Dilok Klaisataporn/iStock via Getty Images

Overview

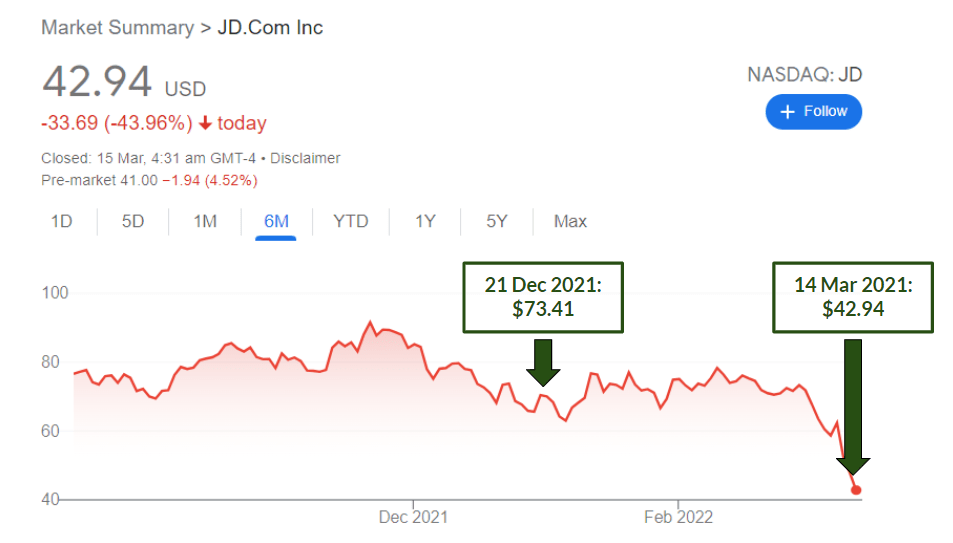

(Source: Google)

Wow! Since we last covered the company on Dec 21, 2021, JD’s (NASDAQ:JD) share price has fallen by a whopping 42%! This was strange because, on a quick glance at JD’s Q4’21 results, the fundamentals do not seem to be deteriorating. Where is the disconnect?

After a quick Google search, we found out that there were a series of macro events that contributed to it.

Remember that just last year, the Chinese regulatory crackdown on Chinese tech companies have wiped out a substantial value of their market value, and investors have been burned bad, REAL bad.

At this point in time, we believe that investors’ confidence has likely hit an all-time low. Companies like Alibaba’s (BABA) share price have declined back to their IPO days, something that was “unthinkable”. How insane is that?

Putting these events aside, we will also access JD’s Q4’21 results in-depth. For readers who are new to the company, here is a short overview:

JD.com is a Chinese e-commerce company operating one of the largest logistic network infrastructures in China. Through scaled economics shared, JD has been reinvesting its margins to provide low-cost and high-quality goods to its consumers.

And before we go into its recent quarter results, do also head to our written articles on JD’s deep-dive and a recap on Q3’21 results.

What’s Happening On The Macro Level?

Now, we all know that the outbreak of the Russia-Ukraine war has led to a massive selloff in Chinese stocks, but how has that affected JD? To quote from Bloomberg:

The broad rout follows a report citing U.S. officials that Russia has asked China for military assistance for its war in Ukraine. Even as China denied the report, traders worry that Beijing’s potential overture toward Vladimir Putin could bring a global backlash against Chinese firms, even sanctions.

This means that if China were to join Russia, they are likely to receive similar sanctions imposed on Russia, or even worse! To understand the implications of the sanctions, here’s a quote from CNN business:

Russia is already paying a price for its aggression. The country’s stocks and currency tanked last week after Putin’s ordered troops into eastern Ukraine. Russia’s stock market was closed Monday. The Ruble hit record lows Monday, sliding as much as 30% against the dollar, while the Russian central bank more than doubled interest rates to 20%.

But a question that comes to mind is if China was well aware of the implications, would they still participate in the war? In this case, we believe China does not want to step on the toes of the U.S, as well as other countries who are against Russia. In fact, multiple sites like CNBC, Yahoo, and TheDailyMail have also cited that China has refused to participate in the war, although stocks continue to decline.

In our view, this is most likely due to self-inducing fears as sentiments were already at their lows since the Chinese regulatory crackdown last year. Therefore, we felt that the drawdown was unwarranted.

