William Barton/iStock Editorial via Getty Images

Introduction

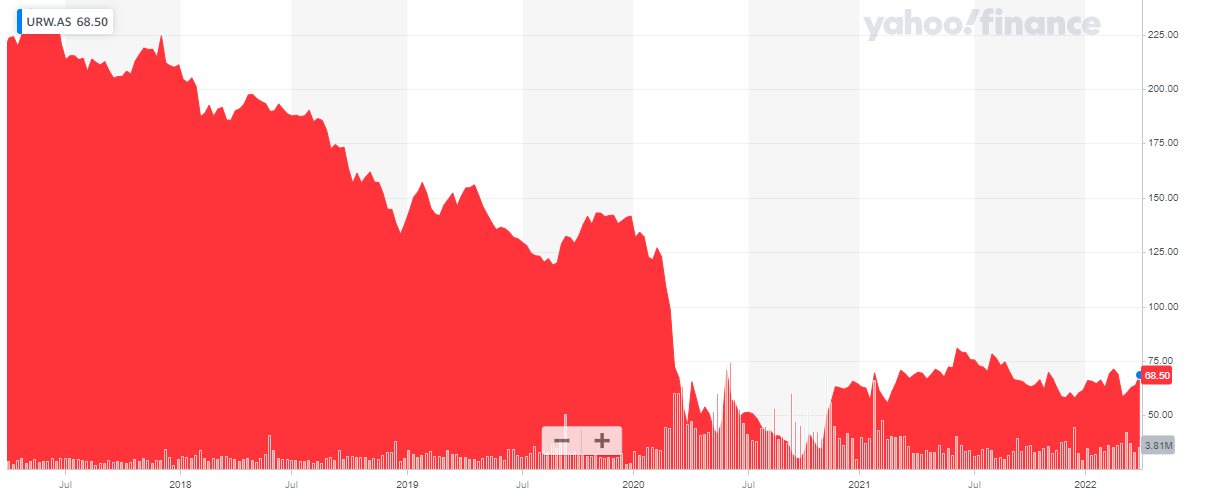

2020 and the first semester of 2021 haven’t been easy for commercial REITs. But in Unibail-Rodamco-Westfield (OTC:URMCY) (OTCPK:UNBLF) (here after “Unibail” for simplicity sake), its issues started about five years ago when it acquired Westfield in a multi-billion transaction. This happened right before the COVID crisis, and Unibail was never able to fully integrate the newly acquired malls and generate the synergy benefits before COVID hit. Now, in 2022, the REIT plans to sell its US assets within the next two years and fall back on the European market. Back to square one, but that doesn’t mean the “cleaned-up version” of Unibail couldn’t be an interesting investment option.

Yahoo Finance

Unibail has its primary listing on Euronext Amsterdam where it’s trading with URW as its ticker symbol. The average daily volume in Amsterdam exceeds 750,000 shares, making it the most liquid trading venue. On top of that, the Amsterdam listing offers options which could help in a scenario where one writes out of the money put options.

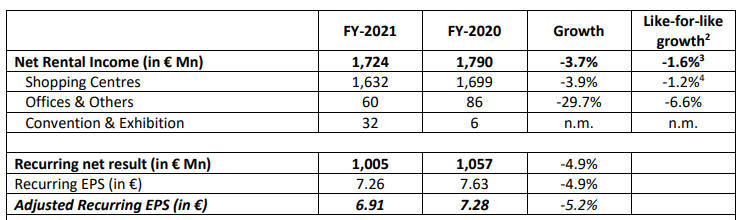

The REIT kept the damage limited in 2021

I was looking forward to seeing how the REIT performed in 2021. The first semester was rather weak as the malls owned and operated by Unibail were still facing mandatory closures. As the vaccination ratio increased throughout the second quarter of 2021, malls were allowed to reopen and the financial performance of the REIT improved.

