MOZCO Mateusz Szymanski

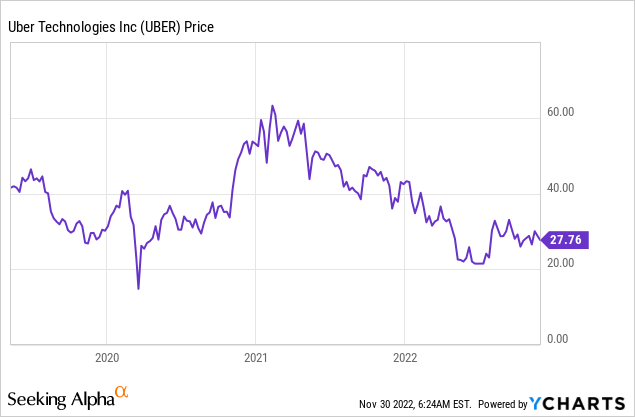

Uber (NYSE:UBER) is the world’s largest taxi company but it doesn’t own any vehicles itself. The company has ~72% market share in the U.S. ride-hailing market and is the industry leader. In addition, the company has two more growth engines, Food Delivery and Freight which have grown substantially over the past few years. In the third quarter of 2022, the company reported solid growth as it beat revenue estimates. Thus in this post, I’m going to break down the company’s financials and valuation. Let’s dive in.

Strong Third Quarter Financials

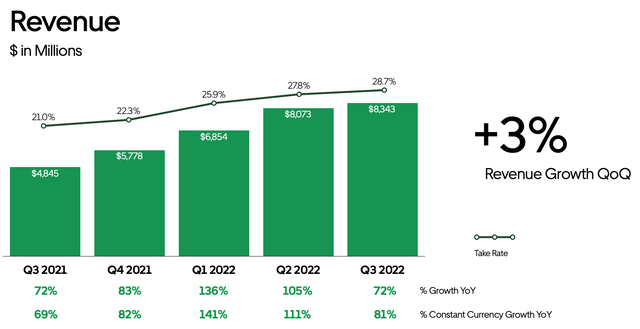

Uber reported strong financial results for the third quarter of 2022. Revenue was $8.34 billion which increased by a rapid 72% year over year and beat analyst expectations by $221 million. A strong dollar did impact foreign exchange rates slightly as on a constant currency basis, the company reported 81% year-over-year growth.

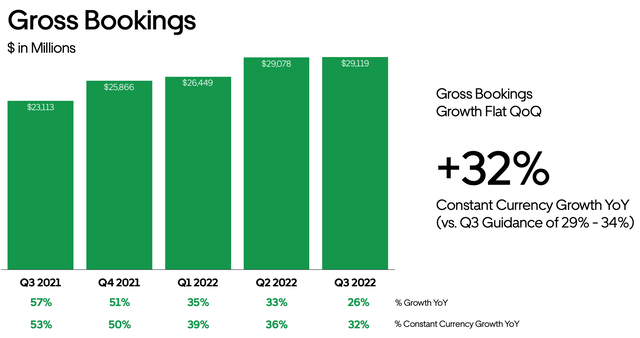

Total Gross Bookings to increase by 32% year over year to $29.199 billion on a constant currency basis.

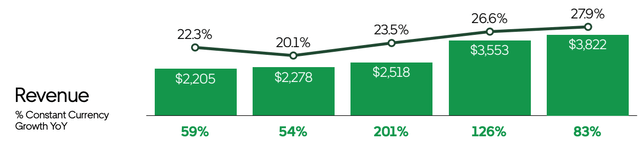

This fantastic result was driven by strong growth in the Mobility segment as travel boomed and consumers were active. The Mobility business increased its revenue by a blistering 83% year over year to $3.8 billion. This segment now makes up 46% of total revenue.

Mobility Revenue (Q3,22 report)

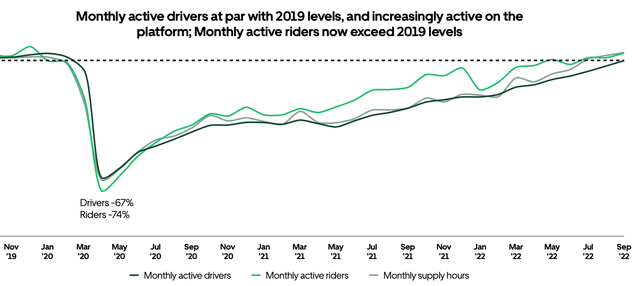

It was great to see that the number of active Uber drivers and riders has recovered since the lockdown of 2020, to slightly greater than 2019 levels. This demonstrated a return of strength for the business.

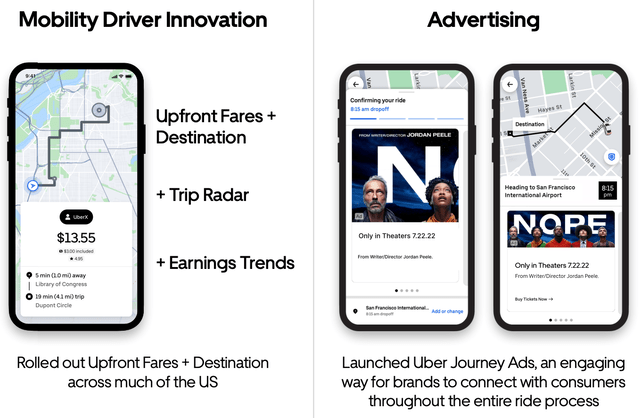

The company also reported an increase in the number of trips per monthly active customer, from 5 in early 2022 to 5.3 by Q3. Management believes this has been driven by a few factors which include the membership program Uber One which now has over 10 million members and has recently launched in new markets. This is a brilliant membership program as it offers customers both delivery and mobility benefits, thus you can think of it as an ecosystem-based savings model similar to Amazon Prime. This will also help to drive customer loyalty and further cement Uber as the market leader. Uber also launched new features such as earnings trends and upfront fares. in addition to advertising on the platform which should help to drive increased revenue.

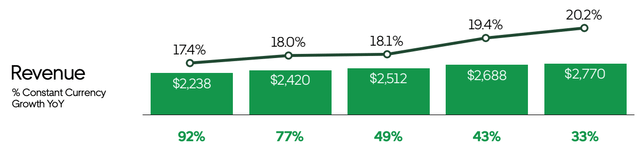

In previous posts on Uber, I stated that the pandemic was a blessing in disguise for the business despite the shutdown in travel. Prior 2020, the company derived the majority of its revenue purely from ridesharing, but during the lockdown, food delivery became immensely popular and Uber Eats exploded in terms of growth. This has meant Uber now has at least two growth engines moving forward and it offers an immense number of cross-selling opportunities. Uber also has a competitive advantage over rivals as its drivers can effectively act as dual business workers, providing services for delivery and ridesharing. This is a strong value proposition for drivers who can maximize income in a more efficient manner. The dual business units can also be used to actively cross-sell food delivery customers to grocery shopping, alcohol, and of course mobility.

Due to the economic reopening and as consumers cut costs, growth has started to slow in the Food Delivery segment. This segment reported a 92% growth rate in Q3 21 but in Q3 22 this growth rate had dropped to 33% year over year (constant currency basis). Despite this, the business still generated $2.77 billion in revenue which makes up 34% of the total.

Delivery Revenue (Q3,22 report)

Uber has also announced multi-partnerships in the self-driving vehicle space. For example, the company has partnered with Softbank-backed robot Nuro company. These small street-legal robots can be used for autonomous food delivery in Houston and Mountain View, California. In addition, the company announced a 10-year partnership with robotaxi provider Motional. This builds on top of Uber’s other partnerships with Aurora, Serve, and Google’s (GOOG) (GOOGL) Waymo in Freight.

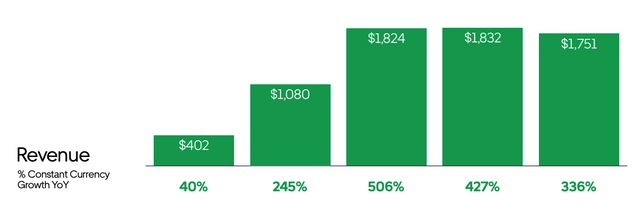

Uber’s freight division has also been growing rapidly as it increased revenue by an outstanding 336% year over year to $1.75 billion. This segment now makes up a substantial 20% of Uber’s revenue and is the third growth engine for the company.

Profitability and Expenses

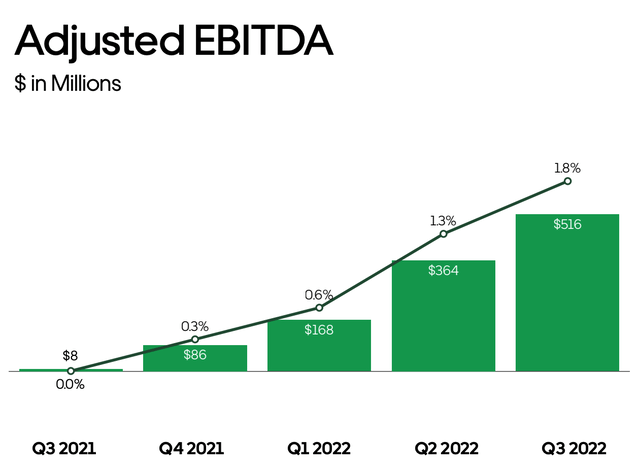

Profitability has always been an issue for Uber as the company has run a low-margin business and paid a lot out in driver incentives.

In Q3 22, Earnings Per Share were minus $0.61 which was an improvement over the minus $1.28 in the prior year. However, this metric still missed analyst expectations by minus $0.43 cents. If we “pop the hood” on the expenses then we can see the root of the high costs. The company reported $8.8 billion in total costs and expenses in Q3 22, which was up substantially from the $5.4 billion in the prior year. This has scaled roughly proportionally with revenue growth with slight improvements. The 54% increase in Research and development expenses is not really an issue as I believe the company must continually innovate to stay ahead. However, I would like to see General and Administrative expenses decline over time as the company scales.

A positive is the company is profitable on an Adjusted EBITDA basis with a 1.8% margin on Gross Bookings. This metric has increased by $508 million year over year to +$516 million which is positive.

Adjusted EBITDA (Q3,22 report)

The company also reported solid free cash flow of $358 million, which has increased substantially from the $24.5 million in the prior year.

Uber has a robust balance sheet with $4.866 billion in cash and short-term investments. The business does have fairly high debt of $11.3 billion but just $182 million of this is short-term debt.

Advanced Valuation

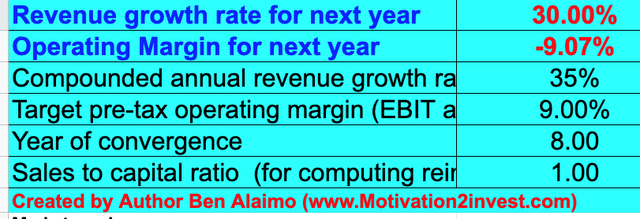

In order to value Uber I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted an extremely conservative 30% revenue growth for next year which is much lower than the 72% revenue growth reported in the prior year. I am being so conservative due to the macroeconomic environment although management seems unfazed by it so far. In years 2 to 5, I am forecasting the growth rate to increase to 35% per year.

Uber stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation I have capitalized R&D expenses, which has lifted net income. In addition, I am forecasting a 9% pre-operating margin in 8 years as the company should improve its operating leverage with scale.

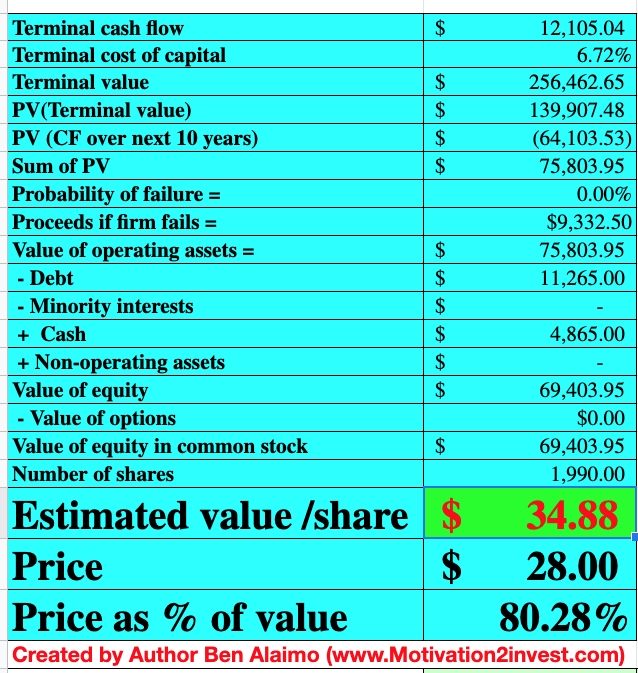

Uber stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $35 per share, the stock is trading at $28 per share at the time of writing and thus is ~20% undervalued.

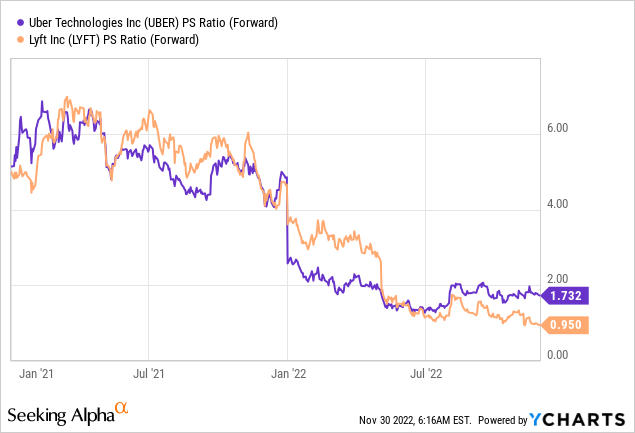

As an extra data point, Uber trades at a Price to Sales ratio = 1.87 which is 57% cheaper than its 5-year average. The company does trade at a higher valuation than Lyft (LYFT) which trades at a P/S ratio = 0.95, but Uber is the market leader with a much more diverse business.

Risks

Recession/Slowing Demand

The high inflation and rising interest rate environment has caused many analysts to forecast a recession. As the consumer sees their living costs get squeezed, they may cut back on unnecessary food delivery purchases and even ride-hailing. This could be a risk for the company and as Uber is a low-margin business, the high inflation environment doesn’t help with margins.

Final Thoughts

Uber is a tremendous company that has transformed its business model over the past few years. The company is now stronger than ever and continues to produce solid financial growth. The stock is undervalued intrinsically and relative to historic multiples and thus could be a great long-term investment.

Be the first to comment