metamorworks

Rope-a-Dope1

In 2022, stock and bond investors have been pummeled, losing money in both asset classes for three consecutive quarters, a first in at least 45 years.2 In previous letters, we have discussed our defensive stance, holding “dry powder”3 and remaining disciplined. Yet, as openings occur, we take our shots. We continue to find “money-good”4 bonds and leveraged loans that have attractive yields with potential for additional upside if anticipated events come to pass:

- long-term debt reclassifying to current liabilities

- event-driven corporate actions

- Mergers and acquisitions

- De-leveraging initiatives

- Relief from debt covenant constraints

- potential future takeover targets

Below, we discuss some of the indicators that we are watching closely and describe some of the opportunities we are seeing that should allow us to “punch above our weight.”

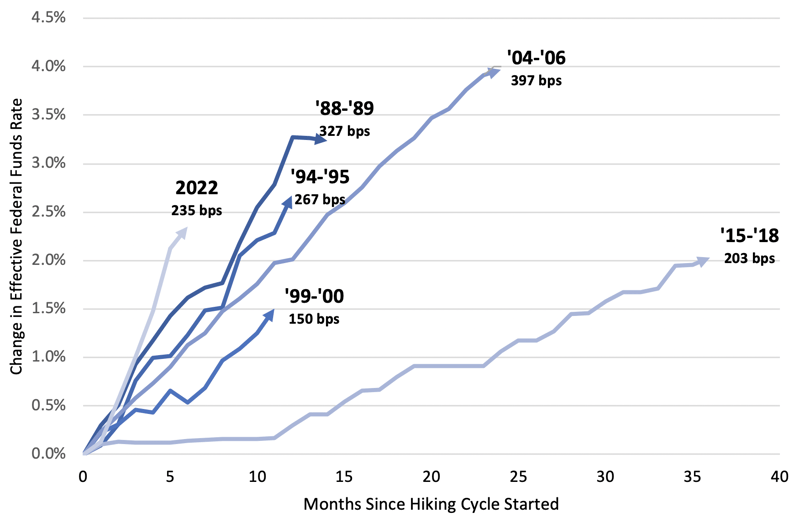

Rapid Rise in Interest Rates

Comparison of Speed of U.S. Interest Rate Hikes5

As the Fed grapples with inflation, which is no longer “transitory,” the financial markets have sold off sharply in response to the most rapid interest rate hikes in recent history. In 2022, the Fed Funds rate rose by 235 basis points in six months with indications that this will continue. The financial markets fear, but may not have fully priced in, the possibility that, ultimately, the Fed’s actions or the geopolitical backdrop will cause something to break.6

With the dramatic rise in rates, we believe the economy will slow, corporate profit margins will shrink, working capital costs will increase and debt service will be more expensive. These factors are concerning, but, more importantly, also create opportunities that may be exploited if patience and diligence are exercised.

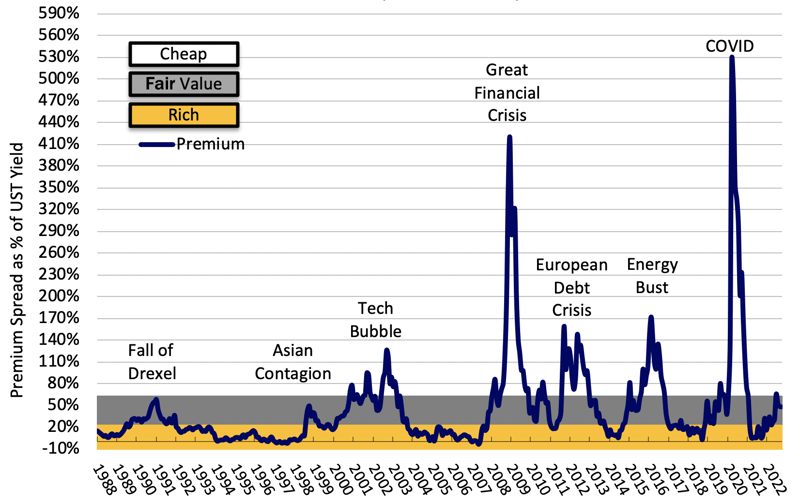

HY Spreads versus Risk Free Rate

Risk Adjusted, After Tax-Premium Spread of High Yield over 10-Year UST (1988 – Current)7

Credit spreads in the high yield market are almost “cheap” as they have widened by approximately 220 basis points to 550 basis points8 since the end of 2021. This is slightly below the 25-year average of 552 basis points,9 leaving room to go wider if unforeseen economic or political events hit the market with a haymaker.10 However, as noted in our 2Q22 letter, a high yield investor who avoided the value destruction in telecom and utility bonds in 2002, a negative year for high yield overall, would have had a positive return for the year.

Similarly, an investor avoiding the deterioration in energy credits in 2015-16 would have experienced far better performance. Looking forward, we are avoiding industries that continue to struggle due to the impact of COVID, such as cruise lines and movie theaters, and those that will be most impacted by rising costs or cyclical risks to demand, including building materials, chemicals and auto parts.

The sharp rise in interest rates and the widely expected resultant recession may also be the “zombie killer”11 that finally forces a wave of restructurings among companies reliant on accommodative capital markets to provide cash infusions to cover interest expense. That said, as a result of the dislocation that has already occurred, there are a lot of quality companies with “money good” debt yielding 7.5-11.5% with maturities in the 1-3-year sweet spot.

