Darren415/iStock via Getty Images

Cannabis stocks have been trending higher heading into the release of a cannabis legalization bill. The bill is very similar to the draft presented one year ago and there is arguably little hope for it to pass the Senate vote. But there is symbolic value in the act in that it may pave the way for a less comprehensive bill but still with incremental legislative progress. In this report, I discuss what the legalization bill may entail, as well as how it impacts cannabis stocks. I also discuss two companies that may benefit from outright legalization.

Cannabis Legalization in 2022

One year ago, Senate Democrats unveiled a draft of their cannabis legalization bill. On Thursday, they unveiled the official Cannabis Administration and Opportunity Act. The bill included discussion ranging from a 25% tax on large businesses to providing protections for financial firms to work with cannabis operators. I should clarify that the bill appears to be more about “decriminalization” than legalization (though the latter will be used in most headlines – and I will use the term legalization elsewhere in this article). The key difference is that this bill would decriminalize cannabis on the federal level, but the states can decide whether or not to legalize it themselves.

That means that this bill will not legalize cannabis in states that do not want to legalize it – but it could still prove to be a key catalyst in driving further state adoption of legal cannabis. My personal view is that cannabis is a secular trend that is inevitable – whereas the average person views it as an addictive and dangerous drug, I instead appreciate its wide range of medical uses (it has done wonders for my insomnia and chronic pain) and lower risk relative to alcohol. Let’s now discuss two companies which may benefit from this bill.

Potential Cannabis Winner 1: Tilray

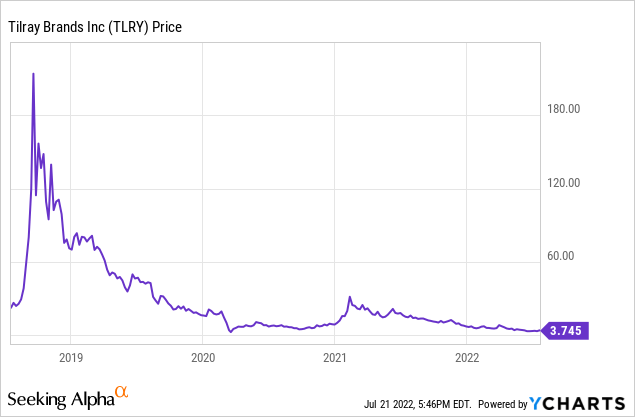

Tilray Brands, Inc. (NASDAQ:TLRY) is one of the more well-known cannabis stocks in spite of being based in Canada. The cannabis investment thesis has seen its share of hype over the years, as evidenced by the extraordinary bull and bear markets experienced by the stock. TLRY is down over 95% from all-time highs reached in 2018.

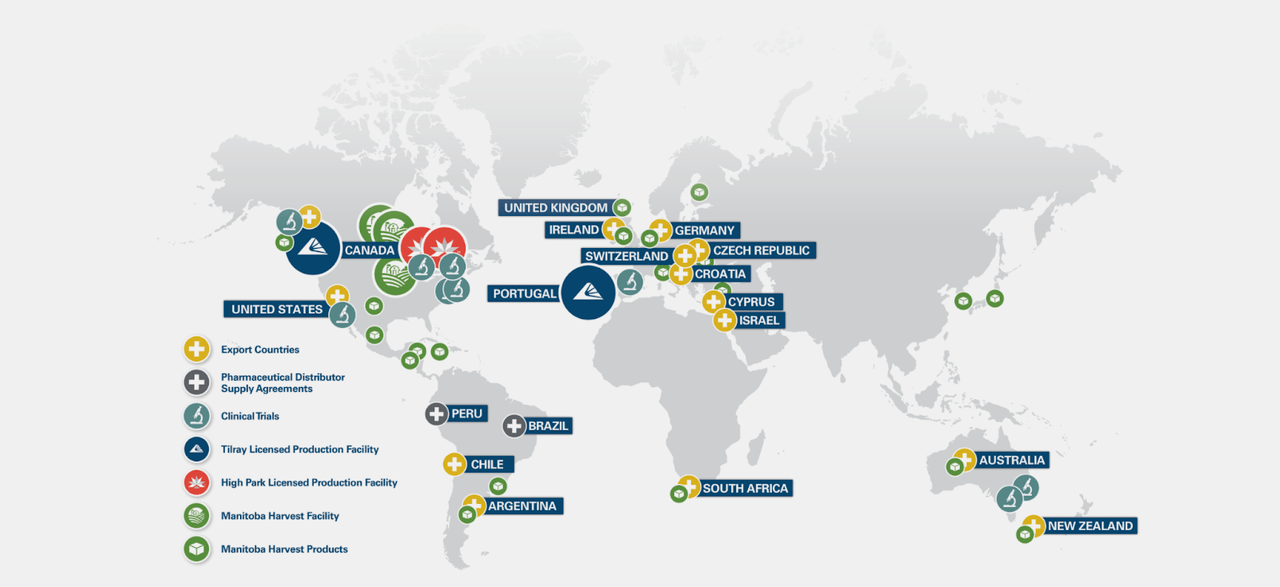

TLRY has sought to become a global operator with a footprint across many countries.

Tilray Investor Presentation

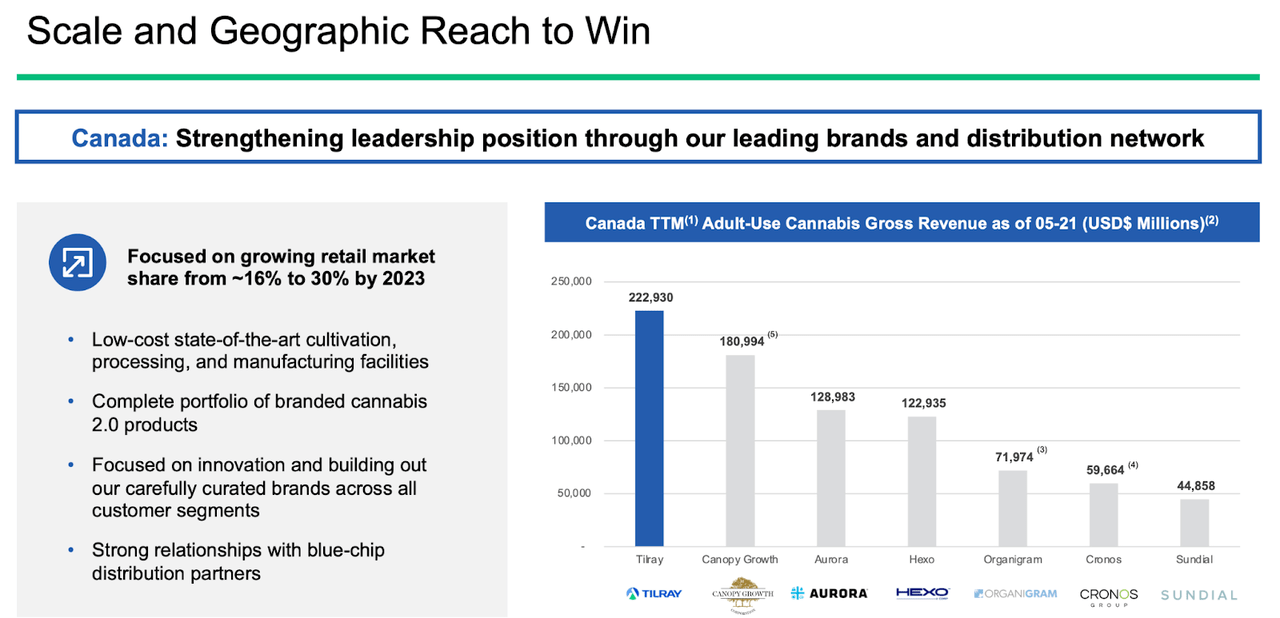

Even so, the vast majority of its cannabis revenues come from Canada, where it is the leader in adult-use sales.

