(Source)

Uber Technologies, Inc. (UBER) shares have gained 47% since the bullish article I published on March 21. I was focused on the long-term prospects of the company, and I still am. To be fair, I did not expect Uber shares to report gains of this magnitude even before the mobility restrictions are lifted. To recap, I assigned a fair value of $87 per share and a time horizon of two years for the market price to converge with this estimate. The company’s losses grew in the first quarter, and the impact of the coronavirus came to light with Q1 results. However, the long-term thesis for Uber remains intact, and the company is significantly undervalued.

Q1 results give reason to be wary about Q2 earnings

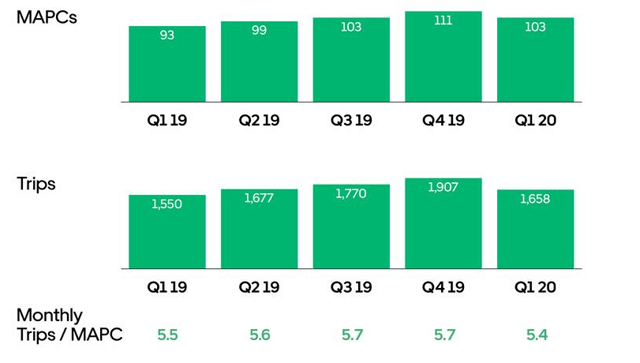

There was nothing too exciting in Uber’s Q1 results. Even though the company reported year-over-year growth in monthly active platform consumers (MAPCs), active users reported a decline on a quarter-over-quarter basis. This goes on to show the negative impact of COVID-19 on Uber’s operations.

(Source: Earnings presentation)

This phenomenon is true for most other operating metrics, including gross bookings, adjusted net revenue, and the adjusted EBITDA margin as well.

The real highlight was the 54% growth in the Uber Eats segment. Adjusted net revenue from this segment increased by a staggering 124% in the first quarter, which was supported by the new partnerships the company formed with restaurants who were struck by COVID-19.

In the earnings conference call, Dara Khosrowshahi stated that rides were down 80% in April, but were recovering on a week-over-week basis as a result of the easing restrictions in some parts of India, the United States, and Hong Kong. This is encouraging news, but investors need to be wary of a disappointing second quarter because of two factors.

- Many countries, including the United States, went into lockdown in the latter half of March. This means that Uber was functioning normally for the most part of Q1. However, things are different for the second quarter. As already confirmed, the month of April was a disaster for the rides segment. The loss in revenue, therefore, could be of a much higher magnitude in the second quarter.

- Governments across the world will likely request residents to adhere to social distancing practices through the end of this year, if not more. There’s a fear of a second wave of the pandemic as well. These negative developments will limit the ability of Uber to return to the pre-coronavirus era in the second quarter.

I would not be overly optimistic about what the second quarter holds for the company. But at the same time, my thesis for Uber still remains intact.

Uber Eats is a growing but challenging business line, and the company seems to be doing the right thing

Here’s something I like about Uber as a growth investor. The company does not kill time in taking bold decisions. Some of these decisions include the discontinuation of its operations in China and selling Indian Uber Eats operations to Zomato earlier this year. These might not be looked upon as favorable decisions by some investors, but as far as I am concerned, they are a reflection of the company’s core strategy, which is to become the number one ridesharing and food delivery platform in all the regions and countries it operates in.

Uber Eats will cease to operate in the United Arab Emirates, which is the latest addition to these bold decisions. The company acquired Careem last year, which has its own food delivery app, Careem Now. Uber will migrate all its Eats accounts to Careem Now on May 18. Careem’s acceptance as a local brand (I know this because I live in Dubai) was proving to be a difficult-to-overcome obstacle for Uber Eats, and this decision will help Uber focus on the markets the company can dominate.

The COVID-19 pandemic has opened many new doors for Uber Eats to establish its presence in markets that truly matter to the growth story, such as the United States. For example, Shake Shack (SHAK) reported earlier this week that it has partnered with Uber Eats and a few other delivery partners to take food to the doorsteps of as many customers as possible. Before the pandemic, however, Shake Shack partnered with Grubhub (GRUB) on an exclusive basis.

