Bryan Bedder/Getty Images Entertainment

Intro

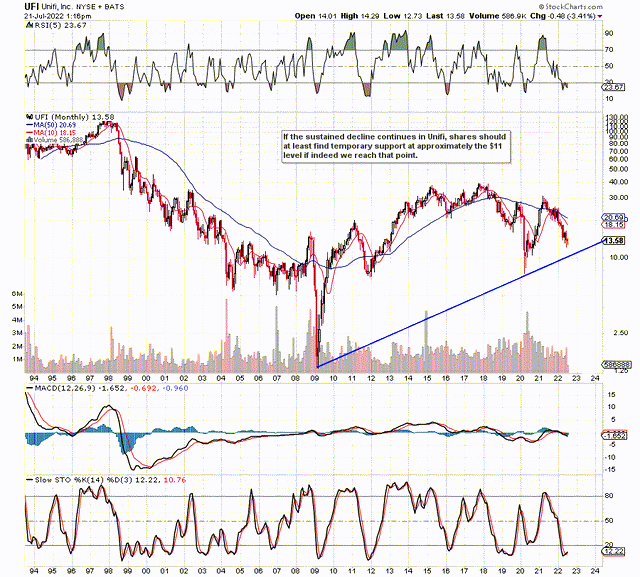

If we look at a technical chart of Unifi, Inc. (NYSE:UFI) (Recycled & Synthetic Product Manufacturer), we see that shares look very oversold on the long-term chart. We see this through the oversold nature of the RSI momentum indicator as well as the slow stochastics indicator. If indeed lower lows continue to play themselves out on the technical chart, then shares should eventually find support at the supporting trend-line depicted below. Our job is to decipher whether support would hold at that level which at present comes in at approximately $11 a share.

Unifi Long-Term Technicals (Stockcharts.com)

Value

From a valuation standpoint, Unifi definitely stacks up as a long-term investment. Shares are trading well under book value (P/B of 0.69) and the company´s sales look very cheap compared to the sector in general (P/S of 0.33 compared to the industry average of 0.91). Furthermore, Unifi´s debt to equity ratio of approximately 0.26 means that interest expense on the income statement does not adversely affect the company´s earnings to any major degree.

Growth Worries

However, the forward GAAP earnings multiple of 17.7 compared to the trailing counterpart of 10.6 highlights the growth problems Unifi has at this moment in time. These multiples mean that earnings per share are expected to drop by well over 30% in fiscal 2022 (Year-End: June 2022) where fourth-quarter earnings are expected to be announced in the next few weeks. Suffice it to say, Unifi as an investment has the valuation and the financial strength to be a sound long-term investment, but the market will most likely only begin to become interested in this play when earnings revisions begin to trickle upward. Welcome to the world of value investing where patience many times is needed in droves in order to succeed in the long run.

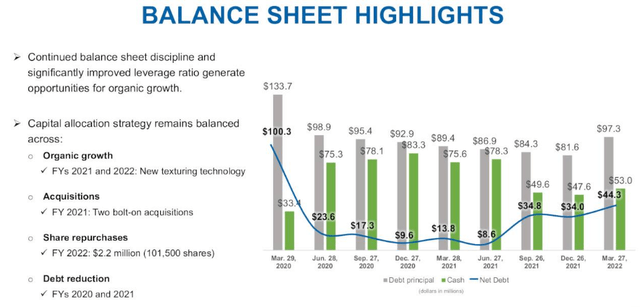

A dialing up in forward-looking earnings revisions will concur with a drop in the company’s cash-flow multiple (Which comes in at 29.12 over the past four quarters). Unifi only managed to generate approximately $9 million of operating cash flow over the past four quarters which is too little for the amount of investment dollars this company puts to work on a regular basis. Net debt as we can see below came in at just over $44 million at the end of the most recent third quarter. The company´s profitability trends will majorly affect how Unifi´s balance sheet fares out going forward.

Balance Sheet trends In UFI (Seeking Alpha)

Gross Margin

Although management alluded to improving conditions regarding the hiring of labor in the U.S. as well as getting to grips with cost inflation on the front-end, it will be interesting to see if indeed these challenges begin to subside meaningfully in upcoming quarters. The business needs to keep both profitability & volume levels buoyant going forward as Covid-19 for example has not gone away and we will see the ramifications of this in the Asian business (on the volume side due to multi-week lockdowns which took place in that jurisdiction in Q4) in the upcoming Q4 numbers. This really is a pity, as the China story up to this point was a positive one, to say the least boasting 15% annual growth rates in previous years.

This really is the issue for UFI in that external conditions are going to affect the numbers here to a greater degree over other industries. Demand trends, sustainability goals, and Repreve (Recycled Fiber) momentum all point to strong growth, but only if trading conditions indeed co-operate. Although management talked up the sequential improvement in gross margin in Q3 (From 8.4% to 9.5%), that 9.5% number was still quite a bit off the 14.3% gross margin print in the third quarter of fiscal 2021.

The Polyester & Nylon segments are definitely becoming more profitable, so it will be interesting to see if more gains can be registered here over the next few quarters. However, with gross margins not far from the 10% mark, UFI does not have much room to play with here. Inflation on the front end as well as labor challenges will continue to put pressure on the company´s income statement if they indeed persist. Hopefully, as mentioned, earnings estimates can begin to be dialed up which would at least buy the company time to take advantage of the clear demand on offer.

Conclusion

Therefore, to sum up, Unifi, Inc has a lot to do, as inflation could really hurt the company´s profitability if indeed it persists over time. Nevertheless, despite the firm´s gross margin problems, the stock is cheap, has low debt and we easily could see a strong snap-back rally if indeed trading conditions can begin to cooperate. Let´s see what Q4 numbers bring. We look forward to continued coverage.

Be the first to comment