No-Mad/iStock via Getty Images

Introduction

It has now been more than two months since I last published an article on Advantage Energy (OTCPK:AAVVF), one of my favorite natural gas players in Canada, and a lot has happened in those months as the company published its full-year results and has now disclosed the buyer of the 50% stake in its carbon storage division.

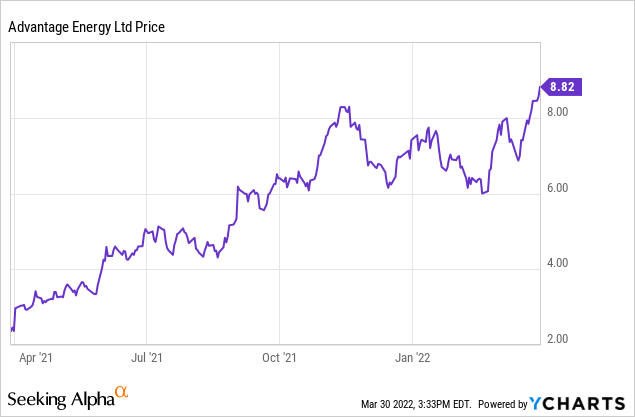

I would strongly recommend trading in the company’s securities using the Canadian listing where Advantage is trading with AAV as its ticker symbol. The average daily volume exceeds 1M shares per day. The current share count is approximately 190.8M shares, resulting in a market capitalization of approximately C$1.7B using the current share price of almost C$9. I will use the CAD as base currency throughout this article.

As expected, Q4 was excellent and there’s more to come in Q1

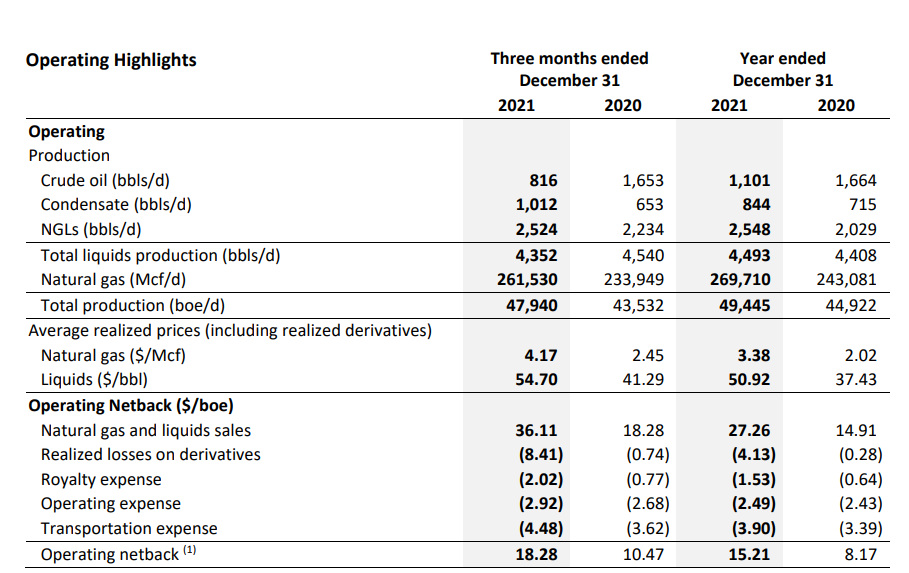

Advantage Energy predominantly is a natural gas producer as the oil-equivalent production rate consists for more than 90 of natural gas. The total production rate in the final quarter of 2021 was just under 48,000 boe/day, which was the lowest quarterly production rate of the year. That’s nothing to worry about as Advantage is planning to increase its production rate in 2022 to 52-55,000 boe/day which implies an increase of more than 10% compared to the Q4 production rate.

Advantage Energy Investor Relations

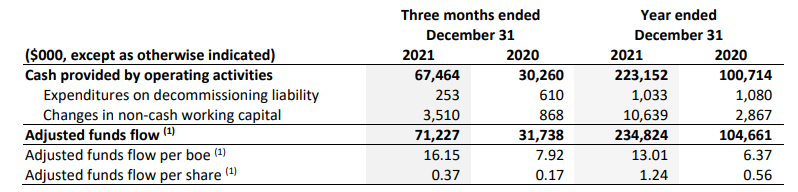

What really matters in Advantage’s case is the free cash flow generated by the company. Advantage generated an adjusted funds flow of C$71.2M in Q4 2021 which brought the full-year AFF to just under C$235M.