At this current valuation, lots of fear, uncertainty, and doubts (“FUD”) have been priced in, and it seems like business fundamentals no longer matter at this point.

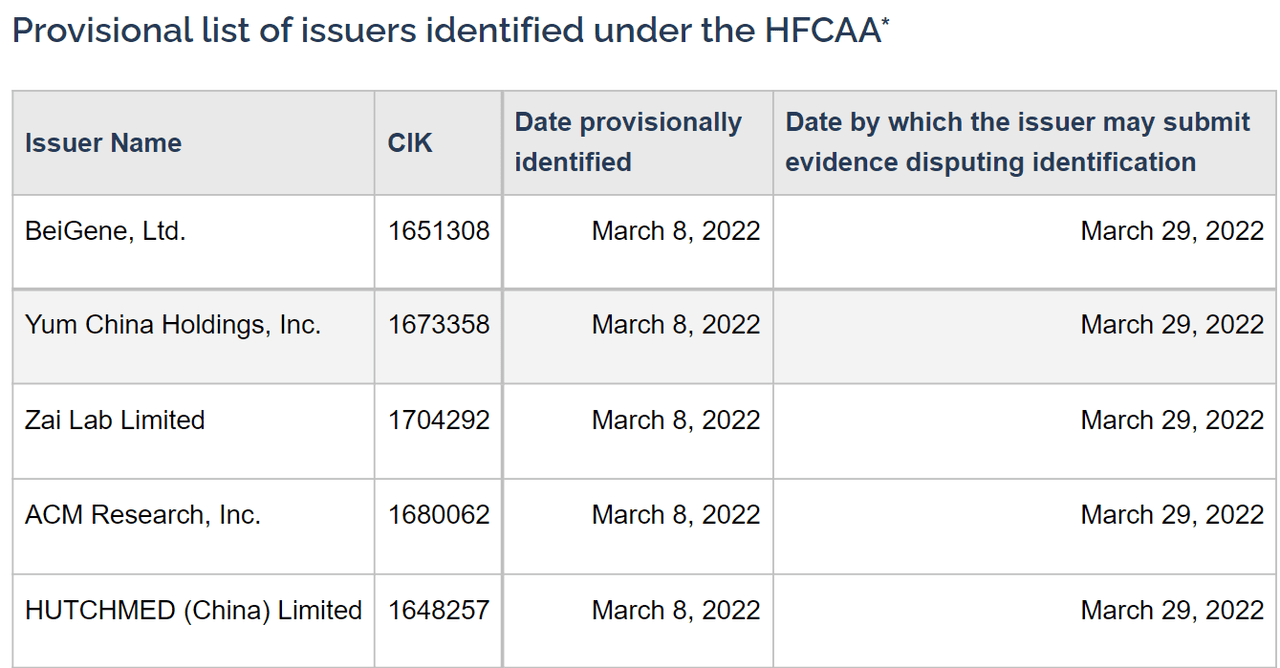

(Source: SEC)

Furthermore, to add oil to the fire, there are also delisting fears as Chinese companies like Yum China (YUMC) and Baigene (BGNE) failed to adhere to the U.S accounting rules. It is very likely to see more companies added to the list in the future, and JD may not be spared.

However, should JD be added to the list, is this the doom for them? Uh-oh!

As of now, we like to think of this as a slim possibility as we believe that management will take action to resolve it rather than idling around. At the same time, this may also cause a short-term impact on its share prices.

These series of events have happened so quickly in the blink of an eye, and many of us are unlikely to comprehend them. But as tough as it may be, it is also equally important to evaluate the company from a lens of a business owner, especially when there are so many noises in the market.

This effectively raised the question, has JD’s fundamentals deteriorated, and is the long-term thesis broken to warrant the share price we see today?

In the next section, that’s what we are going to find out.

