Dan Kitwood

Introduction

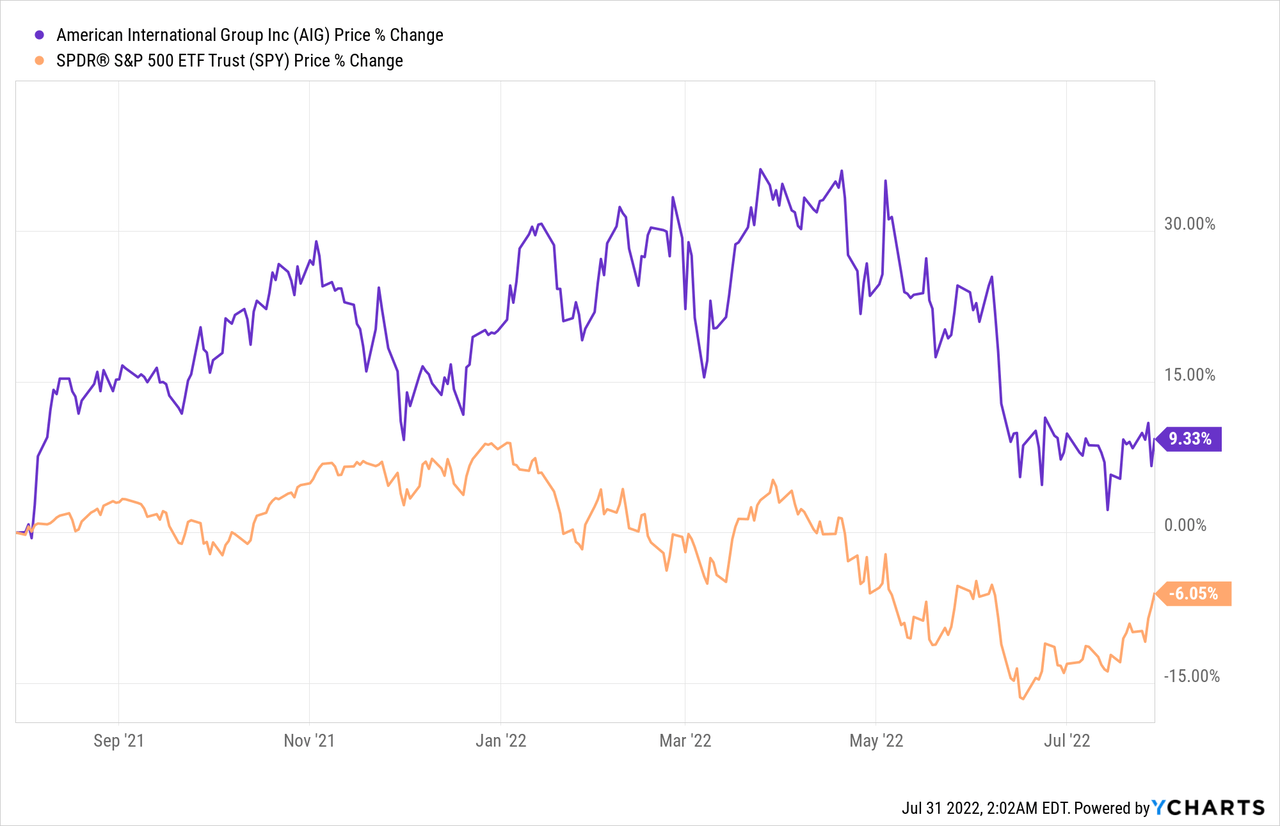

In the past year, American International Group, Inc. (NYSE:AIG) stock has appreciated 9.33% while the broader market has declined by 6.05%.

AIG has suffered significant losses since the 2008 stock market crash but has been growing back its market position and steadily increasing shareholder value. I see many bullish signs in favor of this company: healthy financials, shareholder-friendly decisions, and more. In addition, second quarter financial results are set to release after the market closes on August 8, and I see a compelling “buy before earnings” opportunity. Let’s dive into the primary drivers for my assumptions on this bullish outlook.

Company Activity

After yet another impressive quarterly performance, one of management’s primary financial priorities is to redistribute their funds for shareholder value. We can get a good glimpse at this from AIG’s Chairman & Chief Executive Officer, Peter Zaffino, on the Q1 2022 filing page:

Given our strong balance sheet and liquidity, the AIG Board of Directors increased the share repurchase authorization to $6.5 billion of AIG Common Stock, inclusive of any remaining amounts under the prior authorization. In the first quarter, we returned $1.7 billion to shareholders through $1.4 billion of AIG common stock repurchases and $265 million of dividends, and we ended the quarter with $9.1 billion of parent liquidity.

Given that AIG has a solid track record of share buyback history, it is my view that leadership is ramping up share buybacks because of 2 reasons: the current stability of the company, and management’s confidence in better business prospects to further grow profits over time. This also would further drive the overall demand for this stock down the line. It is also worth noting in Q1 2022 filings that AIG announced an “asset management relationship with BlackRock to manage up to $150 billion of liquid assets for AIG and Corebridge.” Establishing relationships with top companies such as Blackrock (BLK) shows AIG’s commitment to effectively carrying out financial goals and ensuring that all means are met.

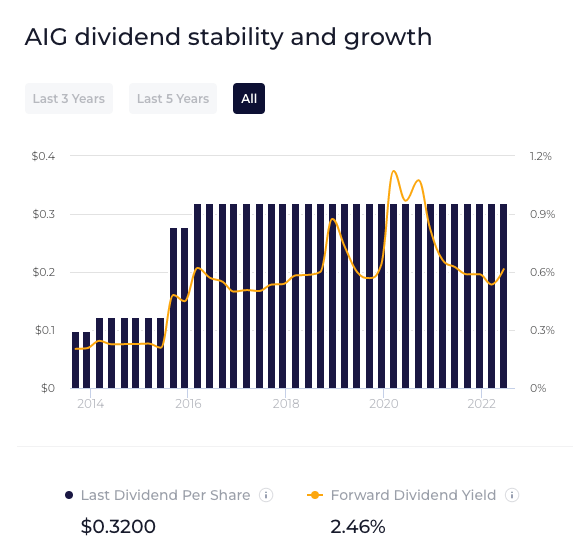

Moreover, I think that the best part about this stock lies in its stable dividend payouts which should help investors in this current inflation-heavy environment. Most recently on June 30th, the company paid shareholders 32 cents per share, which stands at an annualized yield of 2.46% based on its current stock price. Investors are gravitating toward reliable stocks, and I strongly believe that AIG can fulfill their needs. Not to mention, the company is currently listed near the 50% mark of companies for dividends within the Multi-line Insurance industry with a strong EPS of $11.69 (this is more than enough to cover the annual dividend per share of $1.28) and a sustainable payout ratio of 10.90%. I also noticed that dividend yield rates have grown by over 31% in the past 4 years and are relatively stable even in the past 10 years. Currently, there is recovery from the pandemic (given the slight upwards slope of the graph), and I strongly believe that AIG is well-positioned to gain more momentum to improve dividend metrics for the foreseeable future.

WallStreetZen

Valuation

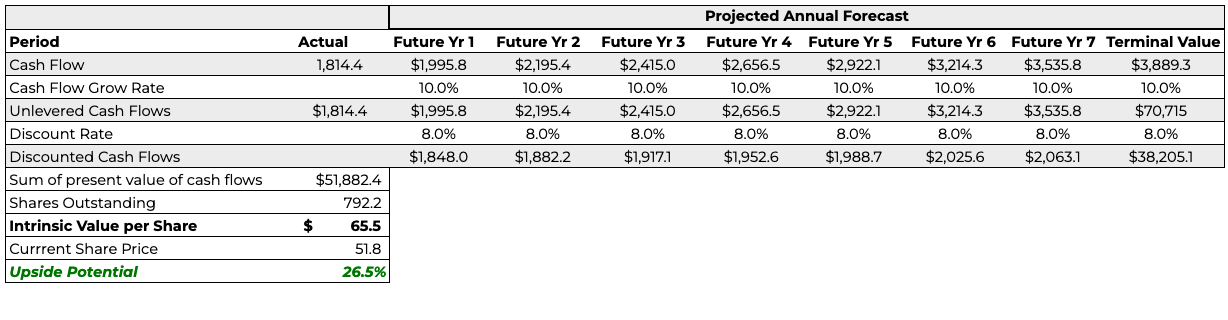

Since we know that AIG has a strong balance sheet and is operating with probability thus far, I decided to use the Discounted Cash Flow (DCF) method and employ conservative assumptions to derive a conservative valuation. I based my model on a $1.814 billion free cash flow value derived from the 10-year average of 2011 to 2021— this is the company’s performance after the fallout from the financial crisis. From 2011, AIG has seen volatile free cash flow (“FCF”) values, but the long-term average during this period has been solid as the most recent FCF rose above $6 billion dollars. With this conservative baseline FCF assumption, I then assumed a 2.5% terminal growth rate and a modest 10% FCF growth rate under conservative estimates for in-line growth with inflation to get an intrinsic price of $65.50, representing a 26.5% upside from its current levels. This shows me that AIG is heavily undervalued by the market and presents itself as a great buy opportunity for investors.

Google Sheets

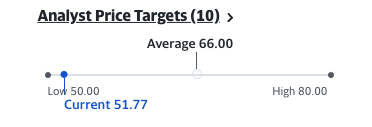

My conservative valuation is also supported by 10 analysts from Yahoo Finance. Their average price target resulted in a mean price of $66.00 and the range spanning from $50.00 and $80.00.

Yahoo Finance

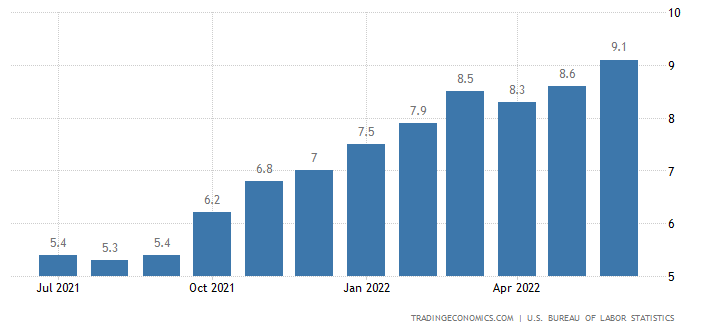

Risk Tailwinds

The biggest risk that I see for AIG is the impact of the rising inflation rate. Currently, the annual inflation rate is still accelerating to record highs and exceeding market forecasts in the process—for example, economists’ forecasts were set to 8.8%, but the actual rates were 9.1% in June 2022. However, I think that AIG is a stable and reliable stock after covering its strong and continued growth in dividend yields and profitability of its business model. These all can act as a moat in place to prevent the inflation rates from substantially affecting this company, as dividends will continue to provide a stable source of income for investors.

TradingEconomics

Company Comparisons

The last piece on my bullish outlook for AIG is based on its competitive positioning within the Multi-line Insurance Industry. AIG is ranked 67th on the Fortune 500, and I decided to create a table below to compare its financial performances among similar competitors that investors may seek out as an alternative.

My table of shareholder return metrics from Yahoo Finance yielded good results as AIG outperformed all of the insurance companies listed below in Return on Equity. They also mostly outperformed and ranked comparable with regard to their dividend yields. There is still way more room for growth ahead for AIG. Increasing free cash flow generation and committing to shareholder value makes me think that AIG is well aware of its undervaluation and has well-positioned itself competitively to outperform the industry. Income-focused investors who also are keen to find modest growth should be gravitating toward this stock.

|

Company |

Ticker |

Dividend Yield |

Return on Equity |

|

American International Group |

(AIG) |

2.47% |

17.51% |

|

Aflac |

(AFL) |

2.79% |

13.19% |

|

Allstate Corporation |

(ALL) |

2.91% |

13.62% |

|

MetLife |

(MET) |

3.16% |

11.44% |

|

The Progressive Corporation |

(PGR) |

0.35% |

4.96% |

|

Chubb Limited |

(CB) |

1.76% |

12.82% |

|

The Travelers Companies |

(TRV) |

2.34% |

13.70% |

|

Hartford Financial Services |

(HIG) |

2.39% |

12.92% |

|

Markel Corporation |

(MKL) |

N/A |

12.98% |

|

Arch Capital Group |

(ACGL) |

N/A |

12.02% |

Conclusion

American International Group (AIG) stock is heavily undervalued and overlooked by investors. Redistribution of excess capital for shareholder value with stable dividend growth all are reasons for buying this stock. My Discounted Cash Flow model under conservative and historical reasoning resulted in an intrinsic price of $65.60 and a 26.5% upside from current market levels. This valuation is also supported by 10 analysts per data at Yahoo Finance.

I strongly believe that AIG has adequate moats to cover the inflation headwinds and will still provide stable returns through their dividends. With all these reasons and more, I recommend a “Buy” for AIG before they release their second quarter financial results after the market closes on August 8.

Be the first to comment