OxAvdeenko

Uber Technologies, Inc. (NYSE:UBER) is the clear leader in the ridesharing market and is gradually making headway into food delivery and freight markets, emerging as an all-weather transportation/delivery company. Uber’s expanded TAM (total addressable market) is massive. Uber continues to make progress towards profitability and consistent positive cash flow. Uber reported its first positive cash flow in its history when it reported solid F2Q22 results.

We believe Uber is rebounding from pandemic lows as the driver supply situation brightens. The company beat analysts’ estimates with revenue more than doubling year-over-year, to over $8B, and gross bookings reaching an all-time high. We believe Uber is leaving negative multiples behind and expect the company’s Mobility and Delivery segments to drive profitability going forward. While Uber did miss EPS expectations, the company is recovering from pandemic lows and expects the business recovery to be swift from these levels. We believe Uber is the undisputed leader in the ridesharing market, and we expect the company to leave its competitors behind. The stock is trading at 1.7x EV/C2023 sales of about $38 billion, at a discount to peer group trading at 2.1x, while growing at 19% Y/Y. Therefore, we recommend buying the stock at current levels.

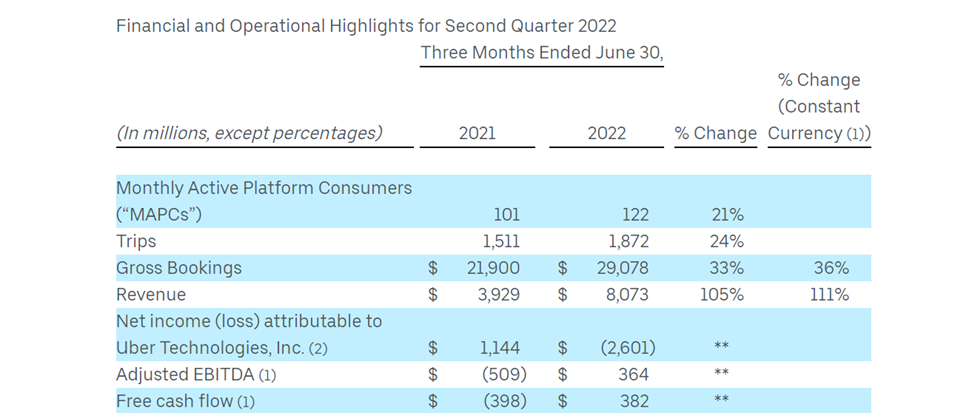

The following table outlines Uber’s 2Q22 earnings.

Uber

Rebounding pandemic lows

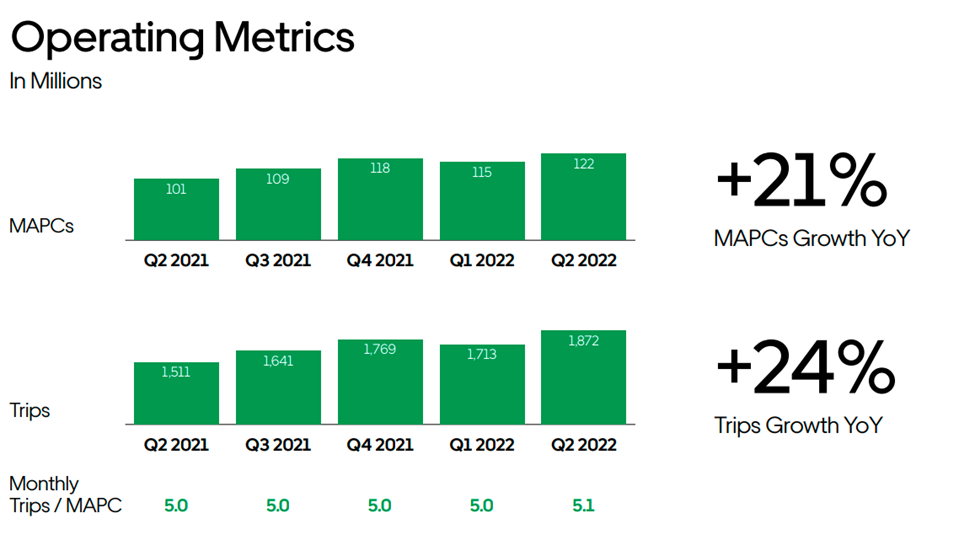

Uber redefined transportation globally. The U.S.-based application gives users access to uber-registered vehicles and drivers to enhance easier Mobility and Delivery. Unsurprisingly, the company’s MAPCs (monthly active platform consumers), total rides, gross bookings, and income declined during the pandemic. The Delivery segment, mainly Uber Eats, was the silver lining of the pandemic but still could not offset the revenue loss from trip services. With the pandemic in the rearview mirror, we believe the company is entering a new age of profitability over the next few quarters. Uber wrapped up 2Q22 with 122 million MAPCs worldwide, up from 93 million MAPCs at the end of 2019. We expect MAPCs to increase and believe Uber is well-positioned to achieve profitability towards 1H23.

The following graph shows Uber’s Operating Metrics.

Uber

Multiple (growth) drivers in Mobility

Uber operates in three main segments: Mobility, Delivery, and Freight. Uber’s primary revenue driver is Mobility, accounting for 44% of total revenue. It is no secret that Mobility demand sharply declined during the pandemic. Our buy thesis is primarily influenced by Mobility’s recovery over the past few quarters. Increased vaccinations in the United States and recovery in travel are improving the demand for Mobility. 4Q21 reported mobility gross bookings grew 67% Y/Y. The most recent 2Q22 quarter saw a continued recovery, with the segment growing 57% Y/Y.

We don’t believe Uber’s Mobility recovery is circumstantial; instead, we believe demand is ramping up to pre-pandemic levels. Mobility growth was primarily driven by the core UberX traction and new products (including hailables, 2-wheelers, taxis, and Uber for business, among others). While COVID-19 uncertainties remain, we don’t see Mobility slowing down again soon. We believe the pandemic lockdown headwind is almost over and is turning into a tailwind; more and more people are going back to actively using Uber transportation.

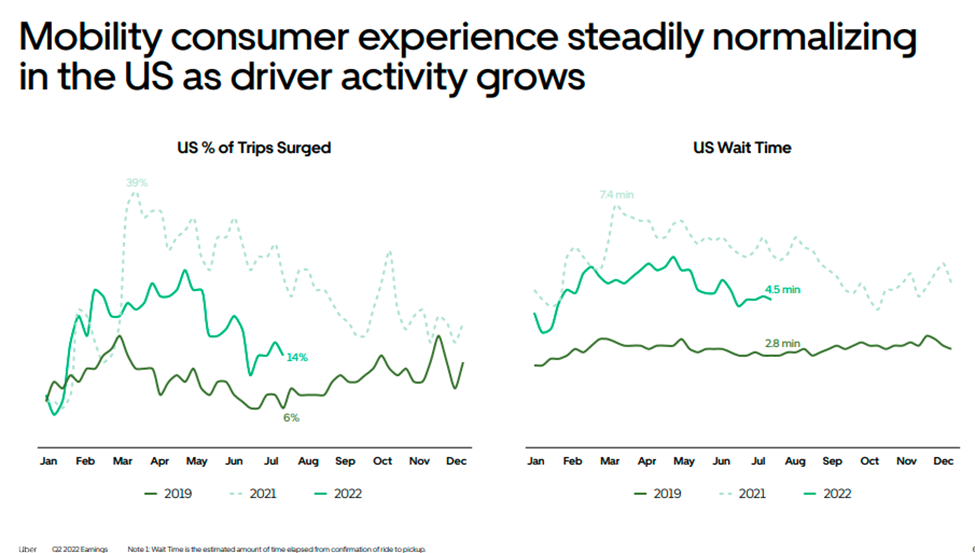

The following graph shows Uber’s Mobility in the U.S.

Uber

We’re excited about Uber not only because of Mobility’s recovery but also because of its expansion into food delivery and logistics. Around 15% of mobility growth in 2Q22 came from international markets. We’re constructive on Uber’s global expansion strategy in Europe, Latin America, the Middle East, and Asia. We believe the regional expansion will serve as a growth catalyst in the future.

Takeout demand is here to stay

Uber’s strife during the pandemic was its rideshare bookings declining while demand spilled into the Delivery segment. The pandemic drove delivery demand for food, groceries, and other tangible items. The good news is that now, post-pandemic, Uber’s mobility gross bookings are recovering, while the delivery demand is here to stay. Uber’s delivery business is booming, with online orders on the increase. In 2Q22, Delivery revenue increased 37% Y/Y, while gross booking grew 7%. We believe Delivery adds significant profitability to Uber and recommend buying Uber stock.

More people behind the wheel

Uber faced a lack of drivers during the pandemic, but this is no longer the case. The company announced it has more drivers and couriers than pre-pandemic and saw an acceleration in active and new driver growth. The drivers’ engagement reached another post-pandemic high in 2Q22, up 76% year-over-year. Both active and new driver growth increased during this quarter as well. In July 2022, the surge and wait times were near their lowest levels in a year in several markets, including the U.S.

Rearranging business to see positive EPS

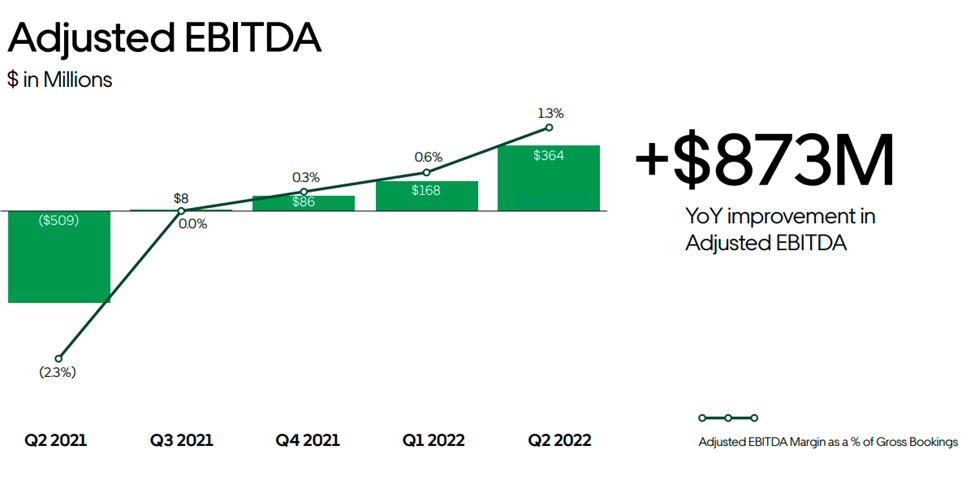

Despite Uber reporting a net loss of $2.6B for 2Q22, we remain bullish on the stock. Cutting out all the near-term noise, Uber’s adjusted EBITDA improved sequentially in the second half of 2021 and became positive in the first half of 2022. Uber beat gross bookings and revenue estimates but did miss EPS by a mile. We believe the positive free cash flow and the 33% Y/Y growth in gross bookings will trickle into EPS over the coming quarters.

The following graph shows Uber’s EBITDA

Uber

Risks to our buy thesis:

Uber is not risk-free. We remain concerned about how the macroeconomic environment will affect the company. Rising costs pose a risk to Uber’s bottom line. We’ve seen costs and expenses rise around 69% Y/Y in 1H22 compared to a surge of 33% Y/Y in 2021. Costs and expenses are rising for several reasons: inflationary pressures, payments for business openings in some countries, and new spending on drivers.

Drivers have been a significant issue for Uber over the past year, specifically the company’s classification of drivers as independent contractors. The company was hit by the UK Supreme Court’s decision in 2021 that required Uber to designate its drivers as employees deserving of minimum wage, holiday pay, and pension benefits. Since Uber had previously considered its drivers independent contractors, this was a significant shift in its business strategy and increased the company’s labor expenditures.

Stock Performance:

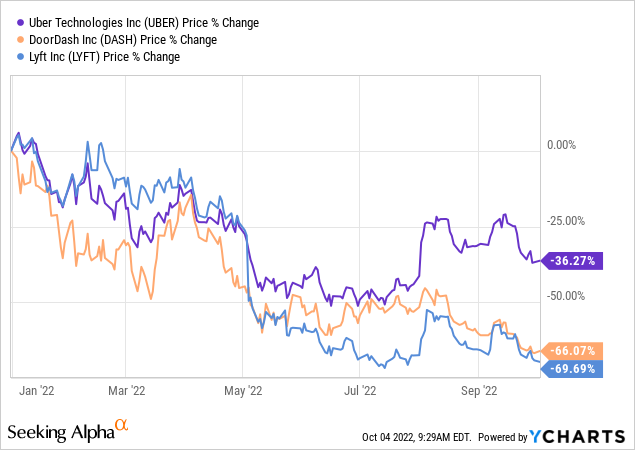

While Uber is down about 36% YTD, we believe the company’s fundamentals never looked better. Despite its YTD decline, Uber still outperformed its competition in its primary U.S. market, DoorDash (DASH) -66% and Lyft (LYFT) -70%. Uber is slowly but surely working its way to profitability, providing stability for the stock.

Ycharts

Valuation:

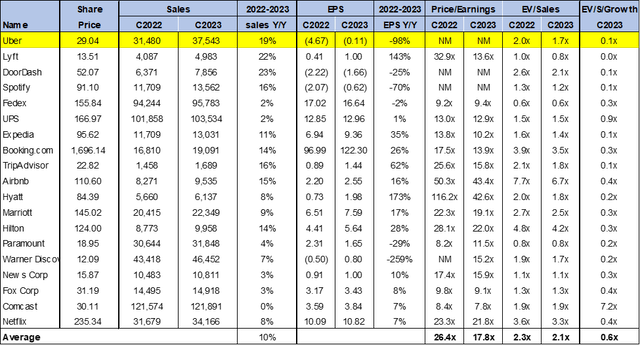

We believe the company is a growth stock and is relatively cheap. On a P/E basis, the company has negative earnings; hence, the P/E metric cannot be used for valuation. On the EV/Sales basis, Uber is trading 1.7x EV/Sales on C2023 versus the peer group average of 2.1x. Uber continues to grow faster than the peer group, yet it trades at a discount. The following chart illustrates Uber’s valuation relative to its peer group.

Word on Wall Street:

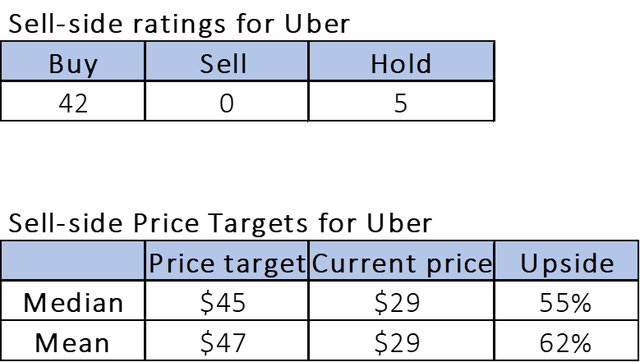

Of the 47 analysts covering the stock, 42 are buy-rated, and five are hold-rated. Uber is currently trading at $29. The median and mean sell-side price targets are $45 and $47, respectively, with a upside of 55-to-62%. The following charts illustrate the sell-side ratings and price targets for Uber.

What to do with the stock:

We are impressed by Uber’s continued recovery in Mobility and its booming Delivery business. We believe Uber is well-positioned to achieve its 2024 targets and become profitable towards 1H23. We believe 2Q22’s positive EBITDA and Cash Flow are signs that, despite Uber’s history, the company is moving forward. We believe Uber provides an attractive entry point at current levels and recommend investors buy the stock.

Be the first to comment