D. Lentz

The past three years have seen dramatic shifts across the industrial metals markets, steel in particular. Steel companies are notoriously cyclical and rise and fall with minor changes in economic demand due to their thin profit margins. Of course, the global economy has also crashed, recovered, and dropped again rapidly over recent years, making it difficult for investors to trust cyclical stocks such as U.S. Steel (NYSE:X).

I had a strong outlook on the steel industry in 2019 and was very bullish on U.S. Steel as a turnaround investment. However, last year I warned that changes in supply and demand in China might have a problematic impact on the market. Specifically, the rapid decline in China’s steel production and demand for it was throwing a wrench into the market. More recently, I detailed the potentially significant negative impact of China’s aggressive lockdowns on long-term steel demand.

Today, the steel market, and industrial metals as a whole, are in a relatively significant correction, driven by a large crash in China’s construction demand. This shift has led to substantial price declines in many steel companies, with U.S. Steel trading at an extremely low TTM “P/E” ratio of ~1X. The company has earned as much money over the past year as its total market valuation today. While its earnings will likely contract materially under the changes in the steel market, the company is making positive changes that may give it an extended position after the smoke is cleared. U.S. Steel remains a very risky stock, but there is reason to believe it is once again trading at a considerable discount.

Slowdown To Cause Losses For U.S. Steel

Steel flows toward areas of the world with high industrialization. China is, by far, the largest global producer, while Asia (primarily India and China) drive the great majority of consumption. China accounts for half of the worldwide consumption, and its property sector alone accounts for roughly one-fifth. China has experienced massive industrialization over the past three decades but is now generally recognized as a developed and fully industrialized country. China has constructed so many buildings that its cities boast the highest home vacancy rates in the world at 15-25%.

China does not need construction steel. After decades of growth, China’s real estate market is in a “crisis,” and its banks and government are struggling to ‘find solutions.’ In my view, this is not so much of an economic crisis as a natural progression. For example, many decades ago, when the U.S. was experiencing rapid industrialization, U.S. Steel was once a behemoth of production. However, as the U.S. became more developed, steel demand declined, and so did U.S. Steel’s market dominance.

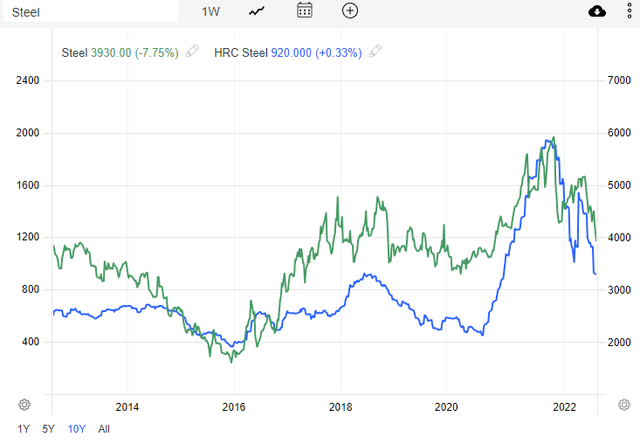

Today, China’s steel mill owners are struggling to remain afloat, and more of the country’s steel is being exported to the U.S. and Europe. This factor has pushed domestic steel prices considerably, with hot-rolled coil steel (blue line, left axis) nearly back to late 2020 levels. However, as you can see below, China’s steel prices (green line, right axis) in CNY per ton are retracing back to 2020 lows:

China Steel Rebar Futures, U.S. Hot Rolled Coil Steel Futures (Trading Economics)

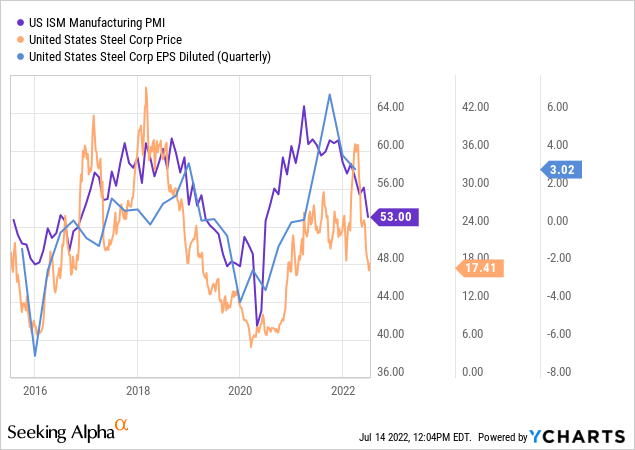

Undoubtedly, the global steel market is in a significant secular transition. On top of that, there has been a marked slowdown in the U.S. and global economy while production prices continue to rise. In the short run, this will negatively impact U.S. steel’s profit margins and its peers’. For now, the U.S. is maintaining tariffs on China’s steel, but domestic prices are still falling as China’s import-export balance shifts. Of course, the U.S. manufacturing economy is also rapidly slowing down. As you can see below, the U.S. manufacturing PMI is tightly correlated to U.S. Steel’s stock price and quarterly EPS:

The last two times the manufacturing PMI was at 53 (in late 2019 and mid-2017), U.S. Steel’s quarterly EPS was roughly zero. As such, it seems U.S. steel’s Q2 EPS may be materially lower than is currently expected (~$3). The company is facing a decline in prices and demand while energy prices, though slightly lower, remain high, creating profit margin pressures. That said, iron ore prices have declined more rapidly than steel. U.S. steel has some positive exposure to iron due to its minor production but generally benefits from lower iron ore prices as it reduces input costs. Still, given the economic shift, it appears likely that U.S. Steel will once again have negative earnings over the upcoming year and potentially longer.

Can U.S. Steel Survive The Transition?

The consensus EPS outlook for the company shows its EPS declining toward zero by 2023. In my view, this is unlikely as the economic trend suggests its margins will be under enough pressure to have negative EPS in 2022. The company’s profit margin has been abnormally high over the past two years, giving it some cushion. Still, I doubt that will last as the recent rise in energy prices may quickly normalize its operating margins. That said, U.S. Steel has experienced and survived many periods of negative earnings over the past decade. With each correction, the company has become a learner and more efficient, making it a stronger competitor coming out of the bear market.

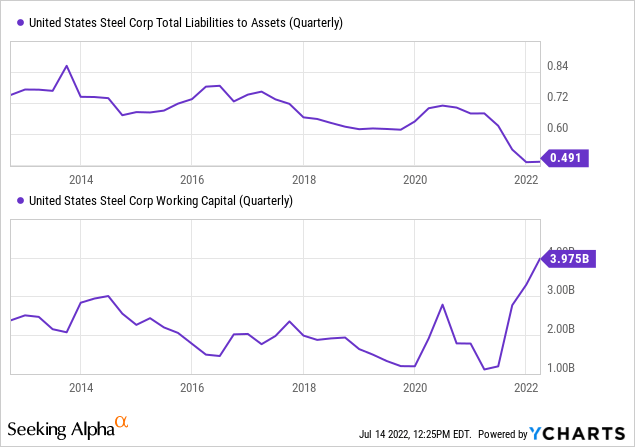

In my view, when considering a cyclical company like U.S. Steel, its short-term earnings outlook is less critical than its balance sheet. The company has dramatically reduced its total liabilities-to-assets over the past decade and has a record working capital supply. See below:

From a debt-to-income standpoint, U.S. steel is also solid, but I expect its income will decline dramatically over the coming quarters. That said, its working capital is nearly as high as its market capitalization of $4.5B, giving it an extremely low valuation. While the stock has generally traded a bit below its book value per share, its price-to-book is also at a staggeringly low 0.46X.

On the one hand, U.S. steel is priced for an extreme decline in earnings. Indeed, it seems many investors and traders are assuming the company will struggle to survive the upcoming/ongoing economic slowdown. On the other hand, the economy is slowing, and trends in China suggest that the global supply and demand balance of steel may be bearish for an extended period as the country unwinds in the colossal steel production sector. Even if U.S. Steel does not have direct business with China, this dramatically impacts the company as steel is a global commodity. Still, for now, it does not appear that the crash in the steel market is large enough to believe U.S. Steel’s operations are in jeopardy, as suggested by its ultra-low valuation.

The Bottom Line

From a long-term standpoint, it seems U.S. Steel is undervalued, given the improved strength of its balance sheet and continued improvements in operating efficiency over recent years. Even if the upcoming period is difficult for the company, it is better positioned today than before. Additionally, with the company trading below half of its book value, it seems to be selling at a fire-sale price.

With that in mind, there is reason to remain cautious about the company. It is notoriously difficult to “catch falling knives” without taking some initial losses. Despite its low valuation, analysts may be overestimating U.S. Steel’s Q2-Q4 earnings, giving it a high risk of falling on revisions or earnings misses. The stock also has a high short interest of ~15%, implying many short-sellers are targeting the firm. This factor can be bullish if the stock rises and causes a short squeeze, but it may also cause the stock to fall even lower as more sellers look to the firm. As such, I would personally wait to buy the stock until after its Q2 earnings report, as it may be trading at an even lower price by then.

Be the first to comment