of 2022. This price target implies a 15.3% upside from the September 23 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.14x | 1.24x | 1.34x | 1.44x | 1.54x |

| TBVPS – Dec 2022 ($) | 22.2 | 22.2 | 22.2 | 22.2 | 22.2 |

| Target Price ($) | 25.3 | 27.5 | 29.8 | 32.0 | 34.2 |

| Market Price ($) | 25.8 | 25.8 | 25.8 | 25.8 | 25.8 |

| Upside/(Downside) | (1.9)% | 6.7% | 15.3% | 23.9% | 32.5% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 8.6x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.01 | 2.14 | 2.19 | 3.43 | ||

| Average Market Price ($) | 22.3 | 20.9 | 15.3 | 22.8 | ||

| Historical P/E | 11.1x | 9.8x | 7.0x | 6.7x | 8.6x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.66 gives a target price of $31.5 for the end of 2022. This price target implies a 22.3% upside from the September 23 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 6.6x | 7.6x | 8.6x | 9.6x | 10.6x |

| EPS 2022 ($) | 3.66 | 3.66 | 3.66 | 3.66 | 3.66 |

| Target Price ($) | 24.2 | 27.9 | 31.5 | 35.2 | 38.9 |

| Market Price ($) | 25.8 | 25.8 | 25.8 | 25.8 | 25.8 |

| Upside/(Downside) | (6.1)% | 8.1% | 22.3% | 36.4% | 50.6% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $30.6, which implies an 18.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 20.6%. Hence, I’m maintaining a buy rating on Unity Bancorp.

Be the first to comment