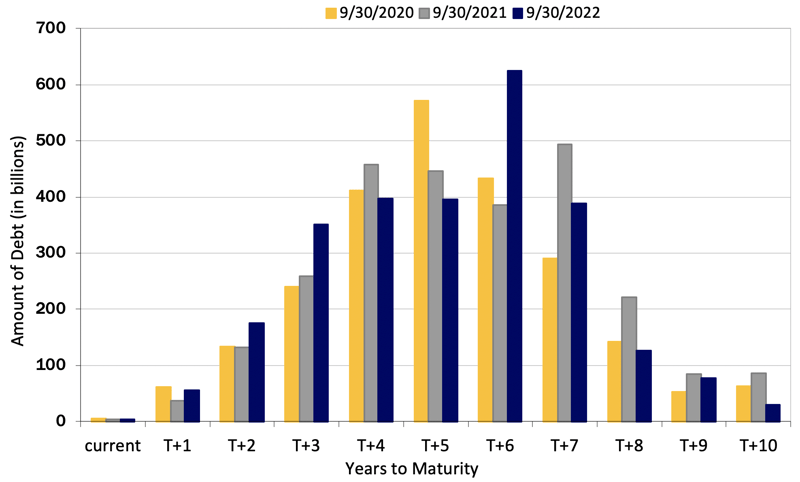

Wall-of-Worry Not So Worrisome

Maturities Moving Out – HY Loans and Bonds12

The rise in rates should have a more muted impact on the high yield market than in previous rate-hike cycles as many borrowers took advantage of the low rates that prevailed in 2020 and 2021 to reduce their borrowing cost and extend maturities. As shown above, in 3Q20, a large portion of the corporate credit market was likely to be faced with the need to refinance debt obligations in the 2024-25 period (i.e. orange bars in T+4 and T+5).

With the new-issuance market very active despite the pandemic, debt coming due in that period has now been reduced significantly (i.e., blue bars in T+2 and T+3) while the bulge in upcoming maturities has been pushed out to 2028 (i.e. blue bar in T+6). Thus, a large portion of high yield issuers completed financings giving them low locked-in borrowing costs for several years. Similarly, many homeowners have benefitted from low interest rate mortgages. Hence the long-awaited distress cycle may be put off a little longer.

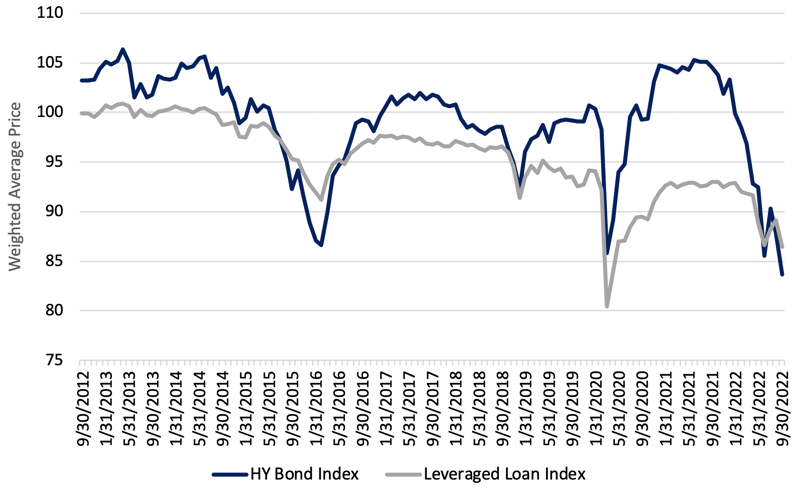

Bonds and Loans Trading at a Discount

ICE BofA HY Index Par Weighted Price vs S&P/LSTA U.S. Leveraged Loan Select Equal Par Value Index13

When interest rates go up, bond prices go down. Consequently, corporate debt is now trading at a discount. The current year has been unusual in that the average bond in the ICE BofA High Yield Index has experienced a price decline of nearly 20 points since the end of 2021 as interest rates have moved up and credit spreads have widened. Such a sharp decline would not be unusual for distressed bonds but, in the absence of a sharp deterioration in credit quality, it is highly unusual.

These discounts create the opportunity for an investor to achieve a return in excess of today’s yield to maturity should a corporate event cause a credit quality upgrade or repayment prior to maturity. Loans are also trading at a discount, but because their interest rates are floating, they have not experienced as much price deterioration as fixed rate bonds. Still, loans trading at a discount may also provide us with opportunities resulting from corporate events.

Where we are taking our shots

While we remain defensive, we are finding opportunities to throw a few “jabs” and “uppercuts” when we see openings. These investments fall into four categories, but in general are premised on events we expect to take place within a relatively short time frame.

Called Bonds and SPACs

Bonds that have been called and are expected to be repaid via refinancing or cash on hand at the end of the call period, typically 30-90 days out. Refinancing among high yield bonds has diminished as the cost of new financing has increased dramatically. However there continues to be a steady flow of investment grade calls and tenders as the “treasury make-whole” call protection,14 which historically resulted in prohibitively expensive call premiums for these bonds, has now fallen to zero.

Thus, the market yield to exit for investment grade bonds has gravitated to about 4.00-5.00%for calls expected to be completed in 2-6 weeks. Meanwhile, the market for the few high yield bonds that are being called has risen to about 4.50-5.50%. This compares to the 2.00% yield to exit that was typical for called high yield bonds as recently as the end of 2021. Similarly, the effective yield on SPACs with liquidation dates up to 9 months has risen to 5.5-6.00%.

Long-term Debt Reclassifying to Current Liabilities

Bonds and loans with maturities 1-2 years out. Once the maturity of these obligations falls within one year, they must be shown on the issuer’s balance sheet as current liabilities, and their auditors must opine on their ability to pay them when they are due. Typically, borrowers prefer to repay or refinance their debt when there is at least one year to maturity to avoid this issue.

