andreswd/E+ via Getty Images

By Anna Hawley, CFA, Lead ESG Portfolio Manager for Systematic Active Equity; Christopher DiPrimio, CAIA, Head of Americas Strategy for Systematic Active Equity

Sustainable investing has become a popular topic and investment approach over the years for several reasons. Anna Hawley, Lead ESG Portfolio Manager for Systematic Active Equity, has witnessed the evolution of sustainability throughout her 20-year history with BlackRock. As recent macroeconomic and geopolitical tensions have created a challenging environment for investors across asset classes, Anna joins us to shed light on the latest market developments and provide her perspective through a sustainable lens.

We use ESG analysis in our process to both navigate near-term uncertainty and dynamically allocate capital towards innovative opportunities.

– Anna Hawley, CFA

How has the sustainable investing landscape changed over the last year?

Over the last year, we’ve experienced heightened macroeconomic uncertainty, with several events impacting society and financial markets. This has included new COVID waves, inflationary pressures and supply chain issues, and the emergence of a devastating war.

Each of these circumstances has contributed to elevated volatility across asset classes. For sustainability, this pressure runs against the recent momentum we saw in the space, with U.S. assets reaching over $635 billion1 at the end of 2021. Despite this near-term shift in sentiment, ESG analysis continues to play an invaluable role in our investment process. It provides an additional lens into company characteristics beyond traditional financial metrics, helping to manage uncertainty and uncover long-term investment opportunities.

How are current energy supply shortages impacting the transition to a low-carbon economy?

The energy transition remains intact, but potentially less linear in the wake of current events. In our view, navigating the path ahead starts with understanding that the economy is transitioning to carbon-neutral, not carbon zero. The two are often conflated, leading to the common misconception that ESG investing requires screening out sectors of the economy—like energy, for example. In reality, energy companies play an important role in both meeting current supply needs and developing new technologies for the future.

In the long run, we expect the current energy crisis to accelerate green innovation in the sector, with greater emphasis on securing affordable sources of energy. We continue to develop new research insights to capture this shift and detect early signs of transition readiness. With the labor market being a critical focus in the US, one way to identify green innovation is through company hiring practices. We monitor job listings across the country in real-time and use machine learning to identify roles that require skills needed for green projects.

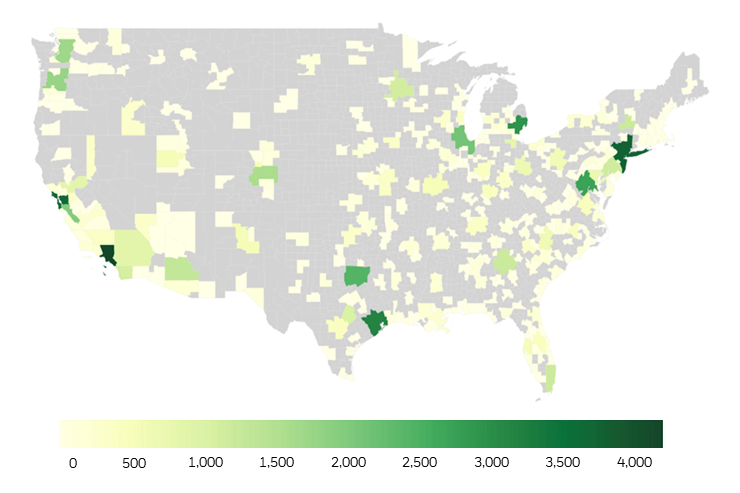

From a regional perspective, our research has revealed an interesting observation that green skills are highly concentrated in communities with a larger share of fossil fuel jobs. As shown below, these regions including parts of Texas and the Midwest may be well-prepared and some of the largest regional beneficiaries from the energy transition.

Number of green jobs listed across metropolitan areas

Source: BlackRock and Burning Glass Technologies (BGT), as of December 2021. Chart shows green jobs listed by metropolitan area in 2021.

