May Lim/iStock via Getty Images

Mispricing is the key source of outperformance or perhaps even the only source of outperformance. In a world where all assets are priced correctly the only way to generate a higher return would be to take on more risk.

Mispricing affords the ability to increase return without taking on more risk. That is what we seek, and it is more reliable to find mispricing if you know the forms in which it comes. There are 3 distinct types of mispricing but to understand them we first must understand what correct pricing means.

In generic terms, the correct price for a stock is its fundamental value. In the real world, there are quite a few unknowns that go into the fundamental value. Thus, the practical definition of a correct stock price is one in which the price matches the fundamental value using a reasonable set of assumptions about the future based on a reasonable knowledge of the conditions that exist today.

With the definition of correct pricing in mind, we can begin to understand ways in which a stock could be mispriced. There are 3 distinctly different types of mispricing:

- Mispricing predicated on misinformation about the present

- Mispricing predicated on misinformation about the future

- Dislocated pricing.

Misinformation

Not all dissenting opinions represent misinformation. Analyst A might think a stock is worth $100 based on his views about future sales given trends he is seeing in the sector. Analyst B thinks the stock is worth only $80 as his outlook calls for a deceleration in sector growth based on certain things he is seeing. One or both of these analysts is certainly wrong, but their views do not represent misinformation about the future. Presumably, both views are based on a reasonable set of assumptions and the discrepancy is a result of uncertainty making it difficult to discern future events. Misinformation comes into play when the opinions on a stock’s value are not grounded in a reasonable set of assumptions. This happens on a daily basis at an individual investor level. For example, a conspiracy theorist loads up on defense and ammunition stocks because he thinks aliens are going to invade earth in the near future.

That is misinformation about the future because it is probably not a reasonable assumption.

When an individual buys a stock based on misinformation it usually does not cause mispricing. In order for mispricing to ensue, the misinformation has to become sufficiently widespread. This happens more often than it should, and there are consistent mechanisms by which this occurs:

- Euphoric momentum

- Depressive momentum

- Company driven misinformation spread

- External misinformation attacks

A widespread mistake in an investor’s process is the use of stock price movement as a signal. If the price is up they think something must be going well fundamentally and vice versa. This consistently leads to momentum carrying stock prices beyond a rational range and this happens in both directions.

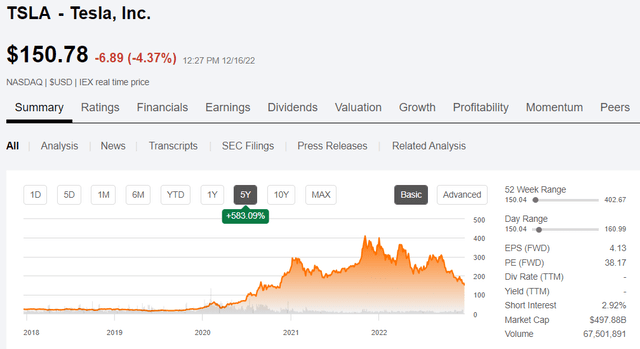

In 2020 and 2021 electric vehicle stocks just kept going up. It began with a rational idea that market adoption of EVs would increase. Indeed, EV sales did increase and as this data came out the stock prices of EV companies rose significantly. That is when momentum took it beyond a rational range. Companies like Tesla (TSLA) shot up thousands of percent to their peaks.

The combined market cap of EV companies got to a point where they would have to capture greater than 200% market share to justify the valuation.

This clearly takes it from bullish but plausible to irrational misinformation because 200% market share is of course not possible.