GoDaddy (GDDY)

GoDaddy is the “800-pound gorilla” in the web hosting space as its attractive domain pricing and breadth of services has helped make it one of the largest global domain registrars. During the first half of 2022 the company has continued to display operating strength with revenues up over 10% and normalized EBITDA up nearly 25%. Meanwhile they continue to produce significant free cash flow, with over $450mm generated year-to-date. At the top of the capital structure, the first lien term loan has a coupon of LIBOR + 175 basis points and matures in February 2024.

Gross leverage through this loan is approximately 2.5x EBITDA based on estimates for 2022.15 With less than 17 months left to maturity, the loan is a good fit for the CrossingBridge Low Duration High Yield Fund. In their most recent earnings call, the company mentioned that they are evaluating the refinancing of this loan.

Given that it will become a current liability by the end of 1Q23, a near-term repayment would not be surprising. While we wait for that event, we’re enjoying a floating rate coupon providing a 5.56% yield-to-maturity based on the quarter-end price of 99. If company were to repay the loan one year prior to maturity, the annualized rate of return would be approximately 7.80% from the end of 3Q22 to February 15, 2023.

Icahn Enterprise (IEP)

Icahn Enterprises LP, headed by investor Carl Icahn, is a diversified holding company with interests in investments, energy, automotive, food packaging, real estate, home fashion and pharmaceuticals. The investment segment derives revenues from gains and losses from investment transactions. Other operating segments, in most cases, are independently operated businesses obtained through a controlling interest.

As of 2Q22, Icahn Enterprises had Indicative Net Asset Value of $6.6 billion, consolidated debt of $7.1 billion and total liquidity, comprised of cash, investment funds and revolving credit availability, of $7.2 billion. Moreover, as of the end of 3Q22, it had an equity market capitalization of $16.0 billion. Thus, we have no concern regarding credit quality. We have traded in and out of the IEP 4.75% senior unsecured bond, due September 2024, since it was issued in February 2020.

In 3Q22, amidst the downdraft in the high yield market, we were able to purchase these bonds at a yield to maturity over 8.20%, very attractive for a 2-year note with such strong credit quality. Purchased at a discount, the bond would have an even higher annualized total return were the company to redeem it prior to September 15, 2023, when it becomes a current obligation. We expect to continue adding to this position opportunistically.

Event-Driven and Corporate Actions

Bonds and loans that are expected to be repaid as a result of mergers and acquisitions, efforts to de-leverage and/or the desire to remove constraining debt covenants.

Seaspan (OTCPK:SESCF)

Based in Vancouver, B.C., Seaspan is the world’s largest containership lessor with a fleet of 132 vessels comprising 8% of world capacity. It also operates commercial ferries serving Vancouver Island, tug and barge services on Canada’s west coast and shipyards where it builds and repairs ships. The company is the largest asset owned by Atlas Corp (ATCO), an NYSE-listed company with market capitalization of $4.1 billion. In early August 2022, Atlas received a non-binding proposal to take it private via acquisition by Poseidon Acquisition, an entity formed by large shareholders and the Japanese liner giant ONE.

Per the terms of the 6.5% senior unsecured bond due February 2024, de-listing of the parent company would trigger the ability of bondholders to put the bond to the issuer at a price of 101. We were comfortable purchasing the bond after the takeover proposal was announced, because, even if the deal did not go through, the company’s debt (although a bit elevated at 7.0x EBITDA), would be well covered by its high value, critical infrastructure assets that support a gross loan-to-value ratio of only 64%.16

Moreover, we also like the fact that the bonds are the company’s nearest debt maturity, due in early 2024, so that, if the acquisition is not completed, there is a likelihood that it will be repaid in February 2023 when it becomes a current liability, further enhancing return. The CrossingBridge Low Duration High Yield Fund (MUTF:CBLDX) purchased the bond in August at a yield-to-maturity of 6.22%, but with the expectation that the annualized total return will be much higher if the acquisition is completed. Late in 3Q22, it was reported that Poseidon had increased its bid, increasing the probability of a deal. We have continued to purchase the bonds opportunistically in 4Q22.

Clear Channel International BV (CCIBV)

Clear Channel International BV is a subsidiary of Clear Channel Outdoor Holdings, Inc. (CCO), one of the largest operators of out-of-home (OOH) advertising displays in Europe and Singapore. The subsidiary is the issuer of the 6.625% first lien bonds due in August 2025. The OOH industry has benefited from the “re-opening” theme as outdoor ad spend had been impacted by COVID-19 lockdowns, although Clear Channel International revenues have only recently returned to pre-pandemic levels given longer lockdowns and greater exposure to metro ridership outside of the United States.

Short-term contracts provide frequent opportunities to reprice supply in response to inflationary pressures with the added benefit of operating leverage given a high fixed cost base. Clear Channel International generates normalized low- to mid-teens EBITDA margins with high free cash flow conversion. The company’s liquidity profile and long-dated capital structure should allow it to withstand a cyclical downturn. We also appreciate the fact that these bonds are the next maturity in the structure, are secured by a first lien on certain U.K. and Nordic subsidiaries and are structurally senior to the company’s holding company debt.

With respect to potential corporate actions, management has announced their intention to sell Clear Channel’s European business with proceeds allocated towards de-leveraging. This would also be a likely precursor to conversion of parent company Clear Channel Outdoor to a REIT as these assets do not qualify for the preferential tax treatment of that structure. Thus, if the European assets are sold, it likely would result in early retirement of the bonds as the restricted payments covenants prevents the company from up-streaming asset sale proceeds to de-lever the holding company.

In 3Q22, the CrossingBridge Low Duration High Yield Fund and the CrossingBridge Responsible Credit Fund (MUTF:CBRDX) purchased Clear Channel International’s secured bonds at a weighted average yield-to-maturity of 8.94%. With the bonds callable at 101.65 beginning in on February 1, 2023, and trading at approximately 93 as of the end of 3Q22, there is potential for a much higher rate of return if the bonds are called early.

