JJFarquitectos

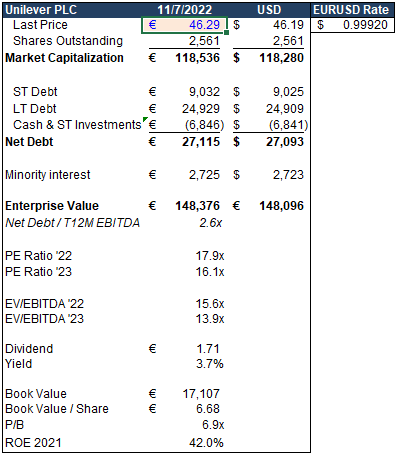

Unilever PLC (NYSE:UL) is one of the largest consumer products companies in the world, with a market cap of ~$120B. The company’s shares trade both in Amsterdam as well as in London (where the company is headquartered). Unilever reports its earnings in euros, and U.S. investors can purchase NYSE listed shares under the ticker “UL.”

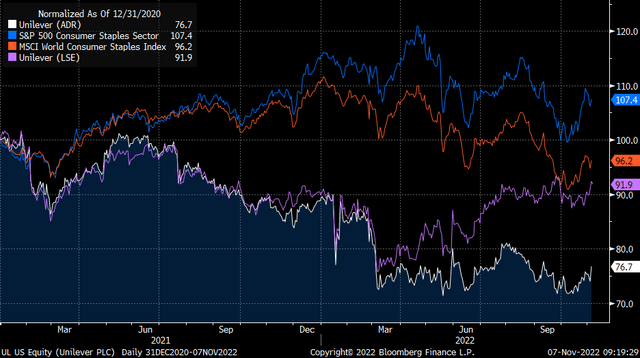

Starting at the end of 2020, Unilever’s P/E ratio began to de-rate to below the 17.5x to 23x range the company had historically traded at since 2014. The decline in the stock’s P/E ratio seems to be the result of slowing growth, exacerbated by a global surge in commodities as rising input costs put pressure on the company’s margins. Additionally, the decline in the euro versus the dollar has dragged on the ADRs. The ADRs for UL are down 18.14% since 2020, while the Euronext traded shares are down just 0.32%. UL has underperformed the S&P 500 Consumer Staples Index and the MSCI World Consumer Staples Index by 30% and 19.1%, respectively. The Euronext listed shares have underperformed as well during this time frame.

Historically, up until the pandemic Unilever was a market outperformer. During the 10-year period between 1999 and 2009, the ADRs outperformed the S&P 500 (SP500) by ~11.2% on an annualized basis. While the stock underperformed the S&P 500, for a low-beta consumer staple during the longest period of economic expansion in modern historically the ADRs arguably did quite well, rising ~9.7% per annum while the S&P 500 returned 13.5% per annum.

Unfortunately, since the end of 2020, Unilever stock has struggled even as the business continues to perform at or above management’s expectations. Given the 2-year underperformance, we believe today’s prices represent a solid entry point for Unilever stock.

Business Highlights

EPS Growth/Volatility

As a consumer staples company, Unilever grows at a slower rate than the market, but also has significantly less earnings volatility. The company is a “portfolio stabilizer” that has shown an ability to beat the market over a long-time horizon. Adj. EPS has gone from €0.72 in 2001 to €2.65 in 2021, which represents a 6.7% CAGR over a 20-year period. During this time frame, the ADRs returned 9.2% annually, just slightly below the S&P 500’s 9.5% annualized return.

Unilever tends to outperform during times of market distress because Unilever’s earnings are much less volatile than the typical S&P 500 company. The standard deviation of the Unilever’s EPS growth rates over the last 10 years is 9.1%, versus 19.3% for the S&P 500. Put another way, over the last 10 years, ~66% of the time Unilever’s EPS growth has been above or below its average EPS growth rate by 9.1%. A prime example is 2020, where the S&P 500’s EPS fell 20%, while Unilever’s EPS fell just 1.2%.

