Firn/iStock Editorial via Getty Images

My Thesis

Many investors see the low valuation of BASF SE (OTCQX:BASFY) as a great opportunity to buy a quality company at a cheap price. However, in my opinion, this approach is erroneous – BASF is in danger of further losing its position in the petrochemical market due to strong global competition. If you believe, as I do, that the current energy and geopolitical crises will not end anytime soon, then you should not buy BASF just yet, despite the stock’s historically low valuation.

My reasoning

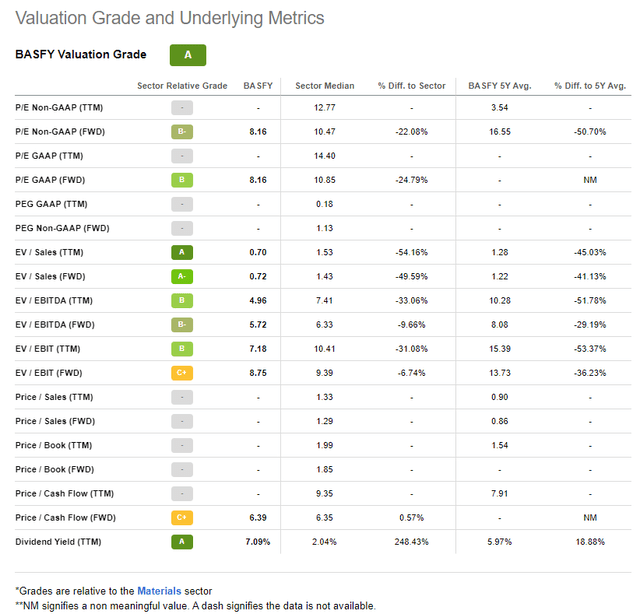

As one of the largest petrochemical companies in the world, BASF is indeed trading at quite large discounts compared to the overall Materials sector:

