JJFarquitectos

Unilever (NYSE:UL) is a giant multinational consumer staples companies. It has a broad range of products; personal products and packaged food both make up around 40% of the company’s sales each. The other 20% comes from home cleaning and care products.

The company is a stable blue chip known for its relatively high dividend. Unilever also used to produce capital gains. Now, though, shares have been down over the past five years. With a lack of growth and now investors seemingly selling shares amid concerns around inflation and rate hikes, what comes next for UL stock?

First, The Bad News

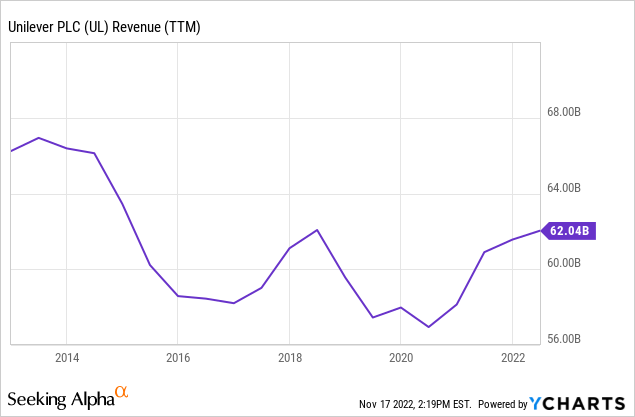

The big issue with Unilever stock starts on the top line. Put simply, Unilever hasn’t grown — at all — over the past decade. In dollar terms, revenues are down from $64 billion in 2012 to $62 billion this year:

A roughly flat result isn’t a disaster by any means. But it’s hardly inspiring either, especially when we consider the impact of inflation over time. Even a stagnant company should generally be able to eke out at least a small amount of revenue growth from price hikes over time.

Unilever has made some splashy acquisitions, such as Dollar Shave Club, to drive growth and bring more products into the fold that hold more appeal with the next generation of shoppers. However, these acquisitions haven’t moved the needle compared to Unilever’s older staid brands like Lipton tea or Hellman’s mayo.

The bottom line has looked a little better than the top line. Over the past decade, Unilever has grown its gross margin from 40% to 42% and its operating profit margin from 13% to 18%. This shows that Unilever has done a reasonable job of making more from the revenue pool that it does have.

Also, the company’s lack of overly-expensive acquisitions has kept funds available for share repurchases in addition to the outsized dividend. Over the past decade, Unilever has shrunk its diluted by more than 10%, taking it from 2.9 billion in 2016 to 2.6 billion shares today. Combine the smaller share count with improving profit margins, and Unilever was able to grow EPS from $2.02 to $2.49 over the past decade despite seeing revenues decline slightly over that time period.

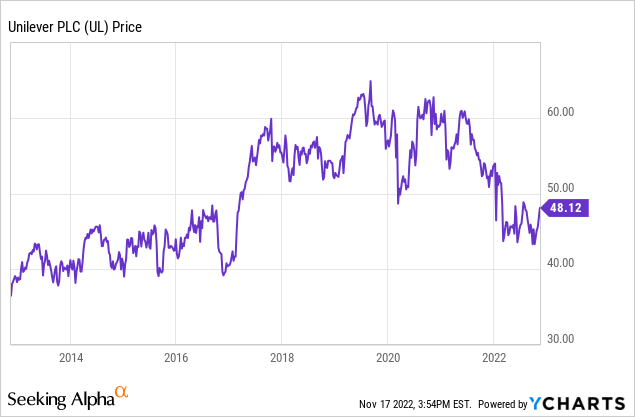

Though the company’s earnings performance was better than its revenue trajectory, 20% EPS growth over a decade is still an uninspiring performance. Not surprisingly, the stock has hardly budged, moving from $37 per share ten years ago to $48 today:

At first glance, Unilever might be appearing to turn the corner now. Organic revenue growth hit 8% in the first half of 2022 and topped 10% in the most recent quarter. This seems like progress for the company after a decade of stagnation.

However, there’s less there than meets the eye. The sales growth was almost entirely driven by price hikes due to the ongoing inflation situation. In fact, even while posting double-digits revenue growth, actual unit volume growth was slightly negative.

Unilever has posted especially strong growth in Latin America in recent years. That’s a positive, as this region has stronger demographics and a rising middle class which can potentially move toward more packaged goods products in coming years. On the other hand, emerging markets are likely to see volatile results in the near-term thanks to the historic run-up in the value of the dollar.

On the other hand, Unilever continues to struggle in its European market. There, sales growth has been in the mid-single digits, which works out to a meaningful decline in real terms once we account for inflation.

Unilever’s long-term struggles have resulted in shareholder frustration. Activist investors, including Nelson Peltz, have forced Unilever into some strategic changes. For example, current CEO Alan Jope will be retiring in 2023. It remains to be seen how Unilever’s corporate direction may shift once new management takes over.

Making The Case For Unilever

The case for Unilever is a fairly simple one but comes with merit. Arguably, Unilever has gotten too big to really grow or innovate all that much. On the other hand, its size also protects it from failure. Unilever is such a massive enterprise with so many entrenched brands in all corners of the world that it will continue to gush out cash flow for decades to come.

As fellow SA author NJ Value Investor put it, Unilever is a classic “Long-Term Portfolio Stabilizer.” The conclusion of their piece ran as follows:

“Unilever is not the type of stock that is going to get you rich overnight, but we do believe that this is a great portfolio stabilizer. The stock can generate some relatively decent income (a 3.7% yield) with low volatility returns. In a risk off market, Unilever is likely to outperform like it has this year.”