Long-Term Growth Prospects

The consumer products industry is mature, but it contains sub-segments of significant growth. For example, Estee Lauder (EL) derives ~50% of its revenues from skin care products that are typically high-end products designed to prevent aging. The market for skin care products has exploded over the last few years, and EL is now growing their skin care business in the high teens/low twenties percent range. EL’s exposure to this high growth category has earned it a sector leading P/E ratio of 34x.

Unilever has invested in high growth areas within the consumer products category, which are expected to be significant contributors to growth over the long term. However, in general, large consumer products companies will typically grow their top line at GDP+ type rates.

Sustainable Competitive Advantages

As a global multi-billion-dollar consumer products company, Unilever’s distribution, supply chain, and sales network, would take a significant amount of time and capital to replicate. This is often why smaller consumer products companies, once having reached a certain size, will typically sell themselves to the big companies. Brand value and loyalty is also built up over years and arguably decades.

Low Capital Requirements

Unilever requires very little investment to fund its growth. Capital expenditures have averaged just 2.6% of revenues over the last 5 years.

Portions of R&D expense run through the income statement for accounting purposes, but we consider these expenses an investment in the company. R&D expenses are also a small percentage of sales, averaging just 1.5% of revenues over the last 5 years.

Conservative Financial Policies

Unilever has a high-quality balance sheet with a net debt to EBITDA ratio of 2.6x on a trailing-12-month basis. The company’s interest coverage ratio (EBIT/Net interest expense) is ~14x on a T12M basis.

The company has an A+ issuer rating credit rating from S&P and an A1 rating from Moody’s.

Management Team

Unilever’s CEO, Alan Jope, has been with the company since 1985. Prior to becoming CEO in 2019, he was the President of Unilever’s largest division, Beauty & Personal Care. Under his leadership, the Beauty & Personal care division averaged organic growth of 3.6% and expanded its operating margins 180bps.

Investors have largely criticized him, as the stock has significantly underperformed the MSCI World Consumer Staples Index since he took over. This prompted activist investor Nelson Peltz to step in and take a stake in the company. Peltz joined the board in July. Since that time, Mr. Jope has announced he would be retiring at the end of 2023. News reports have surfaced that Peltz has been actively seeking his replacement. Given Peltz’s success at P&G (the stock doubled between the time he joined the board and when he left in August of this year) that largely involved a management shake-up, Peltz seems to be the right guy to get the business on track for strong performance in the future.

Capitalization

Author

Management announced a share buyback program at the end of Q1 of €3bn. The company completed its first €750 tranche in July, and the company expects to complete another €750 tranche by December of this year.

Thesis

Unilever bears have largely been in control for the past 2 years, as the U.S. ADR are down 14% from year-end 2020 levels. The company’s forward P/E ratio is now more than 1 standard deviation below the company’s 10-year average.

Unilever is successfully implementing price increases to offset a significant portion of the input cost inflation it has been facing. While increasing prices has dampened volume growth, investors have underappreciated Unilever’s pricing power as organic growth is strongly positive.

Input commodity prices have already started to reduce the strain on the company’s profitability. It is likely that household product inflation is fairly sticky, which should translate into the company achieving higher margins as input cost inflation comes down and the company maintains its price increases.

The depreciation of the euro has provided a tailwind to financial performance, but has punished U.S. investors. The Fed has given mixed signals about the path of monetary policy moving forward, but any moves to reduce the tightness of U.S. monetary policy should cause the USD to weaken against the euro and would help boost performance of the ADRs.

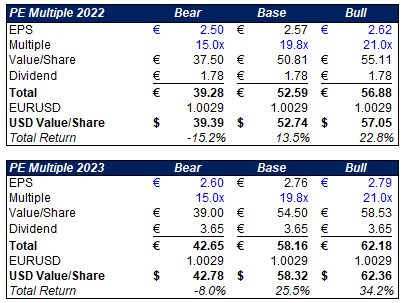

We forecast EPS will be down ~1.8% in 2022, but to grow in the high single digits in 2023 and 2024. As fundamentals improve and the company shows an ability to offset inflationary pressures, we see the ADRs re-rating back to ~19.8x, which represents upside potential of 25% over the next 12-18 months.

