Scott Olson

What to expect from Kroger’s Q2 earnings?

The Kroger Co. (NYSE:KR), a US-based retailer with long-standing expertise in food retailing, is due to announce its Q2 results on the 9th of September. KR has a fairly decent track record in beating street estimates, particularly on the bottom-line front. Indeed, if you want to consider when KR last fell short of consensus EPS estimates, you need to rewind the clock by 11 quarters, back to October 2019, when it missed EPS estimates by 4%.

Nonetheless, with regards to the upcoming Q2 results, consensus currently expects EPS of $0.7986 on revenue of $34.19bn. Compared to Q1, this would represent some improvement at the EPS level (Q2 expected growth rate of 31%, vs 22% in Q1) but a continuation of the run rate seen in Q1 (+8% annual growth).

Whilst the headlines may look encouraging, there are various nuances to consider. In Q1, management highlighted increased footfalls across their stores, but a lower number of items being billed. One can expect much of the same in Q2 as average gas prices were still somewhat elevated in the quarter (even last month, it was above $4 a gallon, and only in recent weeks has it begun to dip towards the sub $3.80 mark). This will likely have pushed customers to exploit Kroger’s fuel reward programs yet again (under a best-case scenario, Kroger’s customers could potentially save up to $1.25 per gallon), whilst curtailing their spending on other high-ticket items.

A few premium products such as Murray’s cheese, Deluxe Meal Solutions, had held up reasonably well in Q1, but I think it would be unrealistic to expect the same in Q2. Also note that some components of the Q1 sales had received a boost from events such Mother’s Day and Valentine’s Day but Kroger won’t be able to bank on this in Q2. Broadly, I suspect the company’s combo stores and price impact warehouses should see good activity, but conversely, its marketplace offerings and multi-department stores could see some slowdown.

I would expect ongoing weakness on the gross margin front (it was down by 101ps in Q1), firstly, as a greater share of fuel sales tends to weigh adversely on this metric. Secondly, considering worsening consumer dynamics across the US, you would expect a greater shift towards Kroger’s ‘Own brands’ portfolio which typically witnesses high promotions; just for some context, last year, ‘Own brands’ contributed 20% of total group sales.

Investors should also keep an eye out on the uptick of the Kroger Boost Loyalty Membership program; Kroger had piloted this last year in a few divisions but in July this year, they’d decided to expand their reach across the nation.

Steep inflation levels will continue to pressurize Kroger’s LIFO charge on an annual basis, but I’d like to believe this could slow down as we move into Q3 and Q4. For the whole year, Kroger expects to levy a LIFO charge of around $300m (vs $197m a year ago) but given that they already made allowances of $93m in Q1, it’s fair to say that the run rate may not be as high.

It would also be interesting to keep track of the level of buybacks Kroger did in Q2. Just for some perspective, in Q1 they were pretty aggressive doing around $552m of buybacks (the most for a quarter in three years), accounting for over half of the $1bn buyback program launched in late December last year.

On the cash generation front, I could be wrong, but I suspect the company may continue to face pressure here in Q2 as well (in Q1, Kroger only generated OCF of $1.1bn, half as much as it generated a year ago); in Q1, one of the major catalysts for operating cash outflow came from inventory build (-$676m of inventory related cash outflow vs +$205m of cash inflows in Q1-21). Some of this was linked to steep inflation, and some of it was linked to an easing of supply-chain-related pressures.

