sergeyryzhov/iStock via Getty Images

One of the most iconic names in the equipment rental space has got to be United Rentals (NYSE:URI). With the ability to rent a wide variety of equipment, ranging from lifts to aerial work platforms, to air compressors, and more, the company is a true one-stop shop for your traditional handyman and for the numerous businesses out there that operate in the trades space. Over the past several months, the financial performance of the company has remained strong. But fears about the broader economy have pushed the stock down rather significantly. Even so, the company has slightly outperformed the S&P 500 since I last wrote about it in December of 2021. Given the numbers that are coming out today and considering just how cheap shares are, I do think the company makes for a ‘strong buy’ prospect at this time, with the firm likely to generate returns that should exceed the broader market’s returns for the foreseeable future.

Buying the rental economy

As I mentioned already, United Rentals operates as a leading renter of equipment and other similar goods. Back in December of last year, I wrote in more detail about the enterprise, lauding how cheap shares were and finding myself impressed by the company’s robust financial performance. Ultimately, I ended up keeping my ‘buy’ rating on the company at that moment. But since then, the market has not been so kind. Shares are currently down 19.4% since the publication of that article. Though to be fair, that loss is less than the 21.2% drop experienced by the S&P 500 over the same window of time. So in a way, I would count this a small win in the grand scheme of things.

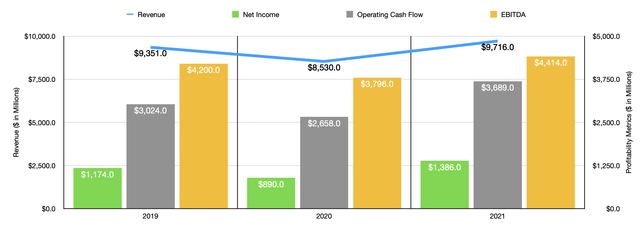

Normally, when you see a company drop as much as United Rentals has over the span of less than one year, you expect there to be some fundamental reason behind the descent. But that does not appear to be the case today. To start with, we should touch on how the company ended its 2021 fiscal year. Because after all, when I last wrote about it, we only had data covering through the third quarter of that year. For 2021 as a whole, revenue came in strong at $9.72 billion. That represents an increase of 13.9% over the $8.53 billion the firm generated in the 2020 fiscal year. From an absolute dollar perspective, the biggest contributor to this increase was the 14.9% rise the company saw in equipment rental activities. This was driven in large part by a 10.4% increase in fleet productivity as the demand for the equipment the company owns rose following the darkest days of the COVID-19 pandemic. But the company also saw improvements elsewhere, such as a 12.8% rise in the sale of rental equipment thanks to improved pricing in a strong used equipment market and because of an acquisition the company had completed.

On the bottom line, the firm also performed quite well. Net income rose from $890 million in 2020 to $1.39 billion in 2021. Operating cash flow also increased, climbing from $2.66 billion to $3.69 billion. Another profitability metric to pay attention to is EBITDA. According to management, this totaled $4.41 billion during the company’s 2021 fiscal year. That translates to a year-over-year increase of 16.3% compared to the nearly $3.80 billion generated during the 2020 fiscal year.

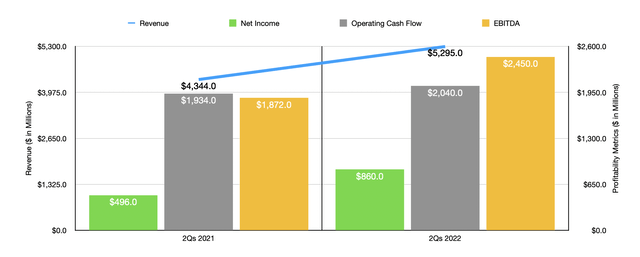

Although investors are right to worry about the near-term outlook of the economy, data presented so far has been positive. Revenue in the first half of the 2022 fiscal year, for instance, came in at nearly $5.30 billion. That’s 21.9% higher than the $4.34 billion generated at the same time one year earlier. Equipment rental revenue was particularly robust, rising by 28.2% year over year, with the second quarter alone still strong at a 26.2% increase. This surge in equipment rental revenue was driven largely by a 15% increase in pricing and by a 12% rise in fleet productivity.

With this increase in revenue, we saw yet another improvement in the company’s bottom line. Net income in the first half of the 2022 fiscal year came in strong at $860 million. That dwarfs the $496 million in revenue generated in the first half of 2021. Other profitability metrics did not rise quite as much. For instance, operating cash flow rose more modestly from $1.93 billion to $2.04 billion. Over that same window of time, EBITDA for the firm increased from $1.87 billion to $2.45 billion.

For the 2022 fiscal year in its entirety, management has pretty high hopes. They are currently forecasting revenue of between $11.4 billion and $11.7 billion. At the midpoint, that would translate to an 18.9% increase over what the company achieved in 2021. In addition to coming in strong relative to the 2021 fiscal year, it’s also higher than the previous range that management expected of between $11.1 billion and $11.5 billion. The company has also increased guidance when it comes to EBITDA, with that metric now slated to be between $5.40 billion and $5.55 billion. Previously, management said that the metric would be between 5.20 barium dollars and $5.40 billion. The firm also provided guidance when it came to operating cash flow. The current expectation for that is for a metric of between $3.85 billion and $4.25 billion. That stacks up favorably against the prior range of between $3.70 billion and $4.10 billion. The company did not provide any guidance when it came to net income. But if we assume that it will increase at a similar rate to the other two, then we should anticipate a reading of $1.52 billion.

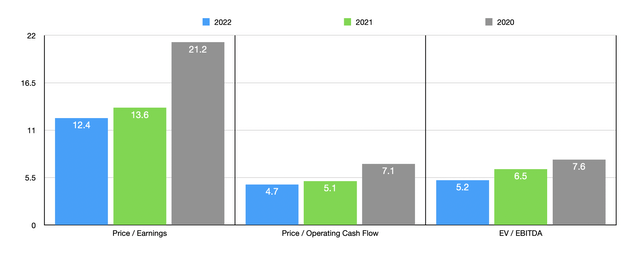

Based on these figures, United Rentals is trading at a forward price-to-earnings multiple of 12.4. The price to operating cash flow multiple is 4.7, while the EV to EBITDA multiple should be 5.2. These numbers are all lower than what the company achieved in 2021 and even lower than in 2020. Even if fundamental performance were to weaken, dropping back to what the company achieved during the pandemic, shares would still look cheap from a cash flow perspective. I also compare the company to two other renting-oriented enterprises. On a price-to-earnings basis, these firms traded at multiples of between 21.2 and 24. And using the price to operating cash flow approach, the range was between 6.4 and 8.2. Our prospect was cheaper than either of them in both scenarios. Meanwhile, using the EV to EBITDA approach, the range was between 2.8 and 7.5, with one of the two being cheaper than United Rentals.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| United Rentals | 13.6 | 5.1 | 6.5 |

| Herc Holdings (HRI) | 21.2 | 6.4 | 7.5 |

| Rent-A-Center (RCII) | 24.0 | 8.2 | 2.8 |

Takeaway

All the data available right now suggests to me that United Rentals is a quality company that continues to grow even in light of current economic concerns. Management remains adamant that the rest of this year will be robust on both the top and bottom lines. Normally, you would expect a company like this to be trading at a premium. But based on my assessment of things, the stock looks very cheap. Due to these factors, I have decided to increase my rating on the firm from a ‘buy’ to a ‘strong buy’.

Be the first to comment