Our bear case scenario is that margin compression continues and whereby earnings remain flat. In this scenario we see the ADRs trading around 15x earnings, which would be down ~15% including dividends.

Overall, we like the risk/reward for UL stock. Unilever may not be a market-beating name in a loose monetary regime, but long-term consumer staples with well-managed, strong brands can generate solid returns for years.

Business

Founded when Margarine Unie and Lever Brothers merged in 1929, Unilever is one of the largest consumer products companies in the world. The company’s early days focused on animal fat products, such as butter and margarine, and personal care products such as soap. Throughout the 20th century, the company expanded into several other consumer products areas largely through acquisition.

Today, Unilever generates ~€55bln in annual sales, owns over 400 brands, employs 149k people, and has products available in over 190 countries. Overall, the company targets underlying organic sales growth of 3% to 5% over the long term.

Unilever’s business strategy is guided by five strategic pillars. The company looks to achieve these goals through organic and inorganic initiatives. The goals are:

-

Develop the company’s portfolio into high growth spaces

-

Win with the company’s brands as a force for good, powered by purpose & innovation

-

Accelerate in the USA, India, China, and leverage EM strength

-

Lead in the channels of the future

-

Build a purpose-led, future-fit organization and growth culture.

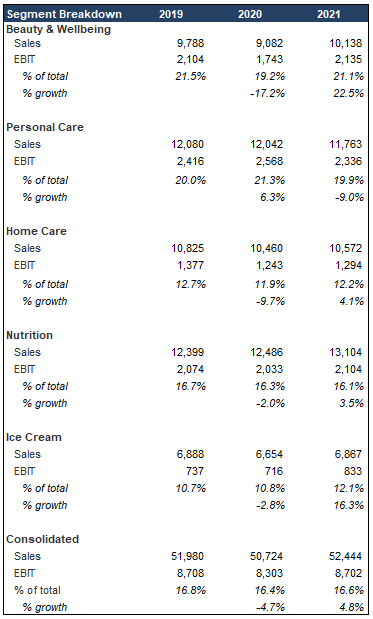

Unilever updated its operating segments in September of 2022 to be a more category focused. The company reports in five segments: Beauty & Wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream.

Beauty & Wellbeing is the company’s 3rd largest, but fastest growing, segment. The business line includes brands such as Dove, Sunsilk, Vaseline, and Liquid I.V. This business segment is a mid-single digit grower, with operating margins in the low 20% range. Inside of this segment is a ~€1.0bn Prestige Beauty business growing double-digits organically. This business competes with the likes of Estee Lauder and L’Oreal (LRLCF, LRLCY), which are the darlings of the consumer products space.

Personal Care is another strong performer, with ~€11.7B in sales. This segment includes brands such as Dove, Rexona, Lux, and Axe. This segment grows organically in the 2-5% range, but has been growing faster in recent periods as management has been raising prices aggressively within this segment. While margins were in in the first half of 2022, historically margins in this segment have been strong in the high-teens low 20% range.

Unilever’s Home Care is ~€11B in sales, and has a been growing organically in the mid-single to high-single digit range for several quarters in a row. However, this is a significantly more competitive industry. As a result, operating margins are in the low-double digits range. Popular brands in this segment include OMO, Sunlight, Comfort and Seventh Generation.

Finally, Unilever has a Nutrition and an Ice Cream segment. Brands in the Nutrition segment include Knorr, Hellmann’s, and Red Lable, while the Ice Cream segment includes Ben & Jerry’s, Magnum, and Breyers. These segments have historically struggled to grow much more than 4 or 5% at the most. Organic sales have jumped in recent quarters as the company has increased prices in the mid-to-high-single-digit range. Margins in the company’s Nutrition segment are in the mid-teens while the Ice Cream segment’s margins are in the low-double digit range.

Here is a segment breakdown:

Company Filings

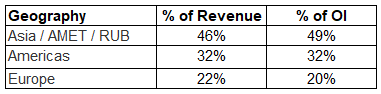

Revenue and earnings are geographically diversified, with 60% of revenues coming from higher growth emerging markets.

Company Filings

Key growth markets for the company are the U.S., India, and China. Today, these countries represent ~€9bn, ~€5bn, and ~€3bn of sales, respectively.

M&A

Unilever is active with its portfolio management, as the company has executed approximately €14.5bln in M&A and divested €8.1bn of brands since 2015. The company has been pretty quiet recently as management has been largely focused on improving business fundamentals.

The most recent major acquisition was a €5.2bn purchase of a health food and drinks business primarily focused on Asian markets called Horlicks from GlaxoSmithKline. The business has grown at double-digit rates over the last 15 years. The transaction was immediately accretive to EPS even though Unilever paid 20x post synergy EBTIDA. The primary rationale for the deal was to increase Unilever’s presence in health-food categories and high growth emerging markets.

Focused on portfolio development and growth, Unilever is willing to divest underperforming businesses. At the end of 2017 the company announced it sold its spreads business, which included brands such as Becel, Flora, Country Crock, and Blue Band, to KKR for €6.825bn. The spreads business was very profitable but faced secular decline issues as people eat less bread and margarine. The company sold the business for somewhere between 9x and 10x EBITDA returning the proceeds to investors via €6bn in buybacks during 2018.

The company just recently divested its Tea business to CVC advisers for €4.5bln in July of 2022.

Fighting Inflation

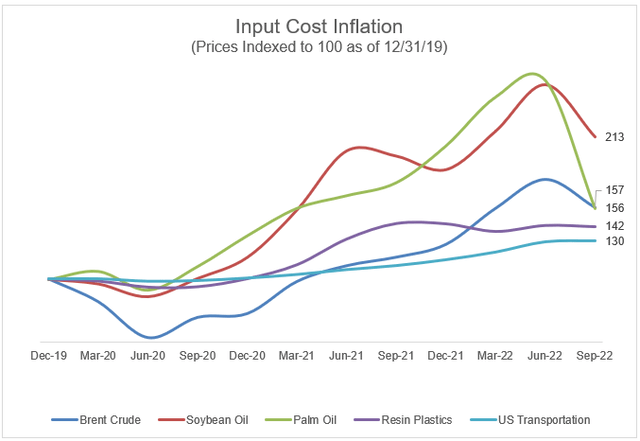

Global inflation has taken center stage in financial markets as economies deal with supply disruptions in the face of a faster than expected rebound in demand for goods.

Several commodities used in Unilever’s products have seen significant prices increases versus their pre-pandemic levels. Rising prices have created a challenging operating environment for the company.

Bloomberg, Author’s spreadsheet

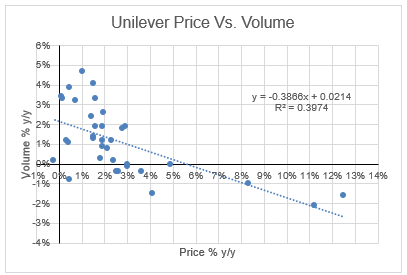

-Author’s Graph. Data obtained from Bloomberg.

During Unilever’s 3rd quarter of 2022, the company raised prices 12.5% to offset the cost inflation the company has experienced. That was the 2nd quarter in a row the company raised prices by double digit percentages. Volumes declined just 1.6% in the most recent quarter translated into consolidated underlying sales growth of 10.6%. That is the highest organic sales growth rate for the company going back as far as we have data for. The subdued volume declines in the face of significantly higher pricing shows that Unilever likely has some strong pricing power that it can use to maintain its margins.

