SolStock/E+ via Getty Images

Introduction

Planet Fitness, Inc. (NYSE:PLNT) has dropped 20% since the beginning of 2022 along with the rest of the market due to the looming recession. Fundamentally however, the company has performed well, as reflected by its revenue and various KPIs. In addition, the company appears to have a strong grip on GenZ, potentially creating many more loyal customers down the line. Still, the hype surrounding the stock has driven up its valuation above what I believe to be its fair value. Therefore, I recommend continuing monitoring the stock for better buying opportunities.

Company Overview

Planet Fitness, based in New Hampshire, is a well-known fitness chain with locations all over the country. Planet Fitness’s revenue is segmented into three sources: Membership fees from corporate owned gyms were 28% of Planet Fitness’ total revenue, 50% came from franchised owned stores, and 22% came from selling equipment to existing franchise stores.

Planet Fitness is popular among customers because of its affordability, with the standard membership costing just $10 per month. Planet Fitness is also known for its atmosphere of being a “Judgment Free Zone”, which makes customers feel more comfortable in what could otherwise be an intimidating environment. The Health and Fitness club market is expected to grow at a CAGR of 7.21% between 2021 and 2027, with Planet Fitness currently holding 20% of the market share. As the pandemic wiped out many smaller gyms, Planet Fitness has consolidated more of the market and has only a few other significant chain competitors.

Solid Earnings

Planet Fitness reported revenue of $244.39M in the third quarter of 2022, up 58.4% year on year and $9.82M higher than expected. Planet Fitness also reported $0.42 earnings per share, $0.04 more than expected. Revenue is expected to increase in the high-50 percent range in fiscal year 2022, while adjusted earnings per share is expected to increase in the 90% range. Adjusted EBITDA is expected to rise by about 60%, while adjusted net income is expected to rise by about 100%.

Sound Fundamentals

Planet Fitness has seen robust growth on a fundamental level. It saw a net 300,000 customer increase in Q2 2022, ending the quarter with 16.5 million customers. In addition, management reports increased frequency of gym visits and reduced cancellation rates, even compared to 2019. This rapid customer growth can be attributed to a variety of factors, the most important of which is the company’s ability to attract younger generations of customers. Planet Fitness revived its popular summer teen challenge this summer, which gave teenagers free access to Planet Fitness facilities. The program attracted over 3 million teens by the end of the summer of 2022, a 67% increase from 2019. As a result, Planet Fitness has increased its Gen Z membership from 5.5% prior to the pandemic to 9% now–showing that the program was effective in converting new customers. Overall, it is clear that this program will remain an important part of Planet Fitness and will attract an unprecedented number of younger customers in future years.

In addition to bringing back one of its greatest summer teen programs, Planet Fitness continues to expand across the nation. Planet Fitness added 34 new locations, bringing their total to around 2,200. Across all the locations, Planet Fitness saw same-store growth increase by 13.6% Quarter over Quarter and franchisee same-store sales increase by 14.6% Quarter over Quarter.

ESG

Planet Fitness is also a great company for the community. Because of its low costs and emphasis on “no judgment”, 40% of all its members are first time gym goers, helping people take the first step towards improving their physical and mental health. In addition, its low cost has allowed low-income households to access the benefits of fitness, with 25% of all Planet Fitness stores operating in low-income areas.

Valuation

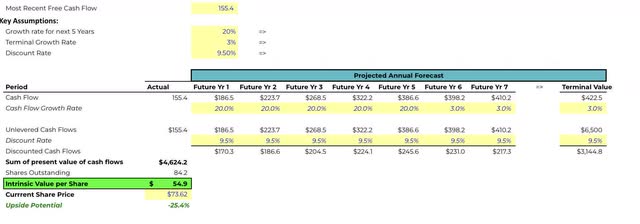

For my DCF valuation model, I assumed a terminal growth rate of 3%, a discount rate of 9.5%, and a 20% growth rate for the next five years, which the company has historically been able to generate. My model’s price target is $54.9, which is 25% below what the stock is currently trading at.

Excel

To me, it seems like the optimism around Q3 earnings created too much hype for the stock, and the stock is no longer trading at a bargain. Still, I believe the volatile market could send waves of price fluctuations to a consumer cyclical stock like Planet Fitness. Therefore, investors could potentially pick up the stock at a more attractive price.

Conclusion

Planet Fitness is a fast-growing company with a unique ability to capture GenZ. However, I currently place a neutral target on the stock because its valuation presents a risky prospect to investors. Still, I recommend investors placing the stock on their watch lists and wait for better opportunities as the company remains healthy and poised for continued growth.

Be the first to comment