Ozgu Arslan/iStock via Getty Images

Investment summary

Not much has changed since November 2020 for BioSig Technologies, Inc. (NASDAQ:BSGM), when we last covered the company here on Seeking Alpha. We weren’t holders then and, given the culmination of factors in this report, we are agnostic to the stock today as well. Around 3 weeks ago, in May, the company released the rollout of its much anticipated national launch campaign. The stock didn’t even budge. In fact, it fell from former closing highs of $1.27, and has tracked further south since. On that evidence, the market looks to have already well priced in the impeding good news. Either that, or it doesn’t care, amid the wealth of systematic and macro-specific headwinds currently plaguing equity markets.

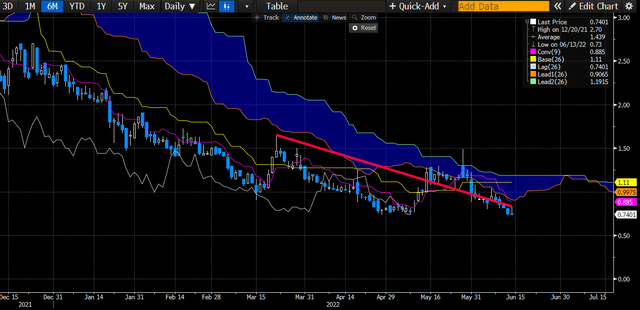

Exhibit 1. BGSM 12-month price action

BSGM is a high-beta name that has low-factor exposure to the risk premia current driving equity returns in 2022. It lacks profitability, earnings momentum, free cash conversion, top-line defensibility and is a high-duration stock that’s hyper-sensitive to inflation risk. The high-beta trade has doubtlessly unwound in 2022 and high-growth names have been punished to pre-Covid lows. Directional preference is now on the short side, and we’ve. seen any number of long-only funds wiped clean this year.

BSGM is the same, now trading 70% below its pre-pandemic low-point of $2.56. Put simply, investors are chasing quality factors including size, profitability, yield, FCF, strong balance sheet metrics and ample liquidity. In the absence of these quantitative factors, and total ablation of qualitative drivers, we’ve no choice but to remain neutral on the stock.

Colour on PURE EP economics, finally

Investors were mute to news BGSM has started its national rollout campaign. The company said it already had “30 advanced leads at Medical Centres of excellence” stacked into the pipeline. The official launch date of the rollout isn’t expected until 1st July 2022. That was the highlight of the update. Investors (including us) were seeking more – dates, figures, estimates, names of leads, more than just leads as well. Specifically, the strategy is centered on the national launch of its PURE EP System.

Back in 2020, the company started to commercialise the system. It’s been designed around a total of 5 system capabilities, that purportedly provides clear signals across the entire range of cardiac frequencies. Its use is indicated in the evaluation of electro-cardiac signals obtained from electrograms. This is on patients undergoing electrophysiological examination, itself apart of wider cardiological studies. In theory, and hopefully practice, it is of benefit in patients with cardiac arrhythmias and other conditions of cardiac output. As we reported previously, “This technology aims to integrate electrophysical data and diagnostic accuracy in common cardiac conditions like atrial fibrillation and tachycardia.”

However, as in our first coverage of BSGM, visibility on the launch curve and the cadence of placements is murky, by estimation. Plus, there are additional, sector specific risks at play. There have reportedly been good feedback from electrophysiologists, although reimbursement is still an overhang and the company’s update didn’t add any colour there. Hospital capital budgeting has wound right back in 2022 from our talks with various hospital executives, and remains hyper-sensitive to Covid-19. The commercial structure on PURE EP is therefore integral in understanding pricing mechanics, and if pricing power is benign on BGSM’s end.

National launch campaign already priced in

To that effect, the company did mention it has a new strategy with commercializing PURE EP. It will reduce product evaluations down to 60 days from 180-360 days. It’s also implemented an agreement with Summit Blue Capital to do the heavy lifting in PURE EP back in March. It’s entered into a leasing and financing program for PURE EP, aiming to “expedite the pathway to purchase and increase scope” of the system. Summit Blue is a leader in equipment finance and leasing. The execution risk is now spread between Summit Blue and BSGM and PURE EP’s economics are more clear. Under this arrangement, BSGM hope to get paid up front for each placement. It also expects to launch a subscription-based revenue model for the software, opening up another revenue stream.