Seeking Alpha, BASFY’s Valuation

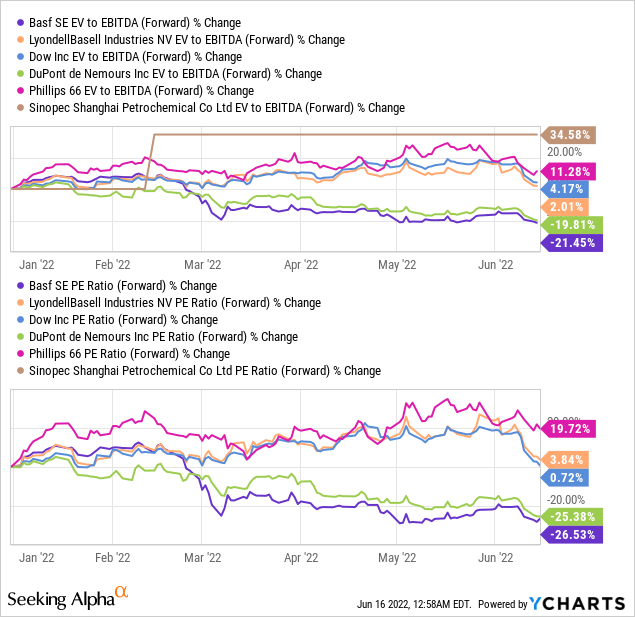

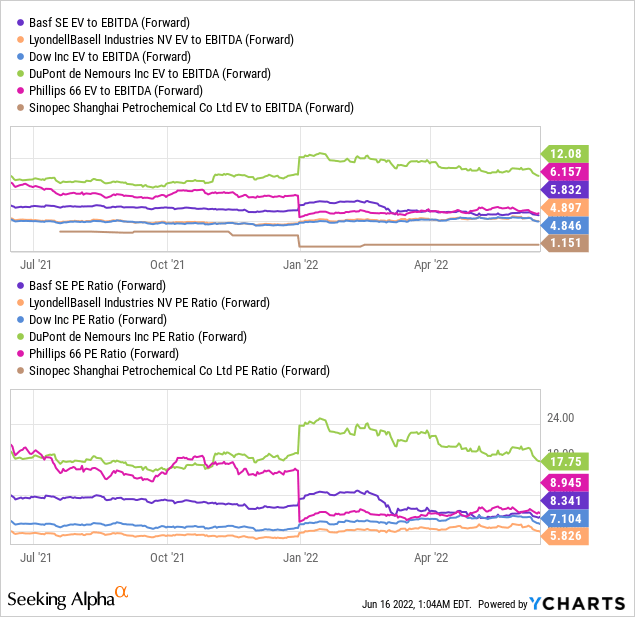

Since the beginning of the year, BASF has experienced the sharpest decline in valuation multiples among companies with a similar market capitalization. The company’s current valuation is slightly below the industry average:

Geopolitics was undoubtedly the culprit for the current situation – BASF, whose operational efficiency is highly dependent on Russian gas supplies, has been forced to look for ways to get rid of its Russian assets since the beginning of hostilities in Ukraine:

BASF SE is exploring a plan to offload energy assets in Russia belonging to its Wintershall Dea AG unit to its Russian billionaire joint venture partner, according to people familiar with the matter.

Source: From BNN Bloomberg

According to the company’s latest factbook, Wintershall’s assets in Russia generated about 48% of the total production of this project, while holding 63% of all proven reserves (2P). With a 72.7% stake in this project, BASF earned 5.952 billion euros in 2021 (7.6% of total sales), of which 2.857 billion euros came from production in Russia. Divesting oneself of such assets is a necessary action, but at current oil and gas prices, this is financially not viable for BASF in terms of opportunity costs.

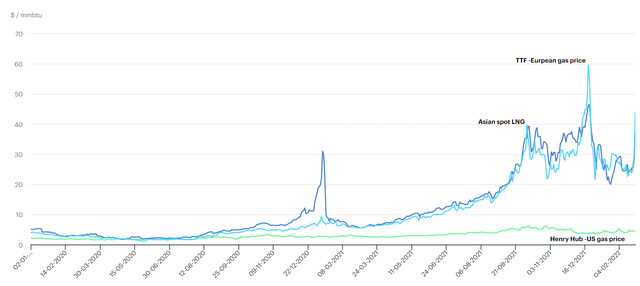

Moreover, although strong demand has allowed the company to pass on a significant portion of the increased costs in 1Q 2022, it is far from certain that demand will remain at such high levels. Natural gas prices in Europe still have a colossally high premium to US prices. This puts heavy and light industries in a very difficult position and increases the risk of demand disruption across different sectors of the EU economy.

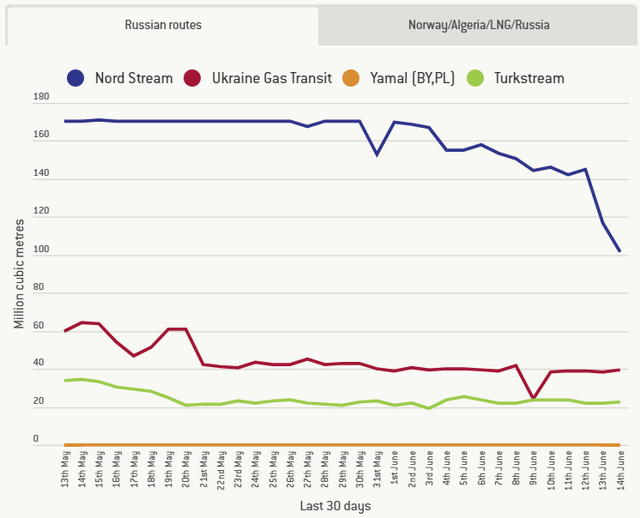

Gas supplies from Russia via Nord Stream 2 began to fall sharply due to the restrictions imposed – this was particularly noticeable from the end of May 2022:

