Marko Geber/DigitalVision via Getty Images

Investment thesis

I recommend buying Udemy (NASDAQ:UDMY). The surge in need for quality online learning platforms has been fueled by the recent global pandemic, the dynamic technological advancements, and the need for distant learning for people already working or for those who can’t access in-person training. The need for up-to-date educational content is also on the rise.

UDMY has tapped into this opportunity and offers a platform for learners and enterprises to access content that is updated regularly based on their feedback or due to other technical changes. Tutors on this platform are given a very large market to market their content. With the need for a good online learning platform on the rise, UDMY has set itself up as a unique platform that has attracted millions of students, businesses, and tutors.

Business overview

UDMY is a global online learning and teaching platform. UDMY is a two-sided platform.

On one side are the instructors, who create content based on specific topics to meet the demands of learners on the platform. The courses they offer are either for re-skilling or up-skilling in business and technology, for enhancing soft skills, or for personal development.

On the other side are the learners who access these courses through direct-to-consumer or Udemy Business [UB] offerings. They gain access to tools such as exercises, quizzes, and instructor questions and answers.

UDMY is a market disruptor

The shift to online learning has never been more important than it is now. Technological advancements, novel industries, and new fields of study have made existing skills obsolete. As continuous proficiency in the latest technology becomes a requirement in many fields, individuals and organizations are urgently struggling to keep their expertise up to date. In addition, the COVID-19 pandemic changed how companies and organizations work. Employees’ skills and roles should adapt to an operating model that can spring back from any setback. The global move to online learning has been ongoing and is expected to continue. Given the demand for these, surprisingly, my research suggests that most of the learning solutions currently available have shortcomings.

Traditional learning methods are based on a publisher model. This model employs an expensive and lengthy top-down process that is characterized by multi-level editorial and review teams. This model discourages continuous course creation or improvement after publication by limiting the speed of course development, limiting the cost-effectiveness of localized content production, and also limiting the instructor’s oversight over their content.

The way I see it, the importance of employees accessing relevant training is only set to increase over time. However, available content in popular learning areas such as creative and technical skills or personal development strategies is limited. This is due to the slow speed and the high cost attached to the publisher model. As a result, the content on these topics lacks depth and the diversity of the instructors needed to meet the objectives of modern learners. Existing solutions therefore do not adequately address the needs for continuous and multidisciplinary learning.

Another shortcoming of traditional learning solutions is that they lack ways to ascertain their own quality. No ratings, reviews, or past performance are provided for a learner to determine the quality of the content offered. This is despite the fact that large volumes of these solutions exist globally.

In short, existing solutions are ineffective in the global market. They cannot operate on the global scene since they largely rely on in-person training. This causes them to be restrained by the instructor’s time and physical resources and the slow pace of adopting technology to widen their reach. The available digital solutions, which are more scalable than in-person training, struggle to provide local content for international communities.

Finally, affordability also prevents many learners from taking up these available solutions. The high cost of these solutions prevents learners from advancing or upgrading their skills. With a globally standardized pricing system, access to many geographical areas becomes limited.

UDMY on the other end has a different offer, one that counters all the shortcomings listed above and connects learners on a global platform with up-to-date knowledge from experts and practitioners worldwide.

Strong content generation capability

UDMY offers a platform for instructors to develop content on any topic. Content created can be continuously updated based on feedback from millions of learners worldwide. The continuously updated content, personalized recommendations, and advanced search capabilities provide greater benefits to learners. Learners in UDMY access up-to-date, high-quality, and relevant content. High-quality content is maintained in UDMY by the continuous feedback loop between learners and instructors.

UDMY’s marketplace model is motivating to instructors. They are presented with three opportunities:

- To be the first to address in-demand topics,

- Refresh existing topics, and/or

- Present existing topics in new and better ways.

Instructors who use either of the approaches will have the “first mover” advantage of attracting more learners and increasing enrollments in their courses. This leads to an increased likelihood of their content being featured by UDMY’s ML algorithm or being included in the UB offerings, both of which increase enrolment and learner engagement. When added to the aligned incentive model, these structural incentives push instructors to update their courses more often than they do with the traditional publisher model.

This capability is extremely important as it sets UDMY apart from its peers. UDMY’s competitors specialize in offering a specific category of content. I believe these are seen as low quality by companies and their employees that seek a blend of technical, business, and soft skills. UDMY’s marketplace, on the other hand, is diverse, and it provides learners and UB customers with solutions that supplement technical and business content with personal enrichment courses in wellness, music, and lifestyle categories, among others.

Udemy has global reach and a strong brand

UDMY’s platform is global, with individual learners, enterprise customers, and instructors across the world. I think this is crucial, as it has allowed UDMY to create a global distribution platform to target all members of the learning ecosystem.

How UDMY executes its growth strategy in new markets is something worth highlighting as well. UDMY employs a winning strategy to expand into new markets, which is done by allowing curious learners and organizations to test UDMY’s platform. During this testing period, an engagement kicks off, and through their marketing, advertising, pricing, and language customization, they use these opportunities to expand their customer base. This also attracts instructors to create native language courses for learners and enterprises. UDMY claims that the scale of their platform and the increased awareness of their brand create more avenues for their growth.

Strong flywheel effect

The increase in learners’ population and UDMY’s platform attract instructors who seek a new or extra source of income to support their families and local communities. As world-class teachers and experts make courses that are more relevant, high-quality, and up-to-date, they attract more individuals and businesses. More importantly, UDMY’s channels are collaborative. Their direct-to-consumer channel, for example, indirectly markets UB. When learners experience the quality and benefits of UDMY’s platform, they note the positive impact it could have on their teams or organizations if they were to join. This creates a free marketing platform for UB. This has led to directing highly converting and successful leads to UB and subsequently boosting UB’s rapid growth.

3Q22 review

Quarterly growth for UB was 67%, and annualized recurring revenue growth was 59%, both of which were higher than Consumer growth. Despite the macro backdrop, UB “performed well across a broad array of verticals and geographies,” and new expansion deals have been on the rise. I think some of the most important highlights are:

- Multi-year contracts now generate over 40% of UB’s revenue, a 135% increase from just two years ago.

- The consumer segment brought in $75 million in revenue, down 6% year-over-year. The consumer sector is showing signs of resilience, with both foot traffic and average monthly purchasers rising from one year to the next.

- UDMY’s new midpoint revenue guidance for FY22 is $629.5 million, which is slightly higher than the consensus revenue projection of $628.1 million. Also, the adjusted EBITDA margin forecast for FY22 was reported at -9.5%, which is an increase of 150 basis points from the previous forecast.

Valuation

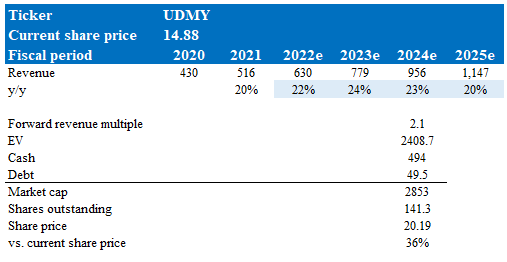

My model suggests that UDMY has ~36% upside from where it is trading today. My model values UDMY on a forward revenue basis, as the business is not expected to generate meaningful profits in the near term. The model follows consensus growth estimates, which I believe are achievable given UDMY’s competitive advantages, global reach, first mover advantage to create a recognizable brand, and a strong flywheel effect.

UDMY is trading at 2.1x forward revenue today. To be fair, this valuation makes more sense than the 6x it was trading at last year. At 2.1x forward revenue and an estimated long-term net margin of 15%, it implies UDMY is trading at 14x long-term P/E, 3 multiple turns lower than the S&P average). Hence, I simply assumed it would at least stay flat in FY24.

Based on these assumptions, I believe UDMY’s stock is worth $20.19 in FY24.

Own estimates

Risks

Loss of key instructors

Although UDMY boasts a broad and diverse instructor base, a huge percentage of their most popular content, which translates to a significant percentage of their revenue, is created by a limited number of instructors. UDMY relies on the limited number of instructors to create more popular content to continue boosting their revenue. A loss of such instructors and a failure to attract additional instructors will impact UDMY’s business negatively.

Competitive market

The rapidly evolving nature of the online learning industry, paired with a low initial investment, floods this market with competitors. The fact that the market is relatively new adds to the competitiveness of this industry. A good example is Coursera (COUR), which has been gaining good traction over the past few years.

Conclusion

To conclude, I believe UDMY is undervalued today. As UDMY’s flywheel effect kicks in, more visitors flock to the platform, encouraging tutors to update and create more high-quality content, resulting in more visitors and new tutors. This cycle only points to continuous growth for UDMY, with online learning becoming the new norm.

Be the first to comment