Advantage Energy Investor Relations

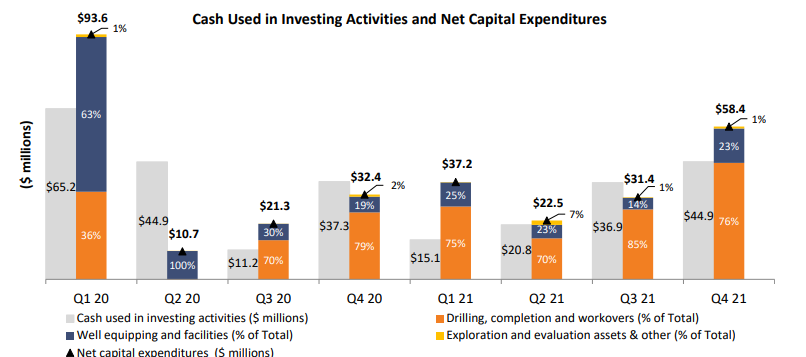

Meanwhile, Advantage ramped up its investments as you can clearly see the total capex level was higher than in the two preceding quarters combined. The majority of those investments will start contributing in 2022 which explains the relatively low oil-equivalent production rate in Q4 2021 and the positive guidance for 2022.

Advantage Energy Investor Relations

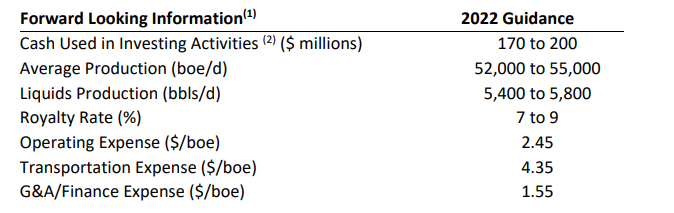

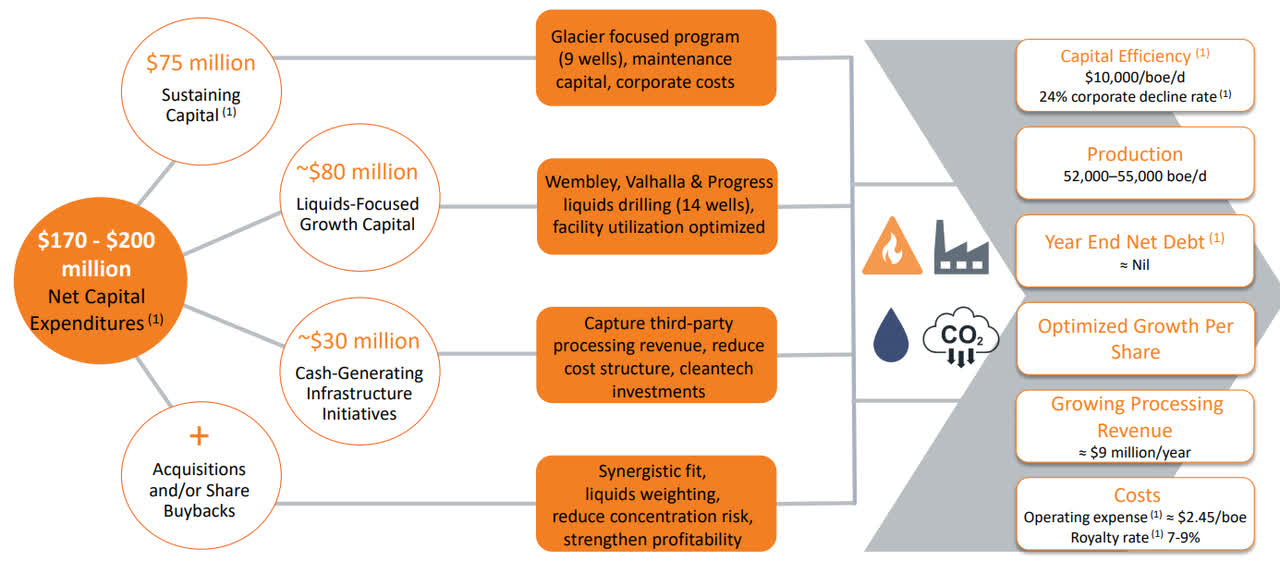

The 2022 guidance is pretty straightforward. The company plans to produce between 52,000 and 55,000 barrels of oil-equivalent per day and is planning to spend C$170-200M on capital expenditures.

We know that at an average received gas price of C$3.38 in 2021 (including hedge losses), Advantage generated approximately C$233M in operating cash flow. Using the same natural gas price but at an increased output to the tune of 6% (which implies an average production rate of 52,500 boe/day, which is at the lower end of the company’s guidance), we can expect the operating cash flow to be around C$245M.

