JHVEPhoto/iStock Editorial via Getty Images

Shopify Inc. (NYSE:SHOP) is under heavy fire for lower projected growth, which is odd to me. This is because the growth is still there, it’s just not going to be at the rate investors got used to over the last two years, which everyone knew were going to be outliers given the global pandemic. Did this many people actually think what was going on in 2020 and 2021 was going to be the new normal? That we would never visit stores in person again and malls would be dead as we know it?

Obviously, this isn’t the only factor at play that has caused the 60% haircut in share price, but it seems to be a resounding theme. So the question I ponder is, what growth rate is acceptable? Analysts seem to still believe we will see 30%+ revenue growth over the next few years, and as long as I have been doing this, that’s usually enough to keep investors invested. Especially for a company with a share price worth as much as Shopify’s is. Therefore, I do think this is an opportunity.

What Do I Like About Shopify?

Maybe I am completely out to lunch here, but I think the company is extremely attractive at current levels. We can look at P/E, PEG, and PB ratios all we want, but those haven’t mattered to investors for years. If they are coming back in favor, then there is still a lot to unwind here in the entire sector. Not just concerning Shopify.

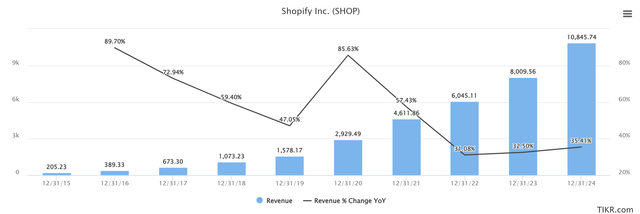

What I do know about Shopify, and I led onto it earlier, is that the growth isn’t going anywhere. Yes, we saw 85% revenue growth in 2020 as the world was scared into hibernation, and that was followed up with 57% growth in 2021. But, let’s not forget that we are now talking about a company bringing in an expected $6.05 billion in revenue in 2022. Naturally, we would expect growth to slow. Looking below, we can get an idea of what investors are looking at and why they could be unhappy. But in all reality, the future looks extremely attractive as far as I can see.

The one red flag for 2022 is the projected EPS. We could see it fall to $3.36, which would be a 48% drop from the $6.41 we saw get posted in 2021. The good news is it will be short-lived, as analysts project it to come back to $12.43 by 2025. To me, this just seems like investors are shocked at just how much growth targets are decreasing, which I would have thought was obvious. If only I put my money where my mind was!

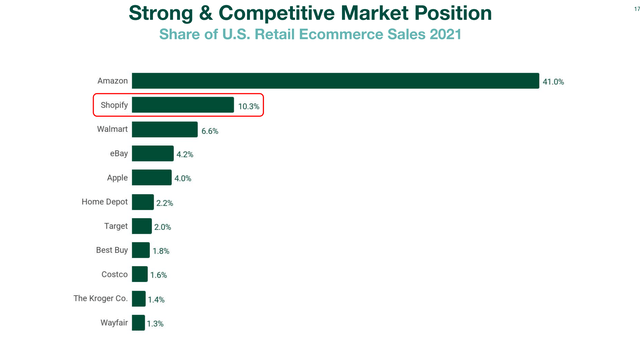

The long-term thesis behind Shopify is the belief in e-commerce. We are looking at a market that could be worth as much as $6 trillion by 2024. Now, that is on a global scale, but nonetheless, to be a fairly big player in that market is a good spot to be. With respect to U.S e-commerce, Shopify has been the second-largest player for several years now, but they continue to grow. Looking below, we can see that Amazon (AMZN) continues to run away with the race at 41% of the market, but Shopify is now sitting in double digits as they gained 1.7% of market share to get up to 10.3% in 2021.

Now, if you isolate this to e-commerce software, you will see that Shopify controls 29% of the market. The next closest are WooCommerce Checkout (23%) and Wix Stores (WIX) (14%). I do not see a reason why they would lose any further share. I fully believe that based on their current projections it’s only going to continue to grow from here.

