EricVega/iStock Unreleased via Getty Images

Introduction

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (“Google”) is a complex company that is difficult to summarize in a single article. I have already written articles on individual aspects of the “other bets,” DeepMind, and Waymo. This article is about how Google’s market share is developing, whether there is still potential upside or most of the potential market has already been tapped. It is mainly about Google and YouTube.

This question is crucial for the future potential of Google. Although the company has pricing power, it cannot exploit it to the full, of course. Advertising must be worthwhile for the advertiser. So, this article is not about current quarterly results or the like. There are enough other good articles for that since Google is one of the most discussed stocks on Seeking Alpha.

World Internet Users

A few days ago, I read the UN estimates that humanity has crossed the 8 billion threshold. I think it makes sense to start this article with the larger context in which Google operates because an increasing number of people among Internet users is a general tailwind for Google.

Of those 8 billion people, about 5 billion currently use the Internet, and 4.7 billion use social media. These numbers are lowest in Africa and Asia; in other words, the potential for increased Internet use is still highest. The number of Internet users will probably increase because many older people worldwide have grown up without the internet and, therefore, never really found their way into it. All in all, we can strongly assume that in 10 years, there will be far more than 5 billion Internet users. I mentioned this at the beginning because the market share of Google or YouTube may decrease, but the absolute number of users increases simultaneously.

Google market share over time

This is Google’s market share worldwide, split between desktop and mobile and three different periods. So we can see they are much stronger on mobile than on desktop, where they have lost some market share. Both combined, Google currently has a 92% market share. I got all the data from statcounter.com.

| Okt 2012 | Okt 2017 | Okt 2022 | |

| Desktop | 90.7% | 87.7% | 83.7% |

| Mobile | 96% | 94.7% | 96.4% |

These are the statistics of competitors for mobile and desktop computers combined.

| 2012 | 2017 | 2022 | |

| Bing | 3.1% | 2.8% | 3.6% |

| Yahoo | 3.0% | 2.2% | 1.3% |

| Yandex | 0.3% | 0.4% | 0.8% |

| Baidu | 0.3% | 1.3% | 0.6% |

| Other | 1.4% | 1.3% | 2% |

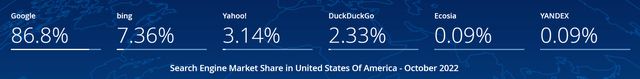

USA

Since many people from the U.S. are on this site, I would like to list these statistics separately. Also, they are particularly interesting, and the market shares differ significantly from the worldwide statistics.

The three alternatives, Bing (MSFT), Yahoo, and DuckDuckGo, are particularly strong here. Five years ago, Bing had a 6.5% market share, Yahoo 5%, and DuckDuckGo 0.5%. I find this interesting, especially since one of my questions was whether the increasingly apparent censorship on Google and YouTube is causing the market share of alternatives like DuckDuckGo to rise. The answer seems to be yes. From my personal use, I can also confirm that Google and DuckDuckGo sometimes lead to very different search results. I use both search engines, and Google is great for almost everything, but if I know that my search query belongs to sensitive topics, I switch to DuckDuckGo. And in fact, I find more answers there, while Google, for my taste, too often redirects me to mainstream media like CNN.

Overall, Google had a market share of 92% worldwide even ten years ago. In individual countries, it may have changed, and the market shares between the alternatives have changed, but Google had 92% ten years ago and still has it today. What surprised me, I thought that Google lost more market share, but they have played the mobile segment so well that this makes up for the lost market share on desktop computers.

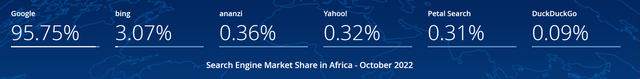

Africa

In addition to the U.S., I would also like to take a separate look at Africa, which has the fastest-growing population in the world and the lowest percentage of Internet use. Looking to the future, Africa has the most catch-up potential. Google’s market share is likely to benefit from the fact that Africa, like many Asian countries, has largely skipped the desktop computer era, and many people’s first contact with the Internet was directly on smartphones. Overall, the market share here is significantly higher than the global average.

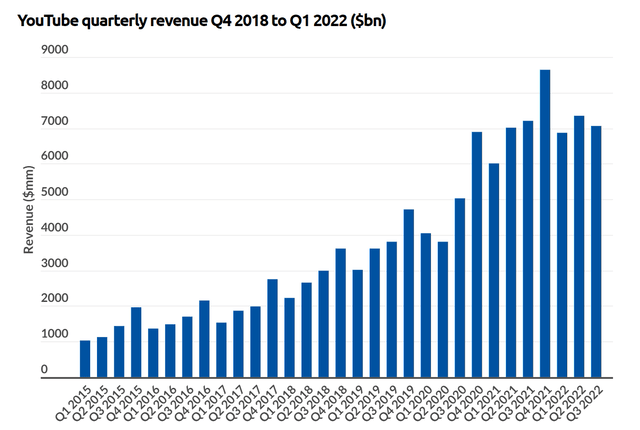

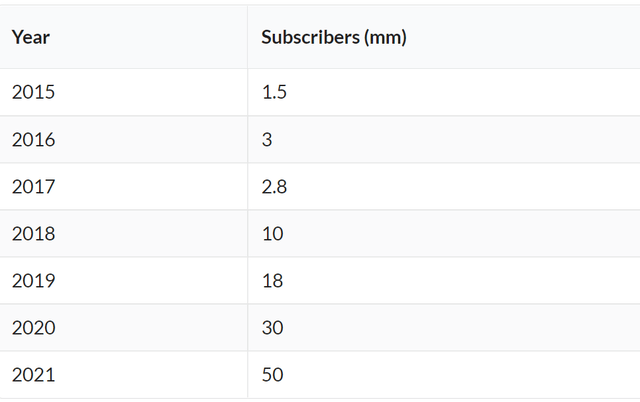

YouTube’s development

On the one hand, YouTube is social media, but on the other hand, unlike many other social media platforms, YouTube can also be classified as a search engine. YouTube is the second largest search engine in the world behind Google. Unfortunately, I can’t find market share data for YouTube as nicely prepared as for Google. I think this is because the video streaming industry is heavily divided across many apps and platforms. Therefore we have to try to approach the development in a different way to get an overall picture. Some stats:

- Over 2.5 billion people access YouTube once a month

- YouTube Premium achieved 50 million subscribers in 2021

- In the last quarter, YouTube contributed $7B to the $70B revenue (Google search engine contributed $40B).

Here we already see something interesting: the revenue of YouTube has grown steadily but has stagnated for several quarters. There was this big jump at the beginning of the pandemic, but now they are struggling to move beyond that. And that’s even though the number of premium users is increasing, and YouTube is putting more and more ads for the free users, to the point where it’s already so annoying that I wonder why anyone even watches without a premium account. A YouTube premium account is much more profitable for the company than a viewer who watches advertising.

The combination of these points is strange. Why does the revenue stagnate when premium users increase, and more advertising is placed for other users? Theoretically, this indicates that the number of users is decreasing, but I can not prove this with exact figures. You can only find rough numbers of monthly active users, which is pretty meaningless. Because it makes a massive difference if viewers watch YouTube every day for an hour or once every three weeks, but both are monthly active users.

I don’t have historical figures here, but I know from my own experience that for advertisers, the cost of advertising on YouTube has risen steadily over the last at least five years. If this is the case and at the same time the users get more ads shown, it makes it strange that the revenues stagnate from this side as well. For me, that´s another indication that the number of users or their time on YouTube is decreasing.

The competition

For years, I had the feeling that YouTube was almost without competition. But now we are at a point where competition is emerging for the first time, and again it has to do with increased censorship. Alternatives have emerged during the pandemic, like Rumble (RUM) and Odysee. Some others, like Vimeo (VMEO), have been around for a while but never really caught on. Other competition comes from short video platforms like TikTok and Facebook. And, of course, streaming platforms like Netflix (NFLX). After all, everyone only has a limited amount of time, and all these platforms ultimately compete for users’ attention.

Odysee is growing rapidly, which can be seen from the fact that the odysee.com domain is already ranked 2,100 among the world’s websites.

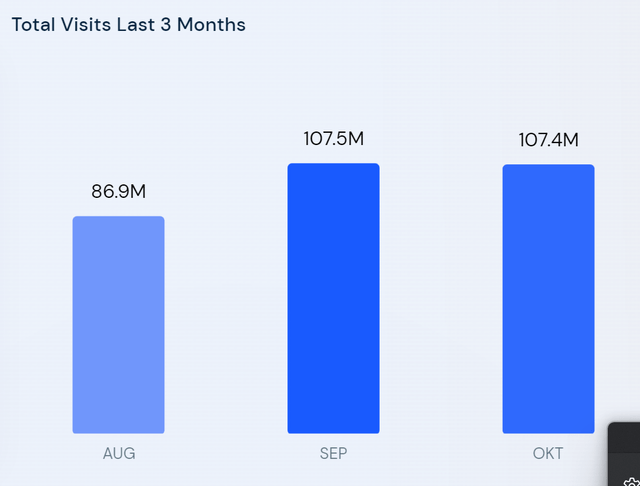

Rumble ranks even better at 443 and in the U.S. at 161. The traffic on Rumble is still growing very fast and reached 107M visits in October. But for comparison, YouTube has 350 times as much and had 35B visits in October.

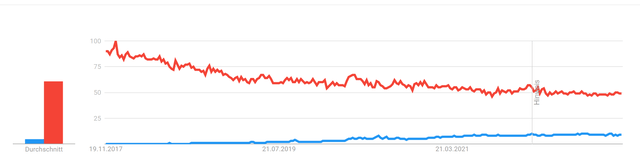

TikTok is probably the biggest emerging competitor right now. It was the most downloaded app of 2021 and has more than 1 billion monthly active users. Among Generation Z, TikTok is already more popular than Instagram. At the same time, TikTok has increasingly opened up the possibility of uploading longer videos, up to 10 minutes. The average video on YouTube is 11.7 minutes long, but this number goes up due to some very long music and gaming videos. For entertainment, TikTok is a real alternative to YouTube with 10 minutes. Below is a Google trends chart for YouTube vs. TikTok.

YouTube Conclusion

The combination of all these points suggests that YouTube’s user numbers (or at least the time spent by them) are likely declining. There are some indications for this:

- premium users on YouTube are increasing, but revenue is stagnating

- competitors like Rumble, Odysee, and TikTok are gaining popularity

- I notice many more bots in the comments on YouTube than I used to. This makes it even more challenging to understand how exactly the user numbers are.

This does not necessarily mean that YouTube’s revenues will decrease in the future. They have several possibilities to keep revenues constant or to increase them even more. For example, the costs for advertisers could increase even more. In addition, more and more people could buy a YouTube premium account.

Overall conclusion

Overall, I think the time of fast-growing user numbers and revenues is over. Google’s market share is already so high that it can hardly be higher. Future growth will come from the increasing world population and possibly higher costs for advertisers in developing countries. Certainly, YouTube also has a lot of room to increase costs for advertisers in developing countries. The single country with the most users is India. At the same time, the price of a premium account here is the lowest in the world (which anyone can take advantage of, by the way 😉

I think Google is aware of all this, and that’s why they have been working for years to diversify their revenues even more via the cloud or the “other bets.” I don’t necessarily want to say that all this is bad because potential is still there and not completely exhausted. Even with the status quo, the company prints a lot of money that it can use for innovations and buybacks.

The most significant risk for Google is if their primary source of revenue, Google search, loses market share. But this will probably not be a quick process, but it will take years. Shareholders should therefore have more than enough time to react to such developments. However, it could also be that we are already at the beginning of this development and just do not understand it yet.

Be the first to comment