SasinParaksa/iStock via Getty Images

Metropolitan Bank Holdings Corp. (NYSE:MCB) remains on solid footing amidst inflationary pressures. Its sensitivity to interest rate changes allows it to generate more revenues from its diverse loan portfolio. It remains one of the fastest-growing banks with the stable loan and deposit streams. But it must be careful with interest-bearing deposits to manage its interest expense better. Cryptocurrencies are also another concern today as their prices continue to plunge. It must brace for many withdrawals since it handles millions for its crypto clients. Fortunately, it has a strong balance sheet that allows it to outlast uncertainties. This aspect makes it an ideal investment along with its discounted stock price.

A Formidable Bank

Metropolitan Bank Holding Corp. faces challenges – the Omicron fears, geopolitical disturbances in Ukraine, and inflationary pressures, to name a few. They are disruptive, especially for those who failed to anticipate them. But MCB exhibits its feral alertness to thwart or cushion the blow of market disruptions. It strengthens its financial position while driving viability and shareholder value.

But what drives its continued success is its impressive liquidity position. It handles its loans and deposits well to generate more revenues while keeping expenses low. Its low-cost deposits allow it to keep its reserves stable while becoming more viable. Moreover, it has already beefed up its balance sheet with its recent share issuance. It now has a larger capital base, which helps it sustain its growing operations. It is another factor that helps it maintain high liquidity. From there, we can see that it leverages its equity and excess liquidity for more income and returns. It remains fruitful, given its impressive revenue growth and operating margin.

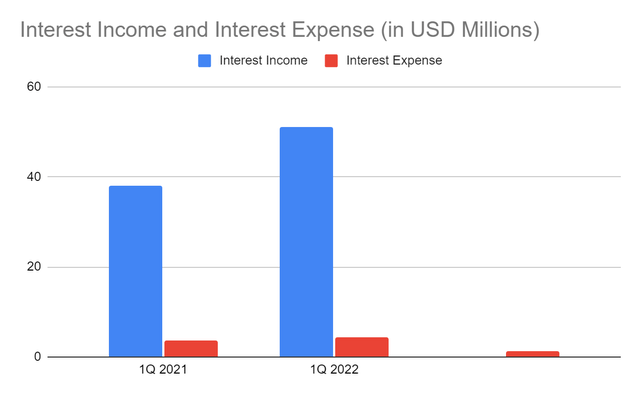

This quarter, its operating revenue in terms of interest income amounts to $50.97 million. It is a massive year-over-year growth from its value in 1Q 2021. Thanks to the strategic location of its banking centers. It helps it generate a stable deposit stream and diversify its loan portfolio with impressive yields. It also uses its capital to make prudent investments, which give satisfying returns. But the increase is driven mainly by its high-yielding loans from $3.2 billion to $4.08 billion. It is indeed nice to see that a 26% increase in loans generates a 34% increase in interest income.

Interest Income and Interest Expense (MarketWatch)

Consequently, interest expenses are higher due to the increased interest-bearing deposits. Note that the company has a high sensitivity to interest rate changes. Both loans and deposits are yielding interest. Even so, it remains profitable since it benefits more from the increase in interest rates. The increase in loans has more impact than the increase in interest-bearing deposits. So, its net interest margin before loan provisions is 91% vs 90%. If provisions are included, the net interest margin will be 84% vs 87%. It is logical, given that higher loans entail higher provisions.

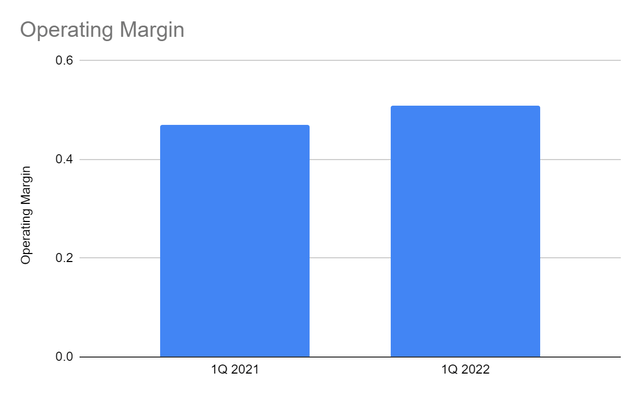

Even better, its non-interest segment remains manageable. Its fees and commissions increase in line with its higher labor and equipment expenses. It has more demand, allowing it to charge strategic service and commission fees. That is why it keeps the threat of inflationary pressures at bay. Overall, its core operations are solid and intact. The operating margin is now 51% vs 47%.