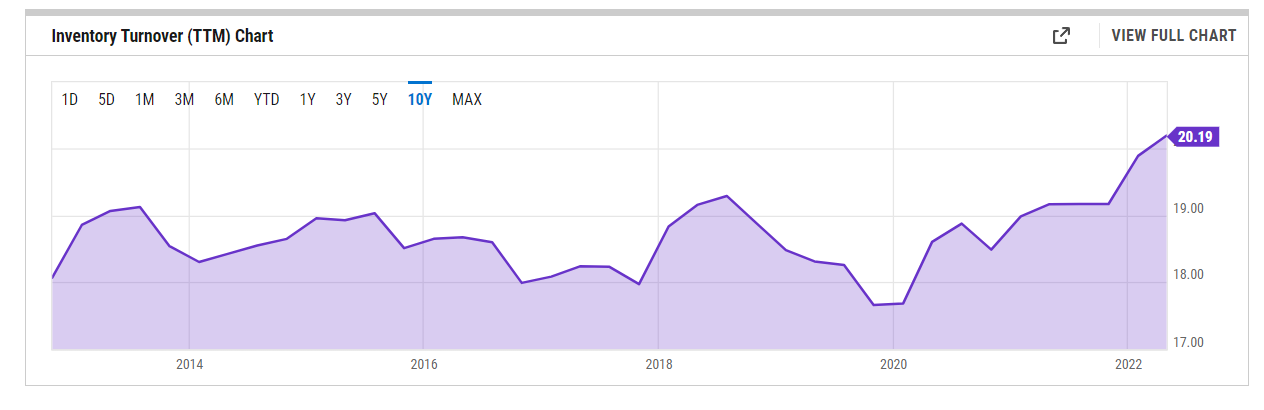

Nonetheless, it’s worth noting that the company still remains some way from getting inventories back to pre-Covid levels, and I’d like to think this will continue in Q2 as well; this is reflected in the fact that despite significant inventory build in Q1, the inventory turnover ratio is currently at 20x, a 10-decade high! We would need to see this dip to 18-19x to get to some sense of normalcy.

YCharts

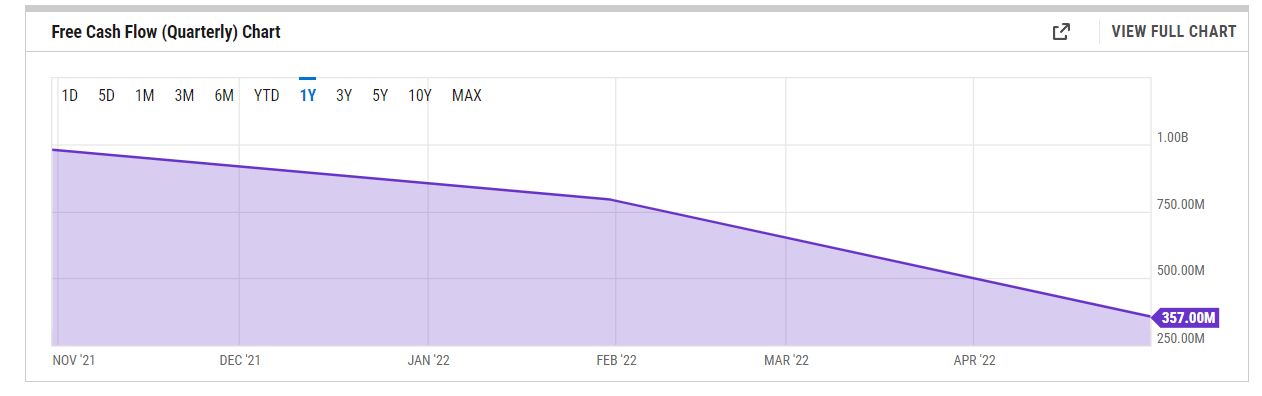

Besides inventory-related cash pressures, also consider that CAPEX spend will likely ramp up in the coming quarters; in Q1 Kroger only spent $745m towards CAPEX initiatives; if you extrapolate that figure, on an annual basis it works out to less than $3bn whereas management’s CAPEX guidance for the FY is a lot higher at $3.8-$4bn; put another way, I think it’s reasonable to expect CAPEX spend per quarter to hover near the $1bn mark over the next three quarters.

All in all, it’s worth noting that even before Q2, the FCF generated per quarter has been on a declining trend over the past three quarters, and most recently, only came in at $357m, below the typical FCF quarterly average of a little over $500m.

YCharts

Subdued FCF generation does not necessarily have to be a challenge as Kroger’s leverage levels are still well below its target range, so they can take on more debt if required; in Q1 the net debt to EBITDA ratio only stood at 1.68, well below their target of 2.3-2.5x. Besides, over the past few quarters, Kroger’s EBIT has been covering its interest expense by over 5.5x (which is better than the quarterly 5-year average of 4.4x)

Is Kroger Stock Overvalued?

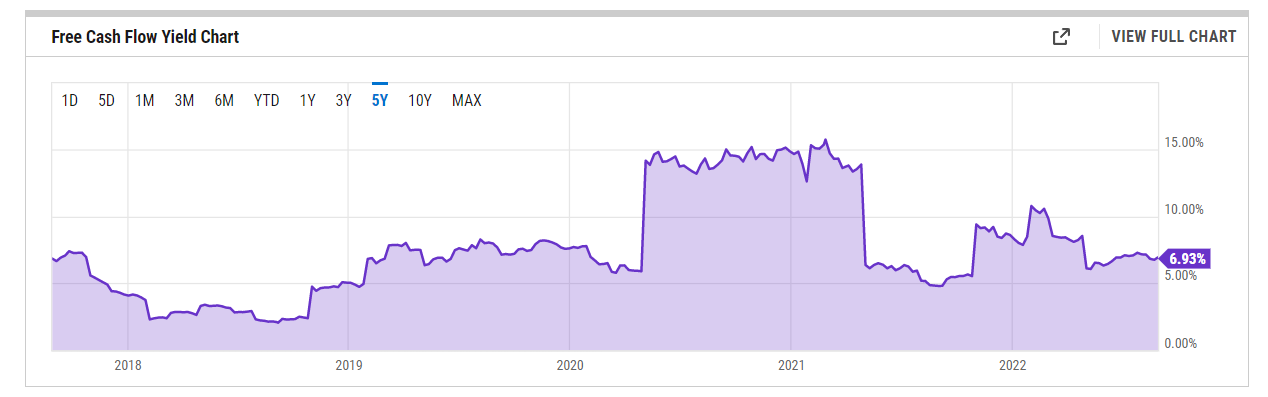

Nonetheless, Kroger’s sub-par FCF generation in recent quarters also means that at the current share price, valuations do not look too attractive from an FCF yield angle. Currently, KR stock only yields 6.93%, below its 5-year average of 7.67%.

YCharts

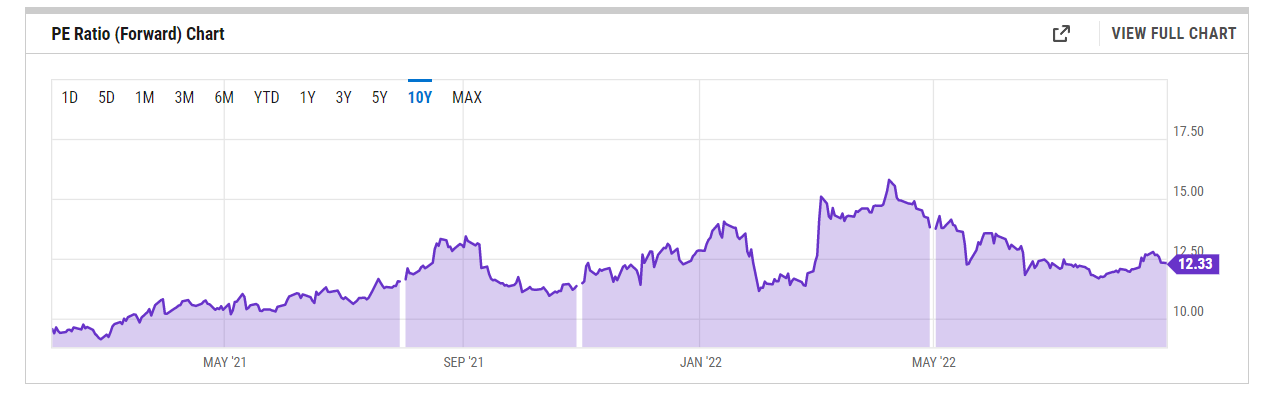

At the end of the Q1 results, Kroger’s management had scaled up their FY guidance by ~3%, lifting the EPS range from previous levels of $3.75-$3.85 to $3.85-$3.95. Consensus EPS estimates are currently only 0.5% lower than the upper end of that range at $3.931, so the potential for upside surprises isn’t a lot. Besides, at current price levels, that EPS translates to a premium forward P/E of 12.33x, which is 3% higher than the stock’s long-term average of 12x.

YCharts

Is KR Stock A Buy, Sell Or Hold?