While it is different across different economies, overall, we believe that consumers are in fairly good shape and have a more inflationary mindset. U.S. consumer seem to have significant excess savings that is providing a buffer during the historic level of inflation the economy has experience. Consumers seem to be less sensitive to price increases than they were during the previous decade.

In addition to price increases, management has leveraged its savings programs, buying efficiencies, and productivity programs harder than ever to fight off inflation. Buying efficiencies alone offset roughly half of the market level inflation.

Overall, we are confident that Unilever can manage its way through this period of input cost inflation without seeing major margin degradation nor damaging the long-term health of the business.

Recently, many of Unilever’s major input commodities have seen their prices changes moderate in recent months if not begin to decline. A weakening global economy and normalizing supply chains have been the main driver behind the changes. While it is hard to predict the direction of commodity prices, Unilever has managed to work its way through these challenges relatively successfully.

Below is an analysis of the how the company’s volume growth changes for a change in prices. This analysis shows that price increases in the 5% to 6% range will result in lower volumes (which we’ve already witnessed in 2022), but should still be accretive to organic growth. Elasticities have been even better than this analysis showed, as the company has raised prices by double-digits the last two quarters and volume declines have been less than what the model would have predicted.

Company filings, author’s spreadsheet

Management

Unilever CEO, Alan Jope, has been in charge since January 2019. He announced his intent to retire at the end of 2023. While he took over Unilever during a challenging time for global staples companies, his relative performance has been sub-optimal. Nelson Peltz’s decision to join the board has likely played a role in Mr. Jope’s departure. Unilever in recent quarters has been very aggressive in protecting margins and market share, which have translated into decent stock price performance.

It has been reported that Mr. Peltz has initiated the process to find Mr. Jope’s replacement. He was tasked with similar challenges when he took a stake in Proctor & Gamble (PG) a few years ago, and that was a great success story. Investing alongside Peltz seems like a sold bet.

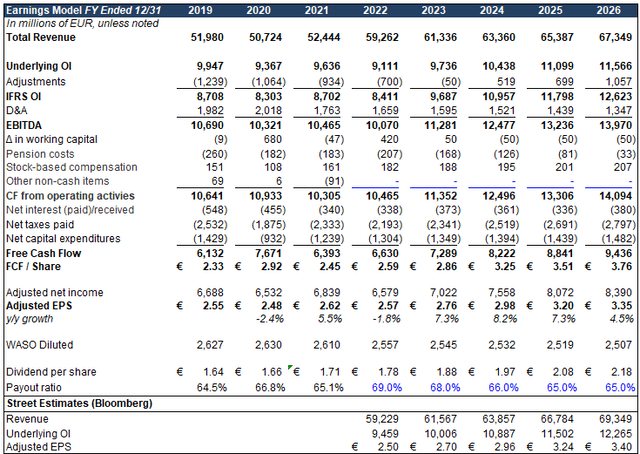

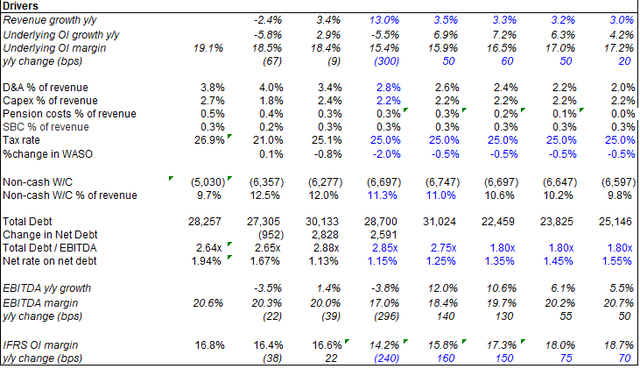

Model

We’ve modeled for strong topline growth driven by high pricing in 2022, but we expect operating margins to fall 300bps y/y driven by higher input cost inflation. However, revenue growth should moderate to mid-single digits in 2023 and 2024, while operating margins begin to expand y/y. We see EPS falling 1.8% this year before growing high-single digits for the next couple of years as input costs come down and the company benefits from higher pricing.