Operating Margin (MarketWatch)

External Pressures

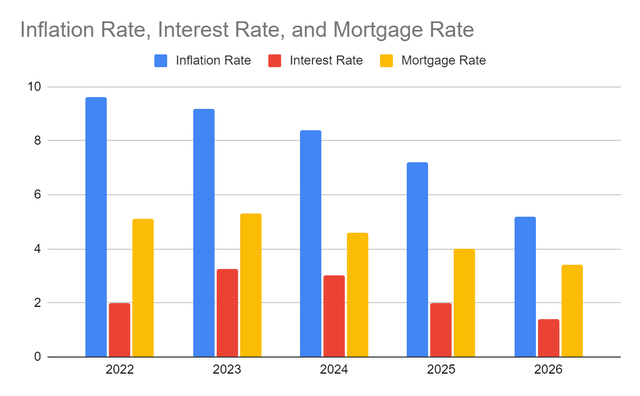

MCB continues to present its efficient asset management and strong capital base. But it has to keep a keener eye on inflation, given that it has already exceeded our expectations. Although it benefits from higher interest rates, it must be extra cautious. Prices are on the rise with stronger momentum. Today, the high-flying inflation rate is 8.6%. That is why I am raising my estimation of the inflation rate from 8.8% to 9.6%.

In turn, a series of interest hikes by the Fed may also exceed our initial expectations. From the initial projection of 0.75-1.00%, it rose to 3.00-3.25%. Now, the Fed raises the rates again by 75 bps. It is no surprise that the estimation of interest rates further increases to 3.25-3.50%. Mortgage rates may even go up to 4.80-5.50%. It must be more careful with its loans and deposits since it has a huge concentration on commercial real estate loans. The high amount of commercial loans for healthcare may also pose risks associated with geographical and sectoral downtrends.

Inflation Rate, Interest Rate, and Mortgage Rate (Author Estimation, Barron’s, and Forbes)

Moreover, it must watch out for the fluctuations in the crypto market. Popular cryptocurrencies, such as Bitcoin (BTC-USD) and Ethereum (ETH-USD) are taking a nosedive. The downtrend has become steeper that analysts have already drawn a line in the sand. But the problem is, the current prices are approaching it. It must be more careful, given the potential millions of crypto withdrawals.

Fortunately, it maintains profitable core operations with an excellent liquidity position. Many employees are getting rehired with a higher minimum hourly wage of $27.33. The unemployment rate is also low and stable at 3.6%. As such, the capacity to save, invest, and pay borrowings is higher today. In fact, surveys show that 43% of Americans intend to increase their savings this year. With more finances, MCB may capture more banked and unbanked people.

Why Metropolitan Bank Holding Corp. May Stay Afloat

Metropolitan Bank Holding Corp. remains durable amidst macroeconomic pressures. Its operations are impressive, which leads to higher returns and cash flows. Its strategic location is what makes it a popular and fast-growing bank. But it is the balance sheet that helps it flourish more.

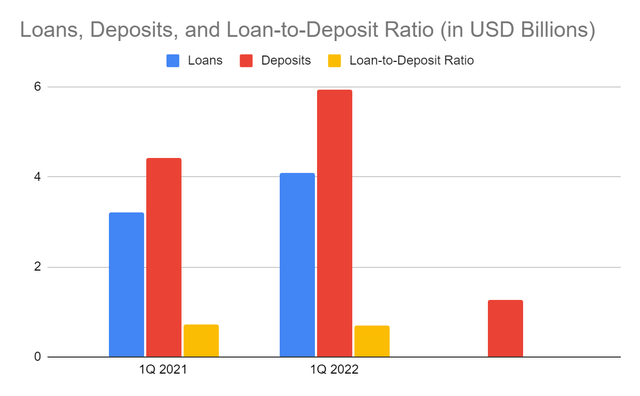

As discussed, it handles its deposits and diversifies its loan portfolio very well. These high-yielding loans and low-cost deposits are its primary growth drivers. Even better is that its loan-to-deposit ratio remains low at 68% vs 72%. It can tell that it has more room to maximize its capacity and generate more returns. It may be possible, given that it is sensitive to interest rate changes. But it is conservative at the same time, which is also a wise move. Note that it concentrates mainly on the commercial real estate and healthcare sectors. These types of loans are high-yielding, which may be the reason for their impressive interest income. But they are also susceptible to risks associated with geographical and sectoral troughs. That is why the company has a lot of reserves when there are defaults. Also, the potential wave of crypto withdrawals is well-covered.

Loans, Deposits, and Loan-to-Deposit Ratio (MarketWatch)

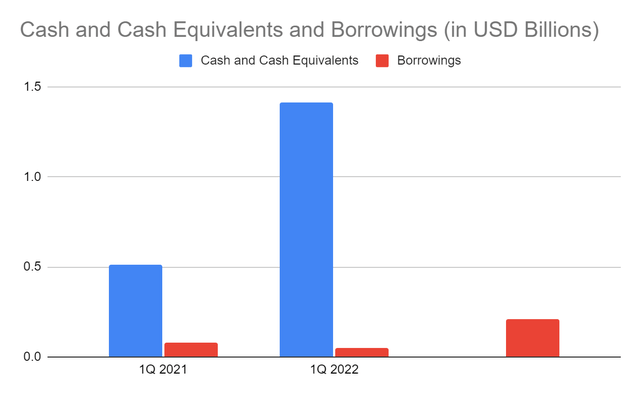

Moreover, it has stable and high cash and overnight deposit levels. Currently, its cash and deposits comprise over 20% of the total assets. So, the company is very liquid and can cover borrowings even in a single payment. Even better, 15% of its assets are composed of investments as part of its liquidity initiatives

Cash and Cash Equivalents and Borrowings (MarketWatch)

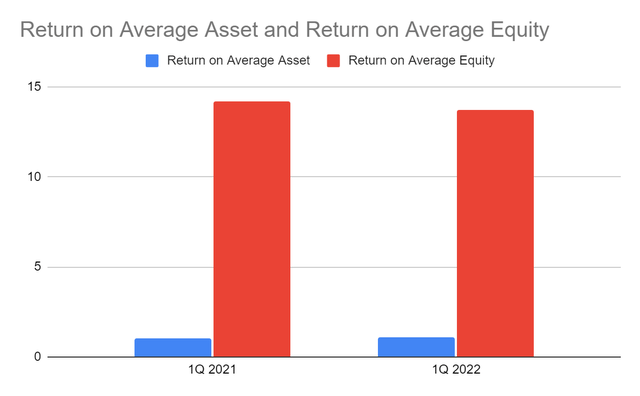

Indeed, most of its assets are generating high returns. Over 90% are from loans, cash, deposits, and investments. The prudent diversification of its high-yielding portfolio and investments are fruitful. It is no surprise that it remains viable and sustainable. Its ROAA is 1.12% vs 1.05% while its ROAE is 13.7% vs 14.2% due to its share issuance.

Stock Price Assessment

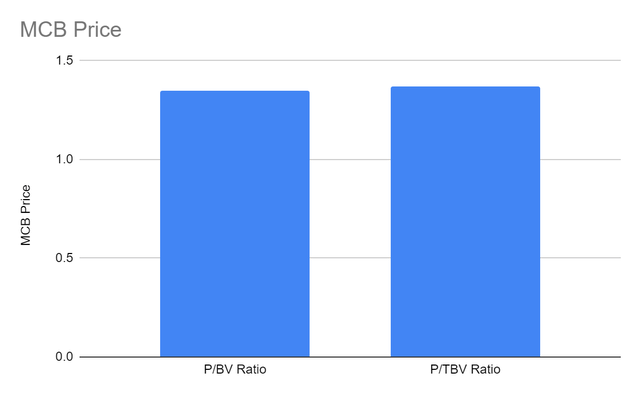

The stock price of Metropolitan Bank Holding Corp. has been decreasing since the start of the year. At $68.49, it has already been cut by 35% from the starting price. But the book value and TBV show that it still has a valuation, setting the correct price at $50-55. That may be the reason the price keeps decreasing, aside from macroeconomic pressures.

Personally, the price is a very good bargain. Its current P/TB of 1.35 and P/TBV of 1.37 is a massive decrease from the book value in the last twelve months. If we use the current price to assess their book value, the P/TB of 1.64 and P/TBV of 1.69 are still higher. The improvement in BV and TBV is over 20% which is far higher than other small to mid-sized banks. Also, the PE ratio of 10.24 shows its earnings are high relative to the stock price. To assess it better, we may use the DCF model.

- FCFF – $45,802,000

- Cash – $32,483,000

- Borrowings – $53,239,000

- Perpetual Growth Rate – 4.2%

- WACC – 8.8%

- Common Shares Outstanding – 10,932,000

- Stock Price – $68.49

- Derived Value – $97.80

The derived value confirms the potential undervaluation. There may be an upside of 42% in the next 12-24 months. This price is still logical, given the enticing growth prospects of the company.

Bottom Line

Metropolitan Bank Holding Corp. remains robust, stable, and liquid amidst external pressures. Its borrowings and deposits are well-covered by its stable cash levels. The excellent fundamentals prove that it is still a solid investment. Also, the stock price is at a good entry point. The recommendation is that Metropolitan Bank Holding Corp. is a buy.

Be the first to comment