SylvieBouchard/iStock Editorial via Getty Images

Let’s get started

PayPal (NASDAQ:PYPL) shares have been on a roller coaster ride since peaking in July 2021 above $300/share. After dipping below $100 in early March, shares of the fintech giant have rebounded to $115. Still, PayPal is down 56% in the past six months, urging many investors to jump on the lucrative buying opportunity. The correction started in response to noise of interest rate hikes by the Federal Reserve. More recently, concerns surrounding the Russia-Ukraine crisis and less-than-ideal forward guidance provided by management during its latest earnings announcement have evoked additional turbulence.

The recent pullback is merely a short-term hiccup, and I’m still confident in PayPal’s long-term flight path. As it stands today, PayPal is one of the world’s leading fintech companies and will continue to benefit as the war on cash gains more momentum. Investors with lengthy time horizons should consider buying the company’s stock today. The upside is clear, and provided the major drop-off, PayPal now carries a favorable risk-reward ratio. Let us now move to three reasons investors should seriously consider adding PayPal to their portfolios right now.

1. PayPal has a solid fintech moat

In an industry becoming increasingly crowded, PayPal’s moat is quite impressive. The company boasts a 50% global share of the payment processing software market, with Stripe and Shopify Pay Installments (NYSE:SHOP) acting as distant runners-up. The company’s total payment volume (TPV) eclipsed $1 trillion for the first time ever in 2021, serving as a major milestone that should help propel PayPal forward in the coming years.

Flaunting 426 million active accounts, PayPal’s user base amounts to nearly one-third of North America and Europe’s population combined. The company continues to expand its network as well – PayPal added 9.8 million net new active accounts in the fourth quarter of 2021. Looking ahead, management expects to gain up to 20 million active users in 2022. While this only implies 5% growth year over year, it’s still spectacular to see PayPal adding users given the colossal size of the company. The numbers speak for themselves whether you like using PayPal or not. New competition could certainly disrupt the company’s market share moving forward, but PayPal has solidified itself as an industry leader.

2. Fundamentals align nicely with the valuation

Investors should look to exploit opportunities where fundamentally sound companies are trading at historically low valuations. PayPal embodies this idea today – the company’s financials remain strong despite its collapse in valuation. This past year, PayPal’s top-line and bottom-line grew 18% and 19%, up to $25.4 billion and $4.60, respectively. Recent guidance disappointed investors, but it was blown out of proportion, in my view. Management is still forecasting revenue and TPV growth as high as 17% and 23% in 2022 – this is very good for a well-established company. The first half of this year might be a bumpy ride as PayPal adjusts to eBay’s (EBAY) transition to its own payments platform. Management expects eBay-related challenges to place up to $600 billion of pressure on its top-line in 2022. This isn’t ideal, but it surely won’t last forever. Dan Schulman, the company’s CEO, stated that PayPal intends to stop adjusting for eBay in the second half of the year. We should interpret this as great news given that PayPal’s ex-eBay revenue growth has been consistently above 20%.

PayPal’s balance sheet and cash flow generation are superb as well. With a cash position of $5.2 billion and a debt-to-equity ratio of only 45%, the company is well-positioned to ride out any storm. PayPal seems to enjoy generating cash – the company’s five-year free cash flow CAGR is 17%. In the final quarter of 2021, PayPal grew free cash flow and cash from operations by 38% and 31%, respectively, up to $1.6 billion and $1.8 billion. Investors should be pleased; PayPal is really settling in as a cash generating machine.

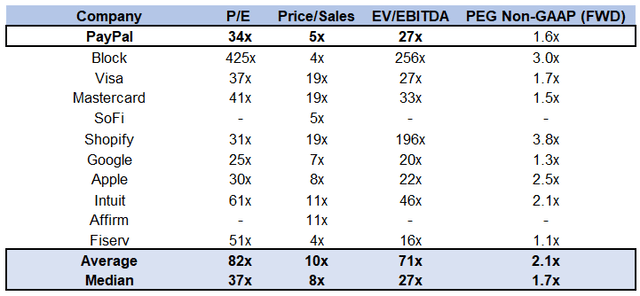

The company’s valuation has moved non-parallel to its robust fundamentals. Today, PayPal trades at 34 times earnings, more than 1.5 times lower than its five-year average of 55. And when you compare PayPal’s P/E multiple to that of close competitors like Block (NYSE:SQ), Visa (NYSE:V), and Mastercard (NYSE:MA), the company is peddling at a bargain.

Seeking Alpha Data, Author’s Material

At a target P/E multiple of 35 (which is below PayPal’s five-year average and industry peers) and a 2022 EPS estimate of $4.70, my twelve-month price target for PayPal is $161/share, offering 42% upside. This is quite the upside for one year, which demonstrates just how undervalued PayPal is today.

3. The company is expanding

Fortunately for PayPal, the company sits at the center of a massive secular growth industry. Management values its total addressable market at a whopping $110 trillion, a truly remarkable number. And while PayPal has its core business in place, the company is branching out into a lot of different areas. Venmo, which is PayPal’s C2C mobile payment service, processed $230 billion in total payment volume in 2021, up 44% year over year. As a result of its recent partnership with Amazon, customers will be allowed to pay with Venmo at checkout starting sometime this year.

PayPal is also excited about its Buy Now, Pay Later (BNPL) service offering, which allows consumers to pay for items in interest-free installments over a specific time period. Buy Now, Pay Later is currently available in eight markets and is growing rapidly. Total payment volume for BNPL surpassed $3.2 billion in the fourth quarter, translating to 325% growth year over year. The company acquired Paidy in 2021, which now exposes PayPal’s BNPL offering to Japan – one of the world’s fastest growing e-commerce countries.

Would PayPal really be a fintech if we didn’t touch on cryptocurrency? The company allows Venmo users to buy, sell, and hold crypto on the payment platform and continues to explore new ways to integrate crypto into its product offerings. PayPal provides investors with the best of both worlds. On one end, it’s a well-established company with consistently strong fundamentals. On the other end, the company is constantly searching for new opportunities to grow its operations.

PayPal is a firm buy today

PayPal is one of my favorite stocks right now, and I think it’s a no-brainer for investors with long time horizons. Short-term headwinds could continue exerting downward pressure on PayPal shares, but I’m personally not worried. PayPal is a tremendous company that has cemented itself as one of fintech’s top dogs. The latest fallback has eliminated a good deal of downside associated with PayPal stock, leaving investors with an advantageous investment scenario. I’m assigning a buy rating to PayPal today – it’s time to ignore the short-term noise and dial in on the fundamentals.

Be the first to comment