simarts

After our initiation of coverage, today we comment on UBS’s (NYSE:UBS) second quarter performance.

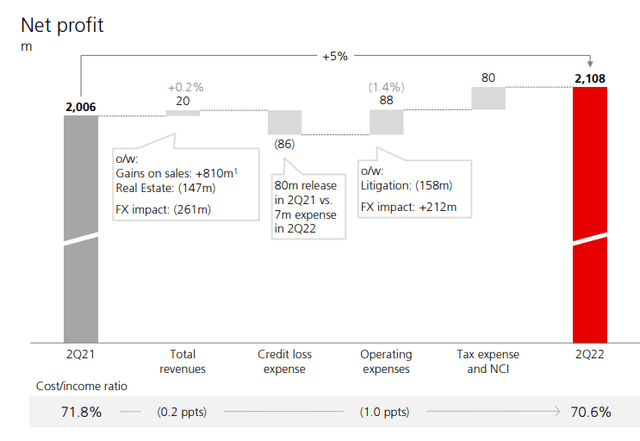

During the period, the Swiss bank recorded a net profit of $2.11 billion compared to a $2.01 billion result in the same period of the previous year (and lower result versus Q1). This performance was driven by accounting noise in the corporate center division, which negatively contributed more than $200 million and, according to management, this outcome should revert over time. Looking at the divisional contribution, we note that Global Wealth recorded higher margins but missed on lower assets under management, Asset Management missed expectations on lower fees, whereas the Investment Bank result was in line with Wall Street consensus.

Concerning the numbers, revenues stood at $8.92 billion, up from $8.90 billion in the same period of 2021. According to the consensus compiled by the Swiss group, both net income and top-line sales line fell short of analysts’ expectations who expected a net profit of $2.40 billion on a turnover of $9.43 billion.

Looking at the specifics, UBS’s Wealth Management Division, the flagship of the Swiss bank, experienced a 2% decline in revenues, driven by negative market performance, adverse currency effects and lower levels of client activity, particularly in the Americas and in the Asia-Pacific regions. “The second quarter was one of the toughest times for investors in the past 10 years,” said CEO Ralph Hamers. “Our underlying performance reflects a good result in an environment with lower asset levels, higher volatility and rising rates.” We understood that institutional clients were very active in the period, and we are not surprised (this should support our thesis on Euronext and toward the London Stock Exchange Group), whereas private clients remained on the sidelines.

Revenues from investment banking were $2.094 billion, down 14% compared to the same period last year. The bank reported a decline of $1.121 billion in net fees, reflecting negative market performance and lower M&A revenues.

Conclusion and Valuation

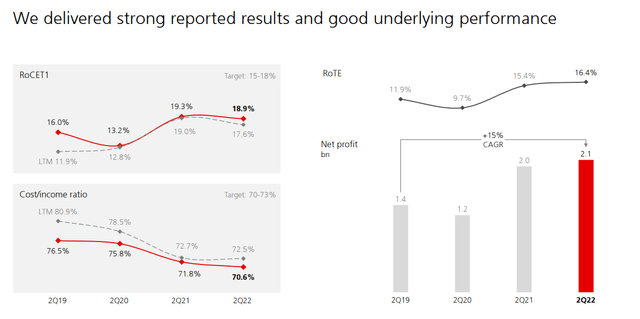

UBS said that it is well-positioned to face the second half of 2022 and reiterated its plan to repurchase about $5 billion of its shares by the end of the year. CET1 ratio stood at 14.2% compared to 14.5% at the end of June 2021. Q2 performance was mixed and the sentiment is not positive due to lower fees in the Global Wealth and Asset Management division, but our internal team believes that higher rates will positively influence the company NII performance. This was a challenging quarter, however, UBS missed slightly on a few lines. Thus, we reaffirm our buy rating on the Swiss bank and confirm our target price of CHF 22 per share based on a sustainable ROTE at an average of 14.5% and a sum-of-the-parts financial model on UBS’s business areas.

Be the first to comment