Company Filings, Author’s Model Company Financials, Author’s Spreadsheets

Comps

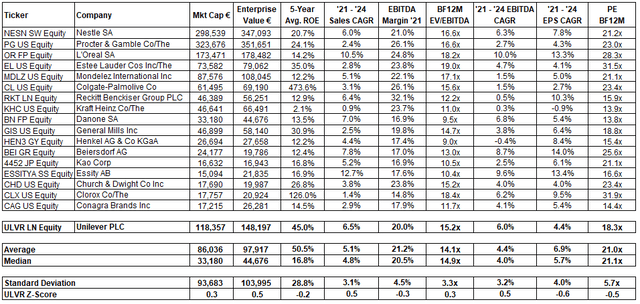

We believe comparing Unilever to companies across the subsectors in the consumer products industry is the most effective way to evaluate it versus peers. There is not one single company that overlaps all the categories Unilever competes in due to the company’s diverse portfolio of food, home care, and self-care products.

Generally, the closest comps to the company are Henkel (HEN3 GY), Danone (BN FP), and Reckitt Benckiser (RKT LN). These three companies have diverse similar categories to Unilever and have similar growth and margin profiles.

Bloomberg, Author’s Spreadsheet

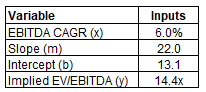

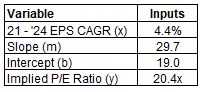

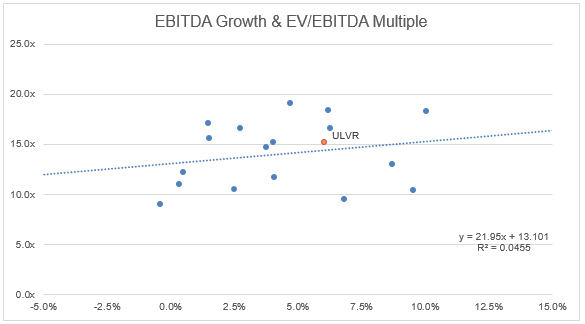

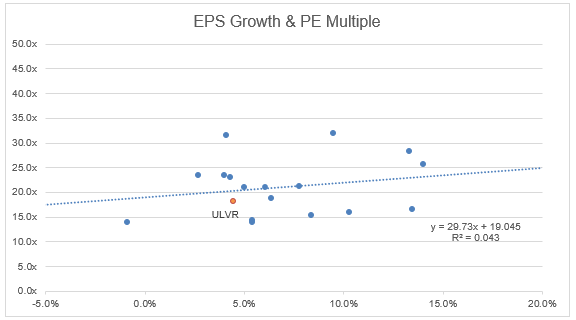

We performed regression analysis on peer companies’ growth profiles and their valuations. We derived an implied valuation based on this analysis and our analysis implied a forward P/E multiple of 20.4x and an EV/EBITDA multiple of 14.3x. These are in line with Unilever’s historical averages.

Author Author Bloomberg, Company Filings, Author’s Graph Bloomberg, Company Filings, Author’s Spreadsheet

Valuation

Using a combination of Unilever’s historical multiples and the implied multiples from our comps analysis, on a forward P/E basis, we believe the ADR today is worth $60. This represents ~15% upside from current prices.

We believe that this stock could provide cumulative total returns of 28% over the next 2 years. 20.3% of the return would come from price appreciation, while the remaining return would come from dividends.

At these levels, we think that there is a significant margin of safety built into the stock, as the inflationary concerns are priced into the stock price at this point. We see the downside on the ADRs of $47.75 with one year of dividends protecting the downside to just 5%.