As of the end of Q2 2021, the adjusted recurring EPS (comparable to the FFO) was 3.24 EUR per share, down from 4.65 EUR per share in H1 2020 as the first quarter of 2020 was still pretty normal, and Unibail had more income-generating assets. The majority of the COVID-related impact in 2020 was recorded in the second half of the year as Unibail’s adjusted recurring EPS was just 2.63 EUR per share. So looking at that weak result in H2 2020, the recurring EPS of 3.24 EUR in H1 wasn’t too bad as it represented a 20% increase compared to the preceding semester.

Unibail’s full-year recurring EPS in 2021 came in at 6.91 EUR per share. Deducting the 3.24 EUR per share generated in H1 2021, the H2 EPS was approximately 3.67 EUR or in excess of 7.25 EUR on an annualized basis, and that’s quite encouraging.

Unibail Investor Relations

It’s still lower than FY 2020 but keep in mind throughout 2020 and 2021 Unibail continued to sell assets to the tune of 3.3B EUR (with for instance the sale of office properties for in excess of 200M EUR and 620M EUR) and that obviously had a negative impact on the recurring EPS as Unibail is repositioning itself.

For 2022, Unibail is now aiming to generate 8.2-8.4 EUR in adjusted recurring earnings per share which would be another major step forward. Of course, effectively realizing this result will depend on the timing of the sale of the US-based assets.

Although Unibail has posted okay results in 2020, good results in 2021 and a very positive guidance for 2022, the REIT is still foregoing paying a dividend as it first wants to get its balance sheet back into a much stronger position.