I believe that’s exactly the right framing. Unilever has shown that it simply hasn’t been able to muster up much of any growth in recent years. However, it is maintaining its existing positioning, and that could be enough to achieve acceptable returns.

UL shares are now trading at 19.3x estimated 2023 earnings. This amounts to an earnings yield of just over 5%. The company, in turn, returns most of that to shareholders via the dividend yield, along with retaining a portion of earnings to invest in expansion of the business, M&A, or other such opportunities.

Take a 5% starting earnings yield plus the company’s 10-year compounded EPS growth rate of 3.2%, and if valuation stays the same, investors should expect total annualized returns in the 8% range. With faster earnings growth or expansion in the multiple, we could see closer to 10% annualized returns. On the downside, if earnings growth stops altogether or the company’s multiple falls, total returns could be closer to 5% annualized instead of 8%.

In any case, if you’re deciding between owning bonds or Unilever stock (the ultimate bond-like equity if there ever was one) there’s a good case for UL stock.

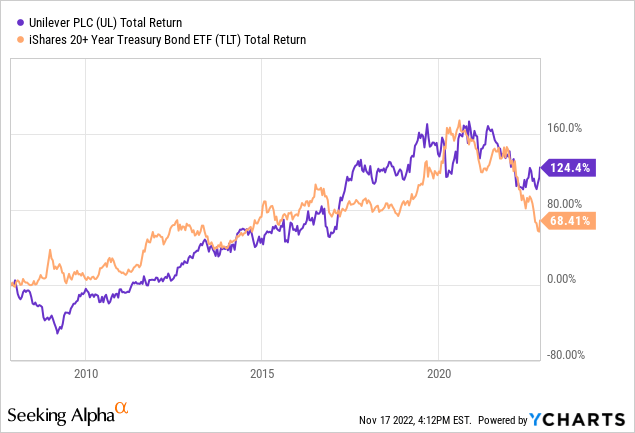

Here is the past 15 years of returns for Unilever vs. U.S. long-term treasuries (TLT):

Even if you bought Unilever in 2007, right before the financial crisis started, you’ve still outperformed bonds meaningfully over the long haul (and yes, this includes the respective dividends and interest from both investments, respectively).

It’s been neck and neck. Bonds took the early lead during the financial crisis. Unilever caught up and then took the lead in the late 2010s. Then bonds briefly moved ahead during the beginning of the pandemic. Now, Unilever stock has pulled ahead again thanks to the sharp sell-off in bonds.

I think this is the right framework for thinking about the business. Unilever’s management has done so little with the company’s assets or growth possibilities that it effectively is just a yield play today. Is the premium on Unilever stock high enough to offset the added volatility versus a risk-free treasury bond? I believe the answer is yes.

Even with the recent run-up in bond yields, lending to the government is going to get you somewhere in the 3-4% range. Unilever gets you a starting 5% earnings yield, and probably a smidgeon of earnings growth on top of that. Over the long-haul, the bigger starting yield will usually outperform. It may not be by that great of a degree, as the above 15-year chart shows, but there is some alpha here.

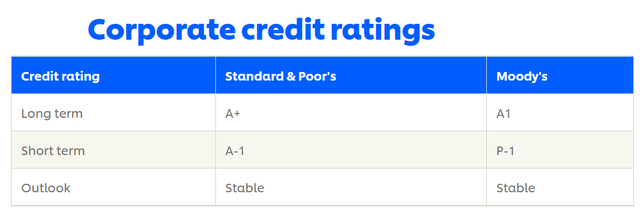

Normally investors might demand a fairly significant yield premium to own an equity versus a government bond. In the case of Unilever, however, risk is modest. For one, the company’s products are the sort that don’t have to change or face much disruption risk. For another, Unilever has a tremendous balance sheet, ensuring that it won’t run into financial problems any time soon:

Unilever credit ratings (Corporate website)

Unilever has failed to meet investor expectations in recent years. However, it has a strong platform of brands and a great balance sheet which give it considerable flexibility in charting a new path forward. In the meantime, even if Unilever is not able to optimize its operations, owning an ultra-defensive company at 20x earnings is not the worst situation to be in. Unilever shares are unlikely to lose money from here over any meaningful length of time and can be expected to produce mid-to-high single digit returns going forward.

Unilever Stock’s Bottom Line

I purchased my holding in Unilever back in 2016 around $40/share. Since then, I haven’t worried about the company too much. Shares initially appreciated and the dividend has been stable and generous. Unilever has been and likely will continue to be a fine defensive holding that generates adequate, albeit not especially compelling returns.

That said, there may be a window of opportunity here. UL stock dropped back into the low $40s, pushing its earnings yield up to 6%, before the recent rally. If the Fed pivot rally we’re seeing now fades, UL stock could easily end up back near the lows and offer a decent entry point.

I view Unilever as a straight-up bond alternative at this point, albeit one with some upside optionality depending on what activists and new management may end up doing. A 5% earnings yield with a starting 3.5% dividend yield isn’t bad. And with another market correction, we could be looking at 6% and 4% on those two figures, respectively.

Clearly, Unilever isn’t the most attractive consumer staples stock out there by any means. There are plenty of staples firms that have grown earnings at 8-10% compounded rates and which trade at multiples not that much higher than Unilever. Those faster-growing staples are likely to outperform considerably over time.

However, for the slow-moving ultra-defensive category of equities within a portfolio, UL stock seems like a reasonable pick at today’s valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment