Kevin Frayer

I agree with the buy rating of Seeking Alpha Quant AI has for Baidu, Inc. (NASDAQ:BIDU). This stock’s YTD return is -35.63%. BIDU is down -54.52% from my July 2017 buy recommendation. Baidu is a perfect bottom-fishing candidate because it is now trading -44.62% from its 52-week high of $171.87. This beating has made BIDU very affordable and undervalued.

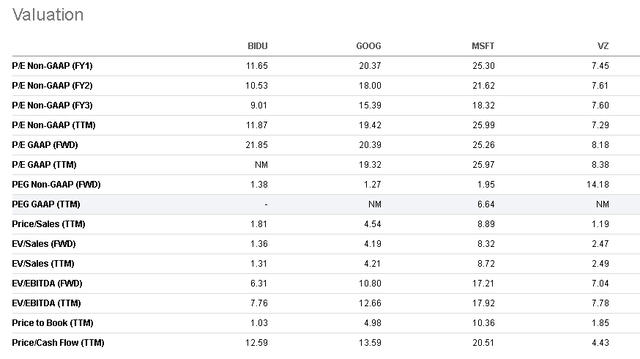

The thesis of his essay is that negative price momentum has made Baidu relatively undervalued when compared to its search engine peers, Google (GOOGL) and Microsoft (MSFT). BIDU is a buy before its November 22 FQ3 2022 earnings report. A beat on EPS and revenue might encourage my loyal readers to boost that non-GAAP 11.65x P/E valuation of BIDU. It is a bias or aberration that GOOG and MSFT have greater than 20x non-GAAP P/E.

Seeking Alpha Premium

China’s government only imposed a fine of 500,000 yuan ($70k) on Baidu last year. Google has recently lost its anti-trust EU appeal. Google will have to pay the EU-imposed penalty of $4.12 billion. The U.S. and EU cannot impose their whims on Baidu because it operates mostly in China. Consequently, the currently undervalued BIDU should be a better search engine investment than Google.

Equitable treatment should be given to BIDU when evaluating its investment quality. Just like Google’s 83.84% dominance of the global search engine business, Baidu continues to dominate China’s search engine market with more than 84% market share on all platforms. Google and Baidu do not pay dividends. They should be evaluated with near parity. The yuan spent on Baidu is as good as the U.S. dollars spent on Google search ads.

It is therefore jarring that BIDU only has a TTM Price/Sales ratio of 1.81x. Google has 4.54x and Microsoft has 8.89x. Microsoft has Windows 11 and Office 365. Going forward, Baidu’s DuerOS for smart devices and AI-infused products could eventually give BIDU a higher P/S valuation.

Baidu’s lowered P/E and P/S ratios could bounce back higher. The stock market is fickle and unpredictable. A big beat on Q3 numbers plus optimistic guidance for Q4 and F2022 could help BIDU breach $110 before 2022 is over. It is desirable for management to always issue optimistic guidance.

Brighter Days Ahead Thanks to Artificial Intelligence

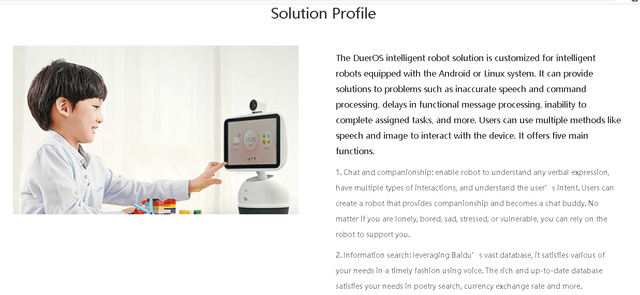

You should go long on BIDU because its DuerOS already touts many global-centric Chinese brands for most appliances, phones, and other electronic gadgets/appliances. Xiaomi, Haier, Foxconn, and TCL are multinational vendors that could boost the adoption of DuerOS outside of China.

Baidu.com

I hope this essay will encourage former BIDU bulls to consider DuerOS as Baidu’s most relevant offering inside the fast-growing $422.37 billion global artificial intelligence market. This industry touts a CAGR of 39%. AI could be the white knight for Baidu’s declining growth.

