Stefan Tomic/E+ via Getty Images

iShares MSCI UAE ETF (NASDAQ:UAE) is an around $44 million passively managed fund with a portfolio cramming 32 United Arab Emirates equities from the MSCI All UAE Capped Index.

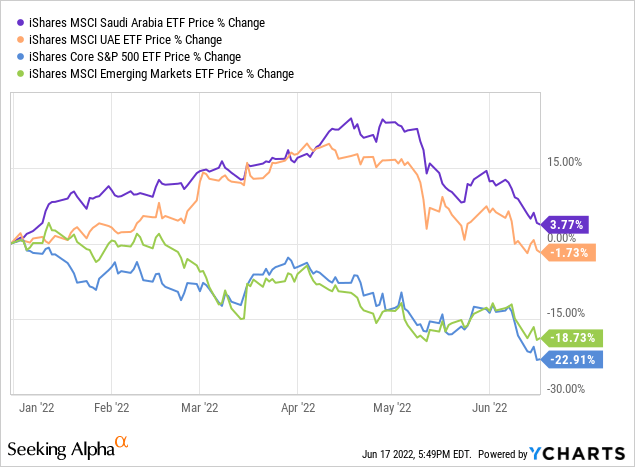

UAE’s price has declined by ~3.8% YTD as of writing this article, with the total return being approximately 1.7% below zero. It certainly coped much better with aggressive bearish forces circling around the globe, as its single-digit retreat is in sharp contrast with the U.S. bellwether equities comprising the iShares Core S&P 500 ETF (IVV), which are down by a whopping 23%, already officially in a bear market zone, though failing to keep pace with its Middle-Eastern peer the iShares MSCI Saudi Arabia ETF (KSA) which is up in low-single-digits. It should be noted that UAE has started this tumultuous year on an up note, surprising investors to the upside until April, but then things suddenly turned south and earlier gains were erased.

Speaking of positives, I appreciate the fund’s low correlation with the U.S. market, together with seemingly adequate valuation with a P/E of ~14.6x as of the iShares data. This mix might look close to ideal to prepare for further contraction of the growth premia in overvalued stocks, which the global equity market will be experiencing as hawks are doing what is necessary. I also like the short-term trends in the country’s financial sector, mostly in terms of loan growth on the back of healthy economic activity, which may be supportive of the ETF’s performance both in terms of capital gains and dividends.

Amongst weaknesses, I highlight its concentration (the main two positions account for close to 44% of the net assets in total) and utterly lackluster historical risk-adjusted returns.

I am also of the opinion the UAE is clearly not invulnerable to the global macro risks, particularly in case the aggressive rate hikes already omnipresent catalyze a recession in major economies, triggering the international growth slump, and thus probably resulting in the oil prices reset, not to mention other ripple effects related to capital flows and global tourism, which is of unquestionable importance for Dubai. That is to say, I believe weathering a U.S. stagflation in the UAE equities should one materialize does not make sense.

Next, longer-term, regardless of how the current oil & gas crisis develops, the switch to greener energy alternatives away from fossil fuels over the coming decades looks like a risk for the UAE’s revenues, which potentially can result in softer economic growth and subsequently lower equity returns, especially for the financial sector, which is the fund’s principal allocation.

That said, while appreciating the soundness of the Emirates’ economy discussed below, I would opt for a Hold rating given downside risks.

The Economic Background: Key Matters Worth Discussing

The key macro themes for the UAE investors to watch are economic expansion and inflation, which have been a gnawing concern for the EM and DM investors alike this year, causing regulators to abandon their dovish stance, and thus eating into rich pandemic gains in assets prices.

In the April 2022 World Economic Outlook, the International Monetary Fund forecasted the UAE’s real gross domestic product to increase by 4.2%, followed by a 2023 growth rate of 3.8%. For better context, in 2020, its economy was dragged into a recession by the coronavirus crisis, with real GDP falling by 6.1%; 2021 was a year of a nascent recovery, with a 2.3% improvement.

Meanwhile, the UAE central bank is of the opinion the real GDP growth can touch 5.4% this year, followed by a 4.2% expansion in 2023. This is an upgrade from an earlier forecast of just 3.3%. To bring a bit more color, the OPEC data shows that “about 30 per cent of the country’s gross domestic product is directly based on oil and gas output,” as of 2020. So the premise that elevated oil prices are amongst the top contributors to the rosier outlook looks rational.

At the same time, inflation, the metric that is causing a lot of worries globally, is being kept at bay. The IMF forecast is a 3.7% change in consumer prices this year and 2.8% in 2023, a justly adequate level. It is worth reminding that in 2019, the UAE plunged into outright deflation, with the primary reason being falling rents amid the oversupply of property. Deflation persisted in 2020 principally due to the coronavirus restrictions imposed which dented global travel and also resulted in the departure of foreign workers. Nevertheless, the Emirates finally escaped the deflationary spiral, staging a solid recovery from the Covid recession in 2021, benefiting from tourism revival and oil revenues climbing higher.

Inflation and the robustness of the national currency are intimately intertwined. Higher prices mean higher rates, which should bolster demand for sovereign debt and support FX gains. However, the UAE investors should remember that the dirham is pegged to the U.S. dollar, thus with American interest rates creeping higher, the possibility that the Emirates’ central bank will follow the suit increases inevitably. It has just hiked the rate by 75 bps, mimicking the Fed’s recent historical decision.

A Closer Look At Holdings

Overall, we see the UAE’s economy advancing at a healthy pace, with the consumer prices changing comfortably, at least for now. That is a supportive backdrop for the financial sector, the one the UAE fund has invested heavily in, with an over 47% allocation, and First Abu Dhabi Bank alone accounting for a massive 23.1% of the net assets. Communications are in second place, with Emirates Telecom being the key position with a 20.5% weight.

It should be noted that KSA is also grossly overweight in financials; that is also the case with the iShares MSCI Kuwait ETF (KWT).

As the credit demand in the UAE has been on the boil this year, the conditions for the Emirates’ banks look opportune. However, we see that this alone is not enough for investor optimism, as the price of the ADX-quoted shares of First Abu Dhabi Bank has been slipping almost incessantly since April, down ~11% in three months; the sector median price performance is (16.2)%, so its case is not unique. For context, the bank is trading with a TTM P/E of ~14.2x, while the financial sector median is 9.44x.

Performance: Seemingly Steady 2022, After Bullish 2021 And A Decade Of Softness

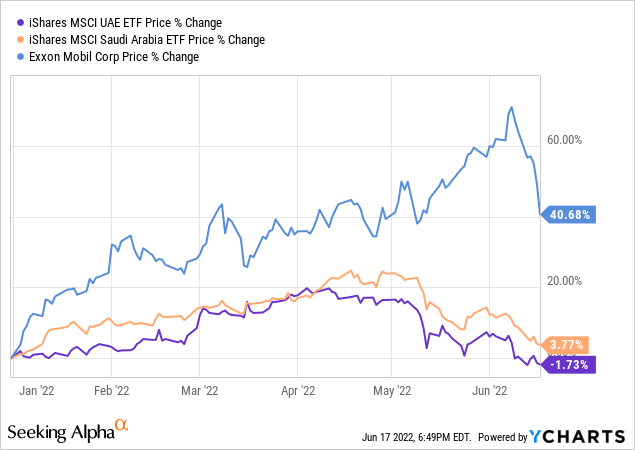

Though deemed as a possible beneficiary of the oil price remaining higher for longer, this year, UAE has not delivered a return that would vividly illustrate that the demand for crude contributes much to its appreciation. We see the fund’s price has declined by 1.7% since the beginning of the year, while Exxon Mobil (XOM), a supermajor highly correlated with the petroleum price, has risen by almost 41%.

Oddly enough, we also do not see even double-digit gains from KSA, which is up ~3.8%. That is to say, I am strongly against treating UAE and KSA as funds simply for exposure to the oil price dynamics, and, hence, a bet on the supply/demand imbalances to continue.

Speaking of historical risk-adjusted returns, the Sortino ratio the fund delivered over the May 2014 – May 2022 period is 0.06. The optimal level is 2. IVV’s result over the same period is 1.63. And that is even despite UAE’s wild run last year, when it rewarded investors with an over 44% total return.

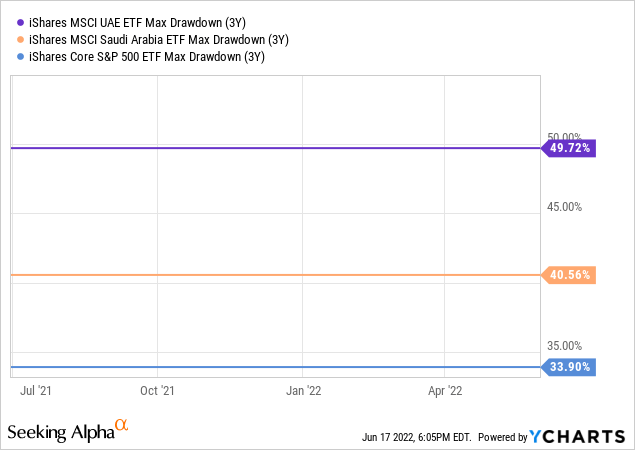

Also, in 2020, the ETF faced a 3-year max drawdown of almost 50% compared to IVV’s 33.9%, so we had already seen the downsides of its top-heavy strategy amid the global economic slump.

Final Thoughts

The UAE demonstrated an objectively low correlation with the U.S. market (a 0.43 coefficient based on daily returns since May 2014), which adds to its allure in an environment where the woes of investors in expensive equities are seemingly far from over as the Fed is walking the walk.

However, as flagged above, the ETF’s historical risk-adjusted returns are merely lackluster, and the drawdown it faced in 2020 is clearly horrible. Thus, there is a risk that if global economic conditions deteriorate further, the UAE price will be disproportionately affected.

Also, we are already noticing signs of oil demand suppression by means of lowering the supply of capital. This is bearish for crude benchmarks globally, and, though indirectly, also bearish for the UAE and KSA ETFs, due to the countries’ dependence on petroleum revenues. Considering all these risks and downsides, UAE is a Hold.

Be the first to comment