Anja W./iStock via Getty Images

A Dec. 6, 2022 article in Reuters noted that U.S. lawmakers have proposed scaling back the controls placed on Chinese-made semiconductors for use by the U.S. government and its contractors after pushback from trade groups, including the U.S. Chamber of Commerce.

I have written several Seeking Alpha articles presenting statistics and data the U.S. sanctions are poorly thought out, are not working, and are only hurting those companies complying with these edicts.

The latest, and most restrictive sanctions came on October 7, 2022 demanding that companies seeking verification to sell to China would be faced with a “presumption of denial” standard if they produce DRAM chips below 18 nm, above 128 layers for NAND chips and below 14 nm for logic chips and would have to apply for a license.

In other words, the onus of the U.S. sanctions outside China have fallen on non-Chinese semiconductor equipment suppliers not allowed to send equipment to Chinese semiconductor manufacturers.

While U.S. equipment initially reacted to these sanctions, which I discussed in a November 5, 2022 Seeking Alpha article entitled “U.S. Chip Equipment Suppliers Biggest Losers From China Sanctions But KLA Fares Best,” the real damage has been a build-up of momentum by Chinese semiconductor manufacturers to buy Chinese-made equipment, hence bypassing when possible non-Chinese suppliers. In fact, which I show later in this article, revenues of Chinese equipment companies have been growing at 5X the rate of non-Chinese companies.

One of the first equipment companies to be impacted was Netherlands-based ASML (ASML) with sanctions against its EUV lithography system. A little-known fact is that ASML sold an EUV system to China’s SMIC in April 2018 with delivery at the end of 2019 and installation in mid-2020. Under pressure from the U.S., the Dutch government caved and blocked the deal.

Now it is apparent that the Dutch government is not cow-towing to the U.S. by restricting DUV lithography equipment exports from ASML to China.

Evidence U.S. Sanctions Aren’t Working

Chinese manufacturers imported $1.2 billion worth of major semiconductor equipment (lithography, deposition, etch, inspection) in October 2022, down 9.4% MoM and up 4.4% YoY. Lithography equipment was up 58%, while etch was down 44%, inspection was down 24%, and deposition was flat, according to The Information Network’s report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends.”

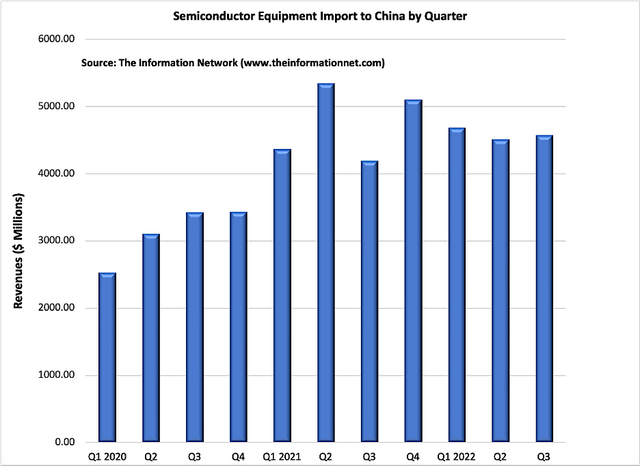

Chart 1 shows major equipment shipments by quarter from Q1 2020 to Q3 2022, showing a flattening of imports since Q1 2021.

The Information Network

Chart 1

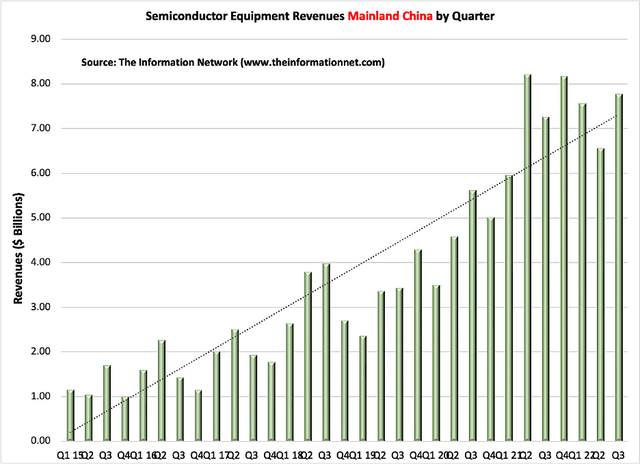

To further substantiate my thesis that there is of evidence negative impact of U.S. sanctions, Chart 2 shows data of quarterly equipment imports to China between Q1 2015 and Q3 2022. One can seep the impact of the Shanghai lockdowns in Q2 2022 only for shipments to recover in Q3 2022.