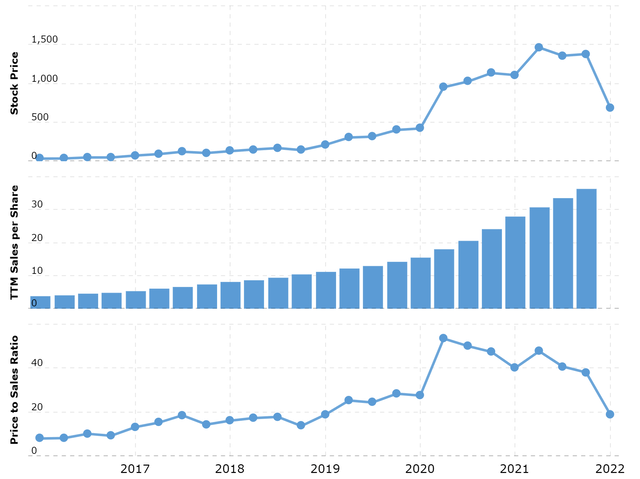

Just for fun, let me look at how the market valuation (old school way) looks. I mentioned they don’t really matter a lot, and that’s because only a few shorts months ago, we saw a Price to Sales (P/S) sitting at ~50x. Now, we see it sit around 18-19x. Has that solved the issue? Some may argue yes, but it doesn’t explain why it ran up so much in the first place if it matters that much to investors. I personally chalk it up to momentum. Realistically speaking, even 18x is too high if we’re playing this purely on fundamentals.

If you liked Shopify at $1700, then you should love it at $670. Nothing has changed. The company is going to continue to grow, and continue to make everyone’s lives easier. While the fundamentals may say it’s still trading at a premium, it’s hard to believe the bottom is not in given the projected growth coming in future years. Like it or not, e-commerce isn’t slowing down.

What Does The Price Say?

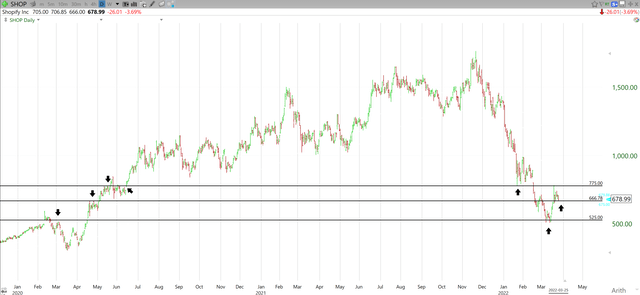

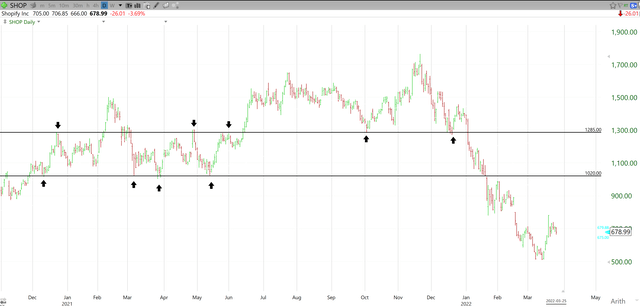

As far as the technicals go, Shopify has played to a T. In early February when I wrote about Shopify being at a pivot point, I posted the below chart with the 3 levels to watch. Well, sure enough, every single line has come into play. This allowed me to pick some shares up under $575 as the stock bounced off my target line twice putting in a double bottom.

Shortly after we saw $666.78 blown through, and a test at $775 that was rejected. As we stand now, we are using $666.78 as support. I was forced to trim some as the stock rocketed up on the 18th to secure profits, but my current stop on what’s left of these shares is sitting at $625.87 as I would love to hold this for the long term and I would look to add if we can get a good bounce off of support.

It goes without saying that if we do break my stop and test $525 once again, I would look to buy on a bounce. I do think the bottom is in here, but I keep my hopes and dreams in the back seat and allow price action to determine my actions.

As for the road back to $1700 and beyond, it remains a long one. My medium-term targets are set at $1020 and $1285. When do we get there? I have no idea. We’re going to need some serious momentum in both tech, and the general market. Looking below we can see these are both pretty obvious levels to watch for. If you wanted a short-term target, you could look at $833. That’s about 18% from where we currently sit. But, we need to see $775 fall first.

That said, I think the chart does look fairly bullish at current levels. I will continue to hold my current shares and continue to execute the plan detailed above so long as the levels all hold. I still think the market will remain volatile, and therefore stops are extremely important to keep in and monitor. Adjust as needed and maximize profits.

Wrap-Up

As you can see, while we may not see the numbers we saw in 2020 and 2021, we are still going to see high growth which is exactly what investors should be asking for. I believe that Shopify is a name you can start to add to your long-term accounts. The path back to $1700 and beyond is going to be a long one, but one worth traveling. The e-commerce giant is going to continue to grow internationally and continue to eat up market share. That will only turn into greater revenues as e-commerce sales continue to grow year-over-year. I am in Shopify for the long haul.

Be the first to comment