Potential Takeover Targets

Bonds and loans issued by companies with relatively low leverage and high cash flow that, with the dramatic decline in equity valuations, may make them ripe to be acquired. In such an event, there is an increased likelihood of early repayment or improvement in credit quality.

Fiven AS (FIVENA)

Acquired from Saint-Gobain (OTCPK:CODGF) in 2019 by private equity investor OpenGate Capital, Fiven, is a Norway-based global leader in the production of silicon carbide grains and powders. The materials are used in end markets including construction, engineering, automotive, electronics, aerospace, healthcare, energy, etc. We made our original investment in Fiven’s €70 million secured floating rate notes, due June 2024, paying interest at EurIBOR plus 6.85%, when it was issued in June 2021.

Since then, we have traded the bonds several times, most recently in 3Q22 when the CrossingBridge Low Duration High Yield Fund and the CrossingBridge Responsible Credit Fund purchased bonds at a weighted average yield of 8.26%. Since the bond was issued, the company has performed very well with 2022 revenues projected to increase by 52% and EBITDA expected to more than double.17 As a result, net leverage has declined from 2.3x to 1.3x since 2Q21.

Moreover, as a result of strong performance, cash has been building on the balance sheet, yet, due to restrictive covenants in the bond indenture, the company is prohibited from paying dividends to its shareholders. While we are content to hold the bond to maturity given its yield and credit quality, we suspect the private equity sponsor may take steps to prepay the bond as early as the first call date in December 2022 as part of a dividend recap in which it will take out a significant dividend.

G-III Apparel Group (GIII)

G-III Apparel is a global designer, manufacturer and distributor of branded apparel. Owned brands include DKNY and Karl Lagerfeld; licensed brands are headed by Calvin Klein and Tommy Hilfiger. While top line revenue and gross profit margins have largely returned to pre-pandemic levels, the company’s public valuation has traded down to historical lows (~4.4x P/E, 3.8x EV/EBITDA) ahead of recession worries. At these depressed valuations and given low leverage and steady free cash flow generation, we see G-III as a potential target for strategic or private equity acquisition.

In 3Q22, we began establishing a position in G-III’s 7.875% secured bond maturing in 2025, buying at price of 91 for a yield-to-maturity of 11.65%. With gross leverage of 1.3x EBITDA, we are confident in the credit and would be content to hold to maturity. In the event the company is acquired, however, the change of control put at 101% of par would likely accelerate repayment. Likewise, a sale of significant assets might lead to redemption of a portion of or all of the bonds at a price of 100. Thus, we view this investment as an attractive bond with a “call option” for a higher total return if there is an M&A event.

Picking our spots, rolling with the punches, and patiently awaiting the time to come out swinging,

David K. Sherman and the CrossingBridge Team

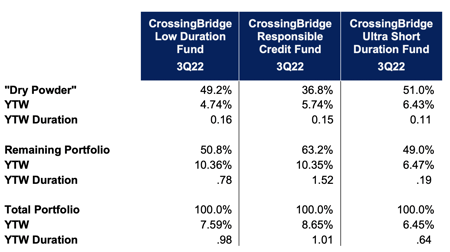

Endnotes:1 “Rope-a-Dope” is a boxing technique in which a fighter leans against the ropes of the boxing ring in a defensive position, allowing his opponent to make non-injuring blows while he looks for opportunities to go on the offensive. Eventually, when the opponent is worn out, the boxer can go on the attack to devastating effect. This strategy is most famously associated with Muhammad Ali in his October 1974 match, staged in Zaire, Africa and dubbed the “Rumble in the Jungle”, against world heavyweight champion George Foreman. Ali vs Foreman – Rope A Dope Explained 2 All Star Charts, allstarcharts.com 3 “Dry powder”, in the context of our portfolios, is defined as cash and investments that are expected to be repaid within 90 days as a result of call, redemption or maturity as well as pre-merger special purpose acquisition corporations (SPACs). The table below reflects dry powder for each CrossingBridge fund as of the end of 3Q22.

4 “Money good” is a term used by CrossingBridge to describe debt it believes will be paid off in full under current market conditions and on a strict priority basis. 5 FRED Economic Data, Federal Reserve Bank of St. Louis Federal Reserve Economic Data | FRED | St. Louis Fed 6 These tensions were discussed in our 1Q22 letter, Locomotive Breath, and our 2Q22 letter, In Flanders Fields. 7 ICE BofA US High Yield Index, ICE BofA 10-Year US Treasury Index. Calculated based on the high yield credit spread, less taxes at a rate of 34%, less 200 basis points of assumed credit losses, divided by the 10-year US Treasury rate. 8 ICE BofA US High Yield Index 9 The graph above uses the high yield spread calculated by subtracting the 10-year Treasury rate from the yield-to-worst of the ICE BofA US High Yield Index. This differs from the index spread to worst, however, which is the index yield-to-worst less the corresponding Treasury rate which varies daily. Actual credit spread data for periods prior to the end of 1996 is limited. 10 A punch thrown with full force and commitment that can be a knockout blow if landed. 11 See our 2Q19 investor letter, Rise of the Living Dead, for a discussion of “zombie companies”. 12 Bank of America Global Research 13 ICE BofA US High Yield Index, S&P/LSTA U.S. Leveraged Loan Select Equal Par Value Index 14 The call premium based on “treasury make-whole” call protection is calculated by discounting all of the scheduled principal and interest payments of the bond by the Treasury rate (plus, typically, 50 or 75 basis points) that corresponds to the bond’s maturity. This premium may not be less than 0 so, if rates rise such that the premium would be negative, the call price is par. 15 Bloomberg, sell-side analyst estimates 16 DNB 10/13/22 17 Crushing expectations, bond looks cheap at 750 bps (Fiven), Pareto Securities, August 29, 2022 |

|

THE PROSPECTUS FOR THE CROSSINGBRIDGE LOW DURATION HIGH YIELD FUND, CROSSINGBRIDGE ULTRA-SHORT DURATION FUND, AND CROSSINGBRIDGE RESPONSIBLE CREDIT FUND CAN BE FOUND BY CLICKING HERE. THE STATEMENT OF ADDITONAL INFORMATION (SAI) CAN BE FOUND BY CLICKING HERE. TO OBTAIN A HARDCOPY OF THE PROSPECTUS, CALL 855-552-5863. PLEASE READ AND CONSIDER THE PROSPECTUS CAREFULLY BEFORE INVESTING. PER RULE 30E-3, THE FISCAL Q1 HOLDINGS AND Q3 HOLDINGS CAN BE FOUND BY CLICKING ON THE RESPECTIVE LINKS. THE PROSPECTUS FOR THE CROSSINGBRIDGE PRE-MERGER SPAC ETF CAN BE FOUND BY CLICKING HERE. THE STATEMENT OF ADDITONAL INFORMATION (SAI) CAN BE FOUND BY CLICKING HERE. TO OBTAIN A HARDCOPY OF THE PROSPECTUS, CALL 800-617-0004. PLEASE READ AND CONSIDER THE PROSPECTUS CAREFULLY BEFORE INVESTING. THE FUNDS ARE OFFERED ONLY TO UNITED STATES RESIDENTS, AND INFORMATION ON THIS SITE IS INTENDED ONLY FOR SUCH PERSONS. NOTHING ON THIS WEBSITE SHOULD BE CONSIDERED A SOLICITATION TO BUY OR AN OFFER TO SELL SHARES OF THE FUND IN ANY JURISDICTION WHERE THE OFFER OR SOLICITATION WOULD BE UNLAWFUL UNDER THE SECURITIES LAWS OF SUCH JURISDICTION. CROSSINGBRIDGE MUTUAL FUNDS’ DISCLOSURE: MUTUAL FUND INVESTING INVOLVES RISK. PRINCIPAL LOSS IS POSSIBLE. INVESTMENTS IN FOREIGN SECURITIES INVOLVE GREATER VOLATILITY AND POLITICAL, ECONOMIC AND CURRENCY RISKS AND DIFFERENCES IN ACCOUNTING METHODS. INVESTMENTS IN DEBT SECURITIES TYPICALLY DECREASE IN VALUE WHEN INTEREST RATES RISE. THIS RISK IS USUALLY GREATER FOR LONGER-TERM DEBT SECURITIES. INVESTMENT IN LOWER-RATED AND NON-RATED SECURITIES PRESENTS A GREATER RISK OF LOSS TO PRINCIPAL AND INTEREST THAN HIGHER-RATED SECURITIES. BECAUSE THE FUND MAY INVEST IN ETFS AND ETNS, THEY ARE SUBJECT TO ADDITIONAL RISKS THAT DO NOT APPLY TO CONVENTIONAL MUTUAL FUND, INCLUDING THE RISKS THAT THE MARKET PRICE OF AN ETF’S AND ETN’S SHARES MAY TRADE AT A DISCOUNT TO ITS NET ASSET VALUE (“NAV”), AN ACTIVE SECONDARY TRADING MARKET MAY NOT DEVELOP OR BE MAINTAINED, OR TRADING MAY BE HALTED BY THE EXCHANGE IN WHICH THEY TRADE, WHICH MAY IMPACT A FUND’S ABILITY TO SELL ITS SHARES. THE VALUE OF ETN’S MAY BE INFLUENCED BY THE LEVEL OF SUPPLY AND DEMAND FOR THE ETN, VOLATILITY AND LACK OF LIQUIDITY. THE FUND MAY INVEST IN DERIVATIVE SECURITIES, WHICH DERIVE THEIR PERFORMANCE FROM THE PERFORMANCE OF AN UNDERLYING ASSET, INDEX, INTEREST RATE OR CURRENCY EXCHANGE RATE. DERIVATIVES CAN BE VOLATILE AND INVOLVE VARIOUS TYPES AND DEGREES OF RISKS, AND, DEPENDING UPON THE CHARACTERISTICS OF A PARTICULAR DERIVATIVE, SUDDENLY CAN BECOME ILLIQUID. INVESTMENTS IN ASSET BACKED, MORTGAGE BACKED, AND COLLATERALIZED MORTGAGE BACKED SECURITIES INCLUDE ADDITIONAL RISKS THAT INVESTORS SHOULD BE AWARE OF SUCH AS CREDIT RISK, PREPAYMENT RISK, POSSIBLE ILLIQUIDITY AND DEFAULT, AS WELL AS INCREASED SUSCEPTIBILITY TO ADVERSE ECONOMIC DEVELOPMENTS. INVESTING IN COMMODITIES MAY SUBJECT THE FUND TO GREATER RISKS AND VOLATILITY AS COMMODITY PRICES MAY BE INFLUENCED BY A VARIETY OF FACTORS INCLUDING UNFAVORABLE WEATHER, ENVIRONMENTAL FACTORS, AND CHANGES IN GOVERNMENT REGULATIONS. SHARES OF CLOSED-END FUND FREQUENTLY TRADE AT A PRICE PER SHARE THAT IS LESS THAN THE NAV PER SHARE. THERE CAN BE NO ASSURANCE THAT THE MARKET DISCOUNT ON SHARES OF ANY CLOSED-END FUND PURCHASED BY THE FUND WILL EVER DECREASE OR THAT WHEN THE FUND SEEK TO SELL SHARES OF A CLOSED-END FUND IT CAN RECEIVE THE NAV OF THOSE SHARES. THERE ARE GREATER RISKS INVOLVED IN INVESTING IN SECURITIES WITH LIMITED MARKET LIQUIDITY. CROSSINGBRIDGE PRE-MERGER SPAC ETF DISCLOSURE: INVESTING INVOLVES RISK; PRINCIPAL LOSS IS POSSIBLE. THE FUND INVESTS IN EQUITY SECURITIES AND WARRANTS OF SPACS. PRE-COMBINATION SPACS HAVE NO OPERATING HISTORY OR ONGOING BUSINESS OTHER THAN SEEKING COMBINATIONS, AND THE VALUE OF THEIR SECURITIES IS PARTICULARLY DEPENDENT ON THE ABILITY OF THE ENTITY’S MANAGEMENT TO IDENTIFY AND COMPLETE A PROFITABLE COMBINATION. THERE IS NO GUARANTEE THAT THE SPACS IN WHICH THE FUND INVESTS WILL COMPLETE A COMBINATION OR THAT ANY COMBINATION THAT IS COMPLETED WILL BE PROFITABLE. UNLESS AND UNTIL A COMBINATION IS COMPLETED, A SPAC GENERALLY INVESTS ITS ASSETS IN U.S. GOVERNMENT SECURITIES, MONEY MARKET SECURITIES, AND CASH. PUBLIC STOCKHOLDERS OF SPACS MAY NOT BE AFFORDED A MEANINGFUL OPPORTUNITY TO VOTE ON A PROPOSED INITIAL COMBINATION BECAUSE CERTAIN STOCKHOLDERS, INCLUDING STOCKHOLDERS AFFILIATED WITH THE MANAGEMENT OF THE SPAC, MAY HAVE SUFFICIENT VOTING POWER, AND A FINANCIAL INCENTIVE, TO APPROVE SUCH A TRANSACTION WITHOUT SUPPORT FROM PUBLIC STOCKHOLDERS. AS A RESULT, A SPAC MAY COMPLETE A COMBINATION EVEN THOUGH A MAJORITY OF ITS PUBLIC STOCKHOLDERS DO NOT SUPPORT SUCH A COMBINATION. SOME SPACS MAY PURSUE COMBINATIONS ONLY WITHIN CERTAIN INDUSTRIES OR REGIONS, WHICH MAY INCREASE THE VOLATILITY OF THEIR PRICES. THE FUND MAY INVEST IN SPACS DOMICILED OR LISTED OUTSIDE OF THE U.S., INCLUDING, BUT NOT LIMITED TO, CANADA, THE CAYMAN ISLANDS, BERMUDA AND THE VIRGIN ISLANDS. INVESTMENTS IN SPACS DOMICILED OR LISTED OUTSIDE OF THE U.S. MAY INVOLVE RISKS NOT GENERALLY ASSOCIATED WITH INVESTMENTS IN THE SECURITIES OF U.S. SPACS, SUCH AS RISKS RELATING TO POLITICAL, SOCIAL, AND ECONOMIC DEVELOPMENTS ABROAD AND DIFFERENCES BETWEEN U.S. AND FOREIGN REGULATORY REQUIREMENTS AND MARKET PRACTICES. FURTHER, TAX TREATMENT MAY DIFFER FROM U.S. SPACS AND SECURITIES MAY BE SUBJECT TO FOREIGN WITHHOLDING TAXES. SMALLER CAPITALIZATION SPACS WILL HAVE A MORE LIMITED POOL OF COMPANIES WITH WHICH THEY CAN PURSUE A BUSINESS COMBINATION RELATIVE TO LARGER CAPITALIZATION COMPANIES. THAT MAY MAKE IT MORE DIFFICULT FOR A SMALL CAPITALIZATION SPAC TO CONSUMMATE A BUSINESS COMBINATION. BECAUSE THE FUND IS NON-DIVERSIFIED IT MAY INVEST A GREATER PERCENTAGE OF ITS ASSETS IN THE SECURITIES OF A SINGLE ISSUER OR A SMALLER NUMBER OF ISSUERS THAN IF IT WERE A DIVERSIFIED FUND. AS A RESULT, A DECLINE IN THE VALUE OF AN INVESTMENT IN A SINGLE ISSUER COULD CAUSE THE FUND’S OVERALL VALUE TO DECLINE TO A GREATER DEGREE THAN IF THE FUND HELD A MORE DIVERSIFIED PORTFOLIO. EQUITIES ARE GENERALLY PERCEIVED TO HAVE MORE FINANCIAL RISK THAN BONDS IN THAT BOND HOLDERS HAVE A CLAIM ON FIRM OPERATIONS OR ASSETS THAT IS SENIOR TO THAT OF EQUITY HOLDERS. IN ADDITION, STOCK PRICES ARE GENERALLY MORE VOLATILE THAN BOND PRICES. INVESTMENTS IN DEBT SECURITIES TYPICALLY DECREASE IN VALUE WHEN INTEREST RATES RISE AND THIS RISK IS USUALLY GREATER FOR LONGER-TERM DEBT SECURITIES. BONDS ARE OFTEN OWNED BY INDIVIDUALS INTERESTED IN CURRENT INCOME WHILE STOCKS ARE GENERALLY OWNED BY INDIVIDUALS SEEKING PRICE APPRECIATION WITH INCOME A SECONDARY CONCERN. THE TAX TREATMENT OF RETURNS OF BONDS AND STOCKS ALSO DIFFERS GIVEN DIFFERENTIAL TAX TREATMENT OF INCOME VERSUS CAPITAL GAIN. DEFINITIONS: THE S&P 500, OR SIMPLY THE S&P, IS A STOCK MARKET INDEX THAT MEASURES THE STOCK PERFORMANCE OF 500 LARGE COMPANIES LISTED ON STOCK EXCHANGES IN THE UNITED STATES. THE ICE BOFA INVESTMENT GRADE/COPORATE BOND INDEX TRACKS THE PERFORMANCE OF US DOLLAR DENOMINATED INVESTMENT GRADE RATED CORPORATE DEBT PUBLICALLY ISSUED IN THE US DOMESTIC MARKET. THE ICE BOFA 1-3 YEAR CORPORATE BOND INDEX IS A SUBSET OF THE ICE BOFA US CORPORATE BOND INDEX TRACKING THE PERFORMANCE OF US DOLLAR DENOMINATED INVESTMENT GRADE RATED CORPORATE DEBT PUBLICLY ISSUED IN THE US DOMESTIC MARKET. THIS SUBSET INCLUDES ALL SECURITIES WITH A REMAINING TERM TO MATURITY OF LESS THAN 3 YEARS. THE ICE BOFA HIGH YIELD INDEX TRACKS THE PERFORMANCE OF US DOLLAR DENOMINATED BELOW INVESTMENT GRADE RATED CORPORATE DEBT PUBLICALLY ISSUED IN THE US DOMESTIC MARKET. EBITDA IS A COMPANY’S EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION, AND AMORTIZATION IS AN ACCOUNTING MEASURE CALCULATED USING A COMPANY’S EARNINGS, BEFORE INTEREST EXPENSES, TAXES, DEPRECIATION, AND AMORTIZATION ARE SUBTRACTED, AS A PROXY FOR A COMPANY’S CURRENT OPERATING PROFITABILITY. A BASIS POINT (BP) IS 1/100 OF ONE PERCENT. PARI-PASSU IS A LATIN TERM THAT MEANS ‘ON EQUAL FOOTING’ OR ‘RANKING EQUALLY’. IT IS AN IMPORTANT CLAUSE FOR CREDITORS OF A COMPANY IN FINANCIAL DIFFICULTY WHICH MIGHT BECOME INSOLVENT. IF THE COMPANY’S DEBTS ARE PARI PASSU, THEY ARE ALL RANKED EQUALLY, SO THE COMPANY PAYS EACH CREDITOR THE SAME AMOUNT IN INSOLVENCY. LIBOR IS THE AVERAGE INTERBANK INTEREST RATE AT WHICH A SELECTION OF BANKS ON THE LONDON MONEY MARKET ARE PREPARED TO LEND TO ONE ANOTHER. YIELD TO MATURITY (YTM) IS THE TOTAL RETURN ANTICIPATED ON A BOND (ON AN ANNUALIZED BASIS) IF THE BOND IS HELD UNTIL IT MATURES. YIELD TO WORST (YTW) IS A MEASURE OF THE LOWEST POSSIBLE YIELD (ON AN ANNUALIZED BASIS) THAT CAN BE RECEIVED ON A BOND THAT FULLY OPERATES WITHIN THE TERMS OF ITS CONTRACT WITHOUT DEFAULTING. FREE CASH FLOW (FCF) IS THE CASH A COMPANY PRODUCES THROUGH ITS OPERATIONS, LESS THE COST OF EXPENDITURES ON ASSETS. IN OTHER WORDS, FREE CASH FLOW IS THE CASH LEFT OVER AFTER A COMPANY PAYS FOR ITS OPERATING EXPENSES AND CAPITAL EXPENDITURES. DURATION IS A MEASURE OF THE SENSITIVITY OF THE PRICE OF A BOND OR OTHER DEBT INSTRUMENT TO A CHANGE IN INTEREST RATES. DEBTOR-IN-POSSESSION (DIP) FINANCING IS A SPECIAL KIND OF FINANCING MEANT FOR COMPANIES THAT ARE IN BANKRUPTCY. ONLY COMPANIES THAT HAVE FILED FOR BANKRUPTCY PROTECTION UNDER CHAPTER 11 ARE ALLOWED TO ACCESS DIP FINANCING, WHICH USUALLY HAPPENS AT THE START OF A FILING. DIP FINANCING IS USED TO FACILITATE THE REORGANIZATION OF A DEBTOR-IN-POSSESSION (THE STATUS OF A COMPANY THAT HAS FILED FOR BANKRUPTCY) BY ALLOWING IT TO RAISE CAPITAL TO FUND ITS OPERATIONS AS ITS BANKRUPTCY CASE RUNS ITS COURSE. YIELD TO CALL (YTC) REFERS TO THE RETURN A BONDHOLDER RECEIVES IF THE BOND IS HELD UNTIL THE CALL DATE, WHICH OCCURS SOMETIME BEFORE IT REACHES MATURITY. THE DOW JONES INDUSTRIAL AVERAGE, DOW JONES, OR SIMPLY THE DOW, IS A PRICE-WEIGHTED MEASUREMENT STOCK MARKET INDEX OF 30 PROMINENT COMPANIES LISTED ON STOCK EXCHANGES IN THE UNITED STATES. THE NASDAQ COMPOSITE IS A STOCK MARKET INDEX THAT INCLUDES ALMOST ALL STOCKS LISTED ON THE NASDAQ STOCK EXCHANGE. ALONG WITH THE DOW JONES INDUSTRIAL AVERAGE AND S&P 500, IT IS ONE OF THE THREE MOST-FOLLOWED STOCK MARKET INDICES IN THE UNITED STATES. ETF DEFINITIONS: THE ICE BOFA 0-3 YEAR U.S. TREASURY INDEX TRACKS THE PERFORMANCE OF U.S. DOLLAR DENOMINATED SOVEREIGN DEBT PUBLICLY