Jorge Aguado Martin/iStock via Getty Images

Block, Inc. (NYSE:SQ) is becoming a household name for its growth in the fintech industry. Square is one of the company’s most recognizable products due to its popularity among small businesses; however, this could be an issue if a possible recession causes mass closures. Furthermore, Afterpay could begin to see issues due to large competitors joining the industry and taking market share. Block’s biggest revenue driver, Cash App, outperforms Venmo’s financials despite having a lower user count and total payment volume. However, the selloff of cryptocurrencies has been hurting its fundamentals and will likely continue to do so. Even though the stock appears to have major long-term upside, it may be best to wait for it to get even cheaper from these temporary headwinds.

A Possible Recession Could Cause Small Businesses to Close

One of Block’s most popular products is the Square POS and generates revenue through transaction-based fees and the sale of its hardware. A large portion of its users are small businesses, and this could be a problem for the company in the future.

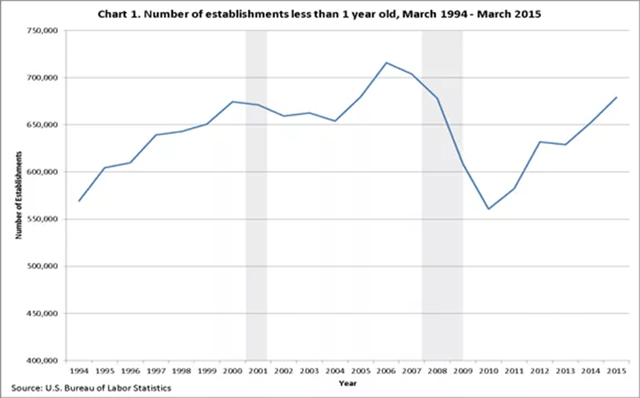

With inflation on the rise, interest rates seeing hikes, and the purchasing of big-ticket items slowing, many analysts and investors are projecting a recession is likely coming soon. This could be big trouble for Block as small businesses tend to see mass closures during economic downturns, directly leading to lower transaction-based revenue for the company. During the Great Recession, over 1.8 million small businesses permanently closed. If a similar occurrence happens again in the next recession, Block could see much less revenue from transactions and hardware sales.

Small Business Closures (Investopedia)

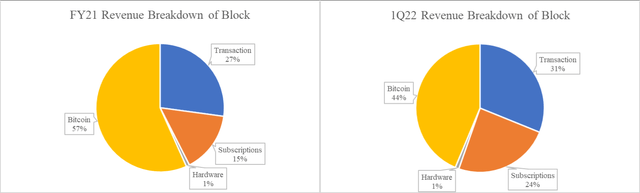

The lower payment volume is devastating to Block because it accounts for a large portion of the company’s revenue. In FY21, transactions generated about $4.8 billion in revenue. This equates to roughly 27% of total revenue. This percentage increased in the first quarter of 2022 due to decreasing demand for Bitcoin (BTC-USD), which we will cover later. In 1Q22, transaction-based revenue accounted for 31% of total revenue.

Revenue Breakdown, FY21 vs. 1Q22 (Created by Author)

A way this effect can be offset is through Block’s new partnership with Apple (AAPL) to provide Tap to Pay on iPhone. This will allow the company to see higher transaction volumes because its hardware is no longer needed. Through this partnership, consumers can make payments using only an iPhone and the Square app. Although this will likely harm the company’s hardware revenue, it is not a major problem as it only accounts for roughly 1% of revenue. On the other hand, it will increase access to the Square POS system and greatly improve the total transaction volume. In turn, this will likely lead to higher transaction-based revenue and help offset possible small business closures.

Massive Players Now Competing With Afterpay Could Cause Trouble

In January of this year, Block acquired Buy Now, Pay Later company Afterpay for $29 billion. Afterpay is one of the leading Buy Now, Pay Later (BNPL) companies in the market with a 22% market share, only being behind industry-leader Klarna (KLAR).

Afterpay is one of the largest-reaching BNPL apps available and is partnered with over 100,000 merchants and is integrated into many of Block’s other services like Square and Cash App. These integrations will help the company achieve higher revenue over time and increase the use of Afterpay, Square, and Cash App.

However, the BNPL industry is an incredibly competitive one. Afterpay is now seeing even bigger players than Klarna it will have to compete with. The first is PayPal (PYPL) which launched PayPal Pay in 4. This service is gaining ground on competitors and is seeing more use among consumers. During last year’s Black Friday, PayPal’s BNPL service saw a 400% Y/Y rise in volumes. Furthermore, the company expanded internationally by acquiring Paidy, the leading BNPL service in Japan. The company also launched PayPal Pay Monthly in June. This expands upon normal BNPL services by offering plans with higher purchase amounts and longer periods. Now, PayPal Pay Monthly users can now make purchases between $199 and $10,000 and pay over 6-24 months. This could help PayPal become an even larger name in the BNPL industry and possibly harm Afterpay’s performance.

Although PayPal is a big competitor of Afterpay, the newest threat is coming from Apple. Apple recently announced its upcoming launch of Apple Pay Later and this could be a major problem for Afterpay. Apple Pay Later is yet another strong player in the BNPL industry and can be used everywhere Apple Pay is currently accepted. This gives it the largest reach of any BNPL service as Apple Pay is accepted at over 90% of U.S. retailers. The number of locations that accept a BNPL service, along with the network effect, are the major ways one grows. Apple Pay Later could become a clear winner in both of these aspects and cause Afterpay to face serious issues.

Rising Rates Could Cause Harm to the BNPL Industry

As mentioned previously, a recession is likely on its way and a partial reason is rising interest rates. This is causing many BNPL companies to get ready for a bleak future, including Klarna who already cut 10% of its workforce. The reason why rising rates are an issue for BNPL companies is because it increases their borrowing costs. Many players in the industry open credit lines to support the financials of the company and help lend out money. Since the Fed plans to raise rates throughout the upcoming future, BNPL companies will begin to see much higher costs, including Afterpay.

Furthermore, multiple BNPL companies are experiencing much higher delinquency and loss rates than in prior periods. Afterpay is experiencing these issues first-hand. Its losses from total payment dollars have risen from 0.9% to 1.17% since last year. Its competitors are also facing issues as well. In March, 3.7% of Affirm’s (AFRM) outstanding loan dollars were at least 30 days late, and this is up from 1.4% compared to last year. This is likely just the beginning of issues for many BNPL companies as money becomes an even tighter issue for consumers.

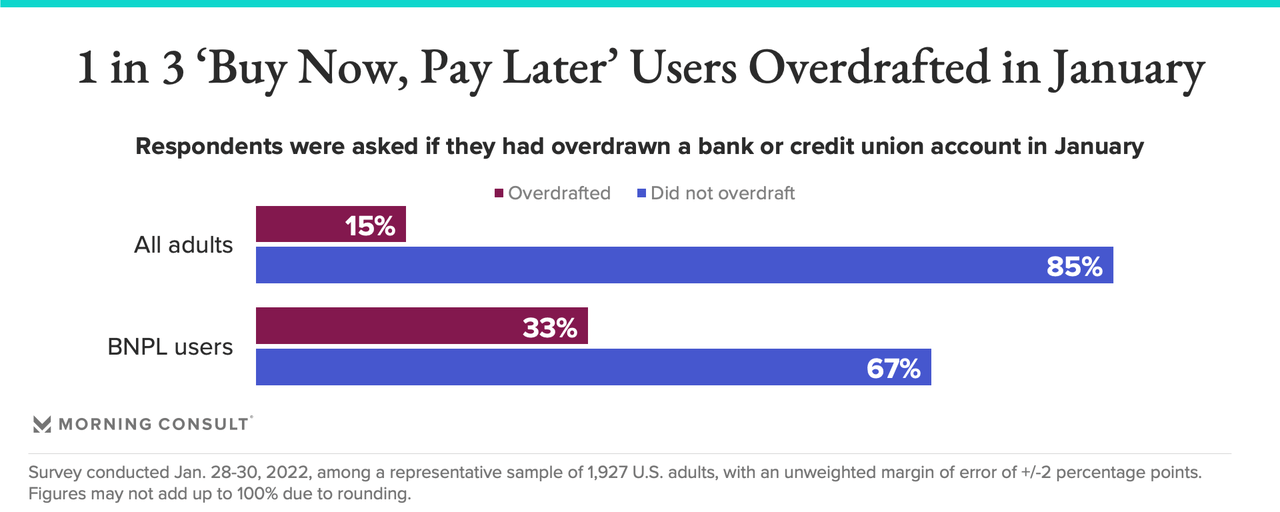

Another developing issue with many BNPL companies is the credit standing of a large portion of users. About 43% of shoppers who applied for payment plans or loans at checkout have subprime credit scores but only comprise 15% of all U.S. adults. Users of Afterpay and its competitors are also much more likely to overdraft than most consumers, such as in January when 33% of BNPL users overdrafted. These issues will likely continue to develop as interest rates continue to rise and an economic downturn further ensues.

BNPL Overdraft Data (Morning Consult)

Despite Having Less Users and Volume, Cash App Outperforms Venmo

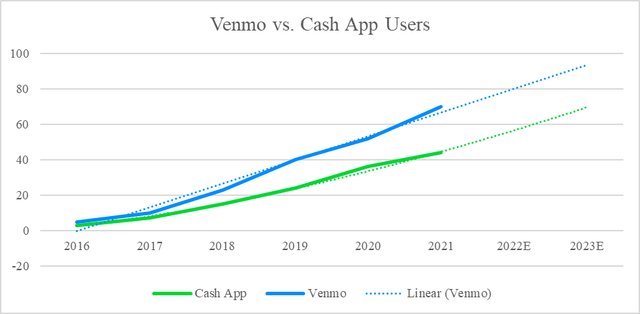

The rising popularity and use of Venmo may also be an issue for Block. Venmo surpassed Cash App in total payment volume in 2019 and is continuing to take off ahead of it. In 2021, Venmo’s payment volume was $229 billion while Cash App’s was $167 billion. Over the past 5 years, Venmo’s CAGR for its annual payment volume was 63% while Cash App’s was far lower at 38%.

Along with its payment volume being higher, Venmo’s user count is also higher than Cash App’s. As of 2021, Venmo had roughly 70 million users while Cash App had 44 million. Both apps have also grown at roughly the same rate over the past 5 years with each one’s user count growing at a CAGR of roughly 70%.

User Count of Venmo vs. Cash App (Business of Apps – Chart by Author)

Despite Venmo having many more users than Cash App, Cash App is more effectively monetized and generates higher revenue. In 2021, Venmo generated about $850 million while Cash App generated $2.07 billion in revenue excluding Bitcoin. This is because Cash App has a higher fee for business transactions at 2.5% compared to Venmo’s at 1.9% + $0.10. Furthermore, Cash App allows users to buy and sell stocks while Venmo does not. Although Cash App does not charge fees for this service, it generates revenue through payments for order flow just like Robinhood (HOOD) and other brokers. These strategies, as well as others, are key factors as to why Cash App generates more revenue than Venmo despite having a lower user count and TPV. It is important to note that Venmo already launched cryptocurrency transactions and could possibly launch a brokerage in the future. If this happens, its larger user count could cause it to seriously rival Cash App.

Bitcoin’s Crash is Creating Major Problems

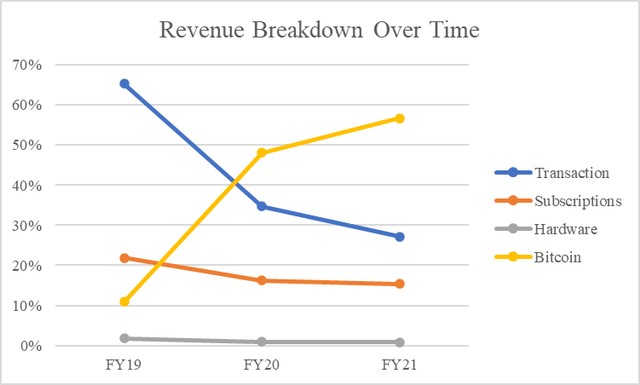

The final and most concerning issue for the future of Block is the fluctuations of Bitcoin. The company’s Bitcoin revenue has grown tremendously over the past 3 years and has been the largest revenue segment since 2020. With less people buying Bitcoin, Block generates less revenue through transaction fees. This is already having a heavy impact on the company’s fundamentals.

Block’s Revenue Breakdown Over Time (Created by Author)

Block generates revenue from Bitcoin by charging a small fee for each transaction of the cryptocurrency. This was extremely beneficial for the company as Bitcoin became wildly popular over the past few years. This caused more people to want to join the action and start buying the cryptocurrency through Cash App, which generated lots of fees for the company. From the beginning of 2020 to late 2021, the price of Bitcoin rose from about $8,000 to over $65,000. This caused the coin to become incredibly popular among consumers and led to even more transactions through Cash App.

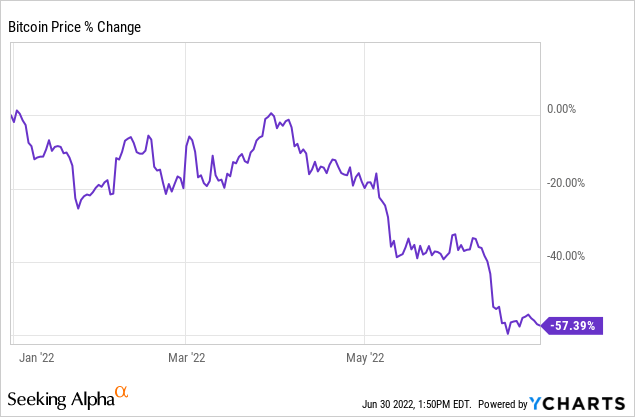

However, 2022 has been a tough year for cryptocurrency, and this is having a direct impact on Cash App. Bitcoin is down roughly 60% YTD and leading to many investors no longer wanting to buy the cryptocurrency.

Without people buying Bitcoin, Block cannot generate revenue through transaction fees. This is already having a heavy impact on the company’s fundamentals. In the company’s first quarter report, Bitcoin revenue dropped by about 51% when compared to 1Q21. This has caused the segment’s total weight to drop from 57% in FY21 to 44% in 1Q22.

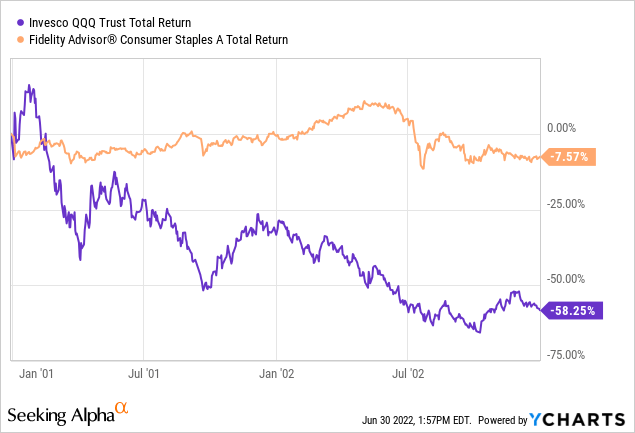

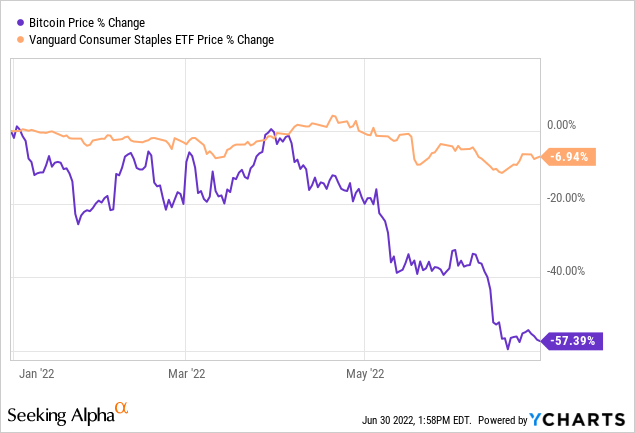

Even though Bitcoin has lost lots of its value already, it will likely continue to fall. As mentioned before, a recession is likely coming soon. This is causing many investors to move their cash out of speculative assets like Bitcoin and into safer companies that will easily survive (or even thrive) during a downturn. For example, the crash of speculative tech companies from the dot com bubble caused the Nasdaq to fall nearly 60% in 2002. Conversely, consumer staples only fell by just over 7%.

This can already be seen happening again currently. While Bitcoin is down nearly 60% YTD, the Vanguard Consumer Staples ETF (VDC) is only down about 7%. This trend will likely continue as consumers brace themselves for the worst, as 16% of consumers expect to lose their jobs in the next 12 months. As long as Bitcoin declines, the demand for it will decline too. This will directly harm Block’s largest revenue segment and make it difficult for the company to continue to achieve its rapid growth.

Valuation

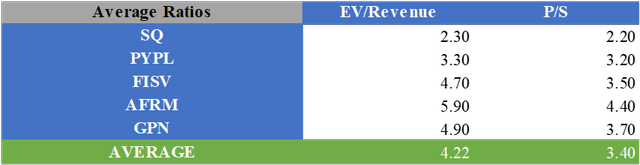

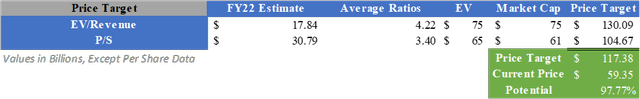

To value Block’s stock, I created a relative valuation by comparing the company to its competitors. By multiplying consensus analyst estimates for FY22 by the average valuation multiples for EV/Revenue and P/S of Block and its competitors, a fair value of $117.38 can be calculated after adjusting for net debt. This calculates to an implied upside of 97.77%. The average analyst price target for the stock is even higher at $143.25, representing an upside of 141.36%.

Average Valuation Multiples of SQ & Competitors (Created by Author) Relative Valuation for SQ Stock (Created by Author)

What Does This Mean for Investors?

Block is a rapidly growing fintech company that will likely thrive in the long run. However, the company is facing multiple short-term headwinds that will likely affect its fundamentals drastically. A possible recession could cause small businesses to close, leading to lower transaction-based revenue and hardware sales. Furthermore, the BNPL industry is seeing huge competitors start to join the market. The entry of Apple Pay Later could be a massive threat to Afterpay as it has the largest network and brand recognition of any player in the industry. Cash App is the company’s most important product and outperforms Venmo’s financials despite having a lower user count and TPV. However, Cash App’s Bitcoin transactions account for the largest portion of Block’s revenue. With Bitcoin being down nearly 60% YTD and likely continuing to fall, less consumers will be buying Bitcoin and this directly harms the company’s topline. Although the stock most likely has major upside, it will likely drop further due to these temporary headwinds. Therefore, I will apply a Hold rating to SQ stock and wait for an even cheaper price.

Be the first to comment