Lukassek/iStock Editorial via Getty Images

In this article, we’re going to look at Linde plc (NYSE:LIN). This is one of those elusive companies with a near-native US listing. It’s a company with a massive market cap, a massive tradition, and a massive upside. Many things about Linde are large – unfortunately, your returns are not likely to be among them.

But it can bring you safely through a crisis while allowing you to be invested in the market.

Let’s see what Linde can offer you.

Linde – The company operations

Linde plc is the world market leader for industrial gases.

That’s as simple as I can put it. The company was originally a result of a takeover of British BOC in 2006, and again the 2018 merger of Linde and Praxair, a US company. The merger was supposed to be an equal one, but accounts show that it was really a bit of a takeover. This is confirmed by the demands on the company in terms of disposals, which leave it with much of Praxair’s original operations, and less of Linde’s.

The original Linde was one of the German “giants”, founded in the late 19th century, and Carl von Linde was the inventor of industrial refrigeration machinery back in 1870, with the company founded in 1879. He was the one who invented a process for separating air into its individual components and producing pure oxygen. The company’s US operations were confiscated following WW2, and renamed, surprisingly, Praxair. As such, there was never a US-tradition gas company called Praxair – it was Linde’s American operations (mixed with Union Carbide), which with the 2018 merger came “back” to its Linde roots.

Linde produces a wide variety of industrial gases, almost all of them purely at their own locations, and sold at bulk-like qualities (called merchant business) or cylinders to a massive variety of different end uses and industries.

The company operates its own air separation plants on-site at certain client locations, meaning it does not rely on third-party commodities to produce its product/s or sometimes does not even need to transport its gas long distances in order to get it to its customers.

Revenues show us a 35% cylinder gas split, 25% merchant, and 22% on-site, with the remaining sales revenue generated from its engineering operations. Obviously, the differentiator here is what amount/quantity of gases the customer requires, with on-site requiring the largest, to cylinder being the smallest. It also depends on what gases are being produced. On-site gases are usually limited to oxygen, nitrogen, and hydrogen, with merchant being liquid oxygen, argon, carbon dioxide, and helium in addition, and cylinder gases including things like acetylene. The group’s engineering operation further uses its expertise to plan, develop and build plants for the purification and work with olefins, natgas, hydrogen, and synthetic gases, not only for Linde, but for other customers worldwide.

Detailed numbers for how large the worldwide gas market is aren’t really available in terms of revenue. However, it’s estimated that the market is around $100B, with Linde occupying about 25-30% of this market, with closest peer Air Liquide (OTCPK:AIQUY) being at around 20%. Being a small player in this field doesn’t really work – even the third player, Air Products, is less than 10%, with other players like Messier, Yingle, Mitsubishi (OTCPK:MSBHF) being less than 8% each.

A business like Linde is stable for a couple of reasons, but one of the main ones is predictability. It’s stable over time, and the geographic scope of its overall operations protects it from potential volatility in any one given geography.

Linde doesn’t organize itself into product segments, but geographies and Engineering, with Americas being around 37% of revenues and EMEA being 24%, with Pacific being 24%. Engineering & Other are around 20%.

The mix here is massive. The company’s end-users work in every single segment of society, including things like Chemicals, straight-line industrial manufacturing, metal, food industries, health industries, pharma, electronics, and others. There’s a massive business volume and lack of volatility when you supply essentially the entire world with a much-needed commodity. The company’s aforementioned business mix is also extremely appealing and split between a variety of segments.

Linde’s overall exposure to Russia and Ukraine is around 1% of sales, which is a non-issue on a longer-term perspective.

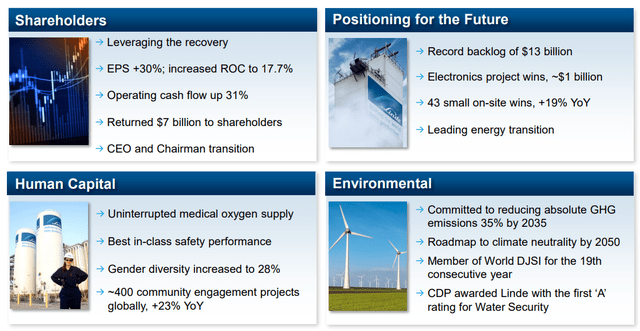

Linde 2021 Highlights (Linde IR)

The way these businesses work is that gas isn’t usually shipped across oceans, which means that production locations need to be built for clients, similar to how concrete works. This requires immense know-how and capital backing. On-site operations come with take-or-pay contracts, which means that clients are required to pay a minimum even if the demand goes down. We don’t see divisional or gas-specific profits from splits or mixes, but it can be assumed that on-site businesses deliver stable put perhaps below-average margins over time, with on-demand businesses such as cylinder providing the solid margins the company might be wanting.

It can be said that these gas businesses create fairly high overall margins that can be characterized as unusual in this world. The recent years of M&As and concentration reflect a need from industrial clients requiring delivered all over the world, which can only be guaranteed by global, massively-backed players. Air Liquide and Linde are pretty much, among them, 50% of the global market for this.

This doesn’t mean that local competition doesn’t exist, but there are competitive advantages such as infrastructure and scale from larger players.

Energy is really the key component in gas production – but any volatility here is usually mitigated by carefully orchestrated pricing formulas which include pass-through arrangements and surcharges to preserve the high margins. There is also a near zero-seasonality to this business, with gas usage being spread “equal” throughout the calendar year.

The risk Linde may be looking at is its production costs given the energy price volatility we’re moving into – but beyond this, it’s pretty safe.

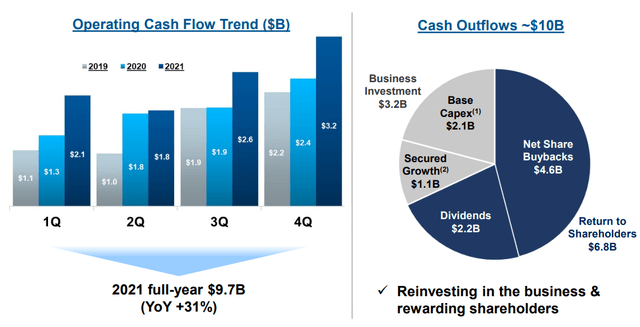

Linde is a world-class business with a world-class capital management plan.

Linde Capital management (Linde IR)

It’s A rated from S&P and Moody’s, and has a net debt/EBITDA ratio of less than 1.5X, with a 2021E EBIT cover ratio of over 14X. The company has access to billions and billions of gross cash, with an unused $5B credit facility. The company’s bonds, less than a year ago, we’re trading of yields close to zero, reflecting the solid cash generation of this producer.

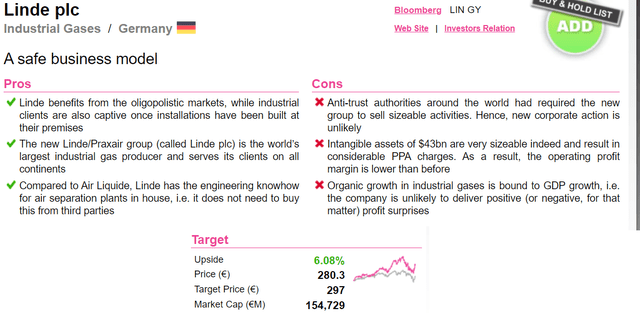

Linde isn’t going anywhere. It’s one of the very few companies I would consider a “BUY”-and-hold-forever, no matter what market situation. Air Liquide is, by the way, also a part of this list.

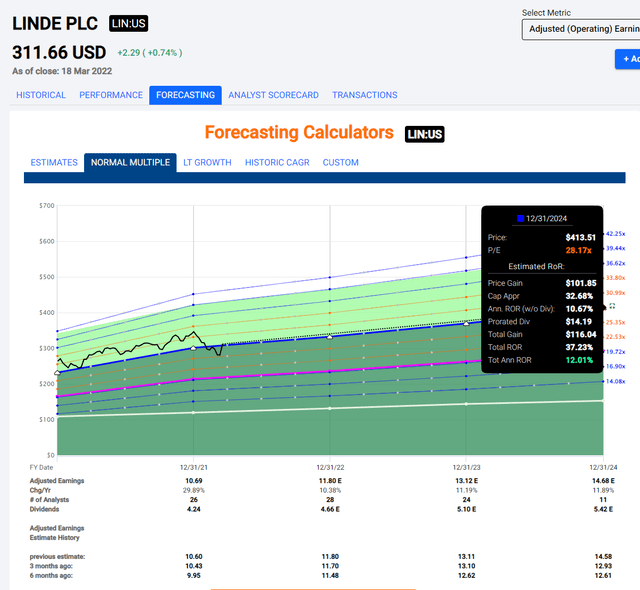

The company forecasts EPS growth of 8-12% in early 2022, with an 8-11% growth in 2021, with an expected full-year EPS upwards of $11.85, with a 2% FX impact and with the general assumption of no changes in the economy.

Obviously, since that forecast, we’ve had Ukraine and Russia which have somewhat impacted things here.

The company has comparative upsides to almost every single one of its peers, given its expertise in Engineering. It doesn’t mean that there aren’t risks to the business, but Linde, at the right valuation, is perhaps one of the better investments in this sector.

Risks

Linde, like most companies, have risks – though I will argue that these are very minor. There are specific balance sheet items that impact the implied profitability of the group thanks to the Praxair merger. The company is still laden with intangibles, and due to the recent M&A, the company has limitations not in terms of capital, but in terms of regulation, as to what it is allowed to do on the market. New M&As or major plays from Linde’s part in the near future are not likely to happen, and indeed Linde hasn’t communicated the intent to grow its business inorganically for some time, despite a well-managed debt situation.

