Marje/E+ via Getty Images

I continued until early June to take profits from energy stocks and sell other stocks not down much. These funds have been going to REITs that have crashed much harder recently. My problem a few days ago was what REIT to buy next.

There were 27 REITs with more than 50% upside to their 52-week high in the table I published June 14. Owning three of them, the other 24 seem likely to provide something.

But most of them are in sectors that for various reasons are not of interest to me – office, industrial, diversified, and storage. Also, it is enough for me to own one mall REIT, one net lease REIT, and one life-science REIT.

On top of that, I have reasons to reject everything else in the table save for one REIT: UMH Properties (NYSE:UMH). I started working on them to consider establishing a position.

Then on June 14 Federal Realty Investment Trust (FRT) dropped to where it has 50% upside. I am very familiar with Federal Realty and very confident in them. So I bought FRT.

But still it seems UMH would be next. So let’s take a look.

UMH Properties is the baby sister of the REITs that emphasize manufactured housing. It is far smaller than Sun Communities (SUI) and Equity LifeStyle (ELS).

In addition, those two emphasize communities in popular destinations that most often serve the upper middle class. In contrast, UMH primarily provides lower-middle-class housing in blue-collar areas. One gets a sense of an affordable-housing mission from their earnings calls.

Here is a UMH community. The shape of these homes can be misleading.

UMH Properties

These are manufactured, permanent homes, not the cheap trailers one sees in the movies. They have nice interiors, too.

UMH Properties

My first position in UMH lasted from February 2020 to March 2021 and was closed with an 18% profit. It was based on a thesis from Jussi Askola at High Yield Landlord that the firm was undervalued.

By the time that thesis played out, some further good things were happening. They did not convince me to stay in UMH then but are part of the appeal now.

UMH Who and When

Eugene Landy founded UMH in 1968 and is now Chairman of the Board. His son Samuel has been CEO since 1995 and his son Michael also serves on the Board.

In short, this is a long-established family business. They adopted REIT status at the start of the modern REIT era, in 1992.

Something went really wrong for UMH across the Great Recession. I did not choose to try to understand that at present. To me it seems to be in the rear-view window now.

Family businesses often make quirky REITs that do strange things, and UMH is no exception. We will note two of them here.