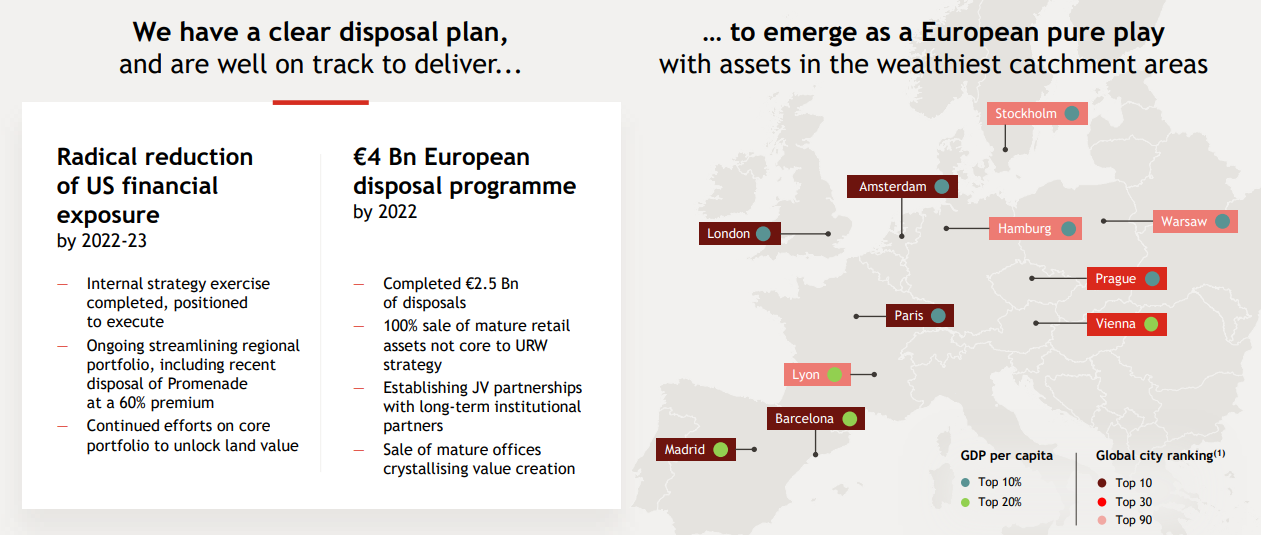

Its plans for 2024 are encouraging, but Unibail will have lost a decade

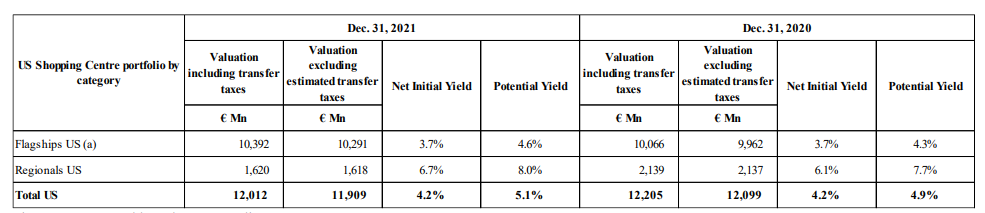

It wasn’t a secret Unibail wanted to sell its US assets and although it’s taking a bit longer than expected, Unibail now wants to complete the sale of its US portfolio by the end of 2023. This will result in Unibail becoming a pure European commercial REIT with a stronger balance sheet than it currently has as Unibail is aiming to achieve a 40% LTV ratio by the time the US portfolio has been sold.

Unibail Investor Relations

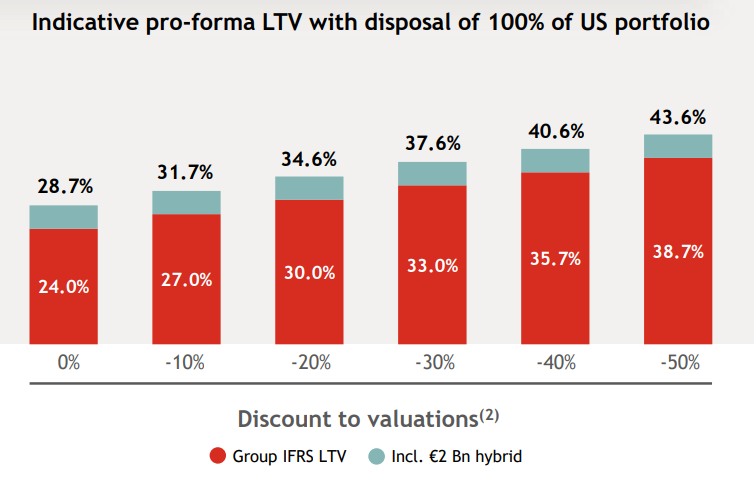

It looks like Unibail is already preparing the market for a disappointing sales price for the US assets as the REIT provided a sensitivity analysis on how the LTV ratio will evolve depending on the discount it needs to apply to the book value of the US assets to get rid of them. As you can see below, the REIT’s most optimistic scenario appears to be a “sell at book value” as there’s zero data on what would happen if the assets would be sold above book value.

Unibail Investor Relations

As you can see above, if the US assets would be sold at a discount of 30% to the book value, the total LTV ratio would fall to just 37.6% (including the deeply subordinated hybrid securities). The financial health of Unibail depends on selling the US assets at a valuation that’s as high as possible. The lower LTV ratio also will help Unibail to self fund its own development pipeline where it has identified over 3B EUR in projects.