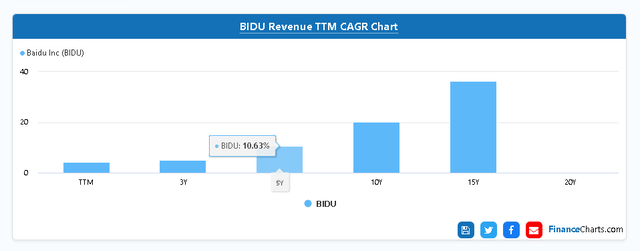

The $52.97 billion search advertising business in China is still growing at 9.6% CAGR. My fearless forecast is that AI solutions like DuerOS and Apollo Go could boost Baidu’s low 5-year average revenue CAGR of 10.63%. It is a long-term handicap for BIDU that its revenue growth rate has been declining for the past 10 years.

FinanceCharts.com

Baidu’s 4.31% TTM revenue CAGR could change for the better when the government-approved Apollo Go service gets traction in the whole of China. The Apollo Go service could be expanded outside of China. I am not sure if the United States will allow a Chinese firm to run a robo-taxi service inside its territories. I am confident that Asian and South American cities will approve Apollo Go self-driving taxis.

Go long on BIDU because there’s a future windfall from Apollo Go. The estimated market size of the global robo-taxi business is $1.7 billion. The estimated CAGR is a whopping 80.8%. Robo-taxis will generate $108 billion in revenue by 2030. Apollo Go is particularly important when you are evaluating the future valuation of Baidu.

The DuerOS is also a tailwind because it is being used inside online education platforms, robots, TV sets, speakers, rice cookers, refrigerators, smartphones, and other electronic gadgets. DuerOS is especially important because of the 22.6% CAGR of the robotics industry. Robotics revenue is estimated to grow to $214.68 billion by 2030.

Baidu.com

The 18.40% CAGR smart home appliances market is also another tailwind for Baidu. This niche market is expected to generate $123.4 billion by 2030.

Technical Indicators Are Bullish

Investors need to use technical indicators to check the general market mood. The technical trade alert for Baidu is Stochastic Overbought Buried. It is a short-term bullish signal that signifies BIDU’s fast stochastic is above 80 and has stayed above 80 for the past five trading days.

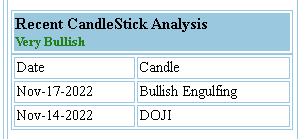

The Relative Strength Index indicator is also bullish for BIDU. Its RSI score of 52.53 is now higher than the neutral score of 50. If you believe in candlestick pattern trade alerts, BIDU had a Bullish Engulfing candle signal on November 17 and Doji on November 14.

StockTa.com

My Verdict

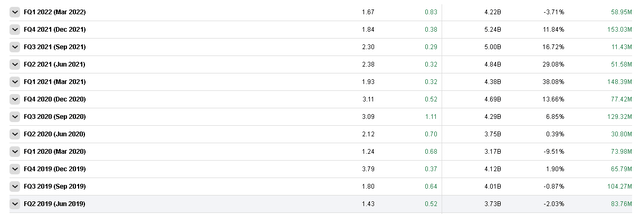

This buy thesis is my opinion. It is congruent with the buy rating of Seeking Alpha Quant AI for BIDU. Baidu is a dominant search advertising behemoth that is involved in Artificial Intelligence products. Apollo Go and DuerOS are solid catalysts for BIDU. BIDU is a buy before Q3 earnings. This company has consistently beaten EPS/revenue estimates. I will not be surprised anymore that Q3 numbers will be higher than the estimated EPS of $2.20 and $4.47 billion.

Seeking Alpha Premium

On a more prudent note, exercise caution and critical thinking. Baidu is a Chinese firm. It is a politically exposed company, or PEC. This year is almost over, and yet NASDAQ has not yet delisted BIDU. Baidu’s management could just follow the provisions of the Holding Foreign Companies Accountable Act, and everything will mostly be fine.

Based on the higher valuation ratios of Google and Microsoft, BIDU deserves a non-GAAP P/E valuation of 15x to 20x. The estimated non-GAAP for 2022 is $8.24. Multiply 15 by $8.24, and we get $126. This price target is much lower than the $173.53 average price target of more than 21 analysts for BIDU.

Be the first to comment