JD Retail

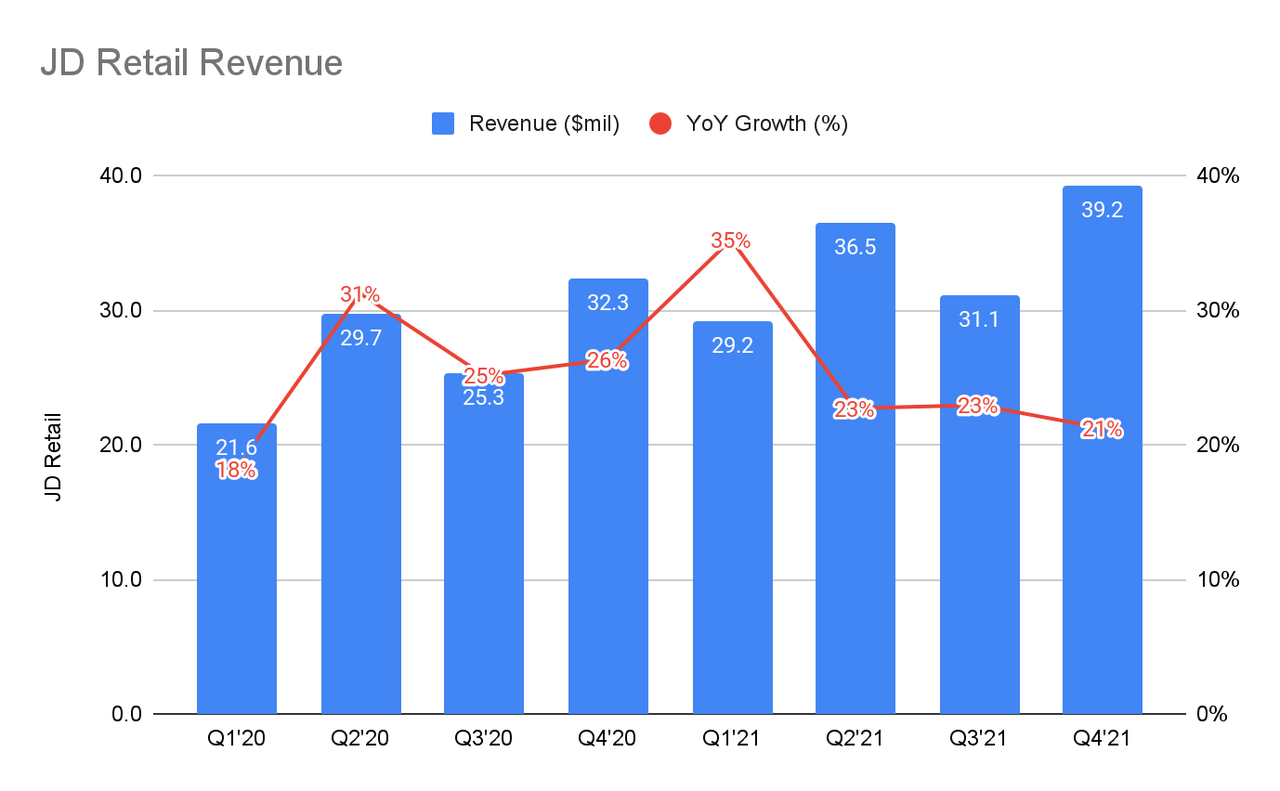

(Source: JD IR)

Starting off with the JD’s e-commerce segment, this quarter’s revenue grew 21% YoY to $39.2 million, compared to 26% YoY growth in Q4’20.

Keep in mind that Q4 is usually a strong seasonal quarter, and knowing that JD is growing from a larger revenue base, it continues to show great sales momentum.

JD Vs. Alibaba

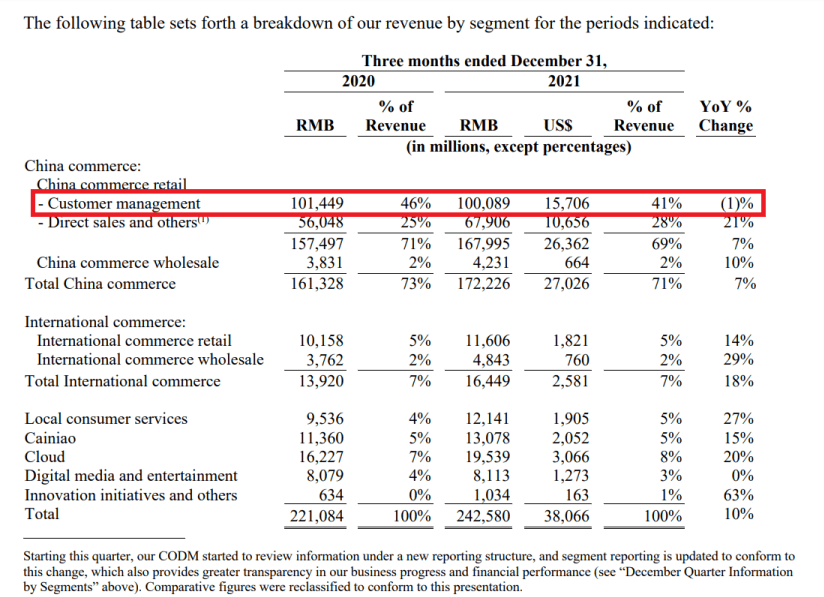

(Source: Alibaba Q3’22 results)

We can also draw a comparison with Alibaba’s results.

From the table above, Alibaba’s Customer Management Revenue (“CMR”), consisting of advertising and commission revenue earned from Taobao and Tmall, has declined by 1% annually. We believe this was also driven by the Chinese Communist Party (“CCP”) crackdown on Alibaba’s anti-monopoly behavior.

And how has that exactly benefitted JD?

To quote from the earnings call, JD has experienced rapid growth in the number of merchants on the JD platform:

In particular, the number of 1P suppliers achieved double-digit percentage growth, while further expanding coverage across all product groups. The growth of third-party merchants also accelerated to the highest level in the past three years as we added more new merchants in Q4 than we did in the previous three quarters combined. We believe that a number of our business partners will continue to grow healthily in the future.

This highly suggests that merchants are no longer bound to operate solely on Alibaba, and therefore have shifted to operate on the JD platform. At the same time, this shows that more merchants are increasingly recognizing the value proposition of JD.

Growing Consumers’ Mindshare

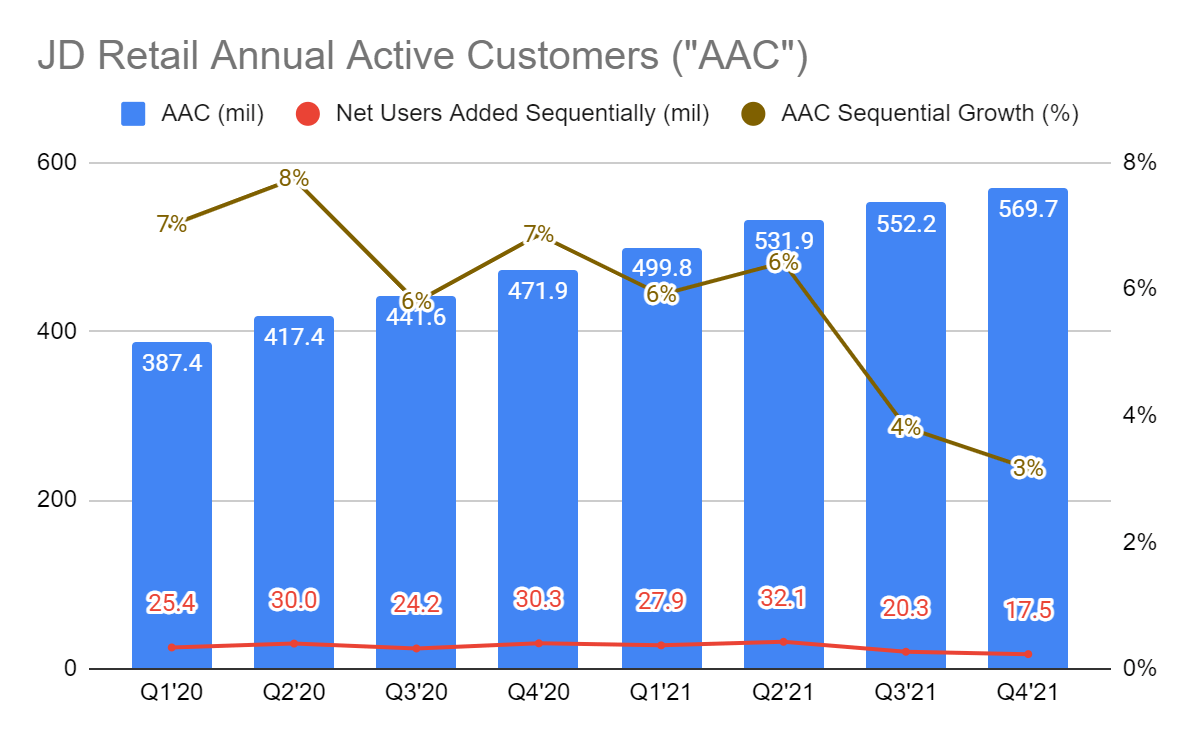

(Source: JD IR)