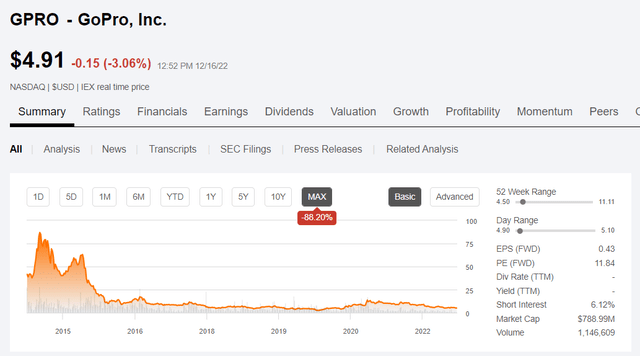

Beyond stock price momentum, some misinformation is created more directly and GoPro (GPRO) is arguably a great case study.

GoPro makes high end camera equipment optimized for active uses. It is a consumer products company, but when the company IPOed it presented itself as a digital media creator and successfully spread this idea to the extent that it got a tech growth multiple rather than a consumer products multiple.

This ‘misinformation’ was spread directly by the company perhaps even accidentally. Perhaps the CEO actually thought it would become a digital entertainment empire, but such a trajectory was wildly outside the bounds of rational projection. Nonetheless, the market went for it and GPRO traded up to absurd multiples.

Finally, the other main source of misinformation is external attacks from individuals, short selling firms, or the media. It can never really be known if these are intended as misinformation or if the entity responsible for these reports is themselves just misinformed. Regardless of intent, when these reports go viral it causes the market to believe the current conditions of the company in question are substantially worse than the actual conditions.

When successful, these attacks cause the market to reprice the company based on the suggested situation rather than the real situation. This would by mispricing predicated on misinformation about current conditions.

Dislocation

Dislocation is the 3rd type of mispricing and perhaps the most interesting. So far, we have been discussing the market pricing stocks at levels that happen to be incorrect for various reasons, but in each case it is the market’s beliefs about a stock that cause it to be priced where it is.

Dislocation is an entirely different concept: one in which the market price doesn’t reflect the market’s opinions. Say, for example, the market believes stock X is worth $15 per share but it is somehow trading at $12 per share. That is a price dislocation.

How does this happen?

In the medium and long term pricing is a matter of market moving price to a level at which buyers and sellers are balanced. It forms an equilibrium in which a price above what the market believes a stock to be worth results in more sellers and a price below that level results in more buyers. Occasionally this equilibrium breaks down, usually for a short or very short period of time.

It can break down for an individual stock or even the entire market. In 2010 there was a flash crash in which the Dow Jones Industrial Average dropped by about 8% in a matter of minutes.

Wikipedia

The market did not suddenly think the entire market was worth 8% less. It was a matter of accidental selling.

Market level dislocations are rare, but it happens on a daily basis for individual stocks. There are countless potential mechanisms but here are 6 that I have seen on a regular basis.

- Stop losses

- Short squeeze

- Low float (legal or functional)

- Illiquidity

- Margin calls

- Stock issuance

Stop losses were a big culprit behind the flash crash, but here is how it works on an individual stock level. The market has good days and bad days and during periods of volatility the amplitude of this daily noise is heightened. Perhaps the market is down 3% on a given day and an individual stock is down 5%. That is a common threshold at which people will set stop losses – a mechanism that automatically triggers a sale of the stock if the price drops below the set threshold.

If too many owners of a given stock set similar thresholds the price hitting that level will set into motion many more sell orders causing the price to cascade down. As the price drops further, deeper stop losses are triggered causing more selling.

Over time, rational people see the stock trading at irrationally low levels and scoop up the cheap shares, eventually restoring market price to the level of perceived value. In that dislocation, however, the stop loss sellers lost a lot of money and the opportunistic dislocation spotting buyers made significant profits.

This is why I strongly discourage the use of stop losses or any other mechanism that forces involuntary trades.

In fact, with most of these sources of dislocation you will note that the transactions causing the dislocation are not voluntary.

- Short squeezes happen when short sellers are forced to buy the stock because the pricing action pushes them out of compliance with their risk tolerance.

- Margin calls force people to sell stocks, even stocks they like at prices they might think are way too cheap

For big highly liquid stocks such activity is less likely to substantially impact market pricing. Dislocations are far more common in lower liquidity issues.

Companies with low float are those where a large portion of the shares are locked up. Maybe they are OP units or perhaps owned by insiders that cannot sell for a certain period of time. There are also instances in which a large portion of outstanding shares are held by passive owners who simply use it as an income vehicle and may not even consider selling for many years.

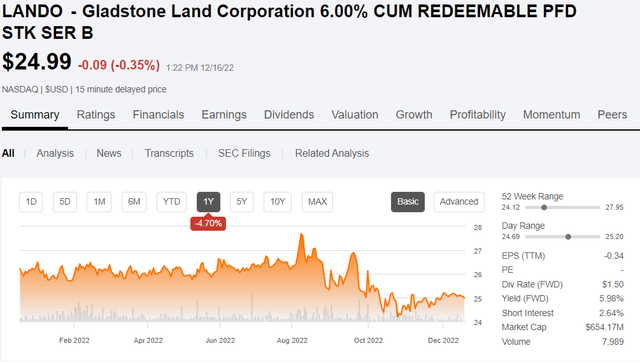

Gladstone Land (LAND) Preferred B (LANDO) is a great example of a current dislocation. In no rational world would a 6% coupon preferred continue to trade at par when interest rates and treasuries are soaring, yet LANDO defied gravity in which every other fixed rate preferred dropped to a substantial discount.

Why? I suspect it is because LANDO was sold to investors as a long term income vehicle. Many bought with the intent to hold forever and just collect its 6% yield. This functionally reduces float because a large portion of owners simply do not trade the stock. It makes the volume woefully small relative to the shares outstanding.

When dealing with small floats it can create dislocation in either direction and it is hard to predict because it only takes a few buyers or sellers to move the price significantly.

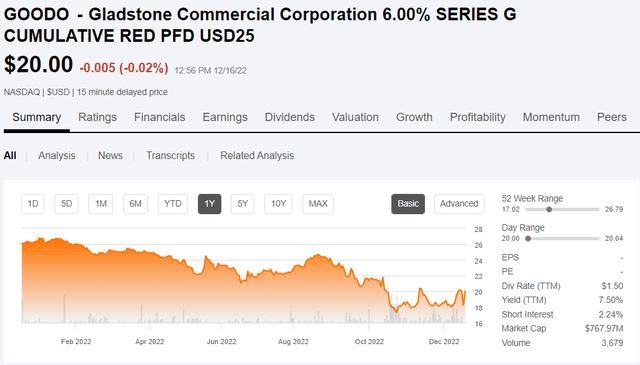

A different preferred from the same family of issuers that also has very low volume is Gladstone Commercial (GOOD) Preferred G (GOODO). It too defied gravity as interest rates took down the rest of fixed income as it maintained par pricing or higher all the way through August.

In September, however, people started selling and with the low volume its price moves harshly causing the price to become dislocated from market perceived value.

I do not think market participants collectively valued this at $18 at any point in its history. It simply sold down to ~$18 from just a few sellers, many of whom may have sold for personal reasons unrelated to the value of Gladstone Commercial. Quite simply, the volume of trading was not sufficient to create a proper equilibrium.

These price dislocations make LANDO dangerous and GOODO opportunistic.

Another very common source of dislocation is share issuance. When a company issues additional shares it dramatically increases selling volume without having a tangible impact on buying volume. In the short term this usually tanks the price 2%-5%, but when the issuance volume is large as a percentage of shares outstanding, it can drop the price significantly more.

There are plenty of instances in which the share issuance is demonstrably accretive to value per share yet the price still collapses in the short term. It is not that the market thinks the company is worth less, but rather that price has become dislocated from the market’s collective opinion of value.

The lesson

Mispricing is the key to outperformance and the key to identifying mispricing is to understand the kind of mispricing that it is.

If you are looking at a stock that you think is cheap and cannot determine the nature of the mispricing, perhaps it is not mispriced at all.

Be the first to comment