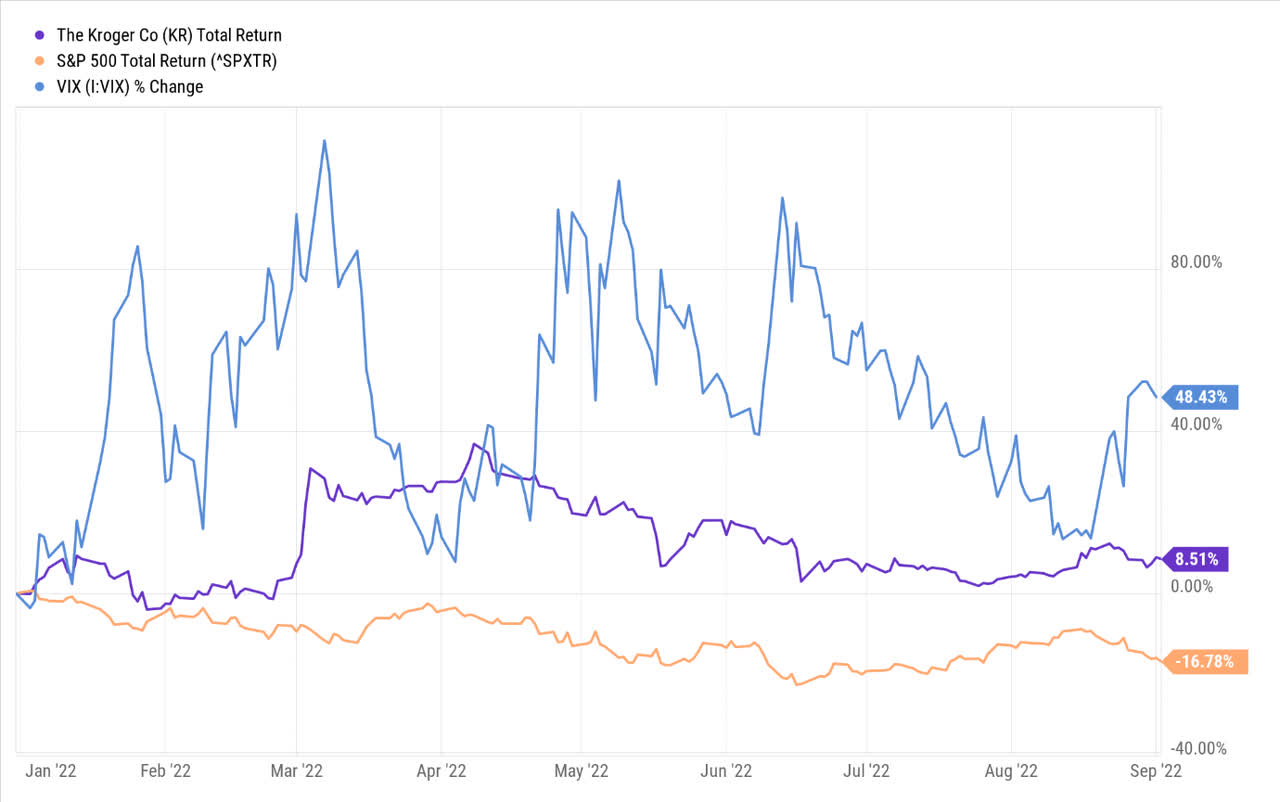

If you already own KR, well done! I can see the merit of owning a steady, defensive play such as Kroger, when the market has been hamstrung by bipolar tendencies this year; in a year when the VIX has spiked by almost 50% on a YTD basis, the KR stock’s low-beta qualities have come to the fore, delivering high single digit returns, even as the market is down by ~17%.

YCharts

Yet still, does it make great sense to rotate into KR at this juncture? I’m not convinced of that. The chart below highlights how the KR stock is positioned relative to its peers in the consumer staples space. We can see that this ratio is now trading above the mid-point for much of 2022 and does not offer great risk-reward.

StockCharts

Finally, consider Kroger’s weekly chart; in late February it appeared that the stock had broken out of its ascending channel, but that proved to be a false breakout as the entire move was sold into by mid-June. Whilst it no longer looks overextended to the upside, currently the price is trading closer to the upper boundary of the ascending channel, rather than the lower boundary, implying sub-optimal risk-reward for someone looking to get in. Those $44 levels look like a more appropriate entry point.

Investing

To conclude, whilst Kroger has some useful defensive qualities, I don’t see any great incentive in entering this stock at this juncture. Would prefer to stay on the sidelines. The KR stock is a HOLD.

Be the first to comment