Andrii Borodai/iStock via Getty Images

Unilever (NYSE:UL)(OTCPK:UNLYF) and Procter & Gamble (NYSE:PG) are both multinational consumer goods companies that operate in the fast-moving consumer goods (FMCG) industry. Both companies have a long history and strong reputation in the industry and offer a wide range of products, including household and personal care items, food and beverage products, and beauty and personal care products.

One key difference between Unilever and P&G is their geographic focus. Unilever has a more diverse global presence, with a significant portion of its sales coming from emerging markets such as Asia, Africa, and Latin America. In contrast, P&G has a more concentrated presence in developed markets, particularly in North America and Europe.

Both companies have been the target of the same activist investor at different times, Trian Fund Management, a hedge fund founded by Nelson Peltz. Trian acquired a significant stake in P&G and Nelson Peltz joined P&G’s board in March 2018, following what was then the most expensive proxy fight in US history. Trian argued that P&G’s portfolio was too broad and that the company needed to streamline its operations and focus on its core brands. There was also a strong focus in reducing bureaucracy at the company. Judging by the excellent performance P&G has delivered since then, it appears the changes were necessary and the activist campaign successful.

After turning P&G around, and selling most of his stake in the company, Nelson Peltz recently turned his attention to Unilever, where he is pushing for similar changes, including strategies to reinvigorate growth. It is therefore very likely that Unilever shareholders will now benefit from the business transformation driven by Trian.

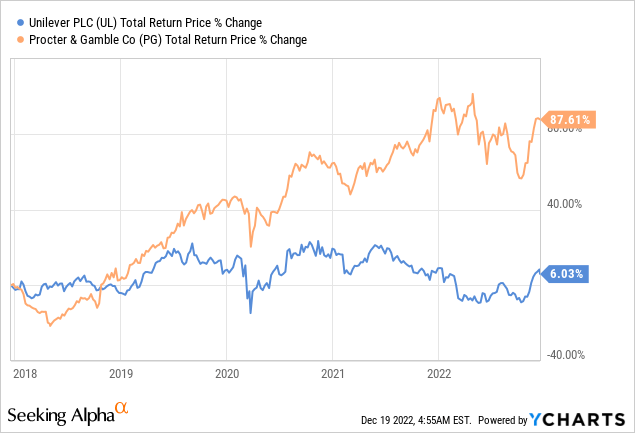

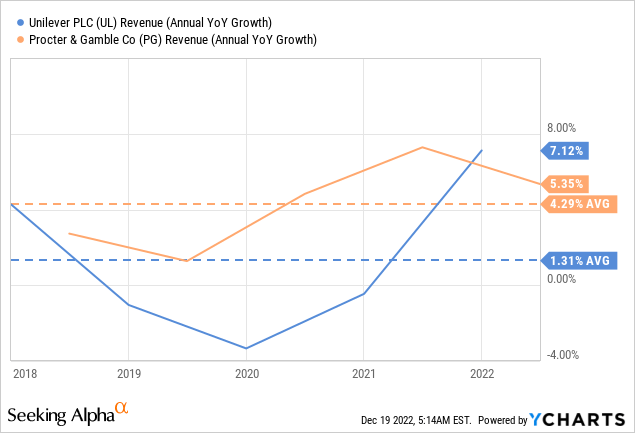

The graph below shows the outstanding performance that P&G delivered after Trian’s involvement. It will be great for Unilever shareholder’s if the company experiences a similar turnaround after implementing Nelson Peltz’s recommendations.

Eroding Competitive Moats

Both companies are seeing their competitive moats weakened by similar threats, supermarket private label brands, as well as startups aiming to conquer specific niches.

For instance, in the household and personal care category, private label brands such as Aldi’s Simply Nature, Walmart’s (WMT) Great Value, and Target’s (TGT) Up & Up compete with Unilever products such as Dove soap and Seventh Generation cleaning products. In the food and beverage category, private label brands such as Aldi’s Fit & Active, Walmart’s Great Value, and Target’s Market Pantry compete with Unilever products such as Knorr soups and sauces and Hellmann’s mayonnaise. In the beauty and personal care category, private label brands such as CVS Health (CVS), Walgreens (WBA), and Rite Aid (RAD) compete with Unilever products such as Vaseline and Pond’s.

Procter & Gamble is not immune to this intense competition either. Target’s Up & Up competes with P&G products such as Tide laundry detergent, Crest toothpaste, and Bounty paper towels. Target’s Market Pantry competes with P&G products such as Pringles chips, Folgers coffee, and Crest mouthwash. CVS Health, Walgreens, and Rite Aid also compete with P&G products such as Olay skin care and Pantene shampoo.

