Ryan Fletcher/iStock Editorial via Getty Images

While the market fluctuates on travel stocks due to soaring fuel prices and recession fears, United Airlines Holdings (NASDAQ:UAL) still appears poised for substantial profit growth in the years ahead. The airlines are again in the news for cutting flights due to staffing shortages during the peak summer flying months. Regardless, my investment thesis remains ultra Bullish on the stock following the big dip despite the ongoing logic that traffic demand is set to ultimately top 2019 levels along with historical trends.

Historical Demand Trends

While revenue in the current period has suddenly topped 2019 levels, the total TSA passenger traffic is still struggling to match 90% of pre-COVID amounts. In several cases, the cut flights were an attempt by airlines like United or American Airlines (AAL) to further increase capacity.

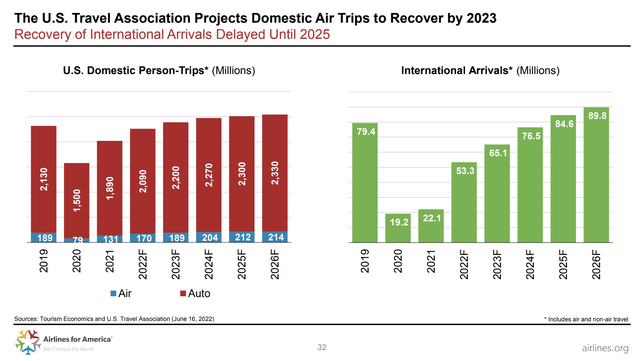

The U.S. Travel Association predicts a path to passenger traffic topping 2019 levels. U.S. domestic travel is already near the 2019 levels and international arrivals is predicted to finally reclaim the 2019 level of 79.4 million passengers by 2025. Either way, passenger traffic will soon top 2019 levels setting up the strong recovery already being witnessed via strong air fares.

The airlines are busy hiring staff to return to pre-COVID levels after so many employees took early buyout offers. The airlines are hiring 3x to 4x the monthly rate of pilots, but pilot training takes a while and the training capacity doesn’t exist to handle this many new hires at once.

According to Future and Active Pilot Advisors, airline pilot hiring through May this year reached a record 5,526 pilots. The advisors suggest close to 45,000 pilot job postings exist on JSfirm.com with the legacy passenger firms competing with corporate charters and EMS helicopter demand for pilot talent.

FAA figures predict commercial airlines plan to hire 13,000 pilots this year with only 5,020 original air transport pilot (ATP) certificates issued in 2021. The discrepancy in the numbers continue to suggest a big discrepancy exists in the available licensed pilot talent pool in comparison to the rebounding demand for travel.

The general point here is that investors should expect some volatility around flight cancellations over an extended period here. Long term, consumers have pent up demand only growing with the flight cancellations piling up, but the airlines will eventually get staffing back to 2019 levels and above.

Big Picture

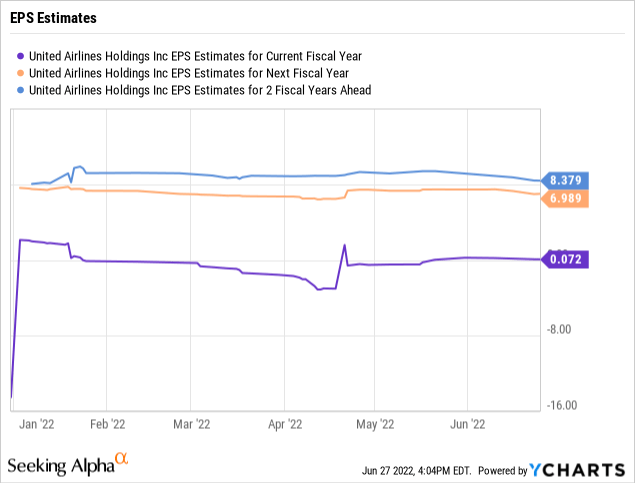

The recent weakness has pushed United Airlines all the way back down below $40 after rallying above $50 back in April following similar levels in the prior year. The moves remain odd due to the standard forecasts for the airline returning to a normalized EPS trend in the $7+ range by next year.

Management has provided indications for much higher profits questioning why the market is so disconnected with current trends. The airlines already forecasted higher revenues in comparison to 2019 levels.

Remember, the forecasted 2022 profit comes after United Airlines reported the massive Q1’22 loss of $4.24 per share. The airline forecasted a massive shift in the profit picture, but the market now wants to throw away the stock, if the summer numbers don’t meet those forecasts.

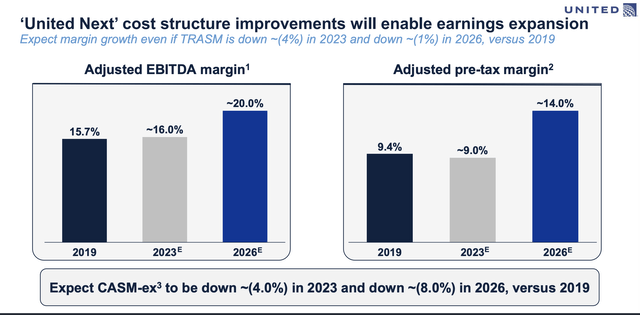

Even before these improved numbers for 2022, United Airlines has launched the Next program to produce far higher margins over the long term. The airline expects additional premium seating and improved connectively to mid-continent hubs will boost margins substantially by 2026.

The United Next plan targets adjusted pre-tax margins of ~14% leading to pre-tax income of $7 billion when revenues reach $50 billion. The airline would have earnings capacity of ~$17 per share with the current share count and a 20% effective tax rate. Though, the opportunity exists for revenue to easily surpass the $50 billion range with the current estimate for 2023 at $48.5 billion.

The amazing part is that United’s stock could double on just hitting half of this target. A 7% pre-tax margin leading to an EPS of $8.50 would be enough earnings for United Airlines to reach $75, or 9x estimates.

Of course, all of the airlines have additional risk due to potential traffic weakness from another virus scare combined with high debt levels now. A lot of the downside risks appear built into the current stock price.

Takeaway

The key investor takeaway is that United is still priced for the next virus shutdown while the airline is ready for earnings to takeoff. Investors should use the weakness to continue building a position in a stock disconnected from the reality of a business quickly headed to strong profits and cash flows.

Be the first to comment