ISSUED BY THE US GOVERNMENT IN ITS DOMESTIC MARKET WITH MATURITIES LESS THAN THREE YEARS. GROSS SPREAD IS THE AMOUNT BY WHICH A SPAC IS TRADING AT A DISCOUNT OR PREMIUM TO ITS PRO RATA SHARE OF THE COLLATERAL TRUST VALUE. FOR EXAMPLE, IF A SPAC IS TRADING AT $9.70 AND SHAREHOLDERS’ PRO RATA SHARE OF THE TRUST ACCOUNT IS $10.00/SHARE, THE SPAC HAS A GROSS SPREAD OF 3% (TRADING AT A 3% DISCOUNT). YIELD TO LIQUIDATION: SIMILAR TO A BOND’S YIELD TO MATURITY, SPACS HAVE A YIELD TO LIQUIDATION/REDEMPTION, WHICH CAN BE CALCULATED USING THE GROSS SPREAD AND TIME TO LIQUIDATION. MATURITY: SIMILAR TO A BOND’S MATURITY DATE, SPACS ALSO HAVE A MATURITY, WHICH IS THE DEFINED TIME PERIOD IN WHICH THEY HAVE TO COMPLETE A BUSINESS COMBINATION. THIS IS REFERRED TO AS THE LIQUIDATION OR REDEMPTION DATE. PRICE REFERS TO THE PRICE AT WHICH THE ETF IS CURRENTLY TRADING. WEIGHTED AVERAGE LIFE REFERS TO THE WEIGHTED AVERAGE TIME UNTIL A PORTFOLIO OF SPACS’ LIQUDATION OR REDEMPTION DATES. FUND HOLDINGS AND SECTOR ALLOCATIONS ARE SUBJECT TO CHANGE AND SHOULD NOT BE CONSIDERED RECOMMENDATIONS TO BUY OR SELL ANY SECURITY. ANY DIRECT OR INDIRECT REFERENCE TO SPECIFIC SECURITIES, SECTORS, OR STRATEGIES ARE PROVIDED FOR ILLUSTRATIVE PURPOSES ONLY. WHEN PERTAINING TO COMMENTARIES POSTED BY CROSSINGBRIDGE, IT REPRESENTS THE PORTFOLIO MANAGER’S OPINION AND IS AN ASSESSMENT OF THE MARKET ENVIRONMENT AT A SPECIFIC TIME AND IS NOT INTENDED TO BE A FORECAST OF FUTURE EVENTS OR A GUARANTEE OF FUTURE RESULTS. THIS INFORMATION SHOULD NOT BE RELIED UPON BY THE READER AS RESEARCH OR INVESTMENT ADVICE REGARDING THE FUND OR ANY SECURITY IN PARTICULAR. SPECIFIC PERFORMANCE OF ANY SECURITY MENTIONED IS AVAILABLE UPON REQUEST. ANY PERFORMANCE DATA QUOTED REPRESENTS PAST PERFORMANCE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS. THE INVESTMENT RETURN AND PRINCIPAL VALUE OF AN INVESTMENT WILL FLUCTUATE SO THAT AN INVESTOR’S SHARES, WHEN REDEEMED, MAY BE WORTH MORE OR LESS THAN THEIR ORIGINAL COST. CURRENT PERFORMANCE MAY BE LOWER OR HIGHER THAN THE PERFORMANCE QUOTED. PERFORMANCE DATA CURRENT TO THE MOST RECENT MONTH END MAY BE OBTAINED BY CALLING 914-741-9600. PLEASE CLICK HERE FOR CURRENT STANDARDIZED PERFORMANCE AS OF THE MOST RECENT QUARTER-END. DIVERSIFICATION DOES NOT ASSURE A PROFIT NOR PROTECT AGAINST LOSS IN A DECLINING MARKET. A STOCK IS A TYPE OF SECURITY THAT SIGNIFIES OWNERSHIP IN A CORPORATION AND REPRESENTS A CLAIM ON PART OF THE CORPORATION’S ASSETS AND EARNINGS. A BOND IS A DEBT INVESTMENT IN WHICH AN INVESTOR LOANS MONEY TO AN ENTITY THAT BORROWS THE FUNDS FOR A DEFINED PERIOD OF TIME AT A FIXED INTEREST RATE. A HEDGE FUND IS A PRIVATE INVESTMENT VEHICLE THAT MAY EXECUTE A WIDE VARIETY OF INVESTMENT STRATEGIES USING VARIOUS FINANCIAL INSTRUMENTS. A STOCK MAY TRADE WITH MORE OR LESS LIQUIDITY THAN A BOND DEPENDING ON THE NUMBER OF SHARES AND BONDS OUTSTANDING, THE SIZE OF THE COMPANY, AND THE DEMAND FOR THE SECURITIES. THE SECURITIES AND EXCHANGE COMMISSION (SEC) DOES NOT APPROVE, ENDORSE, NOR INDEMNIFY ANY SECURITY. TAX FEATURES MAY VARY BASED ON PERSONAL CIRCUMSTANCES. CONSULT A TAX PROFESSIONAL FOR ADDITIONAL INFORMATION.THE CROSSINGBRIDGE ULTRA-SHORT DURATION FUND, LOW DURATION HIGH YIELD FUND, AND RESPONSIBLE CREDIT FUND ARE DISTRIBUTED BY QUASAR DISTRIBUTORS, LLC. THE CROSSINGBRIDGE PRE-MERGER SPAC ETF IS DISTRIBUTED BY FORESIDE FUND SERVICES, LLC. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment