DNY59

Co-produced with “Hidden Opportunities”

2022 has been a volatile year for investors. People often prefer drama and publicized promotions over stocks that provide steady sales and a rising dividend yield. I don’t know about you, but I want no drama or surprises regarding my income. I want to know exactly how much I will receive, from which company, and when. This way, my quality of life is not at the mercy of Mr. Market.

“… (The true investor) will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies.” ‐ Benjamin Graham

Dividend-paying stocks are more profitable and stable businesses in general, making them valuable assets in an uncertain market. Although they may not be immune to the bear market price action, long-term investors can profit from buying low today and selling high years later, long after the markets have recovered. These stocks are paying a reliable and sustainable yield that you can sit back and collect during these times of uncertainty. I am buying dividend assets now, and you can get started with these two picks.

Pick #1: BTI, Yield 6.4%

British American Tobacco (BTI) (will be referred to as BAT in this article) is the largest tobacco company globally. Despite heavy opposition to combustible tobacco products in developed countries, this segment grew 0.6% YoY in 1H2022 due to BAT’s strong presence in developing nations such as Pakistan, Bangladesh, Indonesia, Mexico, etc., where smoking is still appealing, unrestricted, and accepted in society.

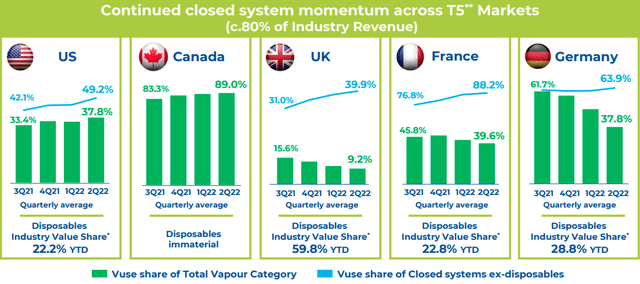

In developed nations like the U.S., EU, U.K., Canada, and Scandinavia, new category revenue comprising vapor, heated tobacco, and oral tobacco products grew 45% YoY. BAT is headed in this direction, investing and aggressively marketing their vape products, rebranding themselves, and targeting £5 in revenues by 2025 and over 50 million new category customers by 2030.

We would be amiss if we discussed BAT and did not talk about the FDA’s proposal to ban menthol cigarettes in the U.S. If put into effect, this ban will be at least two years away and is expected to be contested by legal battles. Every major business faces regulatory challenges from time to time, and the longer a company has existed, the more tried and tested they are. BAT isn’t new to navigating changing regulations, and the company has done so successfully in the past.

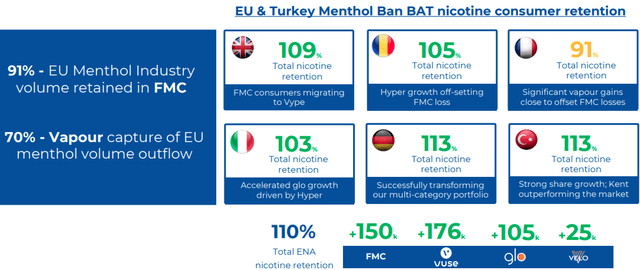

A few years ago, the E.U. and Turkey imposed a similar ban on menthol cigarettes. BAT has successfully retained a significant portion of that volume through other combustible products or the growing adoption of vapor products. ( Source: BAT FY2020 Presentation)

The company boasted 110% total nicotine consumer retention post these menthol bans.

When this proposed U.S. regulation goes into effect, BAT’s new category sales will constitute a more significant portion of its top line and be highly profitable.

Data regarding the Canadian ban on menthol cigarettes (often used as a frame of reference for U.S. research) is largely unreliable since the ban excluded the sale of these products in Indigenous People’s Nations. Moreover, the ban timeline overlapped with Canada’s nationwide legalization of cannabis. Many menthol cigarette smokers who switched to vapor, cannabis products, or purchased from these exempted regions were not included in most studies discussing this regulation’s impact.

BAT has demonstrated market leadership in new category products in key markets, notably in the U.K., EU nations, and Canada, where menthol cigarettes have been banned for a while. Following the FDA’s restrictions on Altria’s (MO) Juul, BAT has the only FDA-approved vape in the U.S., and the company leads the national market in value share. BAT’s products have endorsements from leading health agencies as a “safe” method to quit smoking. (Source: BAT HY 2022 Presentation)

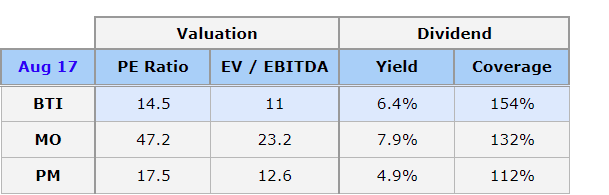

BTI’s 54.45p/share ($0.66) quarterly dividend calculates to a 6.4% annualized yield. The company’s 1H2022 adj. EPS 167.4p ($2.02) covered the 108.9p ($1.31) dividend 154%.

BTI is a U.K. ADR that pays quarterly dividends in GBP. U.S. investors will receive a payment that varies based on USD-GBP rates.

The company is the cheapest big tobacco stock today, with the highest dividend coverage, and is best positioned to grow the sales of its new category products worldwide.

Data source: WSJ

Tobacco is generally an effective inflation hedge as higher prices don’t hurt demand. Moreover, recessions, and higher unemployment, lead to increased demand for these products.

I’ll tell you why I like the cigarette business. It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty. – Warren Buffett

BTI is an excellent moat-driven business with a safe dividend that will fuel your passive income for years. Add this 6.4% yield to your shopping basket before it disappears.

Pick #2: HT-C Preferred Stock, Yield 7.4%

After two years of pandemic-related lockdowns, U.S. hotel operators are reporting unprecedented demand levels, historic rate growth, and meaningful improvements in profitability.

Hersha Hospitality Trust (HT) is a hotel operator with properties in key urban gateway markets like New York, Washington, DC, Boston, Philadelphia, South Florida, and select markets on the West Coast. The company operates as a REIT with its primary strategy to own high-quality luxury, upscale, upper midscale, and extended-stay hotels in metropolitan markets with high barriers to entry.

During the 2nd quarter, HT reported metrics that reveal overall performance comparable to pre-pandemic levels. The REIT reported comparable RevPAR (revenue per available room) at ~95.3% of 2019 levels and comparable portfolio EBITDA above Q2 2019. Every market saw YoY ADR growth (average daily rate). The most important takeaway from the report was higher margins compared to pre-pandemic days, indicating strong pricing power in this inflationary environment.

In April, HT announced the sale of select urban properties to raise $505 million to improve its overall leverage position. Since the company would realize sizeable gains from these transactions, management is considering a special dividend between $0.25 and $0.50 to share the proceeds with shareholders (The special dividend is in the initial discussion stages and yet to be approved by the board of directors)

72% of the HT’s outstanding debt is either fixed or hedged through various derivative instruments, and the REIT reported a weighted average interest rate of ~4.15% across all borrowings with a weighted average life-to-maturity of approximately 2.7 years. Reduced interest expenses and lower interest rates provide increased financial flexibility as HT moves forward into an extended recovery forecasted for the overall portfolio.

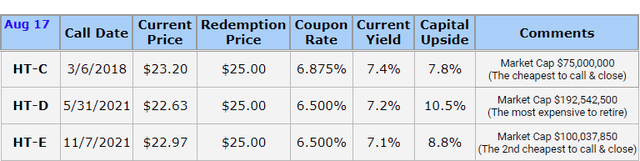

HT has three publicly traded preferreds which are priced with attractive discounts to par value. The 6.875% Series C Cumulative Redeemable (HT.PC) offers ~8% upside and provides an opportunity to lock in 7.4% yields. At the end of Q2, HT reported $101 million in cash and cash equivalents, which covers all preferred dividends for four years. With talks around capital return and special dividends to common shareholders, the preferred dividends present a safe income opportunity.

HT preferreds present among the safest ways to draw income from the booming return of U.S. domestic travel. Up to 7.4% yield for steady cash flow and ~8% upside for the patient investor.

Dreamstime

Conclusion

Wall Street analysts’ opinions on market movements and timing may seem too logical for investors to follow. After all, the so-called market bottom will be extremely obvious to all bystanders, right?

Since the basic game is so favorable, it’s a terrible mistake to try to dance in and out of it…The risks of being out of the game are huge compared to the risks of being in it. – Warren Buffett

Most often, the average investor will miss out on the market rebound and stay uninvested for a significant portion of the rally. Rather than trying to time the market, legendary investors such as Buffett use a strategy called time arbitrage, in which they buy great companies at undervalued prices and then sit back and let the company grow over time and appreciate in value. As income investors, we use market irrationality a bit differently. We buy big dividends at low prices and get paid to wait for the market to adjust.

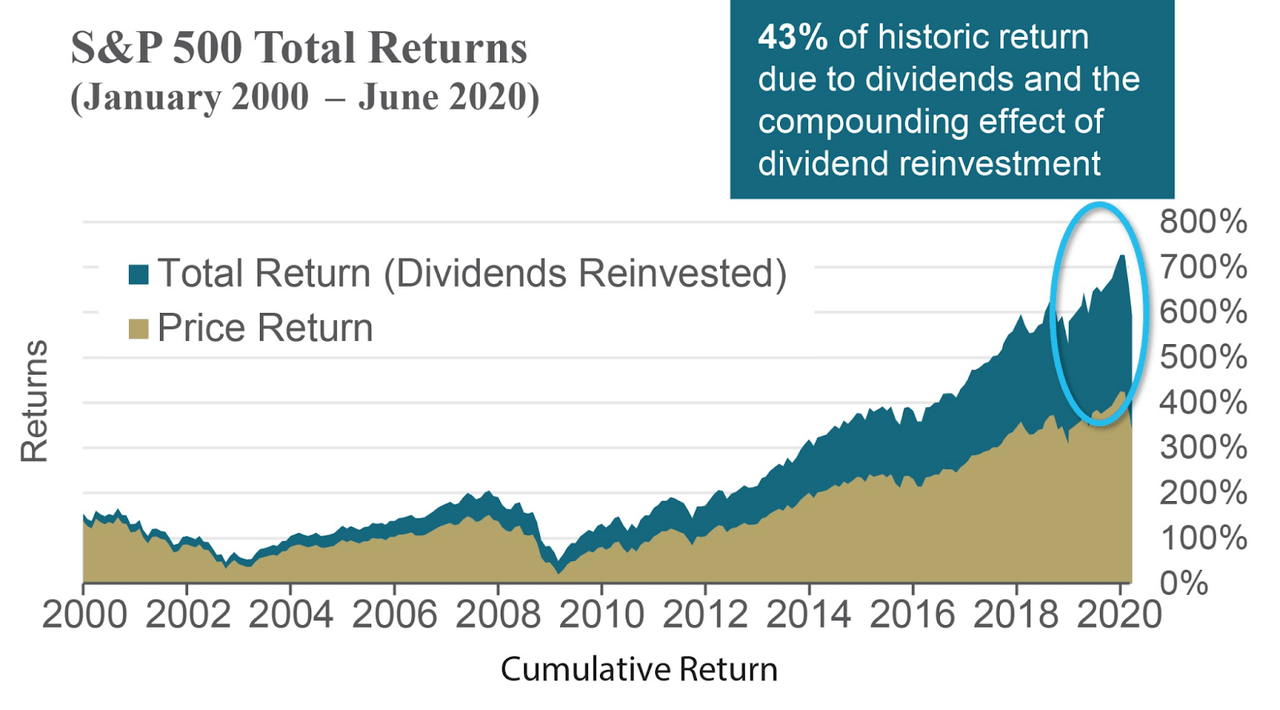

Bear markets make the best case to reinvest dividends. This way, you accumulate a sizable capital gain when markets recover.

TopForeignStocks

I am reinvesting my dividends in this fear-induced market action. I don’t know or care when and where the market finds its bottom, I am in the quest to find income, and I can visually see the success in my bank account. Several of our top picks have raised their payments, and I could not be happier. While markets have bounced from their lows, it is impossible to tell if this is the beginning of a new bull market or just another dead cat bounce. There are still some big dividends at cheap valuations, two picks with up to 7.4% yield to build your income today.

Be the first to comment