Massimo Giachetti/iStock Editorial via Getty Images

Introduction and Thesis

While Under Armour Inc. (NYSE:UAA) continues to grow both their revenue and strategic partnerships, the company remains an underperformer. UAA is in the 4th year of a transition plan that has yet to significantly pan out and now investors are in limbo as they await the next CEO to be announced likely before the end of the summer. I forecast an $11 price target over the next 18 months, based on a CY2023 (FY2024) EV/EBITA of 9.7 and CY2023 EPS of $0.65, which would support an $11 price target at a 16x multiple.

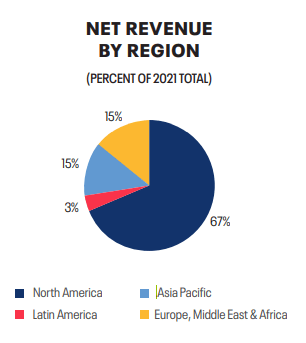

UAA, established in 1996, manufactures, designs, and sells athletic clothing for men and women of all ages. The company’s main revenue drivers are related to the development, marketing and distribution of athletics performance driven apparel, footwear, and accessories. UAA focuses on footwear and apparel products for running, training, basketball, soccer, golf, and more sports. Additionally, UAA offers accessories, including gloves, bags, headwear, and also have recently offered digital subscription and advertising services under the MapMyRun and MapMyRide platforms. UAA markets to consumers under multiple brands, including UNDER ARMOUR, UA, HEATGEAR, COLDGEAR, PROTECT THIS HOUSE, ARMOUR FLEECE, and more. The company sells via wholesalers, including national and regional chains, independent/specialty retailers, department store chains, Under Armour retail stores, institutional athletic departments, and more. As of December 31, 2021, UAA has 422 retail touchpoints and leases, and also sells through e-commerce platforms. UAA operates in the United States, Canada, Europe, the Middle East, Africa, the Asia-Pacific, and Latin America and is headquartered in Baltimore, Maryland.

Company Overview & Q1 Results

UAA’s previous struggles are well known, as growth slowed in the latter half of the 2010’s and investigations were conducted by the SEC. While COVID suffocated retail apparel store traffic, UAA has continued to grow throughout the pandemic both in-person and digital sales. The company has continued to open stores globally, and the company’s key focus for growth is in Asia, notably China and South Korea.

Key global partnerships with mainstream star athletes to position themselves against competitors such as NIKE (NKE) and adidas (ADDYY) have proven fruitful. Steph Curry and the Golden State Warriors recently won the NBA championship, while Jordan Spieth and Bryce Harper have had strong 2021 and 2022 campaigns. The company also has emphasized increasing the footwear sales mix as a larger percentage of overall sales by 300 basis points by 2023, given an estimated 10-12% CAGR in that segment. They have focused on their professional sponsors, including aforementioned Steph, Bryce, and Joel Embiid, and have also announced partnerships with dozens of US colleges for NCAA basketball. The company emphasizes large and clean store designs that act as brand incubators and smaller pop-up locations to test new markets, reach new guests, and grow overall brand awareness. Factory and Brand houses are strategically placed to ensure clients in different locales can utilize discounted items in a grab and go fashion contrasting large and innovative spaces for the newest lines. The company sales mix is about 57% via wholesalers and 43% direct to consumer, though UAA wants to increase its e-commerce business without discounting product.

In Q1, Under Armour reported a transition quarter that would bridge the gap to an updated fiscal year. The company forecasted year end revenues rising between 5-7%, but noted gross margins shrank to 46.5% due to higher freight costs. While still forecasting strong revenue, given margin deterioration there is concern that UAA will miss estimates in the next few quarters. While the company previously forecasted strong growth in Asia, never ending lockdowns in China dragged on sales, leading to a 14% Asia-Pacific (APAC) revenue drop in the quarter. E-commerce represented 45% of the sales mix, but only grew 2% from 2021. Footwear revenue, a key focus for the company, fell 4% while ongoing restructuring charges cut into profit by $57MM. Surprisingly, inventory dipped 3%, but remained elevated at over 80% of cash and 63% of revenue. The company lost $0.13 a share which sent the stock freefalling in early May, and along with rate hikes and a broader market downturn, the stock has now settled at around $9 a share.

UAA Geographic Revenue Distribution

The company also provided two updates: one regarding the previous share buyback plan and one regarding an executive leadership change. UAA purchased $300MM of shares in the recent quarter but didn’t confirm the updated diluted share count – given the average weighted share price in the quarter, it’s likely the total number of shares decreased to about 450-455MM. The company also announced that Patrick Frisk would step down, and that an executive search would be underway. Patrick felt that operationally, the company was now in a much better place than when he took over in 2017, and that now focusing on digital and international growth was paramount. He also believed that the brand perception was increasing towards their competitors, mentioning NKE and LULU. UAA continues its search for a leader, which will leave stakeholders in limbo in the near term.

Industry & Risks

UAA competes in the athletic apparel space, with key competitors that include NIKE, adidas, and Columbia Sportwear (COLM). The global athletic apparel market is projected to reach $267B in 2028, expanding at a CAGR of 5%. The Asia-Pacific region is projected to dominate the market over the timeframe, which fits in UAA’s growth focus. However, recent inflationary trends have started to weigh on the retail apparel sector. May 2022 retail sales dipped 0.3% from the prior month in the U.S., with inflationary pressure and rising borrowing costs outweighing a flush consumer buoyed by recent stimulus. Online sales fell 1%, while travel spending continued to remain strong. It shows that customers are spending on experiences post-COVID as the economy becomes sluggish, showcasing a potentially rough short-term outlook for mid-cap retailers. However, with the World Cup coming up soon, UAA has a high-profile sports event that they can tap into and flex their sponsorships – though soccer isn’t their primary focus.

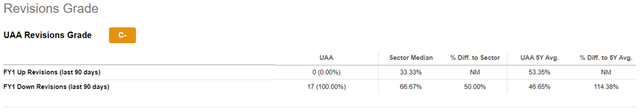

When reviewing any apparel brand, there are crucial risks that are intrinsic and can’t be completely mitigated. On a macro level, there is concern related with UAA’s inability to anticipate and acclimatize to brand and trend preferences. Additionally, there is also risk associated with pricing pressure given high inflation and global supply chain woes, especially for the UAA given their inconsistent cash flow results. A unique risk regarding UAA is their inability to revamp management and choose a successful CEO. UAA is also still reliant on China for manufacturing, with about 20% of its materials still sourced from there. There is a plan in place to reduce their dependency, with a target of 7% sourcing from China in 2023. However, given China’s government lockdowns, manufacturing risk remains, along with a challenging macro environment. These factors have led to a reduction in estimates by analysts across the street.

CEO Transition

UAA recently announced in late May that they will commence the search for a new CEO. Patrick Frisk stepped down from the perch and was replaced by Colin Browne on an interim basis. The company highlighted that Frisk helped architect its long-term strategic plan that underscored its commitment to athletic performance by reengineering its structure, systems, and go-to-market process. Frisk entered UAA in 2017 at a time when scandals plagued the company – while the brand was growing in both sales and popularity, corporate shenanigans and an SEC investigation gave investors pause. The former Aldo Group & North Face executive focused on operational efficiency by cutting wholesale accounts and streamlining production in Vietnam, while also carefully expanding their partnership portfolio. But while founder and chairman Kevin Plank said that the leadership transition was planned, this move feels anything but. Lululemon (which I have rated as Buy) has continued to improve its standing in sports apparel throughout the pandemic, while legacy brands like Nike have proven catalysts coming up before the year end (FIFA World Cup). Meanwhile, UAA remains stranded in the near term – although the company plans to increase its digital sales structure and also improve its international presence, it is unclear how fast a new leader can help shape that vision given the current environment. Analysts from BMO and Cowen emphasized that UAA is now focused on revenue growth – but with consumer spending moving elsewhere in recent months, uncertainty remains. Watch this CEO choice closely, as it will further signal UAA’s focus moving into 2023.

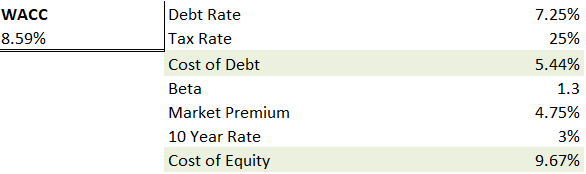

Model Sees Upside, but Momentum is Negative

While I don’t foresee intangible strength from UAA, the model does show that if the company can deliver on forecasted growth, there’s some runway for the stock to modestly pop. While the company’s net cash position dropped dramatically given management’s interest on buying back stock, the company has sufficient cash balances. The model shows a WACC of ~8.6%. Given their weak Q1 performance, I anticipate the cost of debt rising above 7% should they attempt to leverage in this environment and forecast a continuing WACC above 9%. The majority of UAA’s long term debt of $770MM+ will mature within 3-5 years, though if trends continue they may need to raise more money or reduce the buyback plan.

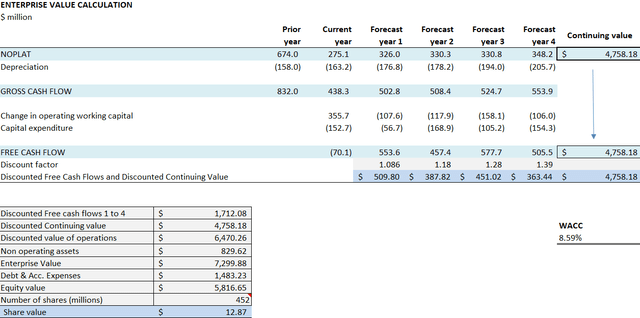

UAA WACC

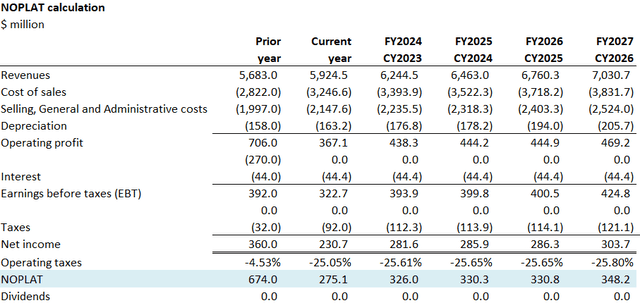

I forecast the continuing value above $4.7B, given a 4.25% revenue increase this year and blended revenue growth of ~4.5% for four years as supply chain woes and inflation continue. I see materials and shipping remaining 400-500 basis points above historical figures given the current environment. I hold other cost ratios mostly equal as a percentage of revenue from 2021 figures, with a slight increase in SG&A along with guidance regarding margin erosion of 350 basis points for next quarter. As the margin dips slightly, a $12 share price (see below) can be supported with fundamentals. However, I think that their margins will continue to lag peers, new leadership will have some growing pains, and that the share price will not support the CY2023 EV/EBITDA model forecast of 11.5. Slashing the share price prediction to $11 based on company intangibles and historical lack of support from Wall St. showcases an EV/EBITDA of 9.7 and a calendar year CY2023 P/E of ~16. In today’s price target, I estimate shares outstanding of 452MM from 469MM, given UAA announced that they spent $300MM on share repurchases from February to May, where the stock averaged around $17 a share.

UAA Forecast UAA EV Calculation

Conclusion

While UAA continues to improve their revenue and operating efficiency, the company remains an underperformer versus their peers. UAA is now well into a transition plan that has yet to significantly pan out and now investors are in limbo as they await the next CEO to be announced. The company reported negative Q1 earnings and with retail sales slowing and elevated inflation, UAA must navigate choppy waters. This article was tough to write, given this brand is my preferred choice for athletic and golf apparel. That said, I still project an $11 price target with a “Hold” rating.

Be the first to comment