Moving on, we can see that JD is gaining greater consumers’ mindshare as the number of AAC has increased by 17.5 million sequentially, reaching a total of 569.7 million users by the end of Q4’21.

Other than its expanding user base, existing customers are also spending more money on JD, making it an increasingly sticky platform:

We are also gaining more wallet share from our expanding user base. As we increasingly become the go-to destination for consumers’ regular shopping, LTM GMV per user has been steadily changing up over time and increased year-over-year in every quarter in 2021, even as we continue to expand our total user base.

Not to mention, the recent rise in COVID cases in China may also act as a tailwind for JD as consumers shift their spending online as they work from home.

However, we’ve noticed that the number of new users added has started to come down gradually. We find this to be rather strange as Q4 is usually a stronger quarter and sales and marketing (“S&M”) expenses also tend to be the highest.

We thought hard about it and we came to a few conclusions:

-

Increased competitive pressure has made it tough for JD to grab market share

-

Inefficient S&M spend as higher S&M expenses are not translating into more users.

Using Alibaba’s China user base of 979 million as a proxy, there are still a substantial number of users to go after. Moving forward, we hope to see the number of new users increasing.

Increasing Profitability

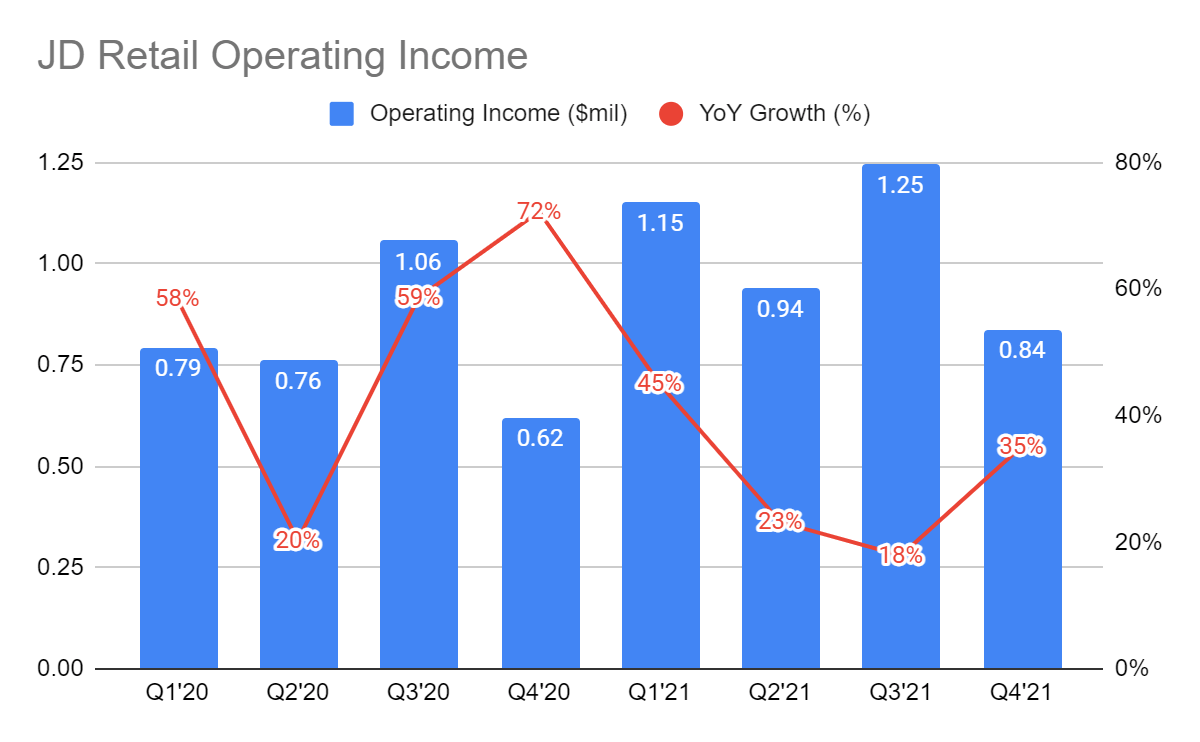

(Source: JD IR)

We also like to bring back the cornerstone of JD’s strategy, called the Scaled Economics Shared (“SES”).

JD has always prioritized short-term profits for long-term gain by consistently reinvesting its excess margins and passing them to consumers in the form of lower prices. In return, consumers will reward JD with more purchases, and this results in higher sales volume and expanding Operating Profits (and margins) over time.

Similar strategies have been adopted by retail giants like Costco (COST) and Amazon (AMZN). Till today, they are extremely defensible businesses.

What you see here on the graph above is simply JD extracting its fruits of labor, called Operating Leverage, as its Operating Profit growth of 35% YoY is growing at a faster pace than its 23% YoY revenue growth.

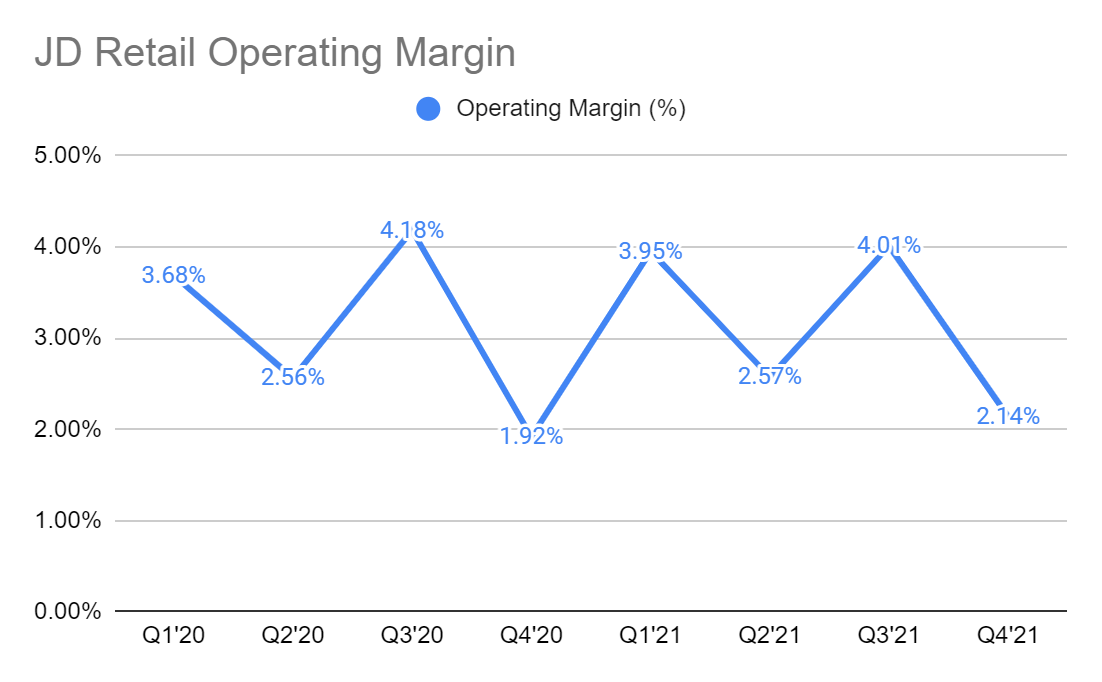

(Source: JD IR)

This resulted in a Q4’21 Operating Margin of 2.14% versus 1.92% in Q4’20. On an annual basis, the FY21 margin is 3.07%, an improvement from 2.97% in FY20.

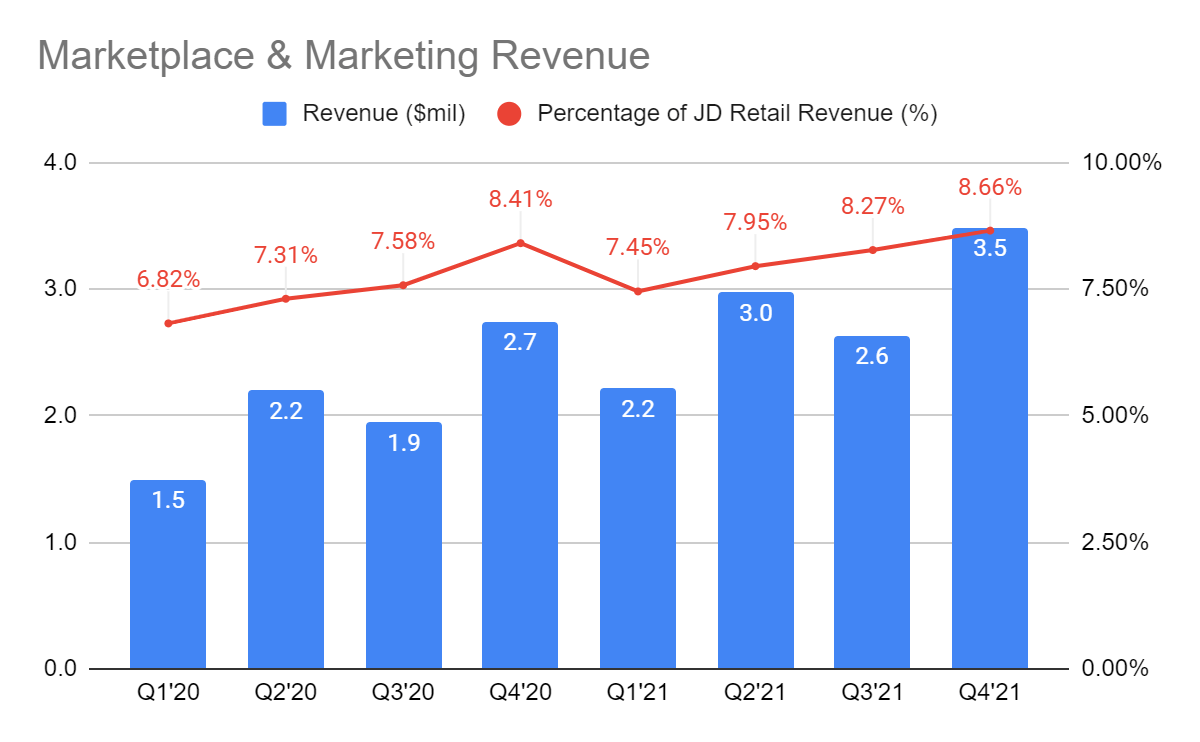

(Source: JD IR)

Another important strategic component of JD’s business is its 3P marketplace.

This is because a marketplace tends to scale faster than JD’s 1P business as it is less capital intensive, and it tends to exhibit a faster flywheel effect. In addition, it also has a higher margin. Here, you can see that its marketplace revenue has been making up a larger portion of its JD Retail’s revenue.

Over time, we like to see it continue to occupy a larger portion of its revenue as this will be an important driver of its overall margin.

Going back into the Q2’19 earnings call, management talks about the long-term profitability for JD:

We maintain our position that over the long term, our first party retail business should generate 1 to 2 percentage point higher net margin than the best run offline retailers. And we are – layering on top of that, we’ll have our marketplace business, which generate a much higher accounting margins. So combining the two, we should be generating somewhere in high single-digit in combined net margin for the business.

Given that JD currently has a margin of 3.07%, there is still plenty of room for margin expansion.

JD Logistics

Robust Top-Line Growth

(Source: JD IR)

Now, let’s turn to JD Logistics (“JDL”), a strategic component of its e-commerce business.

JDL’s revenue grew 28% YoY to $4.8 million from $3.7 million in Q4’20, and this was largely driven by the revenues from external customers.

If we take a closer look at JDL’s FY21 annual report, the total number of customers has reached a total of 72,602, a 41.7% annual increase, while its Average Revenue Per Customer (“ARPC”) has grown by 9.2% YoY to RMB341,424 (US$53,577). This tells us that not only is there increasing demand for its services but existing customers are also spending more money on its platform.

While you may have noticed that the growth rates have started to decline, we do not think that this is a concern as this is likely due to the law of large numbers.

BUT, there is a bigger concern to consider.

The year 2020 and 2021 has turned out to be impressive years for JDL as evident from the excellent top-line growth. But it is crucial to realize that JDL has also been a key beneficiary of the surge in demand for logistics services during the pandemic. It remains to be seen if the re-opening of the economy will impact its demand for logistics services.

If it does, growth rates may deplete quicker than expected. Thus, the valuation may also come down.

Profitability

(Source: JD IR)

Looking at JDL profitability, we can see that its Q4’21 Operating Profit (“EBIT”) and Operating Margins have improved tremendously from Q3’21. It seems like they have turned the loss-making corner.

Furthermore, Operating Leverage also kicked in as EBIT accelerated to 200% sequentially compared to the sequential revenue growth of 18%. This brings their FY21 margin to -1.75% compared to FY20 of 1.50%.

For readers who are wondering why has profitability come down from FY20, this is largely due to its heavy investments to expand its network capacity, which the management talked about in the Q3’21 earnings call:

Starting from Q3 last year, JDL invested these financial gains in network capacity expansion at large scale in lower-tier cities, as well as in front line worker recruitment, which created additional employment opportunities. The quick expansion of JDL’s business and operation optimization this year have gradually mitigated the financial impact from these upfront investments in capacity. As a result, JDL’s overall margin performance meaningfully improved in Q3 compared to the first half of the year.

However, JD Retail is not without competitors in lower-tier cities. Pinduoduo (PDD) is the market leader, and Alibaba is also actively trying to grab market share.

In Alibaba’s Q3’22 earnings call, Taocaicai and Taobao Deals, the company’s two strategic components to penetrate the lower-tier cities have shown robust growth and improved unit economics. Meanwhile, JD’s management has decided to aim for profitability, which may hinder its ability to compete with Alibaba.

If that happens, JD may experience a slowdown in users’ growth rates.

Valuation

(Source: TIKR)

Due to the geopolitical turmoil and other macro events, JD’s valuation multiple has contracted massively, and it is clear that there are lots of FUD being priced in.

But looking at its fundamentals, JD has demonstrated that they continue to execute strongly. Based on our previous valuation, and after the massive selloff, we think that it is undervalued.

However, investors have to also truly understand their risk appetite and evaluate whether they are comfortable with what is happening on the macro levels. There are indeed uncertainties in investing in Chinese companies right now. After all, self-awareness is crucial in this environment, and we shouldn’t be losing sleep over our investments.

Risks

Increased Competitions

-

Increased competitive pressure in the market can make it tough for JD to grab market share, and this may impede its growth. One of the formidable peers is Alibaba. As evident from the last 2 quarters, the users’ growth rate has come down, and we hope to see improvements in growth rates going ahead.

Unpredictability Nature Of China’s Economy

-

The last few weeks have proven to be an extremely volatile period as various macroeconomics events have caused the share price to tumble. It seems like Chinese companies are being hit by a barrage of bad news without having the time to react to it.

-

Investors should evaluate if they are comfortable with what’s happening on the macro level, and if they decide to hold on, they should be prepared to experience further drawdowns.

COVID Tailwind May Fade Away

-

In the last 2 years, logistics companies have benefited from the COVID tailwind as there is an accelerated demand for logistics services. However, it remains to be seen if this tailwind may fade as the economy re-opens and citizens begin to spend more time outside. If this does happen, JD Logistics may experience slower growth rates.

Conclusion

It’s clear that JD continues to win the hearts of the consumers and experienced robust top-line growth and strong operating leverage. This would not have been possible without its disciplined approach to sacrificing short-term profitability for long-term gains, and currently, the management is reaping its fruits of labor.

Based on our analysis, we do not think that its fundamentals have worsened, nor its long-term thesis is broken. With strong top-line growth, coupled with FUD that has been priced in due to the geopolitical turmoil, we believe there is an adequate margin of safety. But there are certain important risks that investors should be aware of, and be prepared for the share price to be extremely volatile in the short term.

Before we come to an end, we also like to leave this question for readers to ponder, “If JD was to decline by 50% the next day, do you have the ability to stomach it?” Now, you can blame us for being naggy in this challenging environment; it is important to separate the noises from the fundamentals. That helps us to remain sane.

While we cannot predict the foreseeable future, we do not expect this journey to be a smooth-sailing one.

Finally, we also like to hear your thoughts in the comments section below!

Be the first to comment