The Information Network

Chart 2

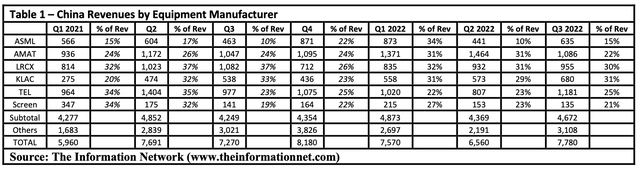

Table 1 shows revenues and percentage of total revenues oof the top six companies into China by quarter between Q1 2021 and Q3 2023. Total revenues by quarter are consistent with quarterly imports shown above in Chart 1. Again, there is no evidence that revenues into China are impacted by U.S. sanctions. Looking at % of revenues, while there are some QoQ variations, there is no consistent trend.

The Information Network

Investor Takeaway

If there are no apparent losers, there are winners – Chinese equipment companies. The efforts by the U.S. government are a catalyst for China to strive for self-sufficiency in chip manufacturing, and that can only be accomplished if these chips are made by Chinese equipment companies.

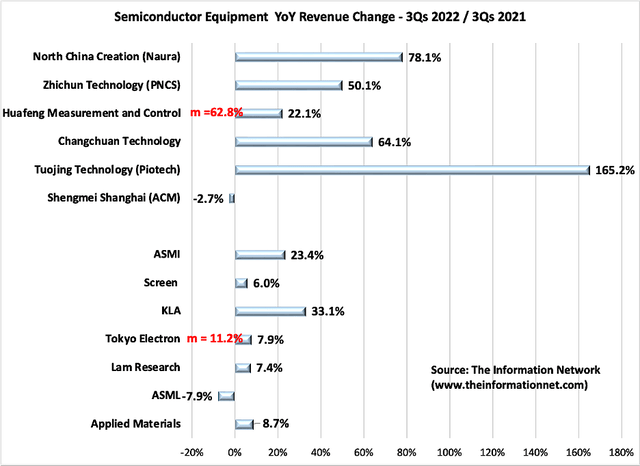

Chart 3 shows performance of non-Chinese compared to Chinese equipment companies, showing YoY growth for 3Qs 2022 vs. 3Qs 2021. There are two takeaways from the Chart:

The Information Network

Chart 3

The mean growth for non-Chinese companies for the nine-month period was 11.2%, and Applied Materials’ (AMAT) performance of just 8.7% (based on guidance for Fiscal 4Q) indicates underperformance against other WFE competitors.

The mean growth for Chinese companies was 62.8%, indicating that Chinese equipment companies are gaining in the market, although their revenues are significantly lower than non-Chinese counterparts.

Sanctions are responsible for a structural shift of Chinese semiconductor companies to push its “Made in China 2025” and other programs to their limits by not relying on foreign companies to encroach on its nascent industry.

But thanks to the refusal by the Dutch government in not blocking ASML’s DUV lithography equipment exports to China, Chinese semiconductor manufacturers have maintained strong levels of purchasing of non-Chinese equipment even though they have a Chinese-made equipment to serve as alternatives for every application except DUV lithography. While Nikon (OTCPK:NINOY) also sells DUV lithography equipment, ASML dominates the sector, and Nikon doesn’t have the capacity to meet all of China’s demand.

In numerous Seeking Alpha articles I wrote on ASML, I have not been favorable, primarily due to continued excuses of supply-chain problems affecting sales and shipments. With a strong backlog of DUV, as well as EUV lithography systems, ASML is positioned to meet the demand of Chinese semiconductor manufacturers, provided the company does not cooperate with ill-advised sanctions. Thus, I now rate ASML a buy.

Be the first to comment