imaginima/E+ via Getty Images

VOC Energy Trust (NYSE:VOC) is an energy trust that was formed by VOC Brazos Energy Partners (an affiliate of Vess Energy Group) to own all of the partnership’s net interests in certain oil and natural gas-producing properties located in Texas and Kansas. Energy trusts in general can be excellent ways to profit off rising oil prices due to the fact that their income is directly correlated with energy prices and they pay out essentially all of their net profits to unitholders.

The price of oil has certainly been in the minds of many investors and consumers since the start of the year and particularly since the beginning of March as the Ukraine crisis sent the price of West Texas Intermediate over $100 per barrel. While crude oil has admittedly fallen a bit from its peak, it is still well over that $100 per barrel price.

Interestingly though, the unit price of VOC Energy Trust has appreciated much more than the price of crude oil. The trust still boasts an eye-watering trailing twelve-month yield of 10.37% and the market appears to expect its distribution to be higher going forward. Let us investigate and see if this apparently impressive investment is right for your portfolio.

About VOC Energy Trust

As stated in the introduction, VOC Energy Trust was formed by VOC Brazos Energy Partners for the purpose of holding all its net interests in the company’s oil and natural gas properties that were actively producing resources as of May 10, 2011. All of the properties in question are located in Texas or Kansas. This start-up date is important because oil and natural gas properties tend to see their production decline over time.

Basically, the number of resources that are produced on these properties will decrease over time until they are unable to produce anymore. Thus, unlike a corporation, the trust will eventually be shut down and the owners of it will no longer receive any money. That is expected to be on December 31, 2030 (although owners will receive their final payment during the first quarter of 2031). This is an important thing to keep in mind when considering the trust as an investment and especially for valuing it as we will discuss later.

The trust makes money by receiving 80% of the net profits produced by all of the properties up to the first 10.6 million barrels of oil equivalents. Thus, the trust itself will basically get all of the net profits from 8.5 million barrels of oil equivalents. This is why I stated in the introduction that energy trusts can be a good way to bet on oil prices and derive an income. This is because their profits (and distributions) directly correlate to energy prices.

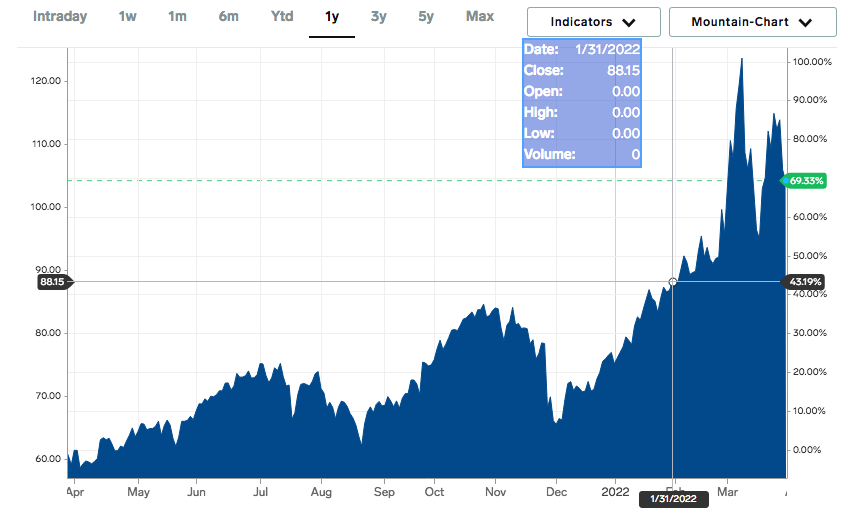

As we can see here, the price of West Texas Intermediate crude oil is up 69.33% over the past year, with much of the gains coming this year in response to the situation with Russia and Ukraine:

Business Insider

Interestingly, the unit price has appreciated much more than the price of crude oil. Over the past year, VOC’s unit price has appreciated by 98.90%:

Seeking Alpha

When we combine this with the 10.37% trailing twelve-month distribution yield, investors over that time period have received a whopping 109.27% total return. This is a sure sign that the market expects the trust’s forward distribution payments to be higher than it paid out over the last year. This is quite likely to be the case if oil prices remain over $100 per barrel as they have been lately. There may be some reasons to believe that this will be the case.

We still need to keep in mind the trust’s limited life, however. As of December 31, 2021, the trust has already received payment for 6.0 million barrels of oil equivalents out of the 8.5 million barrels of oil equivalents that it is entitled to. During the full-year 2021 period, the trust received payment for a total of 586,859 barrels of oil equivalents.

As the trust expires on December 31, 2030, or after it receives payment for the remaining 2.5 million barrels of oil equivalents (whichever comes later), it is difficult to imagine a scenario in which trust unitholders receive more than 32 more quarterly payments, even taking production declines into account.

At a 10% distribution, it takes seven years and four months to double your money. As a portion of the trust’s distribution is actually a return of capital since the trust is a depleting asset, it is difficult to imagine a situation in which someone would do much better than doubling their money here. We will discuss this more later, but it is possible that the trust’s valuation has gotten too high.

As stated earlier, the income of the trust is directly correlated to oil prices. We can see this by looking at the trust’s net profits over the past few years:

|

2019 |

2020 |

2021 |

|

|

Income from Net Profits Interest |

$12,661,799 |

$5,006,227 |

$9,302,296 |

Admittedly, there may be some readers that point out that 2019 had much higher income despite energy prices being generally higher in 2021. In 2019, the average closing price of West Texas Intermediate was $56.99 per barrel compared to $68.17 per barrel in 2021 so this would indeed be true. However, production on the trust’s properties was substantially higher in 2019, which more than offset this. In 2019, the trust received payment for 625,367 barrels of oil equivalent compared to 589,859 in 2021.

There has been no reason given for the production decline over the two-year period but I can think of two possibilities. The first is the natural decline rate of the properties. The production from the trust’s properties is expected to decline at a 6.8% rate over the remaining life of the trust. VOC Brazos Energy Partners was expected to partially offset this over the next four years by investing money into further developing the properties such as drilling new wells or using other techniques to extend the life of a given well.

However, as I have pointed out in various previous articles, many energy companies cut production spending back in 2020 in order to preserve their balance sheet strength in the face of the low energy price environment. This then could have been the case on the trust’s properties, which may have prevented any sort of offset to the natural decline rate. Again, this assumption has not been explicitly confirmed by the trustees, however. Either way, we can still see that rising energy prices greatly benefit the trust by comparing its net profits from 2019 and 2020 as the properties’ production was quite similar in both years.

Energy Prices Are Likely To Rise Going Forward

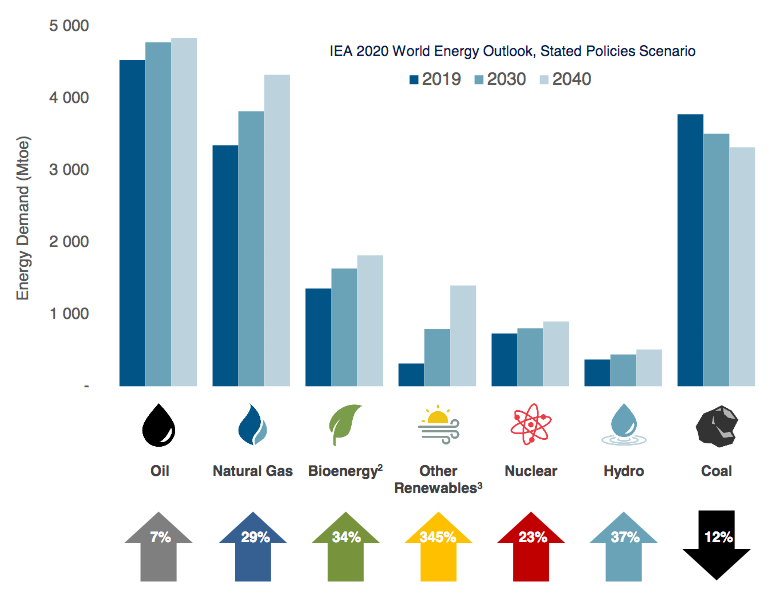

Fortunately for the trust and investors in it, energy prices look likely to continue to rise. This is largely because the fundamentals that create a bullish thesis extend well beyond the current Ukrainian crisis. This is due to the economics of supply and demand, which a few major investment banks have pointed out lately. As I have stated in the past, the International Energy Agency expects the global demand for crude oil to increase by 7% and the global demand for natural gas to increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA

Meanwhile, the world’s energy companies have not been investing nearly enough to satisfy this demand growth. This is a result of the massive crash in energy prices that we saw back in 2015, which many recall led to numerous midstream companies changing their business models and upstream producers curtailing their spending on things such as offshore drilling and exploration. The offshore drilling industry never recovered from this since energy companies did not fully restore their spending even after the bear market ended. This resulted in years of chronic underinvestment, as confirmed by Moody’s stating that global upstream spending needs to increase by 54% in order to avert a global supply shock.

Energy companies may be very unlikely to do this. One major reason is that they have been under pressure from politicians, environmental activists, and even shareholders to improve the sustainability of their operations. This has led some, such as Equinor (EQNR), to favor spending on renewable projects over traditional oil and gas ones. I discussed this in a recent article. In addition to this, many energy companies have been under growing pressure to increase the returns that they provide shareholders. As I pointed out recently, this has resulted in some of them favoring the generation of free cash flow as opposed to production growth. This all points to rising demand and insufficient supply, which economics tells us will result in rising prices.

Valuation

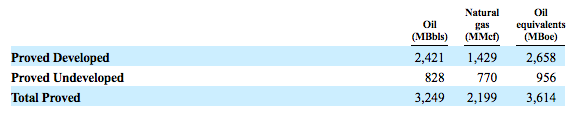

There are two primary ways that we can value the trust in order to determine if the market is indeed overvaluing it. One way to do this is by valuing the reserves attributable to the trust. This tells us the total value of the resources that are likely to be extracted before the trust expires worthless. Here are the trust’s reserves as of December 31, 2021:

VOC 10-K Filing 2021

As of the time of writing, West Texas Intermediate crude oil trades for $107.55 per barrel, and natural gas is trading for $5.32 per thousand cubic feet of Henry Hub. Thus, these reserves are valued at approximately $361.129 million given today’s prices. The trust currently has a market capitalization of 123.76 million so the trust is trading at a 191.80% discount on the value of its assets.

However, that simplistic valuation does not take into account the time value of money or the fact that the trust receives the net profits from the oil and gas produced and not the net revenue. After all, a dollar received in 2030 is worth much less than a dollar received today because you can actually use the dollar today to either invest or acquire goods and services. Thus, it is better to value the trust based on the cash flow that it is ultimately likely to generate and have available to pay out to its owners in today’s dollars. As of December 31, 2021, that number was $67.6182 million. Admittedly, that is based on West Texas Intermediate prices of $66.56 per barrel and natural gas prices of $3.598 per thousand cubic feet at Henry Hub. At today’s prices, the projected value of the trust’s cash flows would, of course, be higher but the market appears to be valuing the trust under the assumption that on average, over the next eight years, oil and gas prices will be higher than the peak that we saw during the Ukraine crisis. While I suppose that is possible, it does seem optimistic. It may be best to wait for VOC Energy Trust to drop a bit in price before buying in.

Conclusion

In conclusion, energy trusts can be an excellent way to profit off rising crude oil and natural gas prices because their income and distribution payments tend to be directly correlated to these prices. We saw this in the fact that VOC Energy Trust’s price skyrocketed along with oil prices over the past year. However, there may be some signs that the market is overvaluing it. This is particularly evident when we consider that it has appreciated much more than West Texas Intermediate crude oil. As such, it may make some sense to wait for the price to come down a bit despite the appeal of the 10.37% trailing distribution yield.

Be the first to comment