anouchka/iStock Unreleased via Getty Images

Introduction & Purpose

Under Armour, Inc. (NYSE:UA, NYSE:UAA) reported earnings that met analysts’ expectations, but didn’t discourage previous concerns about the operational turn around. The company’s wholesale segment generated some growth, while the online and direct-to-consumer businesses saw declines. My recent article on UAA showcased a bear view, and this quarter reinforces my initial opinion. With the macro environment likely to remain a bit challenged as rates rise and supply chain woes drag on, UAA isn’t well-positioned to significantly overcome these obstacles. I reiterate my “Hold” rating with an $11 USD price target over an 18-month timeline.

Q1 Review

UAA announced earnings on Aug 3, 2022 that didn’t turn many heads, as evidenced by the lack of movement post earnings. Revenue was flat year over year, at $1.3B. The company’s adjusted operating profit dipped to just $44MM, an underperformance from the prior year quarter. That said, with the company reconfiguring its year-end to March 31, it’s a bit difficult to compare apples to apples. The only segment that saw revenue jump was the lowest margin business, wholesale, which increased 3% to $792MM. Contrasting this increase were significant drops in retail and online direct to consumer sales, which were a combined 7% underwater from the prior year.

The company did not announce same store sales figures, but given the in-store revenue dipping 8%, I don’t believe it would have been materially positive. The only geographic region to sport material growth was Latin America, up 6%, while all other segments including North America, Europe, and Asia were flat or negative. CFO David Bergman noted that the dip in Asia was primarily due to China’s on-going lockdowns, and that the rest of the region had positive sales. Inventory was up only 8%, which is somewhat positive, given other peers had larger jumps year over year. Legal expenses totaled $10MM as UAA had been wrapped up in litigation against UCLA for a terminated apparel deal. SG&A rose by 9% due to marketing spend and increased labor costs. With diluted earnings per share of just $0.02, UAA’s Q1 performance didn’t send a message that their previously announced turnaround was full steam ahead.

Author – Geographic Sales Breakdown via UAA Press Release

The company also made some adjustments to their year end outlook. UAA now anticipates year end operating profit of $300MM-$325MM, below the previous forecast of $375MM-$400MM. The company also reiterated revenue increase of 5%-7%, while holding SG&A expectations flat to the prior year. Gross margin is now expected to drop 375-425 basis points compared to the previous expectation of a 150-200 basis point decline compared to the baseline period’s margin of 49.6%. The troublesome part of this announcement was why – the company did not mention the supply chain crisis for the updated drop in margins. UAA noted that more promotional activities, channel mix (more wholesale), and negative impacts from anticipated changes in foreign currency will weigh on gross margins. This means that more discounted product will hit the shelves heading into the end of CY2022. These developments led Baird to drop its price forecast after the quarterly report.

With inventory rising and higher promotional activities anticipated, I see UAA continuing to underperform. UAA expects to spend $225MM in CAPEX, in line with their prior communication. The company repurchased $25MM of shares during the quarter, dramatically reducing their spend from $300MM in the prior quarter. They noted that they still have approximately $175MM remaining under authorization to buyback shares. With substantial profit headwinds, I doubt they complete the buyback program in full.

Interim CEO Colin Browne led his first earnings call after stepping into the role. Kevin Plank, Chairman and Founder, provided some brief updates about the brand awareness and strength, but cautioned that the CEO search was on-going. Colin, a 10-year veteran in operations at Under Armour, then noted that in his conversations with suppliers that customers enjoy the brand so much that demand for casual wear is increasing. He also mentioned that while inventory will remain elevated that their revenue growth rate should exceed the inventory increase in the next couple of years.

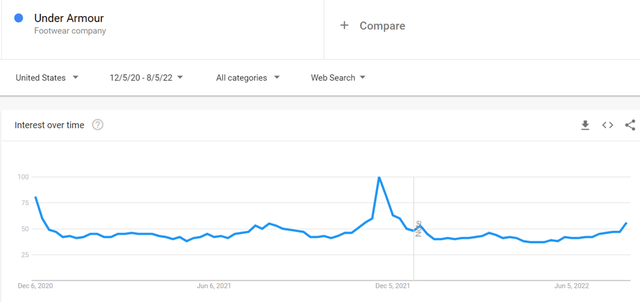

In the Q&A session, executives highlighted that footwear and Asia will continue to drive growth for the business and that the forecasts rely on their outperformance. Leadership was also grilled on the gross margin guide down by Matthew Boss of JPM, and confirmed that additional promotional activities to sell discounted clothes and increased wholesale distribution are the main drivers of the refreshed guidance range. David Bergman, CFO, also cautioned that while there is availability on the share buyback program, UAA liked the liquidity flexibility. Given these comments, I anticipate that the cash supply will dwindle via operational deficiencies, because there were no mentions of increased CAPEX or the search for an acquisition target. Overall, the call didn’t have any surprises – the company is working through some headwinds, but they are optimistic that revenue growth will accelerate into the next year. With margins weighing on profits in the medium-term, I don’t see an X-factor that warrants labelling UAA a buy right now. While revenue in footwear and Asia may exceed expectations, given the company’s lagging interest in both online and North America, I don’t see a positive catalyst that can turn the tide.

Model & Conclusion

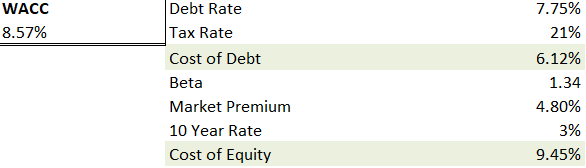

While I don’t foresee intangible strength from UAA, the refreshed model still shows that if the company can deliver on forecasted growth, there’s some runway for the stock to modestly pop. The company’s cash position is likely to somewhat stabilize, as management didn’t hint at a large stock buy-back on the conference call. The model forecasts a WACC of ~8.6%, virtually unchanged from my previous analysis, though with minor updates to the debt rate, the market premium and the 10-year paper. Given their weak Q1 performance, I anticipate the cost of debt rising to 7.75% should they attempt to add leverage in this environment.

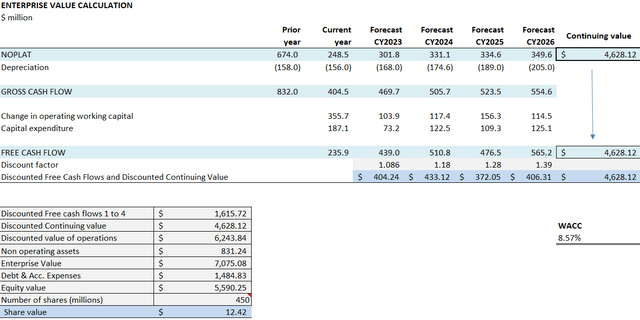

Author WACC

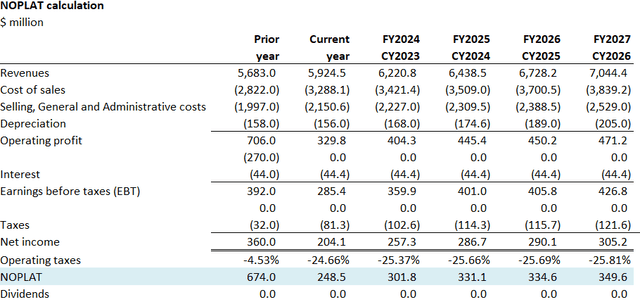

I forecast the continuing value above $4.6B, given a 4.25% revenue increase this year and blended revenue growth of ~4.5% for the three years after. I reduced my gross margin to 44.5% from 46% given the updated guidance from management. I hold other cost ratios mostly equal as a percentage of revenue from the previous forecast. As discounted merchandise sales start negatively affecting the bottom line, I believe CAPEX spend will slow, to $188MM vs. the expected $225MM. As the margin dips, a $12 share price (see below) can be supported with fundamentals. However, I think that new leadership will have some growing pains, and that the share price will not support the CY2023 EV/EBITDA model forecast of 11.7. Slashing the share price prediction to $11 based on negative company intangibles and historical lack of support from Wall St. showcases an EV/EBITDA of 10.4 and a calendar year CY2023 P/E of 17.5. In today’s price target, I estimate 450MM shares outstanding given the share buyback has continued, albeit at a lower pace.

Author NOPLAT Forecast Author EV Calculation

While UAA continues to improve their revenue and operating efficiency, the company remains an underperformer versus their peers. UAA is now well into a transition plan that has yet to significantly pan out, and now investors are in limbo as they await the next CEO to be announced. The company reported sluggish earnings and guided margins and profit down for the remainder of the year. With retail sales slowing and elevated inflation on-going, I still project an $11 price target with a “Hold” rating.

Be the first to comment