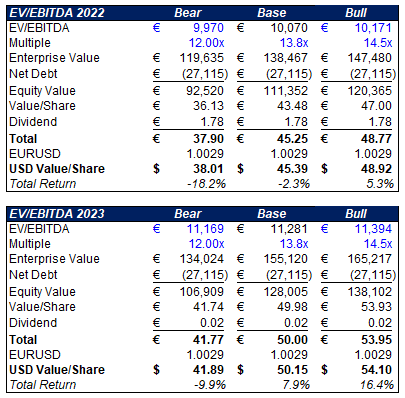

An EV/EBITDA multiple yields similar results. We believe the implied multiple from our comps analysis was a bit too high, so we capped our upside case at 14.5x which is close to the highest the stock ever traded at. Our base case is slightly above the stock’s 10-year average EV/EBITDA multiple, and our downside is the stock returning to close to March 2020 valuations.

Author’s Model Author’s Model

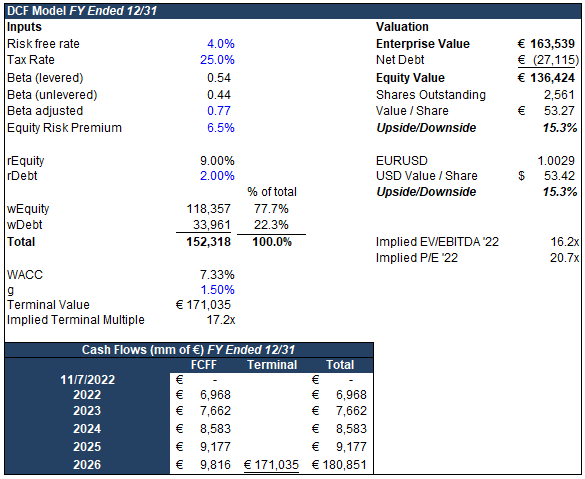

Due to the mature nature of Unilever’s business, a discounted cash flow (“DCF”) analysis is also a useful tool for deriving the value today. Using what we would consider to be highly conservative inputs, we derive an ADR value per share today of $53.42. This represents an upside of 15.3%.

Author’s Model

We note that there is some element of a wait-and-see story here. The market clearly doesn’t believe that management can navigate through the challenging environment, and so earnings releases will play a key role in getting the stock back towards our target valuation.

We confess that it is virtually impossible to predict commodity price movements, currency or consumer buying behavior with any degree of accuracy, so there is the risk of a sell-off on a quarterly earnings release. We would generally add more ADRs to our position in the low $40’s high $30s.

Risks

-

Our analysis of Unilever’s ability to preserve price increases and expand margins once input cost increases abate could be incorrect. This would likely result in slower futures earnings growth and this a lower stock multiple in the future.

-

As a consumer staples stock, Unilever is generally viewed as an income oriented conservative investment. Consumer staples stocks generally have higher sensitivity to interest rates so a drastic move higher in long-term rates could potentially hurt the stock price.

-

Management could poorly manage the company’s portfolio of brands. This would include failing to properly integrate an acquisition, paying too much for an acquisition, or disposing of an asset for too low of a price.

-

Potential liability from consumer personal care products. We’ve seen this with J&J and their talc powder products. Generally speaking, these are safe products and lawsuits tend to be short-term issues.

-

The company could fail to innovate and keep up with changing consumer tastes. This has been a major challenge for the entire industry as consumers have been in favor of products from smaller more nimble companies. Investing in the proper areas and releasing products that are attractive consumers are key to sustainable successful long-term business growth.

-

ADR currency translation is another risk that has played out in recent months. Since Unilever is listed in Europe, a decline in the euro versus the dollar leads to a lower ADR value. However, if the euro strengthens this be really good for the ADRs.

Conclusion

Unilever is not the type of stock that is going to get you rich overnight, but we do believe that this is a great portfolio stabilizer. The stock can generate some relatively decent income (a 3.7% yield) with low volatility returns. In a risk off market, Unilever is likely to outperform like it has this year. Any reduction in interest rates or weakening USD would likely result in major upside for the ADRs. This would just be an extra boost on top of what we expect to be EPS growth for Unilever over the next couple of years.

This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment