(Note: This article appeared in the newsletter on May 4, 2022, and has been updated with current information as needed)

bjdlzx/E+ via Getty Images

Laredo Petroleum (NYSE:LPI) just reported more than $5 per share in adjusted earnings. That report may not satisfy Mr. Market because he has been steadily increasing earnings for oil and gas companies as commodity prices have risen. But the increasing percentage of oil production has made a huge improvement on margins that should last throughout the cycle. Generally, oil is much more profitable than just about anything else produced from a well. Therefore, margin improvement is likely to permanently follow an increasing percentage of oil produced. It is going to take a little time for the market to get used to the new production mix. But when it does, shareholders should see a valuation difference compared to the current price.

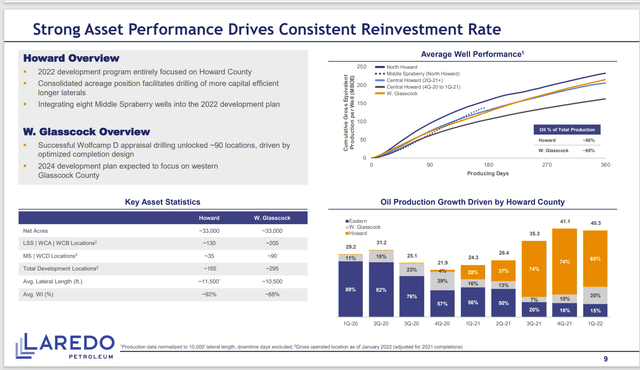

Laredo Petroleum Increasing Oil Percentage Production From Acquired Acreage. (Laredo Petroleum June 2022, Investor Presentation)

The increasing percentage of oil production is coming from wells drilled in Howard County and Western Glasscock County that are mostly producing oil. It takes time for wells drilled to have a meaningful contribution to production as large as is the case for Laredo. But the considerably larger percentage of oil production will definitely help the company oil production percentage for some time to come.

The market has fears about “only” 8 years of places to drill wells at current activity levels. But much of Texas, including this acreage, has stacks of intervals that can be explored for further production.

Lost in the “only 8 years” is the overall concept that Texas should have run out of oil ages ago. But industry technology keeps improving to bring on intervals and other potential plays that just were not profitable when I was growing up. There is always a risk that technology could stop improving tomorrow which would result in finite reserves. But industry reserve reports and drilling locations rarely decline over time. So, it is just not reasonable to assume that technology will not continue to improve so that we as shareholders continue to see improving reserve reports throughout the industry over time.

The other consideration is that management has been making opportunistic acquisitions. Those acquisitions are very likely to continue. Management has gone to some lengths to expand the amount of liquidity available. The first quarter report did mention the redetermination and a larger borrowing base. Therefore, the lending potential is in place should another bargain present itself. It is still considered a buyers’ market even if the deals are not as good as they were a year or two ago. Right now, that makes the management strategy look pretty good.

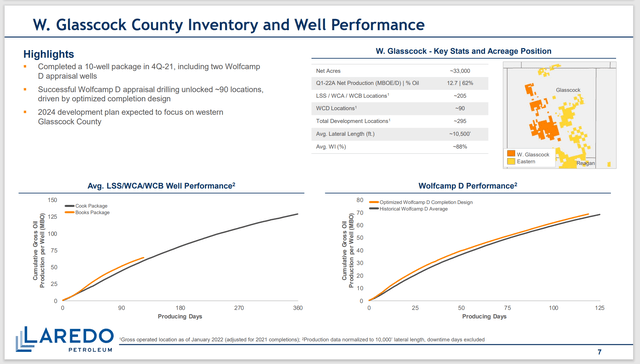

Laredo Petroleum Presentation Of Western Glasscock County Wells (Laredo Petroleum First Quarter 2021, Conference Call Slides)

Part of the continuing improvement has to be the Wolfcamp wells shown above. Those wells open up yet another interval for production and that production appears to have a much better oil percentage of production sooner.

Like the Howard County wells, these wells produce more oil than the legacy acreage. Therefore, management is drilling some wells on this acreage to review profitability. Clearly, this acquired acreage has superior profitability when compared to the legacy acreage.

At some point, the technology improvement may enable the legacy acreage to compete for capital. Right now, that is clearly not the case. The breakeven point on the newly acquired acreage appears to be far lower. For the time being, the capital budget will be spent on the more profitable acreage.

Clearly, the market fears are not warranted. No reasonable management will “stand still” and allow the market fears to happen. This management moved fast to acquire some darn good acreage at decent prices before commodity prices were anything close to current prices. That improved both cash flow and financial ratings. There is no reason to assume that management will not continue to make opportunistic acquisitions in the future when the price is right. The current 8-year inventory is more than sufficient time for management to find more bargains.

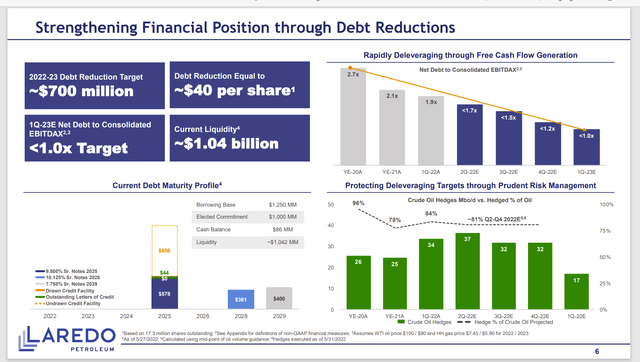

Laredo Petroleum Free Cash Flow Guidance And Debt Reduction Targets (Laredo Petroleum June 2022, Investor Presentation)

This management has already reduced the financial leverage materially. Now the first quarter was a relatively busy quarter. But the level of capital expenditures is not likely to be repeated. Therefore, the free cash flow guidance is reasonable because capital expenditures will be declining.

Since I wrote the original article, second quarter selling prices have been much better than anticipated. This has allowed an acceleration of the debt payment goal as shown above. Should the current price environment continue, then investors can expect more upward debt repayment goal revisions in the current fiscal year.

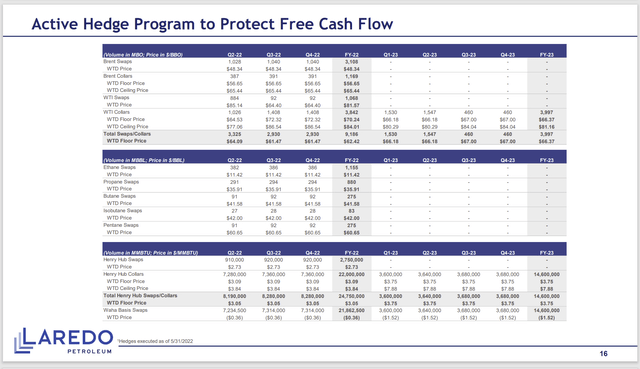

The volumes hedged above are conservative figures designed to protect the cash flow so that minimum goals can be met. Management did mention that the hedging program will take on more risk as the company’s financial strength increases.

Laredo Petroleum Hedging Program (Laredo Petroleum June 2022, Corporate Presentation)

This management has a goal of protecting cash flow. Clearly, this management intends to hedge a year in advance (which is also clearly happening). The market should value the stock by not including the hedges because hedging is seen by the market as a non-recurring event and so a zero-sum game.

All one has to do is look at the past where hedged companies in fiscal year 2020 really fared no better in terms of stock price action than did the hedged companies. Some investors look at the forward curve and really wonder why anyone hedges at prices shown above when the market is so much better. The answer lies in the low visibility of this industry.

Since 2015, we have had the big oil price drop in 2015, another drop in 2019, the OPEC pricing war, and the coronavirus demand destruction. None of that was really forecast in advance by large numbers of people or Mr. Market in general. Yet when the pricing weakness happened, a consistent hedging program was essential to prevent a corporate bloodbath. No one was complaining (for example) when companies shut-in production and lived off the cash flow from the hedges during the coronavirus demand destruction. Hedges are there to reduce earnings volatility and help justify capital investment.

Laredo Petroleum is likely to continue making improvements as opportunities present themselves in the future. The higher oil percentage will benefit profits in the future even with the hedging program in place. Investors can expect management to continue with the conservative financial planning. But that same management has promised a riskier hedging program as the company financial strength can handle the risk.

This management has done more for the company in the few years it has been around than the previous management did in far more years. The improvement in the oil percentage produced came from the advantageous purchase of acreage at a very favorable time when commodity prices were much weaker. Furthermore, management took several suboptimal acreage positions and pieced them together into far more valuable acreage holdings.

All of this shows that this management is definitely above average. Investors should expect the financial performance to improve and the financial strength rating of the debt to continue to rise. That will likely result in a better stock price in the future. The stock price is already far better since this management took over.

Be the first to comment