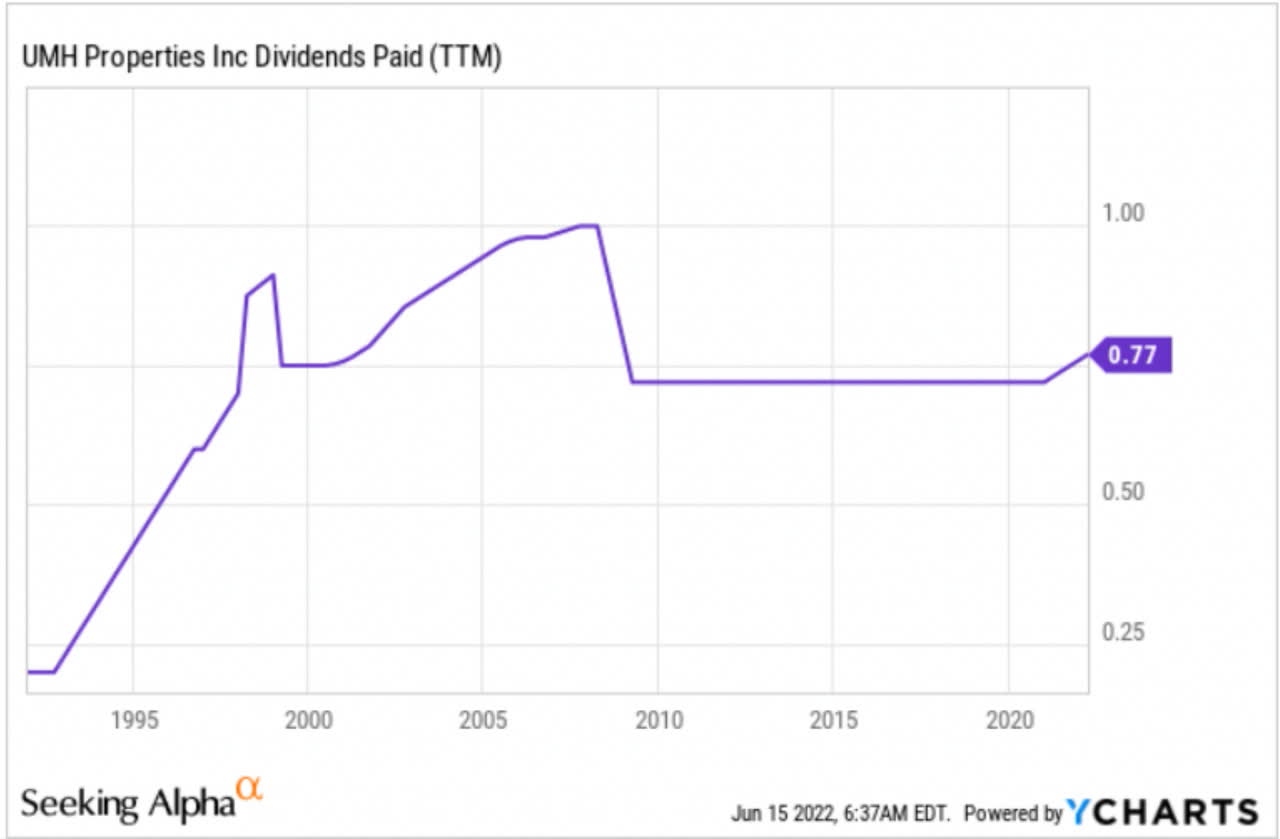

First is the history of the dividend. UMH pushed it up to $1.00 but then cut it to $0.72 during the Great Recession. That was not enough; the dividend was not covered in any sense, on which more below, until 2021.

YCHARTS

Why did UMH not cut the dividend further? I’m not sure. Perhaps the founders desired a minimum income. Or perhaps that they felt they could pull through and also felt some kind of obligation not to let down their shareholders any more than absolutely necessary. The reason matters little today.

Second is their REIT securities portfolio. At least since the 1990s UMH has kept some of their capital in a portfolio of REIT securities.

This complicates their story and has subjected UMH to much criticism. We will take a more nuanced view below. In any event, the securities portfolio is now well below 5% of total assets and UMH has stated their intention not to grow it.

How UMH Grows

REITs are mostly engines for compounding cash flows, which involves much more than raising rents. UMH has the following activities related to growth of earnings:

- Raising rents, generally at 4% per year

- Selling new homes

- Selling used homes

- Developing the homesites they then lease

These are enabled by two kinds of acquisition:

- Acquiring existing communities for further development

- Acquiring vacant land to develop new communities

UMH does not tend to sell their communities. They acquire or develop them, improve them, and operate them. Today they operate 130 communities.

UMH also has one, recently established, Joint Venture to develop communities that are further up the income scale. This is not a needle mover for them now and won’t be for a while, so this article will not discuss it.

UMH has substantial potential to grow. There is much potential for expansion within existing communities and for development of their vacant land. Their recent history has been to steadily add 400 sites per year, but lately they are talking about 800.

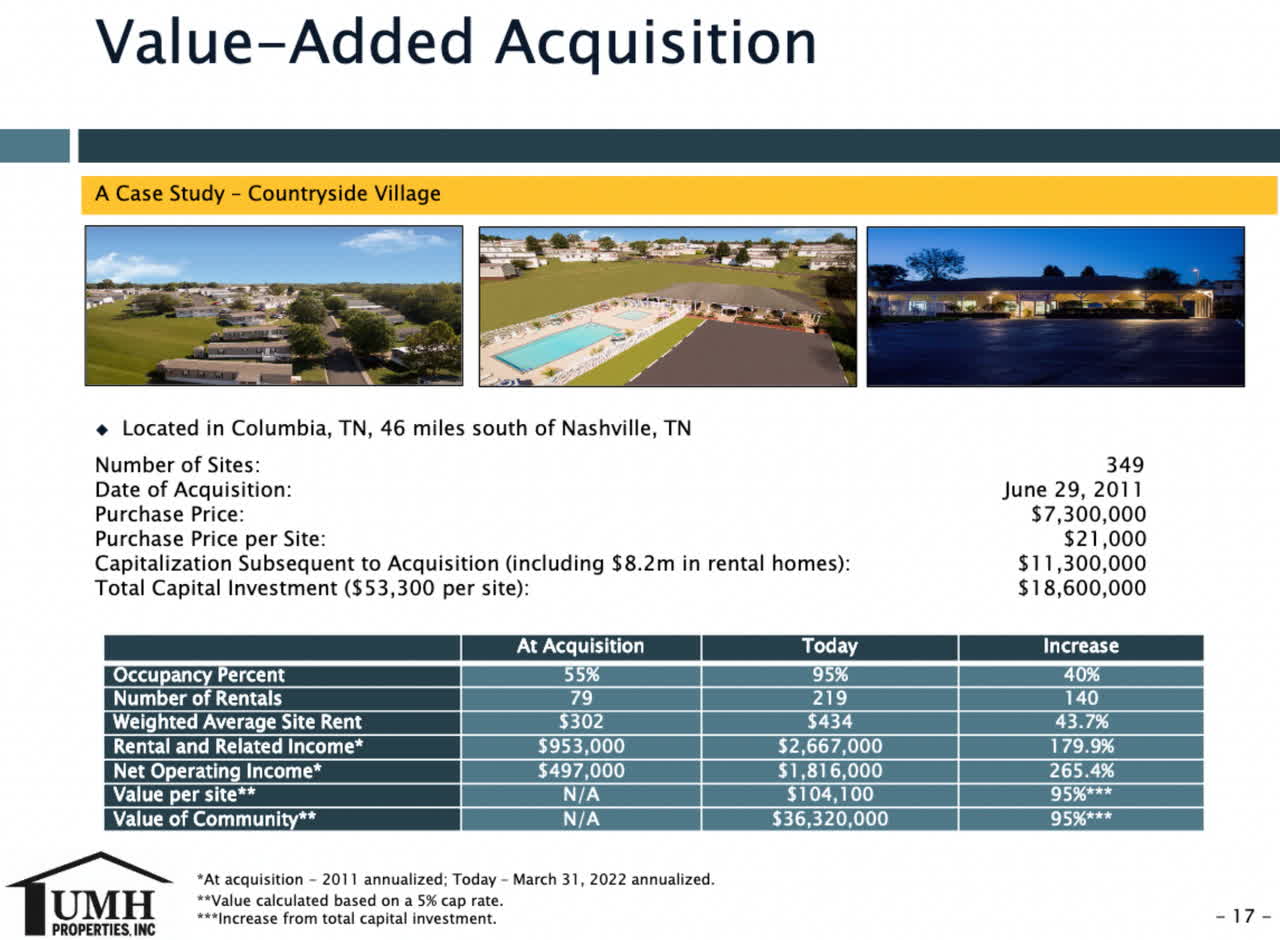

The growth activities of UMH generate cash-on-cash returns in the ballpark of 10%. Here is their example of a community called Countryside Village:

UMH Properties Investor Presentation

Here the cap rate on the initial purchase (the ratio of Net Operating Income, or NOI, to price) was 6.8% The cap rate of their later development was 12%, and the overall ends up being 10%. UMH also shows in their investor presentation a 10% cash-on-cash unlevered return for adding new rental homes to their communities.

Note that these gains may be spread out in time, but any one of them transpires fairly quickly. The actual work of preparing entitled sites is not long or involved and one will do such work only in locations where one expects rapid leasing.

Overall, UMH has raised capital in ways discussed below and invests it at an effective cap rate of about 10%. Since all of their sources of capital have a cost below 10%, this has always added to shareholder value, if not always very much.

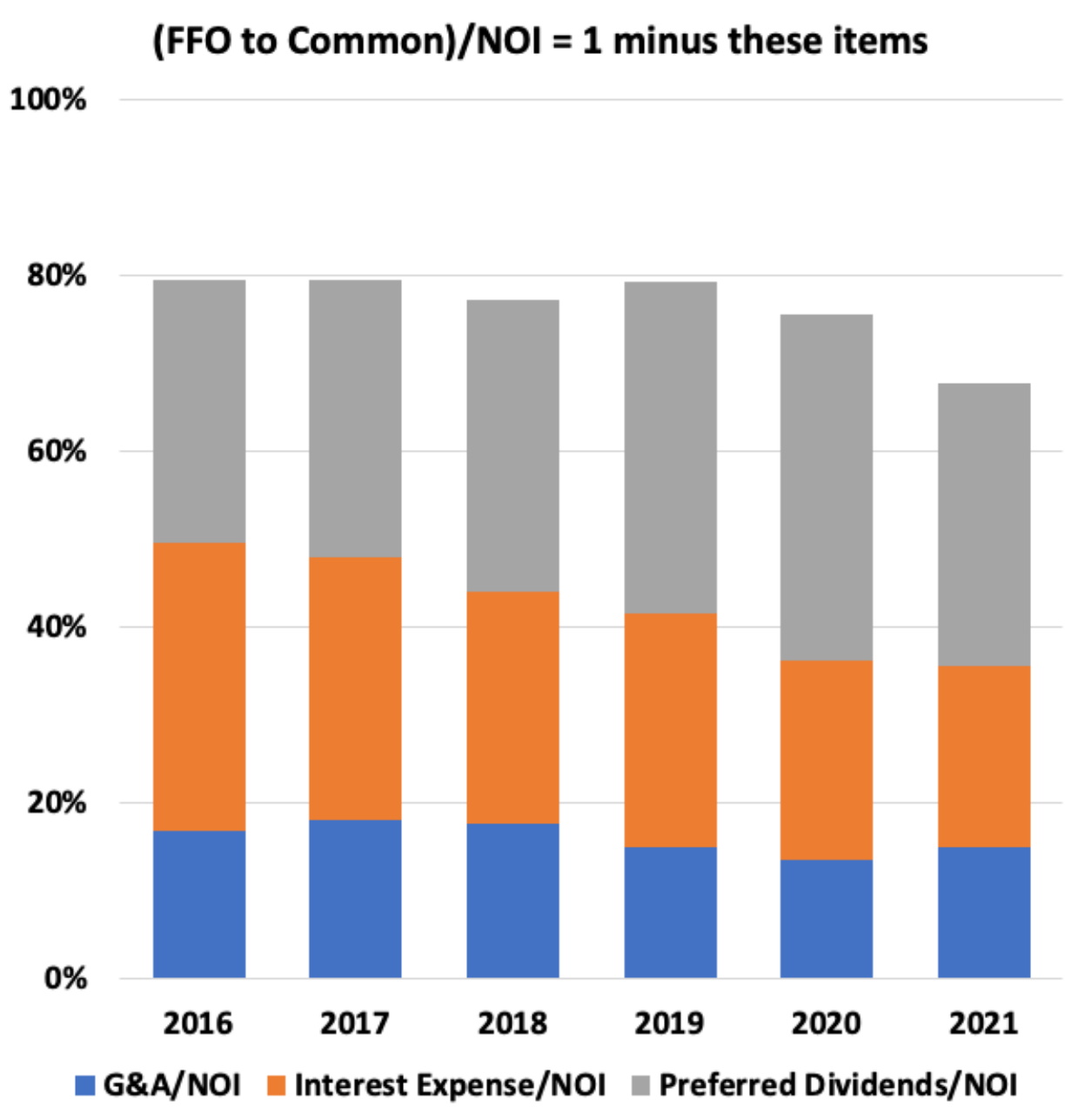

Any specific investment is funded in a specific way and generates returns accordingly. It is nonetheless worthwhile to look at the overall conversion for UMH of NOI to FFO. (Here FFO is Funds From Operations to the common stock evaluated for real-estate operations only, excluding any impacts from the securities portfolio). The net conversion of NOI is the difference between the top of these bars and 100%:

RP Drake

We see that only ~20% of NOI has carried through to FFO in 2017 through 2019, increasing to ~30% in 2021. With the majority of the preferred stock being redeemed within a few weeks, this will go to ~ 40% for this year and ~50% in 2023.

That is a big change. If we assign the costs of debt and preferred dividends proportionally to new capital, then the unlevered return on new capital will have increased from ~2% for the past few years to ~3% in 2021 and to ~5% in 2023. This last is quite a good number for a residential REIT.

[For REIT geeks: it appears recurring capex is small, as are other typical adjustments to get from FFO to AFFO. Quoting the 2021 10-K: “The homeowner is responsible for the maintenance of the home and leased site. As a result, our capital expenditures tend to be less significant relative to multi-family rental apartments.”]

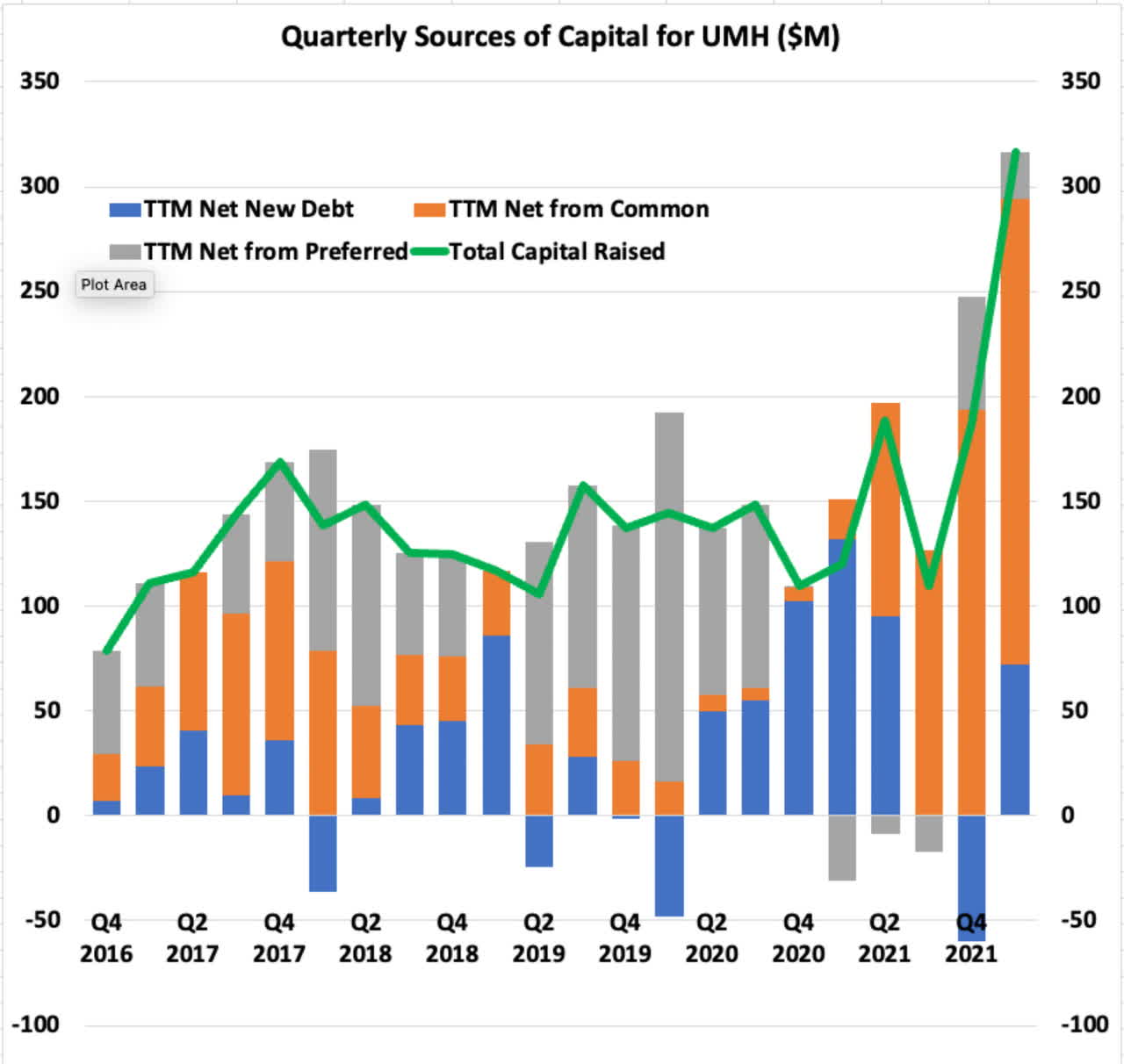

Whence the Capital?

UMH obtains capital by raising debt, selling preferred stock, and selling common stock. Here is the pattern of these over the past five years. As we will see, even this breakdown hides some important developments.

RP Drake using data from TIKR

UMH has long used preferred stock to raise capital for the early phases of development. Most of the capital raised from 2017 through 2020 was from preferred stock.

This was necessary. Quoting Eugene Landy from the Q1 2022 earnings call:

Our business plan has required us to purchase upgrade and infill underperforming communities. At the time of acquisition many of these communities were not financeable because of the low occupancy rates and poor quality. These communities required utilizing preferred stock.

The Series B, retired in 2020, paid 8%, and so using such funds for projects that returned 10% was profitable, but not hugely. Series C and D have paid between 6% and 7%.

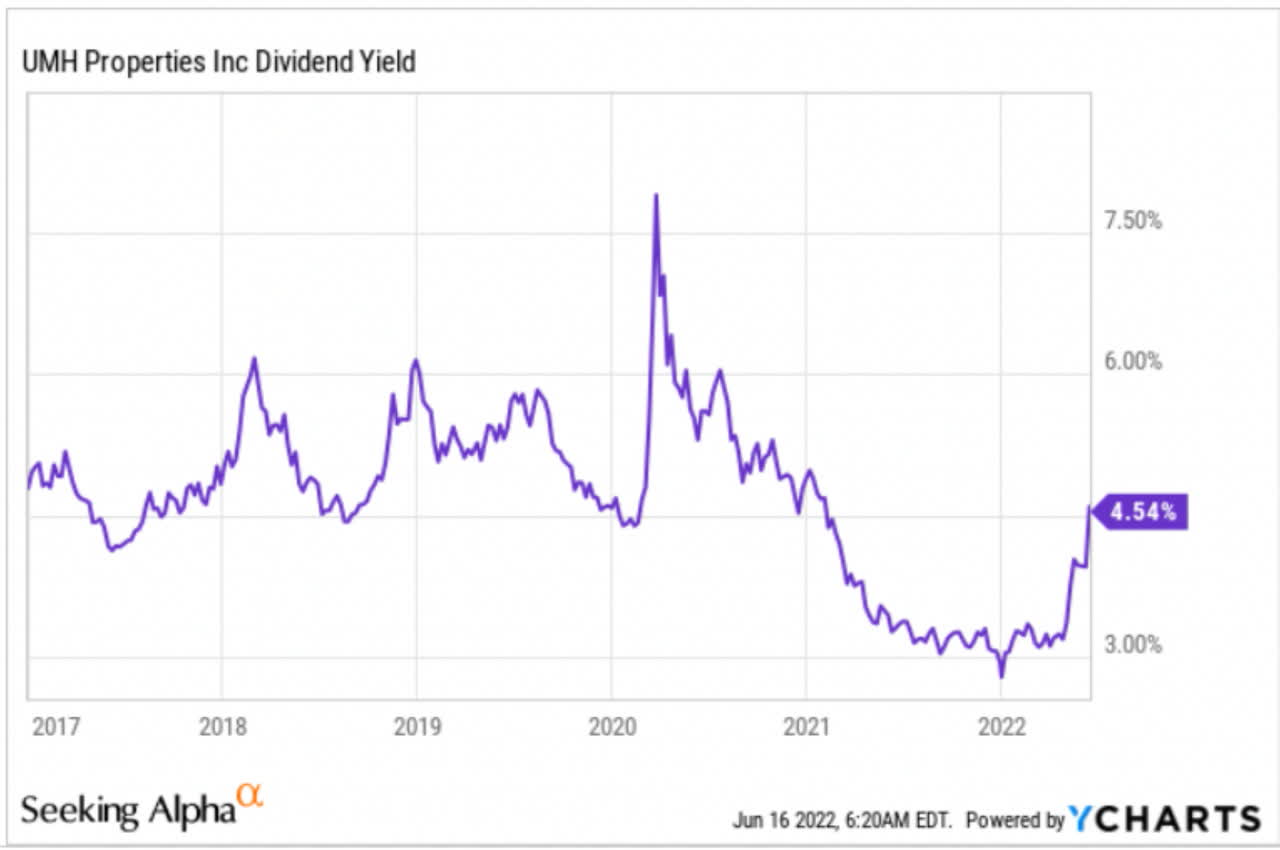

UMH has been intelligent in their issuance of common stock. Here is the dividend yield over the time period of the above plot:

YCHARTS

Issuing equal amounts of equity and preferred stock paying 8%, for example, generates an Investment Yield of 4.3% for a 10% cash on cash return and G&A at 17% of NOI. I described the calculation here.

This only creates value for shareholders if the dividend yield is below 4.3%. This makes it sensible that share issuance was large in 2017 and then very large in 2021, when the price soared and the yield dropped to 3%.

UMH did the smart thing and issued shares when they were expensive. This contributed to the funds with which the Series C preferred will be redeemed in a few weeks.

As seen above, this in turn will significantly increase the FFO per common share. UMH has projected the impact as $0.26, representing an increase of about 25%.

What About the Debt?

This takes us to the debt. Prior to 2020, the debt was bank debt, mostly mortgages. The total debt grew slowly and was about a quarter of enterprise value at the end of 2019.

Since then, there have been two big developments. The first was related to financing from Government-Sponsored Entities (“GSEs”), such as Fannie Mae.

UMH pursued equal treatment for owners of manufactured homes with owners of stick-built homes. In the Q2 2020 earnings call they said:

Since we began the rental home program, we’ve been arguing that when the house and a lot had the same owner, they’re entitled to the same financing as any apartments. … It looks to us like we’ve jumped that hurdle, and we’re going to be able to obtain this GSE acceptance of the rental homes resulting in this lower cost debt.

It’s the hugest development in manufactured housing. Our product, the manufactured house cost 40%, less than stick-built homes, but our loan close to 40% more. We’re going to reduce that cost of the loan to equivalent to apartments.

And then by Q4 2020 UMH could report that

In August, we completed the financing of 28 unencumbered communities, with Fannie Mae for proceeds of approximately $106 million, with a 10-year maturity and a 30 year amortization at a fixed rate of 2.62%.

This produced the spurt of debt financing you can see above in 2020 and the first half of 2021. You can also see that the ratio of interest expenses to NOI dropped from about 30% in 2017 to 20% today.

Then in early 2022 there was yet another development: the first issuance of unsecured bonds. Naturally, this was done in a quirky way, as these were issued in Israel. As reported in the 2021 10-K filing,

On February 6, 2022, the Company issued $102.7 million of its new 4.72% Series A Bonds due 2027, or the 2027 Bonds, in an offering to investors in Israel.

And in the Q1 2022 earnings call, management reported that

We are proud to have received an investment-grade rating of A+ from S&P Global Ratings Maalot, an Israeli credit rating agency. … S&P in Israel rated the bonds AA-.

Your author must confess that he has no idea how these ratings compare with US ones, but they do seem positive. Perhaps a reader with experience will weigh in.

The resulting funds also will help pay off the Series C preferred stock. More importantly, if UMH can now steadily issue unsecured debt, this should enable them to avoid further use of expensive preferred stock to fund their growth.

If, for example, UMH proves able to fund new growth, at the 10% return discussed above, using 60% equity and 40% debt charging 4% interest, they can push their return on equity above 10%.

Getting anywhere close to that will let UMH grow FFO per share at a nice clip.

Impacts of the Securities Portfolio

The securities portfolio, mentioned above, has played a significant role for UMH over the past decade. One has to tease this out.

REITs with investments other than in operating real estate now must mark their investments to market each quarter and report the change as current income or a current loss. This is a GAAP requirement.

Most of these REITs leave this item in when adjusting from GAAP Net Income to FFO. An example where this has a very large impact is Alexandria Real Estate (ARE). UMH takes it out, claiming in their filings that leaving it out is a legitimate application of the latest NAREIT definition of FFO.

All of the REITs I’ve looked at, however, include any cash income from such investments as part of their reported FFO. In seeking an adjusted FFO that reflects only the real-estate operations, one should take out this income too.

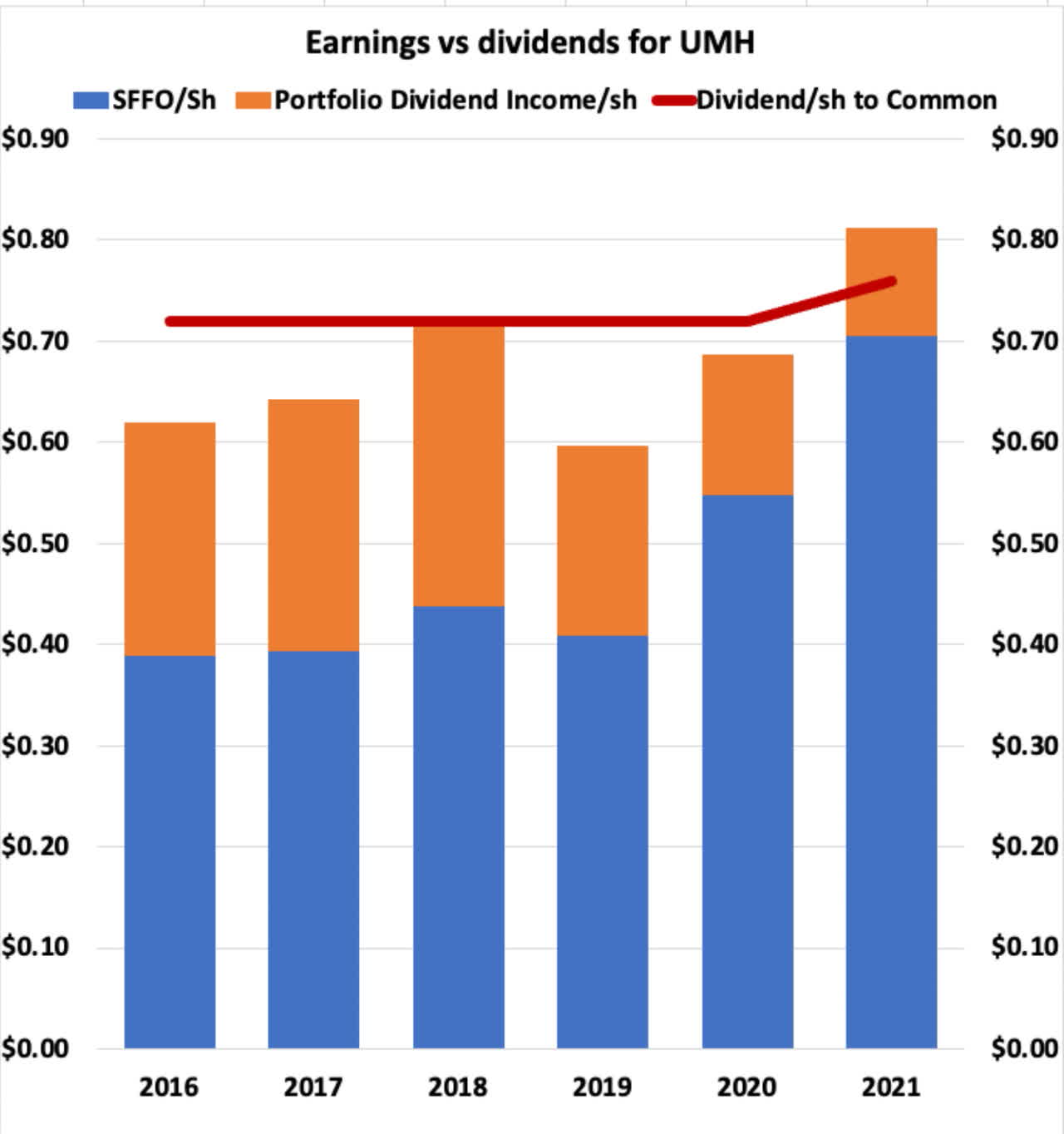

I evaluated a real-estate FFO to common, abbreviated as SFFO, for UMH from the income statements in their 10-K filings, excluding the dividend income from their securities portfolio. This is actually less complex than one finds for many other REITs. Here is the result:

RP Drake

This tells the story. The dividend was not even close to being covered by real-estate earnings before 2021. In fact, in most years UMH was using a portion of the capital they raised to pay dividends on the common stock.

The important feature of the securities portfolio has been that the income generated helped close the gap on the dividend payout. Since UMH seems to have been firmly committed to that $0.72 dividend, they needed to just hang on and hope.

It is true that UMH made some poor choices in which securities they accumulated, as discussed recently by my colleague Austin Rogers from High Yield Landlord. My view is that the mall REIT investments were not as unreasonable as he perceives with 20-20 hindsight.

But I agree with him about the REITs managed by RMR. If you buy those, you are asking to lose principal over time.

My guess is that UMH felt stuck. They could see the improved real-estate earnings coming, as they have made clear for several years. But they needed the income from those securities to stagger across the gap to the future.

In some sense it did not matter what happened to those securities once UMH got to where it is now. And with the buyout of Monmouth (MNR), which was a very large holding, the securities portfolio has pretty much faded into insignificance.

Dumb or Smart?

You can certainly take the point of view that any management team dumb enough to put together that specific securities portfolio cannot be trusted with your money. This seems to be Austin’s perspective.

In contrast, you can be impressed with the moves made in recent years by UMH:

- They issued common stock at good moments.

- They used preferred stock to grow, with modest accretion to common.

- They convinced the GSEs to provide loans to their communities, dramatically reducing their interest expenses.

- They placed their first unsecured bonds.

- They can finally cover and grow their dividend with FFO from real estate operations alone.

The net result is that UMH is in a position to grow FFO per common share strongly from here. Management has indicated in interviews that they expect growth in the ballpark of 10% per year. Based on the numbers above, this seems plausible.

Last year when REITs were more or less fairly valued, the residential REITs (apartments, manufactured housing, rental homes) were all priced at multiples of AFFO in the high 30’s or more. This is not unreasonable.

For example, above 35x corresponds to an indefinite growth rate above 7% at a discount rate of 10% and a total return of 10%. I discussed more realistic growth models for Camden Property Trust here.

With the inclusion of growth this year and the impact of redeeming the Series C preferred, FFO and AFFO in 2023 should be pushing $1. If it were priced at that same multiple, UMH could be pushing $40 in 2023.

UMH may not get to multiples in the high 30s any time soon, being a smaller and less proven operation. But even if it gets to only 30 times 2023 AFFO, this would be close to a double from here.

My takeaway is that UMH should participate in the market recovery when it happens, which will get you more than 50% upside. In addition, substantially larger appreciation is likely as the market responds to their future performance.

Risks to the Thesis

There are all the usual risks detailed in the UMH 10-K filings. Some additional thoughts follow.

UMH does depend on increasing demand for housing in their markets. A nationwide collapse in the economy and housing markets could drag down the results turned in by UMH. Of course, such developments might also increase demand in their segment of the housing market.

Alternatively, suppose that the extreme greens got their way and all production of hydrocarbons was dramatically reduced. This would push western Pennsylvania and eastern Ohio into deep depression, and this is where the bulk of the UMH communities are located. In such a scenario, UMH would suffer for years. This is a specific example of the general point that geographic diversification reduces risk for REITs.

Less dramatically, a prolonged and deep recession could dampen job growth and housing demand across the main area served by UMH.

The thesis above also depends on seeing UMH continue to behave in smart ways regarding their finances. This is true of all REITs, but the risk of stupidity is higher for quirky ones.

My Bottom Line

All in all, UMH is far from my favorite REIT. Yet they have made significant positive progress in recent years.

At their present price they look like an excellent value. Even so, it would be unsurprising to see the market take plenty of time to respond.

Turning to FRT, it now has about 50% upside to fair value, with a better balance sheet and a more robust growth model. In my view it is the higher-conviction investment. For the moment, I boosted FRT from a 2% to a 3% portfolio fraction.

If the markets keep crashing, my portfolio is likely to include UMH before long. If not, perhaps I will be lucky enough to ride them for a while after FRT or something else recovers in price.

Be the first to comment