Both companies are also having to increasingly battle for market share with innovative startups that are going after certain niches such as products in the natural and eco-friendly space. Some examples here include The Honest Company (HNST) and Olaplex (OLPX).

Financials

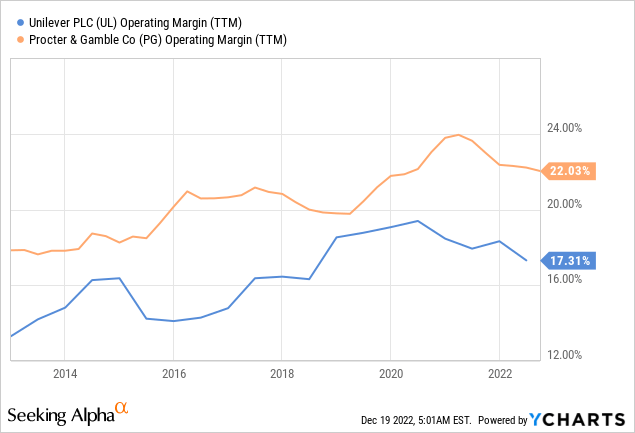

Historically P&G has had better operating margins, and currently the difference is very significant at ~5%. It is probably a combination of having on average stronger brands and operating in a more efficient manner.

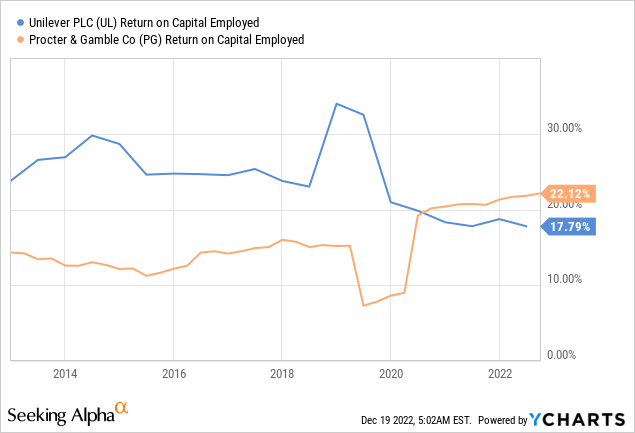

P&G currently delivers higher returns on capital employed, although this has not always been the case. In the last five years P&G’s ROCE has meaningfully increased, while that of Unilever has deteriorated.

This means that today P&G is in general a better business, compounding retained earnings at a higher rate, and with the additional benefit of keeping more of its revenue as earnings.

Growth

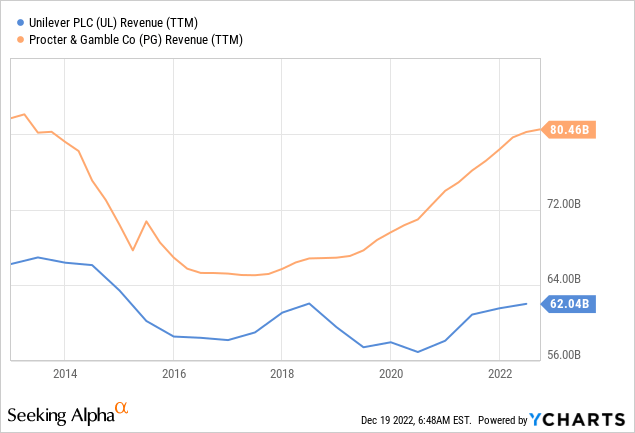

Both companies are industry giants, with P&G having revenues of over $80 billion per year compared to Unilever’s more than $62 billion. In the last ten years, it would appear that neither company has grown its revenue very much, but a large part of the reason is that both companies have been continuously selling some of their brands.

In the last five years Procter & Gamble has delivered significantly higher growth compared to Unilever. It remains to be seen if once Unilever implements the changes that Nelson Peltz is demanding, the growth can be reinvigorated.

Balance Sheets

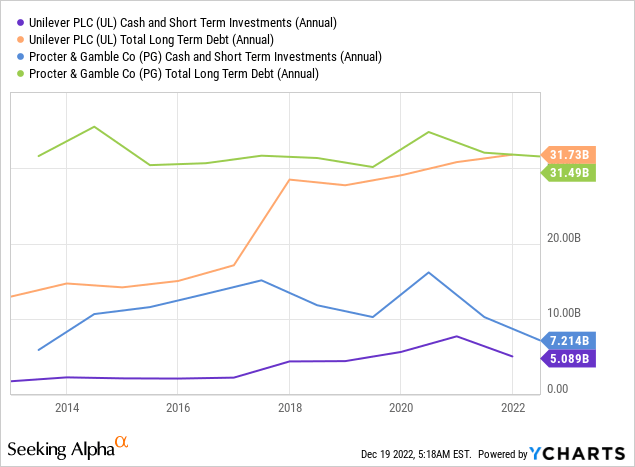

In terms of long-term debt both companies are carrying a very similar amount, around $31 billion. Procter & Gamble has a bit more cash and short-term investments, but overall we believe both companies have solid balance sheets.