Advantage Energy Investor Relations

As explained in my previous article, the sustaining capex is estimated at just C$75M which means Advantage Energy will be spending C$95-C$125M on growth initiatives.

Advantage Energy Investor Relations

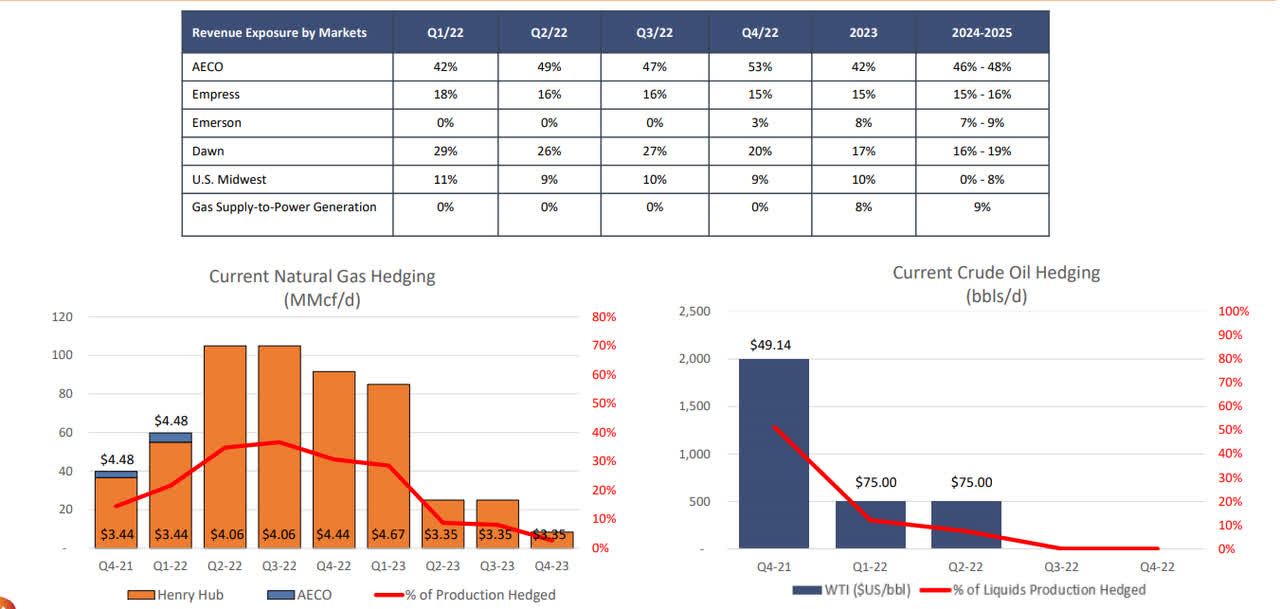

This means that on a sustaining basis and using an average received natural gas price of C$3.3-3.4, Advantage Energy will likely generate C$150-180M in free cash flow and the C$110M in non-sustaining capex should be seen as a capital allocation decision. Of course the natural gas price is now substantially higher than the C$3.3-3.4 I used. About half of the revenue will be generated based on the AECO gas price, and the current AECO price is just around C$5 per GJ. So while I think a natural gas price of C$3.3-3.4 is a decent long-term price point, Advantage will likely record a higher natural gas price this year.

Advantage Energy Investor Relations

The Entropy deal is now being finalized, and this will unlock more value

In my previous article I was discussing how Advantage Energy has some hidden value on its balance sheet as it owned 90% of Entropy, a subsidiary focusing on commercializing the modular carbon capture and storage technology.

Advantage Energy has now successfully concluded negotiations with a third party which remained unnamed until earlier this week when Advantage announced it attracted Brookfield Renewable (BEP) (BEPC) as strategic partner. Brookfield will invest in a hybrid security which values Entropy at a pre-money valuation of C$300M (which means Advantage’s 90% stake has a pro forma value of C$270M or almost C$1.50 per share).

Not only is it great to see a transaction occur which confirms the value of Entropy, in this case the reputation of Brookfield should be seen as a massive vote of confidence as the Brookfield companies enjoy a decent reputation chasing quality assets.

Investment thesis

The share price of Advantage Energy has gained almost 50% in the past five weeks thanks to a continuously strong natural gas price. The stock still isn’t expensive given the current natgas price environment, and even if I would apply a much lower natural gas price of C$3.50 (more than 30% below the current spot prices), Advantage would still be attractive with a sustaining free cash flow of approximately C$0.90 per share. The strong cash flows are underpinned by a reserve life index of in excess of three decades.

I have a long position in Advantage Energy and I have no plans to sell my position anytime soon. I may even be interested in adding to my position on weak days.

Be the first to comment