Delmaine Donson/E+ via Getty Images

By Alex Rosen

Summary

We rate The Emerging Markets Internet & Ecommerce ETF (NYSEARCA:EMQQ) a Sell. EMQQ on the surface sells itself as a no-nonsense straightforward emerging markets tech play, but even a cursory look under the hood shows a very different picture. It would be interesting to see how the fund defines emerging markets, because it has large holdings in such countries including South Korea, the Netherlands, Singapore, Russia, Argentina, India and over 50% of the holdings are in China.

E-commerce in China is a good sector to hold, and the internet is always a safe bet, especially when the focus is on cellular tech and broadband access. However, there are many other ETFs that have similar models but without the emerging market label and the associated expense ratios.

Strategy

According to EMQQ’s own prospectus, “the fund seeks to offer investors exposure to the growth in internet and e-commerce activities in the developing world as middle classes expand and affordable smartphones provide unprecedentedly large swaths of the population with access to the internet for the first time”.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Non-U.S. Equity

-

Sub-Segment: China

-

Correlation (vs. S&P 500): Moderate

-

Expected Volatility (vs. S&P 500): High

Holding Analysis

Setting aside the emerging markets issue for a moment, and focusing on the internet and e-commerce aspect, there is a lot to like about EMQQ’s holdings. The fund is heavily weighted toward the tech and e-trade sectors as one would expect from such a fund. Surprisingly the find holds over 140 individual stocks, despite the fact that the top ten holdings account for 60% of the fund. Perhaps this is why the expense ratio is on the high side.

Having said all that, the elephant in the room is really the lack of exposure to emerging markets. Investors really looking to capture the upside potential of emerging markets will be hard pressed to find that here.

Strengths

It would not be inaccurate to describe EMQQ as a predominantly Asian tech ETF, with a focus on China. Thus the strength of EMQQ really lies in its reliance on China as a driver of its returns. As China goes, so does the fund.

Despite the recent macroeconomic shocks to China’s economy, it remains one of the world’s two economic superpowers. It will continue to be, as it’s still a rising hegemon that has yet to reach the pinnacle of its supremacy. This confidence in China’s ascension is based in no small part by the tremendous growth in the internet software and service providers sector.

Weaknesses

Unlike pure China digital ETFs, EMQQ has spread itself out over a much broader range of digital economies. However just because a fund is diversified doesn’t make it better, it just makes it bigger. With 75% of its holdings in three East Asian countries, EMQQ has no illusions about who it is, and what it is trying to do. However, it is trying to do it at a higher expense ratio. Investors can get similar, if not better exposure to the East Asian digital markets for lower costs and higher returns.

Opportunities

EMQQ is concentrating on the e-trade and internet sectors of East Asia. This is generally a good idea. China will continue to be an e-tail giant in a sector that will only continue to grow. Additionally, the internet is not a passing fad, but a critical factor towards economic growth. Companies that have a sound business model and focus on the digital sector should be solid investments.

Threats

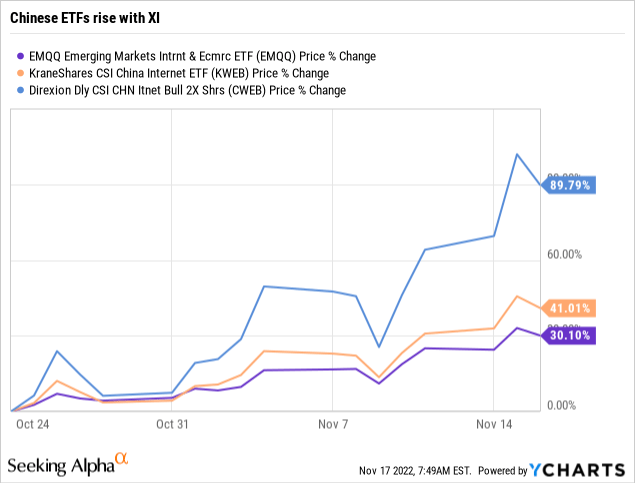

EMQQ rises and falls as the tide in China. Since China cemented Xi Jinping as its leader for the foreseeable future, creating a greater degree of certainty in the country, the economy seems to have stabilized. The chart below shows how two major digital ETFs similar to EMQQ, but with a pure China focus have responded to Xi’s appointment for a third term.

However, the reality is, the funds rose not because of any change in the fundamentals, but because of China itself, and those funds focusing purely on China fared much better then those with only one foot in the door.

Proprietary Technical Ratings

- Short-Term Rating (next 3 months): Sell

- Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

EMQQ is made up of some of China’s strongest tech companies. However, so are many other ETFs. EMQQ also holds shares in South Korea, India, Singapore, The Netherlands and many other developed countries. That is all well and good except for the claim that it is an emerging market fund and not just a non-U.S. e-commerce and internet fund.

ETF Investment Opinion

There is nothing wrong with EMQQ, except that it does what many other China digital ETFs do, only not as well and for a higher fee. For these reasons we can not recommend adding EMQQ to your portfolio, and if it is there, Sell and look for something else.

Be the first to comment