From a social ESG perspective, how are current events impacting consumers and employees?

One insight from a social ESG perspective is the increased focus that many companies are placing on cyber defense. Our digital infrastructure as a society has become incredibly robust. Now, the war in Ukraine and deglobalization present added cybersecurity risks for companies and consumers.

Using alternative data, we can measure several indicators of a company’s vulnerability to cyber-attacks. Systems for detecting threats and correcting weaknesses are important considerations that can impact society and business results. As corporate spending continues to rise in these areas, we can identify companies building resiliency in response to growing risks. This is just one of several timely social topics where we’re focused on expanding our ESG research.

Similarly, insights related to internal company stakeholders are helping us identify opportunities in the current environment. For example, we’ve noticed a trend of stronger performance in companies offering additional employee benefits beyond typical compensation. These firms with robust employee benefits also tend to have higher levels of employee retention, another mechanism we use to measure firm quality that’s especially relevant with current labor tightness.

As we look ahead, what areas of sustainable investing are you focused on most?

First and foremost, we’re focused on maintaining a long-term perspective. This is crucial for weathering near-term volatility and uncertainty. We’ll continue to find new ways to identify high quality, innovative businesses across sectors and industries. These are the companies that we expect to lead on the path to a lower-carbon world.

Similarly, we’re focused on using ESG insights to answer important questions on how society and financial markets are impacted by the events that are unfolding. Currently, what does deglobalization mean for how companies prioritize cyber defense? Which firms offer robust benefits that boost employee retention in a tight labor market? These are just a few topics impacted by today’s events that may play a role in shaping asset returns and society.

Each of these areas of focus builds on our 35+ year history of pursuing innovation in investing within Systematic Active Equity. Over a decade ago, we found that sustainability is an invaluable tool to help uncover long-term company success when used in our investment mosaic alongside several other investment insights. ESG data allows us to examine more company attributes and develop a deeper understanding of business practices in a rapidly changing world. Looking ahead, we remain focused on staying at the forefront of innovation in sustainable investing and expanding our differentiated approach—building resiliency by maintaining a long-term perspective.

1 Sources: Simfund and Broadridge for mutual funds and separately managed account flows, respectively, and iShares GBI for ETFs

Investing involves risks including possible loss of principal.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Stock and bond values fluctuate in price so the value of your investment can go down depending upon market conditions. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. The principal on mortgage- or asset-backed securities may be prepaid at any time, which will reduce the yield and market value of these securities. Obligations of US Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US Government. Investments in non-investment-grade debt securities (“high-yield bonds” or “junk bonds”) may be subject to greater market fluctuations and risk of default or loss of income and principal than securities in higher rating categories. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax.

A fund’s environmental, social and governance (“ESG”) investment strategy limits the types and number of investment opportunities available to the fund and, as a result, the fund may underperform other funds that do not have an ESG focus. A fund’s ESG investment strategy may result in the fund investing in securities or industry sectors that underperform the market as a whole or underperform other funds screened for ESG standards.

The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all inclusive and are not guaranteed as to accuracy. Investments named within this material may not necessarily be held in any accounts managed by BlackRock. Reliance upon information in this material is at the sole discretion of the reader. Statements concerning financial market trends are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will perform well under all market conditions. Outlook and strategies are subject to change without notice.

BlackRock Sustainable Advantage Large Cap Core Fund received a Morningstar Rating of 4 stars for the 3-year period, 4 stars for the 5-year period and – stars for the 10-year period, rated against 1221, 1106 and 807 Large Blend Funds, respectively. Performance results represent past performance and are no guarantee of future results.

The Morningstar RatingTM for funds, or “star rating”, is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product’s monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Morningstar Ratings are for the share classes cited only; other classes may have different ratings.

Prepared by BlackRock Investments, LLC, member FINRA.

©2022 BlackRock, Inc. All rights reserved. BLACKROCK is a trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRRMH0622U/S-2227887

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment