Phynart Studio

Investment thesis: United States Steel Corporation (NYSE:X) may have a few more quarters of global economic stagnation to go through, which tends to be rough for steel companies, as well as most other commodities producers or refiners. As the world is starting to show signs of settling into some sort of new normal, leading to a global economic recovery, perhaps starting sometime next year, global steel demand should recover as well. At the same time, Europe’s steel industry is likely to become permanently crippled, while some Asian producers may face some energy price and even availability issues as well, creating a unique opportunity for North American steel producers to benefit from increased market share, as well as higher steel prices for the foreseeable future. Within this context, U.S. Steel has an energy price and security advantage, while supply/demand fundamentals are likely to become increasingly attractive into a global economic recovery.

U.S. Steel’s financial results suggest that it has decent prospects for long-term profitability.

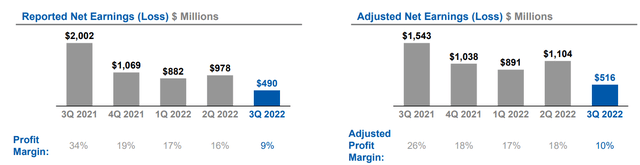

U.S. Steel’s Q3 results suggest that there may be a softening in its prospects going forward. It was a profitable quarter, but less so than previous quarters.

US Steel net earnings (US Steel)

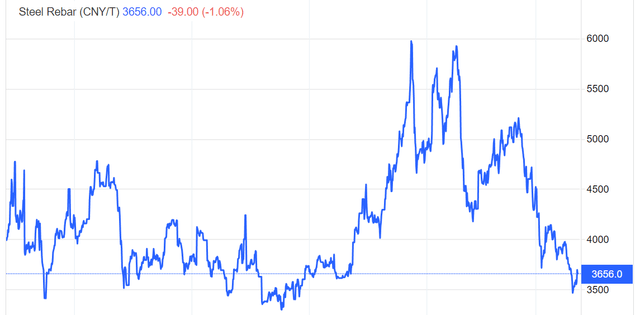

One of the main factors affecting earnings is arguably the lower market price of steel.

The lower market price of steel is a reflection of slowing global economic activity, which led to lower realized prices per ton of steel that U.S. Steel sold in the quarter. Net sales came in at $5.2 billion for the third quarter of this year, down from $5.96 billion for the third quarter of 2021.

Other financial results of note include its debt situation, which has more or less kept stable over the past year. Total debt was $3.89 billion at the end of last year, while it is now at $3.92 billion. As we can see, total debt is less than revenues for the quarter.

U.S. Steel is in solid financial shape overall, which is a good position to be in since steel producers are clearly entering a period of weak global steel demand, which ought to be expected given growing expectations for a global economic slowdown. It will most likely have to weather a few weaker quarters.

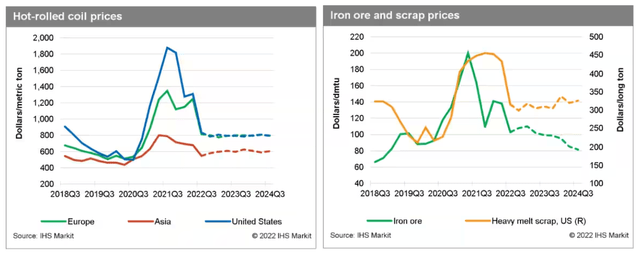

Looking past the next few difficult quarters, U.S. Steel will probably find favorable market conditions, with many European and Asian competitors faced with spiraling energy and other input costs

Looking past the next few quarters where the global economic activity will likely cool, and so will steel demand, I expect a new global economic and geopolitical normal will emerge, with some old economic ties re-establishing themselves, as well as many new ones emerging. A world undergoing significant global economic realignment will need new infrastructure in place. For instance, Russia will look to build up more pipeline and rail transport towards Asia, as its ties with Europe are fraying. The entire BRICS-led economic structure that is emerging seeks to lessen trade dependence on the Western World, in favor of deeper economic integration among themselves. Africa is looking to finally enter the modern era, complete with its own infrastructure needs, which is great. The Western World, on the other hand, seeks to greatly increase its own fuel efficiency, meaning that new infrastructure, such as more railway capacity will be needed. All of this means higher steel demand once we enter a new global economic recovery.

At the same time, global steel output might have a hard time keeping up with demand. Europe’s operations are increasingly unviable given the current regional energy price situation, which I expect will persist for the foreseeable future. There are other costs that already made it increasingly hard for steel producers in the EU to compete globally, such as environmental costs. Russia might see a net decline in exports for the long term, as some form of economic obstruction against its interests is likely to persist beyond the duration of the Ukraine war.

Asia is also set to experience contagion effects from Europe’s energy crisis. On one hand, it benefits from the continued shift in Russian energy flows toward the continent. At some point, Iranian energy might flow in the same direction, as the US-imposed sanctions will become increasingly ineffective in the face of a sustained global commodities bull market. On the other hand, many poorer Asian nations may see their efforts to secure LNG thwarted by Europe outbidding them for supplies, as it is presently doing.

The latest example of that is India’s argument with Germany over contracted LNG that was never delivered. I do not expect Asia’s energy supply & price situation to become as dire, unpredictable, or as economically unsustainable as the situation in Europe is starting to become, but the region is certainly far more exposed as it has to compete for a lot of the same energy supplies with Europe.

Based on recent steel price forecasts, the market is supposedly more or less set to stabilize at current price levels for the next two years or so.

My personal view is that if we are to assume that the global economy will pick up pace towards the end of next year and into 2024, which I think there is a significant chance will be the case, global steel demand will pick up significantly, due to the nature and shape of the recovery, as I already explained.

U.S. Steel, together with most of its North American peers, is set to see a competitive advantage over its European & some Asian peers, due to lower-priced more dependable sources of energy, which is very important for such an energy-intensive industry. It takes about .77 tons of coal to make a ton of steel. In natural gas terms, it comes out to about 14,000 cubic feet of natural gas. For comparison, 14,000 cubic feet of natural gas will cost about $80 in the U.S. currently on the spot market, while it can cost about $500 in the EU, based on prevailing spot prices there at the moment. There are, of course, other factors, beyond the simplified comparison I provided. It is nevertheless increasingly obvious that unless something really dramatic changes in Europe, its steel industry is probably doomed. There are reports of EU steel producers struggling this year already. I expect at some point most of them will just permanently shut down, given that they simply cannot compete.

Investment implications:

U.S. Steel stock is currently trading at around $23/share, down from highs of over $38/share in the past year. I do believe that there will be a much better buying opportunity within a few months, but just in case I am wrong, I decided to take a small nibble for my portfolio, while I am prepared to perhaps buy more next year if a better entry opportunity will arise.

I do believe that the steel market will improve perhaps late next year or perhaps in early 2024, with supply constraints emerging due to the situation in Europe, while demand might come in stronger than expected for the reasons I pointed to in the article. At this point, I prefer Vale (VALE) as an investment opportunity in the space, due to the generous dividend, currently over 9%, which can make a significant difference for a long-term investment position.

U.S. Steel currently offers a dividend yield of less than 1%, but it may arguably outperform Vale in terms of stock price appreciation. Within the current global context of geopolitical upheaval, North American investors may arguably also find it to be a more comfortable investment option. Long-term global economic fundamentals may suggest U.S. Steel may be worth having both in one’s portfolio, as a long-term play.

Be the first to comment