spooh

Investment Rationale

The shares of TC Energy Corporation (NYSE:TRP) have delivered handsome returns to its investors in the past along with a strong dividend growth. Even though the shares of TC Energy Corporation appear to be overvalued compared to its peers, the company can be considered a good investment candidate for the long-term if it is able to turn the charted robust plans for expansion and capturing of various opportunities into a reality.

About the Company

For more than 70 years, TC Energy Corporation has operated pipelines, storage facilities, and power-generation plants in Canada, the U.S., and Mexico. The company’s core operations are – Energy Solutions, Natural Gas, Oil & Liquids, Power & Storage.

The results are reported in five operating segments: Canadian Natural Gas Pipelines, U.S. Natural Gas Pipelines, Mexico Natural Gas Pipelines, Liquids Pipelines, and Power and Storage.

Strong Financial Performance

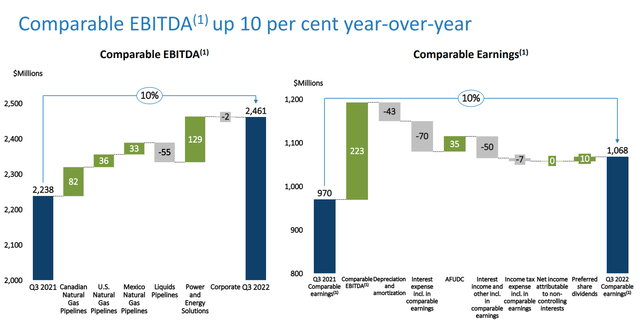

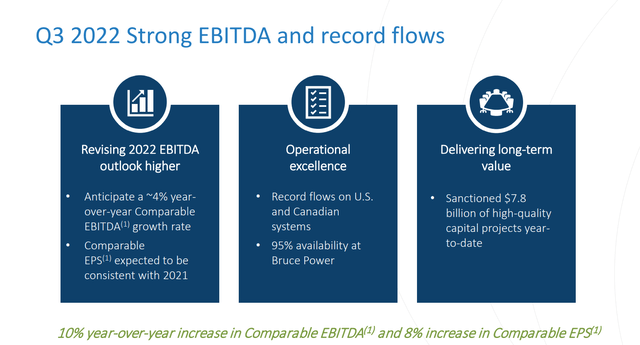

TC Energy’s third quarter results were strongly supported by improved utilization and availability across assets during peak demand. In Q3 FY22, the company generated net income of $841 million, improving from $779 million reported in the previous year, a growth of around 7%. But the comparable earnings jumped 10%, from $970 million to $1,068 million, driven by higher comparable EBITDA. Comparable EBITDA stood at $2,461 million in Q3 2022, gaining from $2,238 million in Q3 of fiscal 2021, with Power and Energy Solutions segment recording the highest EBITDA. As shown in the below graph, the comparable EBITDA and comparable earnings grew decently on a YoY basis.

Demand for the company’s services across its North American portfolio remained higher and the company continued to see strong utilization, availability, and overall asset performance. As a result, the company increased its 2022 comparable EBITDA outlook, which is approximately 4% higher than 2021.

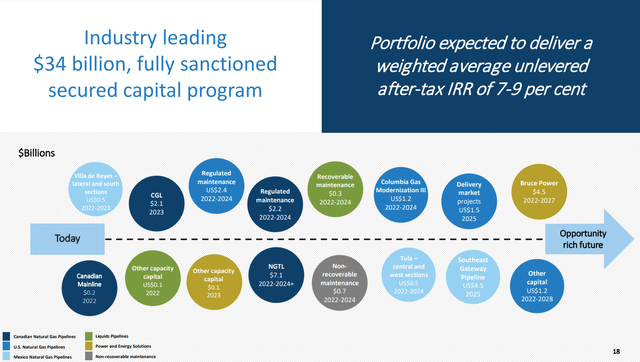

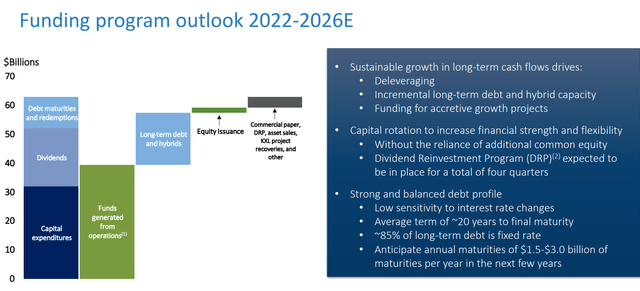

TC Energy’s sanctioned and secured capital program is now at $34 billion, as it has added $7.8 billion of growth opportunities this year alone. These fully sanctioned secured capital projects are aiding sustainable comparable EBITDA growth and an expected annual dividend growth rate of 3% to 5% through 2026.

The following extract throws some more light on the sanctioned and secured capital program.

Factors That May Drive TC Energy’s Growth

- The company is significantly protected from the rising interest rates as it actively manages its long-term debt exposure to fixed and floating rates. A high percentage of its long-term debt is fixed rate, which helps in providing protection against rising interest rates.

- In the past, the company has been successful in efficient capital rotation. This led to a reduction in its Debt-to-EBITDA ratio following the Columbia Pipeline acquisition in 2016. Capital rotation will be used to fund additional high quality projects which the company intends to take and augurs well for company’s deleveraging target.

- Divestiture helps company to eliminate redundancies, improve operational efficiency, and reduce costs. TC Energy is planning to announce and close more than $5 billion of asset divestitures within 2023. The company will continue the divestiture program if it sees an opportunity in the near term. This will help the company in alleviating any potential increase in the leverage.

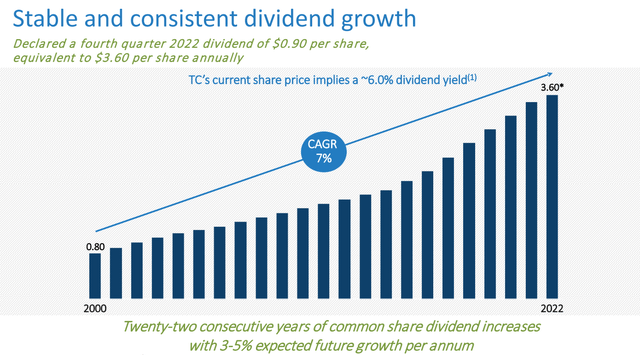

- Owing to sustainable growth in earnings and cash flows along with healthy coverage ratios, the company expects a dividend growth between 3% to 5% through 2026. In adherence to the targeted payout ratio, the company’s dividend has reached an attractive 6% yield. A strong execution is likely to help the company in delivering superior long-term shareholder value.

- TC Energy Corporation aims to invest in low-carbon infrastructure but it does not have enough skills and the capabilities to manage the risks in that particular asset class. The partnerships in the future will be structured more towards managing the risks in a more effective manner.

- The company has a dividend reinvestment policy which has a decent participation rate of 38%. Under this policy, eligible holders of common and preferred shares of TC Energy can reinvest their dividends and make optional cash payments to obtain additional TC Energy common shares. The 38% participation rate added $342 million in the third quarter of 2022 through reinvestment in the common equity.

Valuation

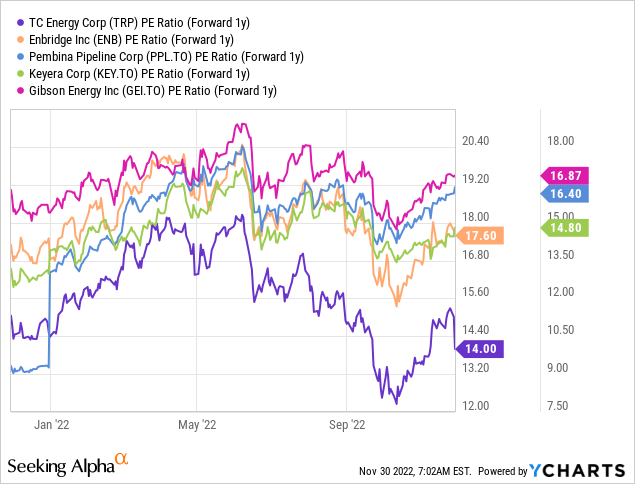

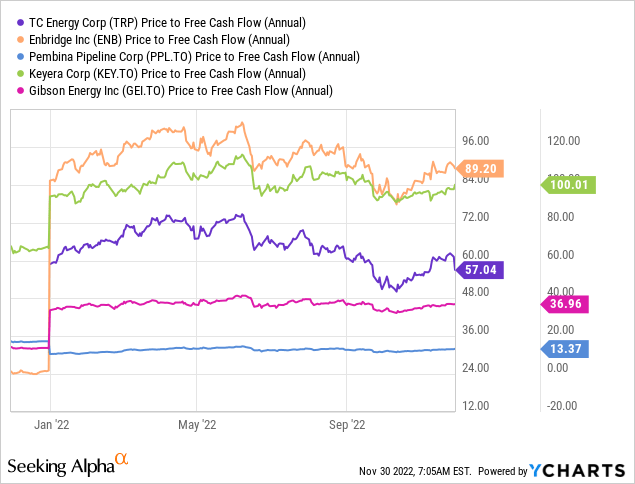

On the valuation front, on the basis of forward P/E ratio and P/FCF ratio, the shares of TC Energy appear to be reasonably valued compared to its peer companies. The following graph compares the forward P/E and P/FCF ratios with TC Energy Corporation’s peer companies.

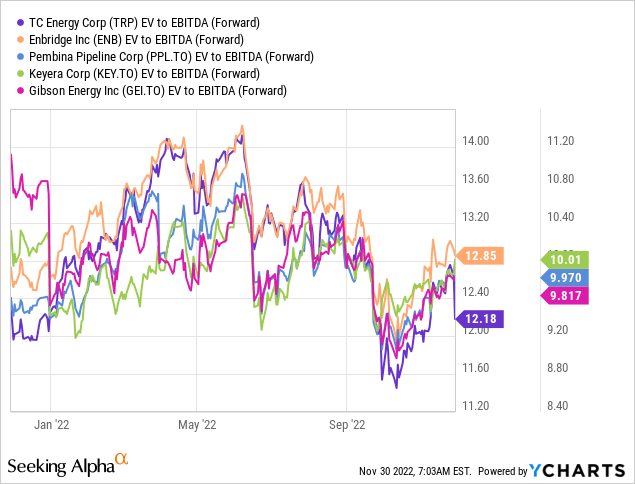

Based on the forward EV/EBITDA multiple, the company appears to be slightly overvalued as compared to its peers Keyera Corporation (OTCPK:KEYUF) (KEY:CA), Pembina Pipeline Corporation (PBA), (PPL:CA), and Gibson Energy (OTCPK:GBNXF) (GEI:CA), which have forward EV/EBITDA ratios around 300 basis points lower than TC Energy Corporation. The following graph gives an overview of the forward EV/EBITDA numbers.

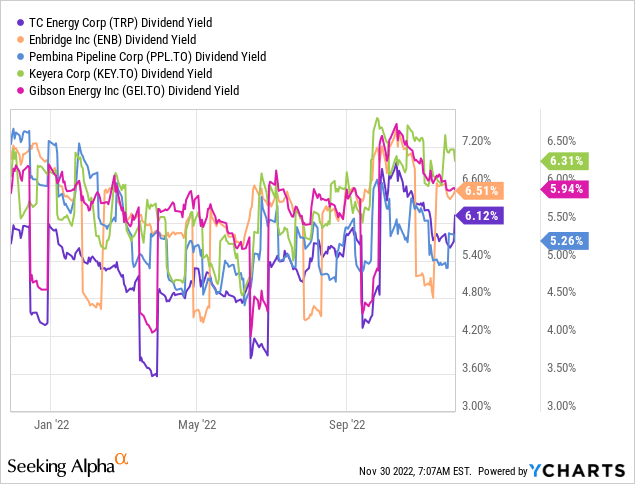

On the other hand, TC Energy has been offering a decent dividend yield close to two of its top peer companies Enbridge (ENB) and Keyera Corporation, and higher than Pembina Pipeline and Gibson Energy.

The following graph compares the dividend yield offered by TC Energy Corporation and its peers.

TC Energy’s solid dividend track record, huge asset base, upcoming growth projects, and focus on conservative leverage justifies its premium valuation.

Seeking Alpha’s proprietary quant ratings rate TC Energy stock as “hold.” It is rated high on profitability and revisions factors, but low on valuation, growth, and momentum factors.

Risks

Some risks for a midstream company operating in oil and gas segment is that although the composite pipelines in the energy industry’s infrastructure offer many advantages, these pipelines are certainly not risk averse and face the risk of aging.

Instrumentation and control systems have aided in transmitting data, but the ability to convert huge data into useful information still lags. The operating budgets for midstream company are predicted to be flat in coming period which may restrict new technology investments and system enhancements.

Government regulations and permitting process may pose challenges in developing new projects and result in cost overruns, delays, or project cancellations.

Conclusion

Going forward, TC Energy Corporation aims to expand and modernize its existing natural gas pipeline network while providing customer-driven low-carbon energy solutions. The shares of TC Energy Corporation have climbed decently since the declaration of its robust results for the third quarter of 2022.

The company earns a brownie point compared to its peers, as its secured capital program, which is now $34 billion, is expected to bode well for further dividend increases. Besides, the planned sale of $3.7 billion assets for repayment of debt and funding of new projects gives the shares of TC Energy Corporation a better upside potential over the medium to long term. Hence, the shares of TC Energy Corporation qualify to be a good candidate for investment purposes.

Be the first to comment