Tilray Investor Presentation

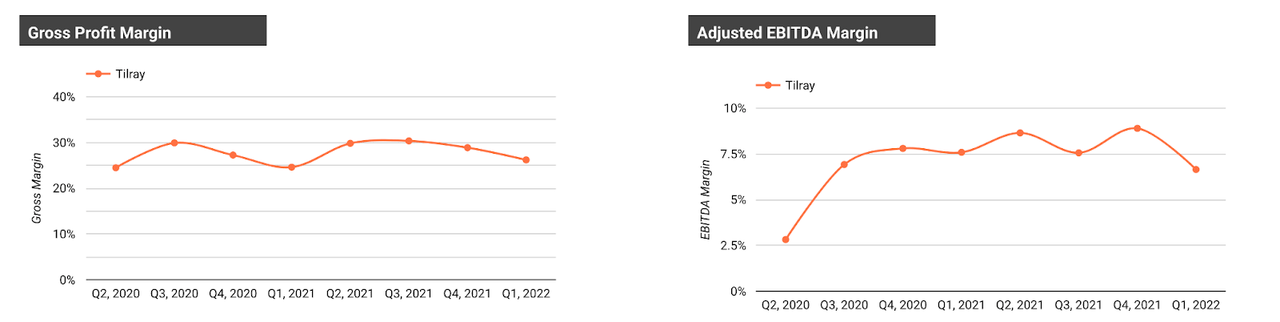

The largest Canadian operators had previously built out large state-of-the-art cultivation facilities to capitalize on the global opportunity, but thus far have been unable to generate meaningful revenues outside of Canada. This has led these operators to use facilities meant for global markets within the single country of Canada and has predictably led to tight profit margins. While TLRY consistently generates among the strongest margins among Canadian peers, its adjusted EBITDA margin remains slim at below 10%.

Cannabis Growth Portfolio

Legalization in the United States may be able to boost TLRY’s profit margins because the company would be able to make full use of its cultivation facilities. I reiterate that, as previously noted, this legalization bill centers more around decriminalization, meaning that there is no guarantee that TLRY will be able to sell into the United States (individual states would have to allow for interstate commerce).

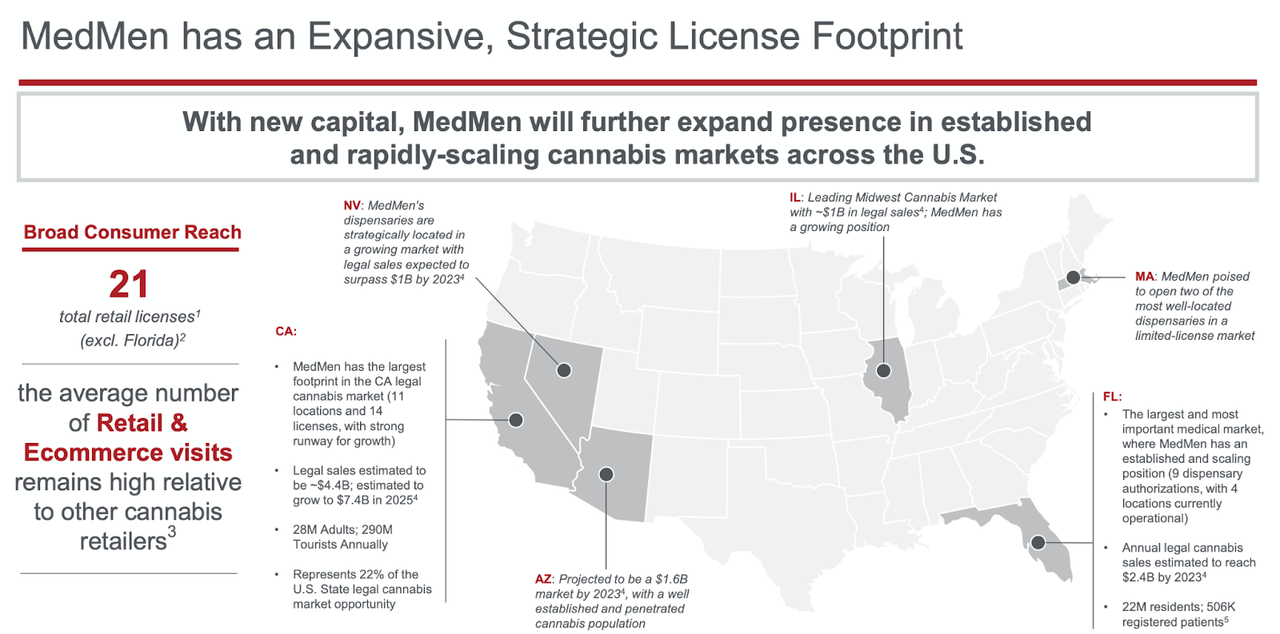

Legalization will also boost TLRY’s equity investments, namely its $166 million investment in the U.S. cannabis operator MedMen (OTCQB:MMNFF).