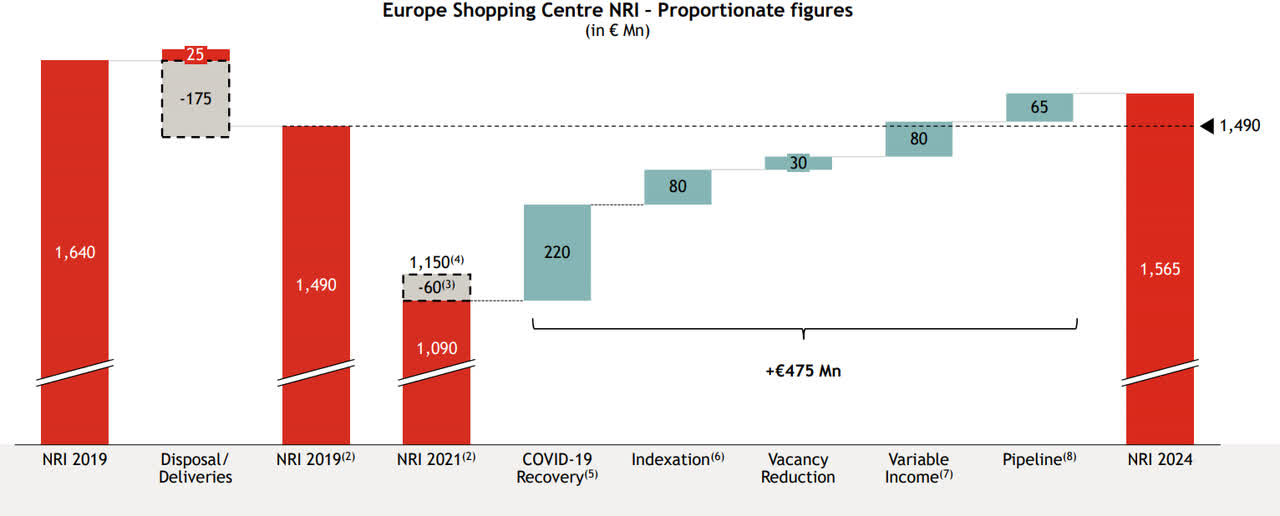

Unibail also provided a guidance for 2024 on a Europe-only basis. The REIT expects its net rental income to get back to the pre-COVID level.

Unibail Investor Relations

This allows us to calculate the recurring EPS for 2024 as we can apply some assumptions for the G&A expenses (175M EUR, down from 212M EUR in 2021 as the overhead expenses will decrease upon closing the sale of the US assets) and the interest expenses (250M EUR). We also should deduct the payments on the hybrid securities and the stake of the non-controlling interests making it realistic to see a direct result of around 1B EUR per share. Note: A lot will depend on the sale of the US assets which have a current book value of approximately 12B EUR. And the real sales price will determine how much debt Unibail can repay and by how much the interest expenses will decrease.

Unibail Investor Relations

The bottom line is, however, that Unibail will have spent 2018-2024 only to end back on square one. It spread itself too thin when it acquired Westfield and I hope the REIT will have learned its lesson.

Investment thesis

Canceling the dividend due to the COVID pandemic likely was a blessing in disguise. As COVID has hit all commercial REITs pretty hard, Unibail’s dividend cancellation got lost in a myriad of other REITs doing the same thing. I also think the decision to forego dividend payments in 2021 and 2022 as well was the smartest thing to do. This allowed Unibail to retain approximately 22 EUR per share in earnings and with just under 139M shares outstanding. This basically means Unibail will have hoarded about 3B EUR in cash flow to reduce the balance sheet risk.

That’s tough for income investors, but I like the drastic approach. Save 3B EUR, dispose of the assets you no longer want and start rebuilding from there. The unknown factor in the Unibail story is the sale of the US assets as the higher the discount on the book value, the lower the impact on the LTV ratio of the REIT.

2022 will be a good year with a recurring EPS of in excess of 8 EUR per share, but I think the sale of the US portfolio may have a negative impact on the anticipated EPS but the positive consequence will be the safer balance sheet.

The dividend will return from FY 2023 on (payable in CY 2024) so there’s no rush for dividend investors to pick up the stock. But the next 12-18 months will likely offer some interesting opportunities to pick up the stock ahead of the dividend reinstatement (a payout ratio of 75% on a recurring EPS of 7.5 EUR would indicate a dividend of just over 5 EUR per share, subject to the 12.8% dividend withholding tax in France). I currently have no position in Unibail but I have written some put options. Those put options are currently all out of the money, and I will likely continue to write put options to take advantage from the high volatility levels. An investment in Unibail is a waiting game.

Be the first to comment