Because of this, growth in the company is limited to organic growth – and this is highly correlated to GDP, inflation, and other macro metrics. Linde doesn’t deliver massive EPS increases, large margin improvements, or other positive things that other companies may be expected. It’s exceedingly stable not only in a positive sense but in a negative sense as well.

Beyond these items, there aren’t really many things that could be considered major risks for Linde.

In fact, the one thing that could be considered a hurdle for Linde is the thing that perhaps matters most – its overall valuation.

Valuation for Linde

This is the major problem not only for Linde but most quality companies. They trade at almost unbelievable premiums to any humane sort of valuation levels. Given their forecastability, and that you can “know” that you’re not going to make more than X% returns here, it requires you to accept a cap on what sort of gains you can have.

The company’s upside is heavily reliant on continued 5-9% EPS growth rates. Provided these growth rates are intact, the company’s record-low debt costs and WACC provide us an acceptable level of upside in valuation methods such as DCF. Based on a WACC of 7.5% and a sustained 5-9% EBITDA growth rate going forward, we get implied EV ranges of €340 on the low end to €390 on the high end, above the company’s current share price.

However, that’s nearly the only upside that’s visible for Linde. In terms of peers, we have Air Liquide, Air Products (APD), DSM, and Clariant (OTCPK:CLZNY). These businesses have average P/E-valuations of around 25-30X on average. Linde currently has almost 45X P/E. In terms of P/E-multiples, this company is massively overvalued, which pushes the average weighted target share price down significantly if weighted to any significant degree. Simply put, the market believes in and applies a massive premium to this company’s valuation, likely relating to its vertical integration, engineering segment, and history as well as scale. I apply a 30-40% premium range to Linde’s P/E to reflect these qualities, which Clariant and Air products cannot really measure up to. The company is significantly below the sector average yield, with ADP at a high of over 3%, with Linde at below 1.5%.

When looking at NAV, we apply EV/EBIT multiples of 12-17X to the company – but even applying the higher range of the multiples here results in a massive NAV/SOTP disconnect. The company has a €90B-€93B NAV, with 500M shares, coming to a €155-€176 – well below the company’s current share price of €280.

The only upside in Linde in terms of its valuation is related to its ongoing, expected growth. What could impact this negatively is if the company starts experiencing negatives on the market relating to its contracts and demand. This, as things stand, seems extremely unlikely. Since its operations are mostly tied to GDP growth and GDP is expected to continue to grow, Linde’s earnings are expected to grow as well.

The upsides are very well-established. FactSet expects between 8-12% annual EPS growth until 2024. S&P Global Expects similar level of growth over the next few years. Average price targets for the company vary between the native ticker and NA-listed LIN ticker to an unusual degree. On a native basis, the company has a €300/share average price target from a range of €245 to €336 per share. The NYSE listing on the other hand shows a 15-17% undervaluation to a price target of almost $370/share. Most analysts either have a “BUY” or “Outperform” rating on either of the listings.

So based on expected growth, there’s a slight upside to Linde, even given the massive premiums we’re looking at here. The average weighted P/E for the NYSE-ticker here is around 28X, and if we use that 5-year average P/E, we can see an upside here of almost 12%, in line with and slightly above the expected EPS growth.

Linde F.A.S.T graphs Upside (F.A.S.T graphs)

Again, you can’t expect any sort of outsized growth – but for those of you looking to place money on the market, make that 8-12% and be “safe”, as safe as you can be, I really believe that there are few better alternatives than Linde.

Other chemical companies offer more – but have closer ties to energy and higher volatility. While not as cheap as a month ago, Linde is still at a decent price for a conservative growth-related upside, for as long as the premium holds.

Equity analyst price targets are slightly different.

AlphaValue Linde price targets (Alpha Value)

I would consider Linde a “BUY” below €290/share. As long as the company remains here, the valuation allows for a GDP-related EPS growth that translates into a fair value increase of 8-10% per year. That’s all you can expect out of Linde at those valuations. On those rare times when Linde gets cheap, such as during COVID, the right move is to put massive amounts of capital to work to ensure results well within triple digits. If you’d bought the company at 20X P/E back in 2020, your return would be 111%, or 45% annually. That’s what you can expect out of a cheap Linde, and given the safety it offers, it should be on everyone’s list.

My PT is €290 – no more than that, making lined a slight “BUY” here.

Thesis

Linde is one of the 20-or-so companies I consider to be buy-and-hold forever companies, regardless of ups and downs. It’s one of the very few chemical companies on that list – and I’ve owned a small stake in it since the COVID-19 crisis. I never, unfortunately, expanded my position significantly, always investing in alternate businesses instead of Linde.

In hindsight, Linde would have been an excellent alternate investment, and that’s why I’m now keeping a much closer eye on Linde when it comes to investing incoming overall capital.

Be the first to comment