Tilray Investor Presentation

Due to cannabis being illegal on the federal level, that investment becomes “valid” only upon legalization – upon which TLRY would be able to monetize the investment. I would expect the stocks of U.S. cannabis operators like MMNFF to appreciate in value as well. At recent prices, TLRY is trading at around 3x sales which is not a demanding multiple, but one must consider that legalization (and its ability to export product into the country) appear to be a necessity in its path to profitability.

Potential Cannabis Winner 2: Green Thumb Industries

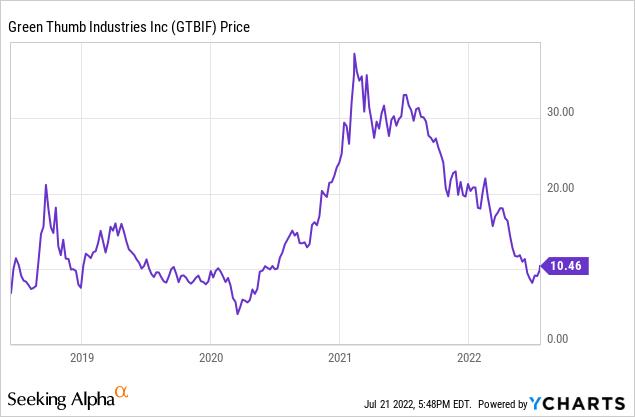

Green Thumb Industries Inc. (OTCQX:GTBIF) is a cannabis operator based in the United States. Unlike TLRY, which currently has minimal business in the United States, all of GTBIF’s revenues are in the country. However, GTBIF has also seen its stock price clobbered as of late.

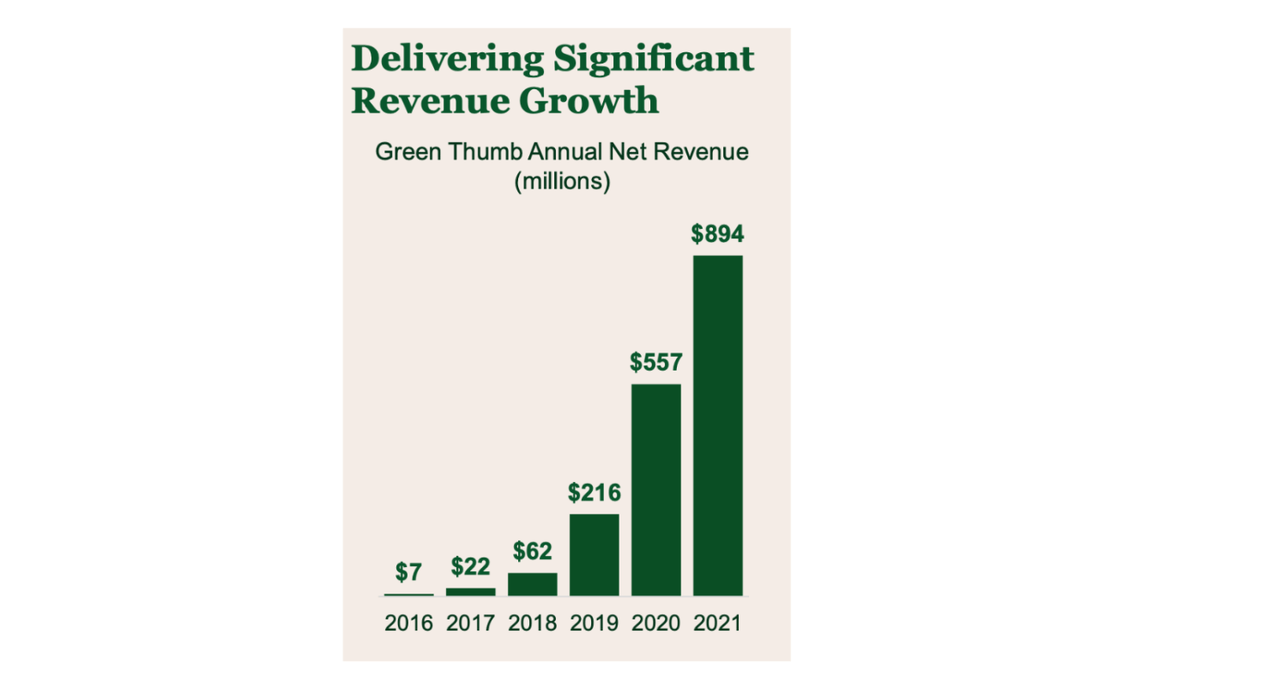

That stock price action is surprising considering that GTBIF has grown its fundamentals at a rapid rate.

Green Thumb Investor Presentation

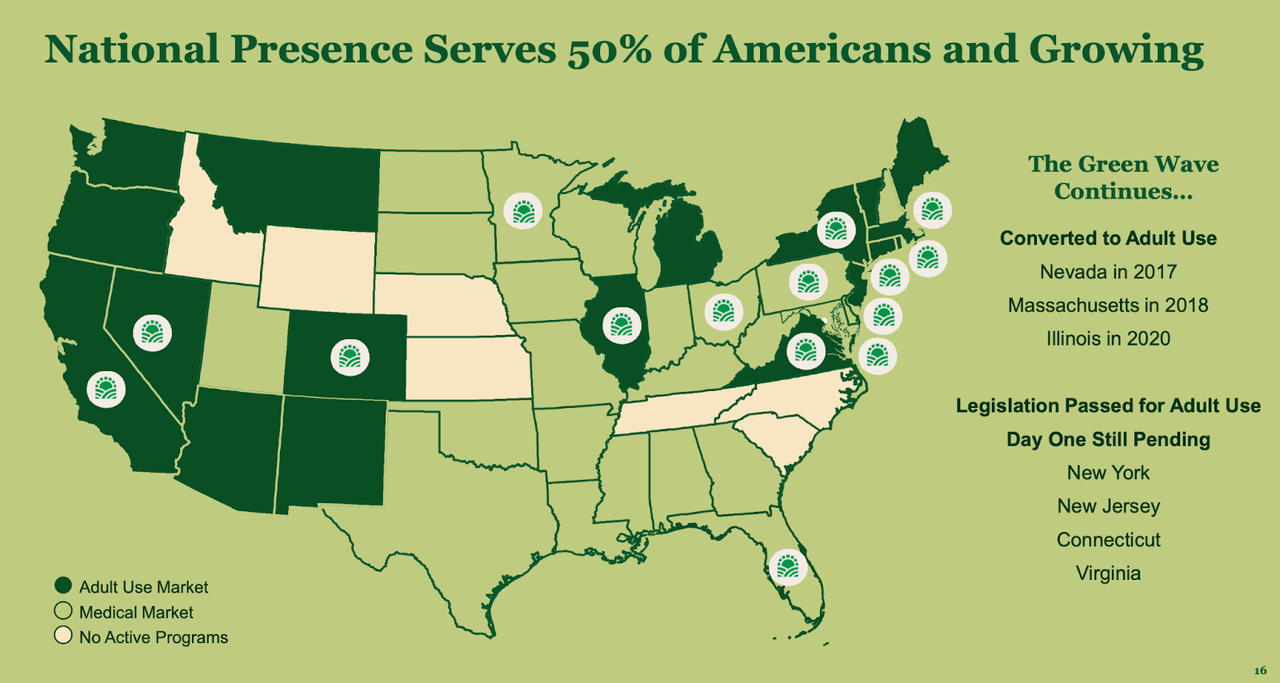

Today, GTBIF has a footprint in 15 states, including key growth states such as New Jersey and New York.

Green Thumb Investor Presentation

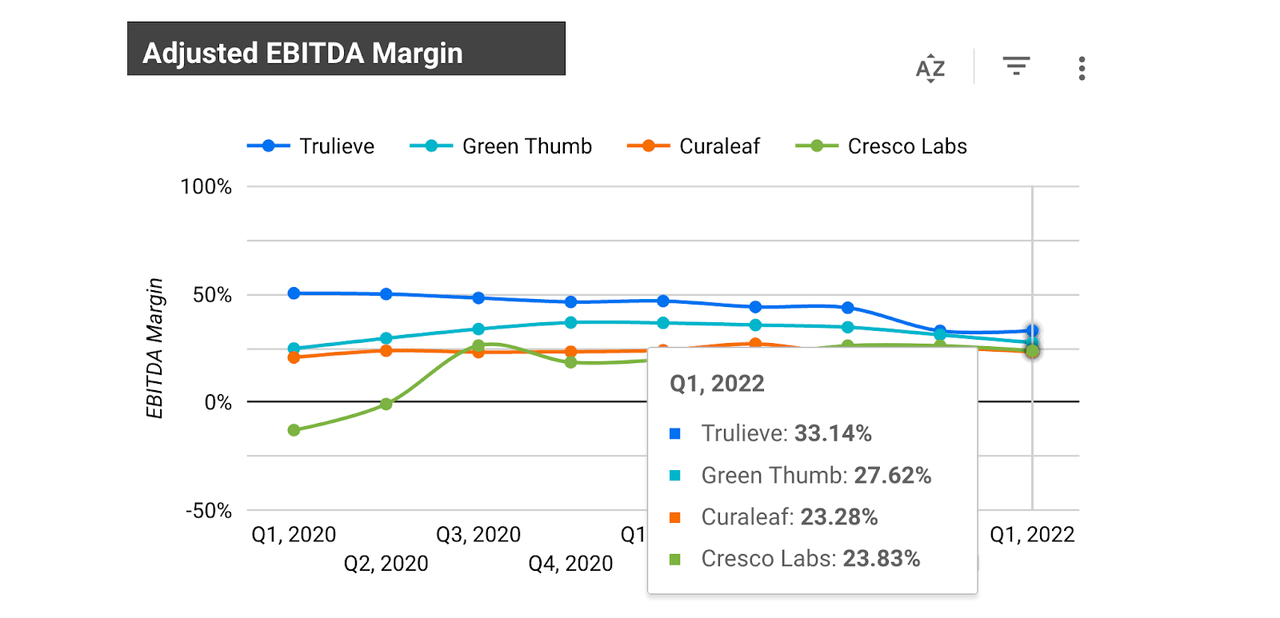

GTBIF, like many other U.S. cannabis operators, has capitalized on ongoing legalization at the state level. GTBIF is well regarded as being led by a top tier management team – the company always seems to be positioned in right states at the right time. Unlike some peers which have seemingly prioritized growing at any cost, GTBIF has struck a perfect balance between aggressive growth and profitability – the company consistently reports profit margins near the top of the sector.

Cannabis Growth Portfolio

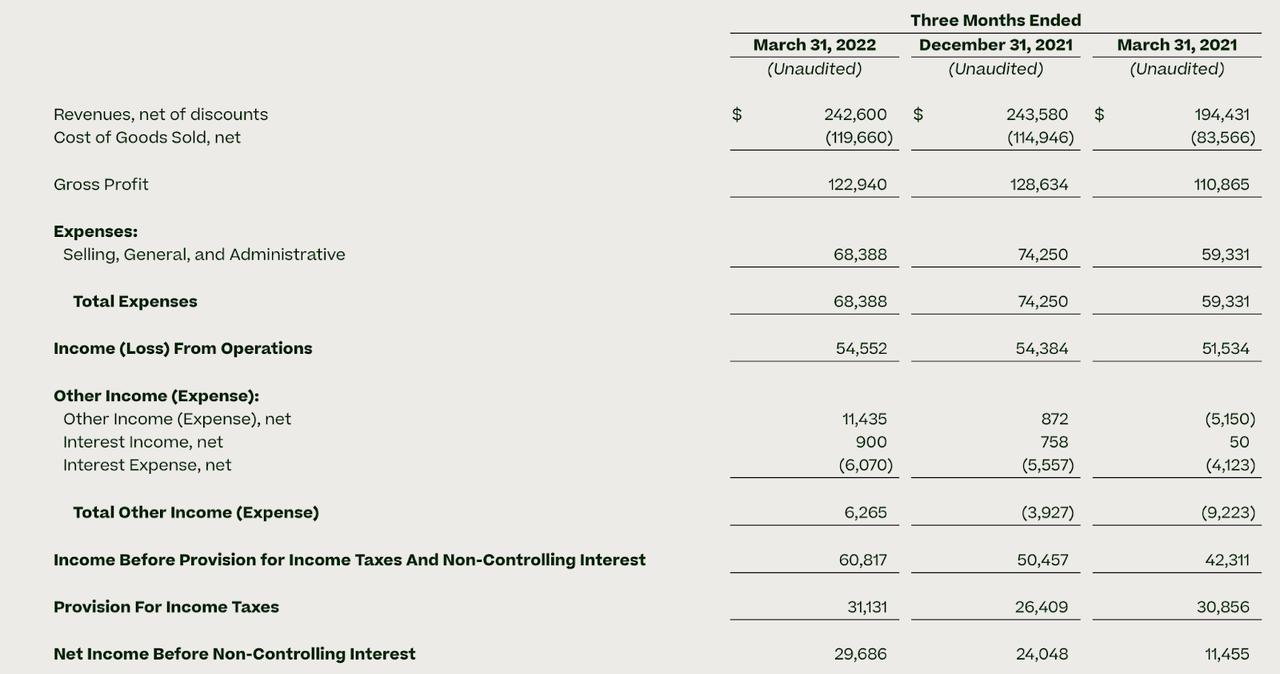

Unlike many U.S. cannabis operators, GTBIF is profitable on a GAAP basis. That this is important may be surprising to those new to the sector – the key thing to understand is that U.S. cannabis operators are not allowed to deduct operating expenses from taxable income. Those operating expenses might include things like rent, debt interest, employee wages, and more. Sometimes U.S. cannabis operators need to pay taxes in spite of having negative taxable income. We can see this play out below – whereas GTBIF generated $60.8 million in income before income taxes in the latest quarter, the company recorded $31.1 million in income taxes – a 51% implied tax rate. That tax rate was even more ridiculous in the prior year when it was 73%.

Green Thumb 2022 Q1 Earnings Release

Legalization would benefit GTBIF by helping to normalize tax rates. Further, I expect interest rates on debt to decline as the capital markets open up. In spite of GTBIF being a profitable operator in a high-growth sector, the company still had to pay a 7% interest rate on its debt. What’s more, federal legalization could prove to be a catalyst for accelerated legalization at the state level, bringing forward many years of growth. Lastly, I could see legalization helping to bring in new consumers who otherwise had been hesitant on trying a federally illegal product. At recent prices, GTBIF is trading at around 6x 2023e EBITDA which is an astonishingly low multiple for a company that is GAAP profitable with a long hyper-growth runway. It might be an understatement to say that fair value is around 25x EBITDA, but that would already imply over 300% upside over the next year.

Bottom Line

Consumers, supporters, and investors in cannabis may be excited for the prospects of legalization. They can also be forgiven if they are skeptical of this bill’s ability to pass through the Senate. While the Democrats hold a majority in the Senate, not all Democratic senators have voiced support for a legalization bill, and very few if any Republican senators have voiced support at all. This means that it is unlikely for there to be 60 votes in support of the bill, which most guarantees that the bill will not pass the filibuster. Instead, I expect this bill to fail but to potentially pave the way for a smaller less comprehensive bill, perhaps one that addresses access to capital markets like the SAFE banking bill.

It may take many years or even decades before the country finally legalizes cannabis. But there are companies like GTBIF capitalizing on the cannabis growth story right now, rapidly taking market share and positioning themselves before the field opens up for everyone. GTBIF and other U.S. cannabis stocks trade at highly compelling valuations while offering high-growth secular stories.

Be the first to comment