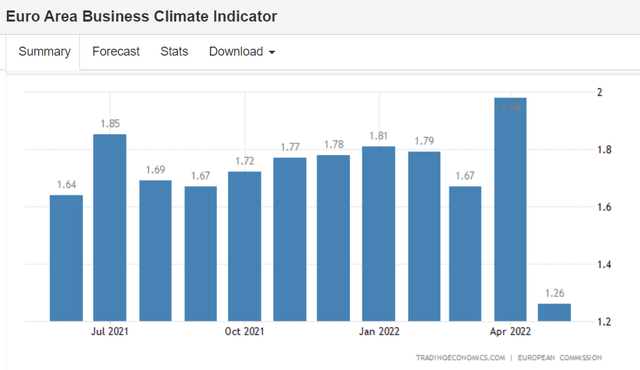

Inventories in Europe are steadily rising, which could indicate a decline in demand for non-perishable and non-essential goods – at some point, European manufacturers, which account for 39% of BASF’s total sales, will produce less, which will mean less demand for the company’s products – or so the latest data (Business Climate Indicator) suggests:

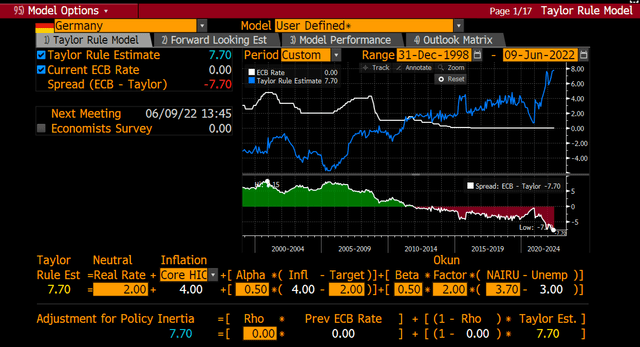

Given the widespread increase in the price of goods, mainly due to rising fuel costs, the interest rate of the ECB should be many times higher than the current level (the spread stands at 7%) – at least if we believe the Taylor rule and financial theory in general:

Holger Zschaepitz’s Twitter account

In my opinion, the monetary policy of the European countries is coming too late, and now the ECB has to move even faster than the Fed – there is a risk that production in Europe will stagnate, causing BASF to lose its recent operating growth as quickly as it gained it after COVID-19.

Another risk for BASF is the strength of global competitors

The geopolitical events mentioned above, in addition to the European crisis, have created many opportunities for BASF’s competitors from developing countries.

Even in Russia, which was isolated by sanctions, the development of the petrochemical industry was in full swing before the outbreak of hostilities in Ukraine. The largest petrochemical company in Russia, Sibur, recently launched a major state-of-the-art polymer production plant in western Siberia, and I assume it will now have a huge production capacity for years to come. Recent news about the expansion of Sibur’s product line suggests that my suspicions are not unfounded:

SIBUR, the largest integrated petrochemicals company in Russia and one of the fastest-growing companies in the global petrochemicals industry, has expanded its offering of advanced, eco-friendly polymers for use in packaging, pipe production and other industries.

Source: Macau Business

Sibur has been increasing its exports to China, leveraging its massive production capabilities that are geographically well-placed for export to the Asian market. The company has also been diversifying its offering for Asian consumers, including the development of new currency payment options for Chinese partners. Even before sanctions, Sibur – which was until recently led by the experienced business executive Dmitry Konov – successfully transformed itself from an outdated Soviet-era producer into a modern international player with a clear focus on ESG. And now that the choice of the key end-market has become clear (Asia instead of Europe), Sibur may actively use its strong credentials to extend market share in the Asian markets. Asia is an important market for BASF as well (though its product range is different from Sibur), with Greater China accounting for 15% of its total sales, according to 2021 data.

The battle for the Chinese market will also have to be fought with local companies – namely SINOPEC, the giant in the global petrochemical industry. Like BASF, it had projects in Russia, but despite all the sanctions, it did not have to write them off (as BASF did). On the contrary, SINOPEC’s $11 billion gas chemical complex in the Amur region (in which Sibur holds a 60% stake, by the way) was “going well,” as the South China Morning Post reported at the end of March 2022.

In general, China has one of the lowest inflation rates compared to European countries and the United States – giving the People’s Bank of China more leeway to ease monetary policy and spur growth in a slowing economy (I have written about this more than once in my articles on bulk shipping stocks here on Seeking Alpha). This development should provide SINOPEC and its partners with growth momentum in the months ahead. It is much easier to build strength amid soft monetary policy (as in China) than amid weak monetary policy (as in Europe).

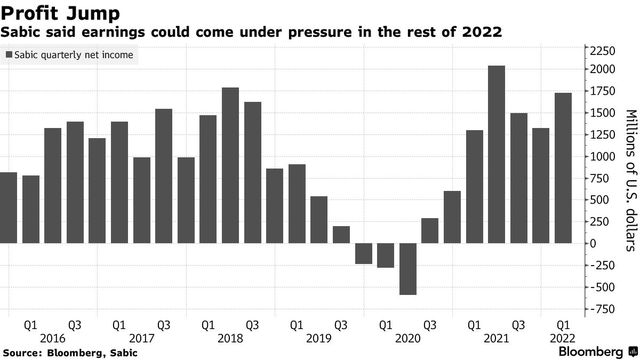

In the Middle East, where BASF has a presence, there is also a player that can use the situation to its advantage against the backdrop of the problems – SABIC (Saudi Basic Industries Corporation). The firm made a net income of 6.47 billion riyals ($1.73 billion) in Q1 2022, in line with the pre-pandemic levels:

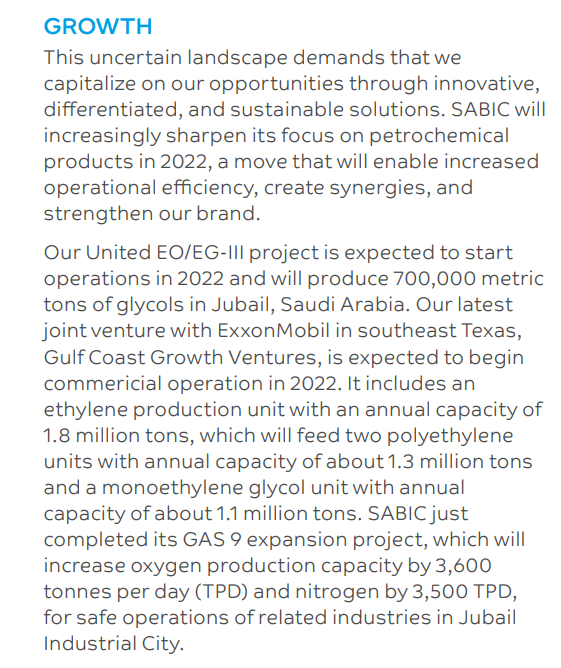

The recovery in operating performance has allowed SABIC to continue the development of some major projects that should add real value this year:

From SABIC’s recent annual report (2021)

However, as the CEO Yousef Al-Benyan said to Bloomberg reporters, chemicals demand in the second half will be pressured by a global economic slowdown, inflation, and also the rise in interest rates. Even if a company whose geography makes it less vulnerable to the negative impact of rising oil and gas prices announces emerging difficulties, what should a European company that struggles daily with how to allocate the cost of natural gas price volatility expect?

Bottom Line

It can be seen with the naked eye that BASF has lost significant value since the beginning of the year, not only in absolute terms (decline in shares) but also in terms of valuation – multiples have shrunk faster than the industry average.

I agree that BASF shares can be a good investment on a 5-10-15 year view, but I am puzzled by current geopolitical events and their potential consequences for European companies. With inflation high and ECB’s upcoming monetary tightening, BASF’s largest market – Europe – is likely to be hit hard. At the same time, there is a risk that other markets important to the company will be taken over by competitors. The reorientation of the relatively new Russian production facilities (which will not need to be renewed in the next few years) to China and SABIC’s competitive advantage in the form of access to cheap raw materials could, in my opinion, severely shake BASF’s pricing power. I think that even from the current price level, BASF shares still have room to move down, so I wouldn’t buy BASF stock now.

I would be happy to read your opinion in the comment section below!

Be the first to comment