The issue is that PURE EP’s launch curve comes at incredibly unpredictable timing. BSGM hasn’t generated a cent of product revenue these past 2 quarters, as it repositions in preparation for the commercial rollout. From this point, first revenues are anticipated at the 1st July rollout date, but any income prior to this date would be a positive surprise. BSGM likely has revenue tailwinds set to be realised in H2 FY22, with a ramp up in sales predicted into the coming years pending a successful launch. There’s also good chance that many users are already incorporating the 60-day system, seeing as many have already been evaluating it pre-launch. With more detailed economics afoot, providers may now be first adopters of the system as well.

Our findings indicate momentum here may have already been reflected by the market and may be already priced in. In the days following the update, shares sunk further and there’s been little-to no indication of a reversal from chart studies. This must be heavily factored into the investment debate.

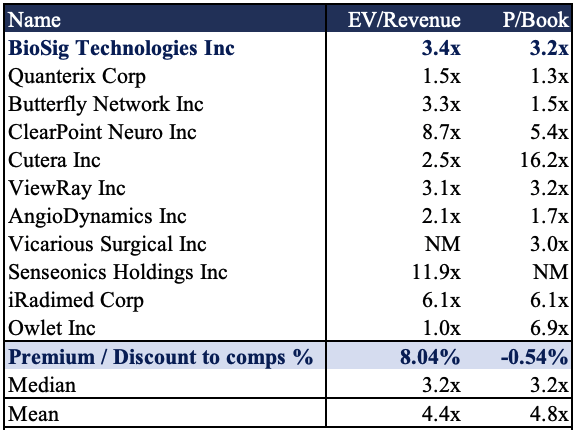

Valuation

Shares are trading at 9x FY22 sales estimates and ~3x FY3 sales estimates in the upside case. Shares are also trading at ~3x book value, and are trading at a substantial premium to the peer group in these measures. Investors also claim $0.22 in cash per share and $0.24 in book value per share – down from $0.80/share in FY20. We’d ideally like to perform a sum of the parts framework on BSGM, but the confluence of macro-headwinds, uncertain market mechanics and the timing of PURE EP’s launch reduces our confidence on the predictability of its future cash flows. Alas, we’ve valued the stock on a forward sales basis. We’ve valued the stock at ~3.5x forward sales after applying a risk-adjustment to current multiples.

Exhibit 2. Multiples & Comps

Data & Image: HB Insights

Assigning our 9x forward sales to our FY22 sales estimates of $3.2 million per share values the stock at $0.80 per share. We’ve actually valued BGSM at ~3.5x forward sales, assigning a risk-adjustment to reflect the uncertainties, as above. This values BSGM at $0.31, implying the stock is substantially overvalued. Setting the same protocol to our FY23 estimates, and discounting this back at 12.5% – a rate that reflects the opportunity cost of holding the SPX + the current yield on long-dated treasuries – see’s us value BGSM at 3.5x FY23 sales of $0.88. From this composite, it appears there’s validity of price targets around the $0.80-$0.90 range, suggesting the stock is fairly valued at its current levels. With little to no upside on offer, this adds to the neutral thesis.

Technical studies

On the charts, trend indicators suggest a lack of bullish momentum and that sellers have the market. Shares have crossed below all MA’s and trade below those key support levels. Shares have broken below cloud support, and on a 6-month cloud chart, have tested the cloud 3x in the last few weeks and failed. This suggests a possible breakout to the downside is looming, by estimation. Shares are tracking lower in continuation of a longer-term downtrend that’s been in situ since December 2021. It hasn’t caught buyers along the way and hence trades at multi-year lows.

Exhibit 3. Trading below cloud support

On balance volume and momentum have also reverted back south after showing signs of potential earlier in May. The reversal further illustrates the fact that bears have it at the moment with BGSM.

Exhibit 4. Trend indicators unsupportive of upside

In short

BSGM lacks the economic pillars required to overcome a large set of macroeconomic and market-specific headwinds, by estimation. The company is set for a period of growth out into the future, but market pundits have punished these high growth/high-beta names in 2022, preferring short duration equities instead. Further, good news around its PURE EP segment is no longer exciting the market, and investors look to have already priced in the impeding upside in BGSM’s PURE EP narrative.

The neutral case is rounded out by lacklustre valuations and a lack of realisable value for shareholders in FCF and earnings. Whilst this could be set to reverse into the future, we aren’t here to sit around and wait whilst the stock continues to get punished and then we are the ones left holding the bag. Active management is paramount in this current market and holding strategies need to reflect this sentiment. That involves directional plays that aren’t just centred on the long side. In that respect, BSGM forms part of a long/short portfolio for active managers. Without flesh to put on the skeleton, we’ve no choice but to rate neutral.

Be the first to comment