When COVID-19 is behind us, Uber Eats will emerge as a better segment than it was before. I’m not sure whether it would be a bigger segment, as the company is keen on focusing only on markets that it can dominate. However, I expect the profitability profile of Uber Eats to significantly improve once business activities return to normalcy. For now, the company is doing the right thing by forming new partnerships in important regions.

There’s only one way Uber is going in the future

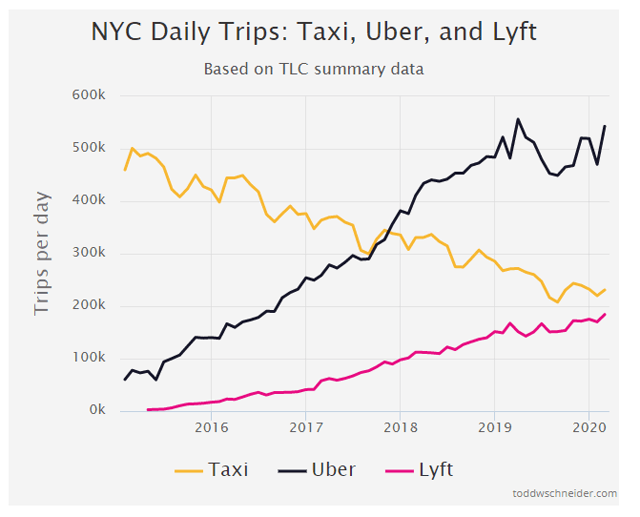

Uber is disrupting the way how people travel. The same way Amazon (AMZN) and Netflix (NFLX) did in their respective industries, Uber will emerge as a company that dynamically changed how we travel. Its success in metropolitan areas has been unfathomable. A quick glance at the below chart should be sufficient to see how Uber is turning a century-old industry on its head.

(Source: Todd W. Schneider)

This phenomenon will not be limited to New York City in the next few years, let alone the United States. Uber has a strong presence in many developing regions of the world, including Latin America and Asia. The economic growth in these regions is expected to be stellar in the next decade. This, on the other hand, will lead to an increase in household income levels, and smartphone penetration rates in high-growth regions of the world can be expected to grow exponentially in the coming years.

| Country/region | The smartphone penetration rate in 2020 | The projected smartphone penetration rate in 2025 |

| Latin America | 66% | 79% |

| India | 24% | 60% |

| Nigeria | 39% | 55% |

(Source: Statista, Venture Beat)

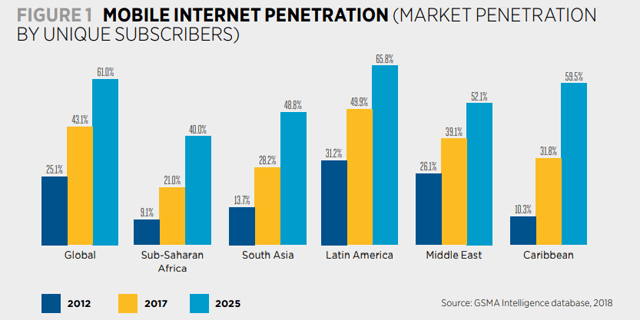

Mobile internet penetration, understandably, is expected to increase along with the majority of a country’s population using smartphones. The global average is expected to increase from 43.1% in 2017 to 61% by 2025. The highlight, however, is the stellar growth projected in other regions of the world.

(Source: GSMA)

For Uber, this is welcome news. The success of Uber is closely tied to the target market for the company and its penetration rate. As we can see from the above data, the addressable market size for Uber will grow exponentially by 2025. Even with no changes in its take rate, the company will grow along with the growth of the industry.

Takeaway: Uber will reward investors handsomely in the coming years

These are uncertain times, and it’s difficult to model the performance of even the most mature companies in the United States. Uber might report lackluster numbers for the second quarter as well, going by the recent developments and how the company performed in Q1. There’s a lot of criticism for its business model and cash burn rates, but 5 years down the line, Uber will emerge as the company that transformed the way we travel for good. The macroeconomic environment is supportive, and the company is doing the right thing by focusing on its core strength by ceasing to operate in markets it cannot dominate.

If you enjoyed this article and wish to receive updates on my latest research, click “Follow” next to my name at the top of this article.

Disclosure: I am/we are long UBER. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment