AnryMos

Introduction

Microsoft (NASDAQ:MSFT) is widely considered a bond-like, safe-haven investment due to its incredible business moats, robust financial performance, rock-solid balance sheet, and humongous capital return program. However, Microsoft has lost ~25% of its market cap in 2022 as treasury yields have surged higher on tighter monetary policy. In today’s note, I run Microsoft through my Quantamental analysis process and TQI valuation model to see if it’s undervalued or overvalued and to determine if it is a good long-term buy at current levels.

While we will be focusing on numbers and charts in this note (and not the business per se), you can find my view on Microsoft’s business and my investment thesis through my past coverage of the company (latest first):

Before we build out an absolute valuation for Microsoft, let’s quickly analyze Microsoft’s fundamental, quantitative, and technical data.

Looking At Microsoft Through The Lens Of TQI’s Quantamental Analysis Process

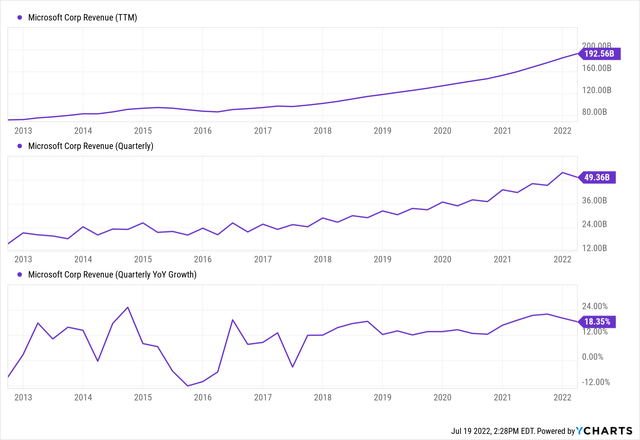

In the digital era, technology is ubiquitous, and Microsoft has built incredible business moats in its humongous serviceable addressable markets, including Cloud, Enterprise Software, Gaming, etc. Over the last twelve months, Microsoft raked in revenues of $192.5B, with Q1 growth coming in at a healthy level: 18% y/y. Riding high on the strength of its cloud infrastructure business [in addition to other solid growth in other business lines], Microsoft’s financial performance has gone from strength to strength for several years now.

YCharts

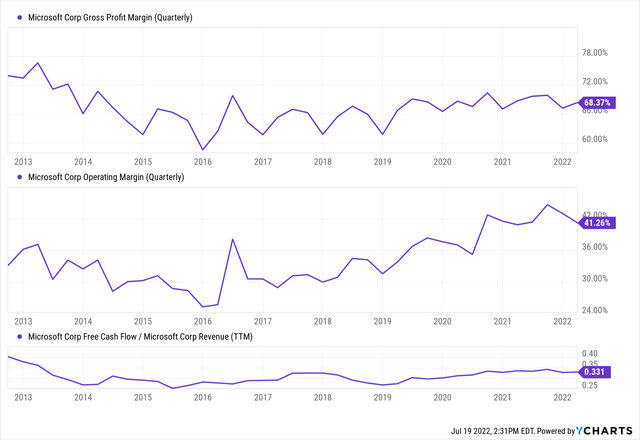

In addition to robust revenue growth, Microsoft’s margin profile is getting stronger with each passing quarter. For Q1 2022, Microsoft recorded gross and operating margins of 68% and 41%, respectively. As you may know, these are best-in-class numbers.

YCharts

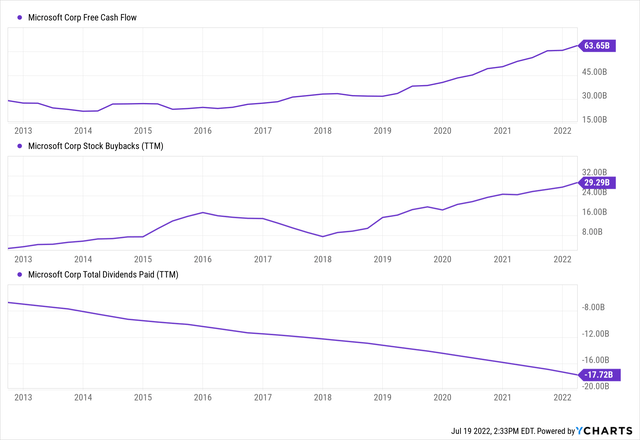

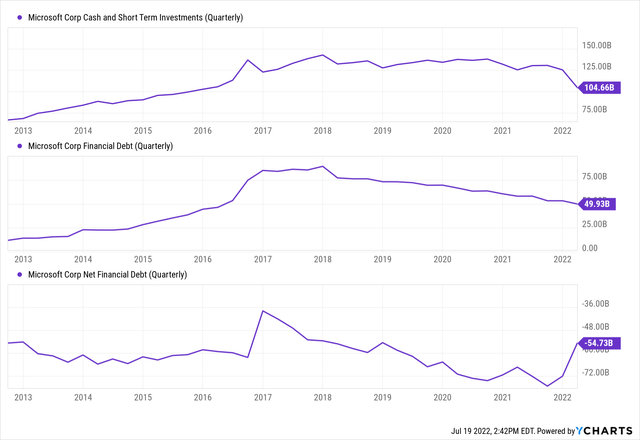

Whilst recording healthy growth numbers at this massive scale, Microsoft is also generating incredible steady-state TTM FCF margins of ~33%. It is fair to say that Microsoft is a cash printing machine. In the last twelve months alone, Microsoft generated free cash flows of $63.65B. Due to a net cash balance of roughly $55B (cash hoard), Microsoft’s management has adopted an aggressive capital return program, which constitutes massive stock buybacks and a healthy dividend.

YCharts

YCharts

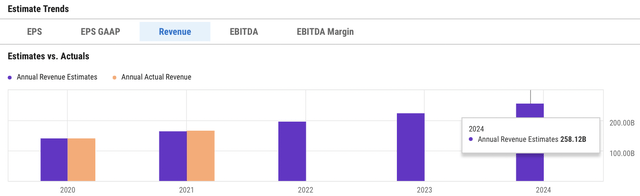

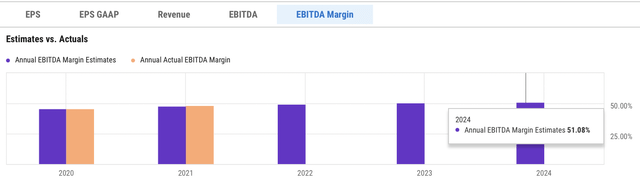

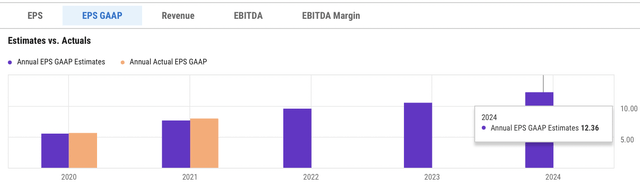

The threat of a global recession is rising; however, Microsoft could continue to deliver sales and profit growth in the coming years (albeit at a slower pace). According to consensus analyst estimates from YCharts, Microsoft’s revenues are set to grow from $198B in 2022 to $258B by 2024 at a CAGR rate of ~14%. During this period, Microsoft’s [EBITDA] margins are expected to improve by another ~200 bps, and projected earnings are set to outpace projected revenue growth.

YCharts

YCharts

YCharts

While the fundamental outlook for Microsoft’s business looks rosy for now, things could change rapidly if we do end up in a deep economic recession (as the FED raises interest rates and implements QT to curtail inflation by lowering aggregate demand). According to recent news reports, Microsoft is slowing hiring amid economic uncertainty (and it cut some jobs too in recent days). In my view, this news is evidence that Microsoft’s business is not immune to economic recession. At this point, I do not believe Microsoft’s financial projections will be met in a recessionary environment. Over the coming quarters, we may see weakening fundamental data from the company.

Now, let’s switch gears and analyze some quant factor grades for Microsoft.

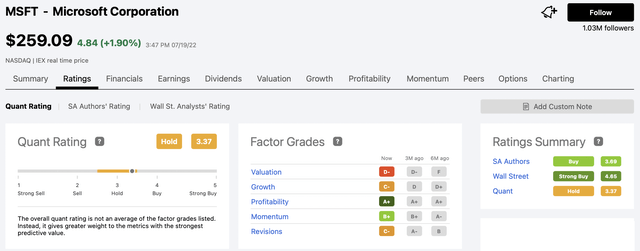

According to SA’s Quant rating system, Microsoft is rated as a “Hold”; however, SA Authors and Wall Street analysts remain bullish on the counter. While Microsoft has maintained an “A+” rating on Profitability, its Growth, Revisions [earnings], and Momentum ratings have been worsening over the last six months. Additionally, the improvement in Microsoft’s Valuation rating is just a result of negative price action. Overall, a cumulative quant factor grade of 3.37/5 puts Microsoft firmly in the “Hold” territory.

SA Quant Rating

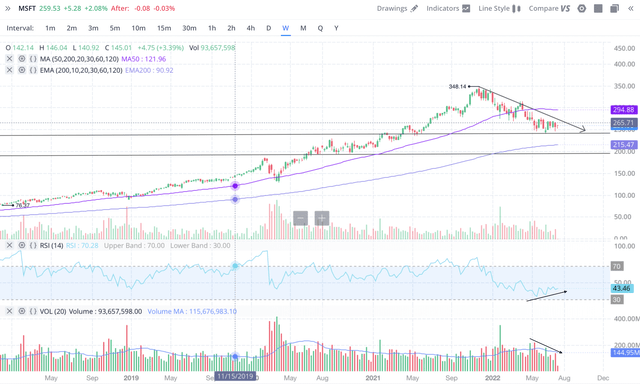

Since the Fed’s pivot in November 2021, Microsoft’s stock has been sliding lower in a downward wedge pattern. As you can see below, Microsoft is currently trading well below its 50-Day moving average, a level it has traded above during its bull run over the last few years.

WeBull

After a ~25% drop in 2022, Microsoft’s stock appears to be forming a base on the weekly chart, with an upward trending RSI. Also, volumes have been trending lower, which could be viewed as a sign of seller exhaustion. Technically, Microsoft seems ripe for a near-term bounce. However, the downward trend that started in late 2021 is still intact and based on valuations, Microsoft’s stock may have more downside in the medium-term. Talking of valuations, let us now try to determine the absolute intrinsic value of Microsoft.

Finding Microsoft’s Fair Value And Expected Return

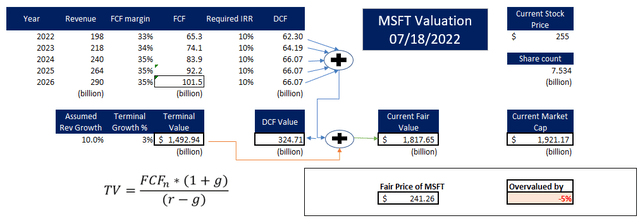

To find the fair value and expected return of Microsoft, we will use TQI’s Valuation model with the following assumptions:

| 2022E revenue (conservative estimate) | $198B |

| Forward 4.5-Yr Revenue Growth Rate (%) | 10% |

| Terminal Growth Rate (%) | 3% |

| Optimized FCF Margin (%) | 33-35% |

| Discount Rate / Required IRR (%) | 10% |

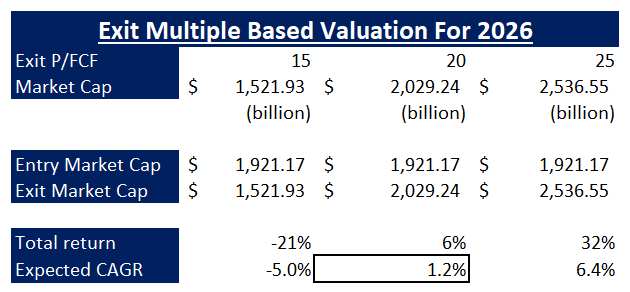

| Exit Multiple [P/FCF] | 15-25x |

Results:

TQI Valuation Model (tqig.org)

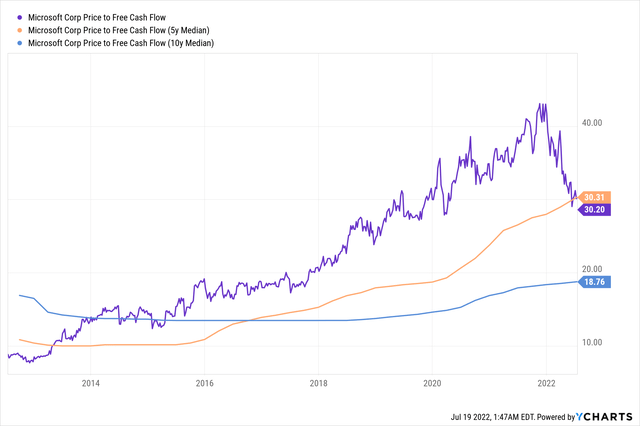

Despite using a lower discount rate (10%) than TQI’s required IRR for GARP stocks (15%), Microsoft’s stock comes out to be slightly overvalued. The valuation moderation in Microsoft’s stock has brought its P/FCF multiple back to its 5-year median P/FCF. However, there is more room on the downside and no real upside for Microsoft’s trading multiples.

YCharts

In one of my previous articles, I outlined the logic behind Microsoft’s valuation moderation, and frankly speaking, the recent surge in treasury yields warrants further moderation in Microsoft’s trading multiples. With the economy potentially headed towards a recession, Mr. Market is irrationally pricing Microsoft as a risk-free asset. While I think Microsoft is one of the strongest businesses on this planet, it is not immune to a recession (and Morgan Stanley seems to agree with my view, according to this news report).

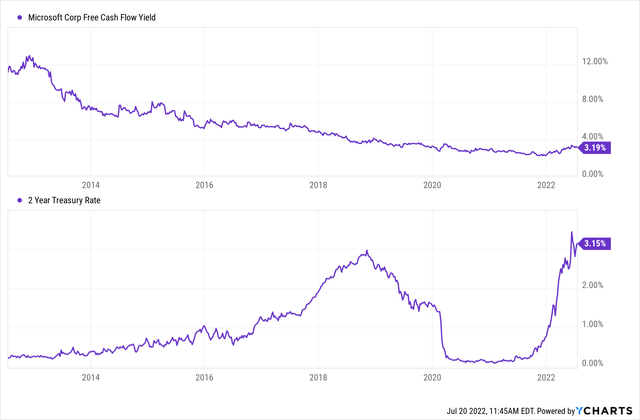

YCharts

Why would anyone buy Microsoft at an FCF yield of 3.21% when the 2-yr treasury is yielding 3.15%? (and that too in the face of an impending recession)

Well, I don’t have a good answer for this question, but let’s take a look at Microsoft’s expected returns to see what an investor could realistically generate from here with Microsoft.

TQI Valuation Model (tqig.org)

Assuming a P/FCF multiple of ~20x in 2026 (inverse of long-term average interest rates of 5%), Microsoft would generate just a 6% price return from current levels over the next 4.5 years. Hence, Microsoft’s stock looks like dead money to me. So far, we haven’t included Microsoft’s capital return program in our analysis, and this is a good time to do so.

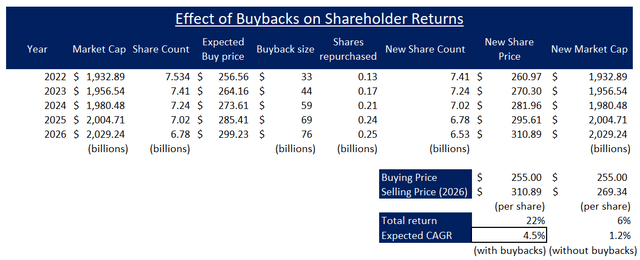

As you may know, Microsoft has lots of cash on its balance sheet, and it is generating tons more in free cash flows every quarter. In recent years, Microsoft has implemented an aggressive capital return program that includes dividends and stock buybacks. While we have discussed this program (and its potential) in great detail in the past (report), I think that if Microsoft’s $68.7B deal to buy Activision Blizzard (ATVI) goes through, the buyback program will be somewhat smaller than my initial estimation. Here’s what I expect from Microsoft’s buyback program over the coming 4.5 years:

TQI Valuation Model (tqig.org)

After factoring in the effect of potential buybacks, Microsoft’s expected CAGR returns went up from 1.2% to 4.5%. With Microsoft’s dividend yield of <1%, I can’t justify buying Microsoft even as a DGI play because the expected return on Microsoft is simply too low.

Concluding Thoughts

Even after a significant drop in 2022, Microsoft continues to trade at a premium valuation. The spread between Microsoft’s FCF yield and the 2-yr Treasury has narrowed to just 0.06%, which means the market is effectively pricing Microsoft as risk-free security. While I understand that a high-quality business like Microsoft deserves a premium valuation, I can’t digest the fact that it is being valued as a risk-free asset. Microsoft’s business is not immune to recession (and economic slowdowns), period.

To determine Microsoft’s fair value, I lowered my discount rate to 10% (factoring in the higher quality of business and treating Microsoft as a DGI play), and still I find it overvalued at current levels. From here, Microsoft’s expected CAGR return until 2027 is ~4.5% (including buybacks) and ~1.2% (without buybacks). Since my base case scenario is built with annualized revenue growth of 10% and steady margin expansion, I wouldn’t say this valuation is conservative. Hence, I do not like Microsoft at $255 as a GARP or as a DGI play. Mr. Market continues to view Microsoft as a safe-haven investment; however, a mean reversion alone could lead to another 25-30% loss in the stock. Also, if we do see a deep earnings recession, Microsoft may have even more downside. Considering the downside risk and little upside potential from current levels, I rate Microsoft neutral at current levels.

Key Takeaway: I rate Microsoft neutral at current levels due to unfavorable risk/reward.

Housekeeping Note: I’ll soon be launching a Marketplace service on Seeking Alpha focused on generating long-term outperformance through financial engineering. For a short period of time post-launch, “The Quantamental Investor” will be offered at a heavily discounted legacy price. Stay tuned for more updates!

Be the first to comment