ESG

Another difference between the two companies is their approach to sustainability and social responsibility. Unilever has a strong reputation for its efforts to reduce its environmental impact and improve the lives of the communities in which it operates. P&G also has a commitment to sustainability, but it appears to be less of a focus for the company compared to Unilever’s efforts in this area.

Valuations

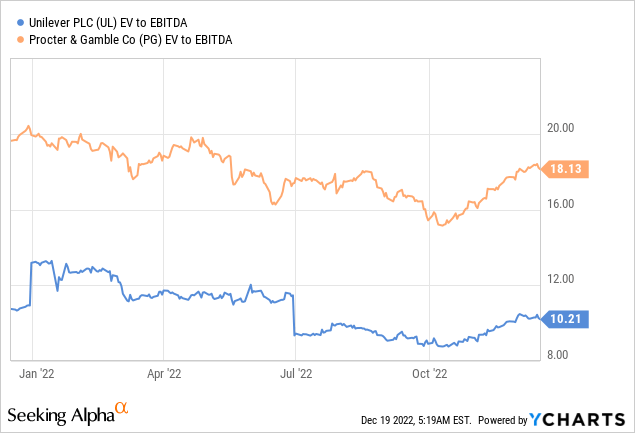

So far it appears that P&G is winning in most areas. It gets a lot more interesting, however, once we get into the valuation. This is where Unilever has a big advantage over P&G as an investment, as the valuation is a lot less demanding. Unilever shares are trading almost at half the EV/EBITDA multiple of P&G. While we do believe P&G deserves a higher valuation given its faster growth and higher operating margin, we believe the current valuation difference is excessive. Especially if one believes that Unilever can close the growth gap with P&G with some of its new initiatives.

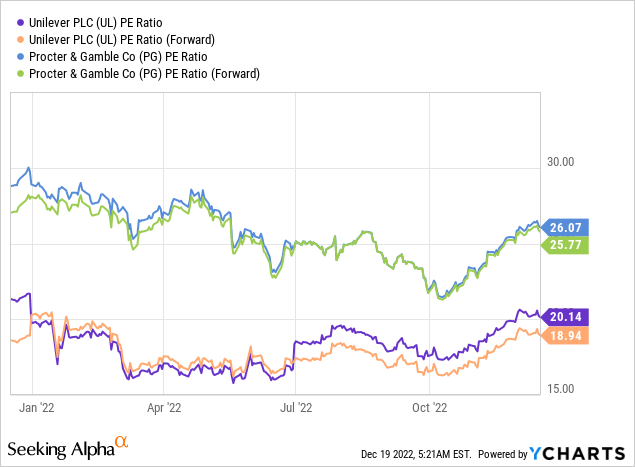

Looking at the price/earnings ratio tells the same story, with P&G valued much higher than Unilever. Both companies are expected to increase their earnings slightly, as can be seen with the slightly lower forward p/e of both.

The lower valuation of Unilever shares also results in a higher dividend yield, which is close to 3.5%. It is important to note that Unilever’s quarterly dividend is in Euros, and the yield is therefore affected by the USD/EUR exchange rate. If the Euro goes up against the Dollar, the yield should move up for US based investors. P&G’s yield is significantly lower at ~2.4%, but has increased its dividend for 66 consecutive years. Investors looking for a higher starting yield might find Unilever more interesting, while investors preferring dividend growth might feel more comfortable with P&G.

Risks

Risks to consider with both companies include the significant competition they are experiencing from supermarket private label brands, as well as a number of startups fighting for market share. Both companies have significant levels of debt, which is particularly important to consider in a rising interest rate environment. We are not overly worried about their ability to refinance, but it might have to be in slightly less attractive terms. There are also legal and regulatory risks for both companies, as well as the impact of currency fluctuations.

Conclusion

While P&G wins in most areas we analyzed, Unilever makes up for it with a much more attractive valuation. Unilever is also at an earlier phase of its business transformation, while P&G has mostly succeeded in its restructuring. We believe P&G has a bigger valuation risk, while Unilever has a higher operational risk. Both companies face some of the same headwinds, such as private label brands eroding their competitive moats. Taking everything in consideration we would favor Unilever over P&G, but can understand why some investors would go in the opposite direction.

Be the first to comment