SeanPavonePhoto

Investment Thesis: In spite of short-term pressures, SK Telecom could see longer-term upside on the basis of strong balance sheet metrics and revenue growth across the Media segment.

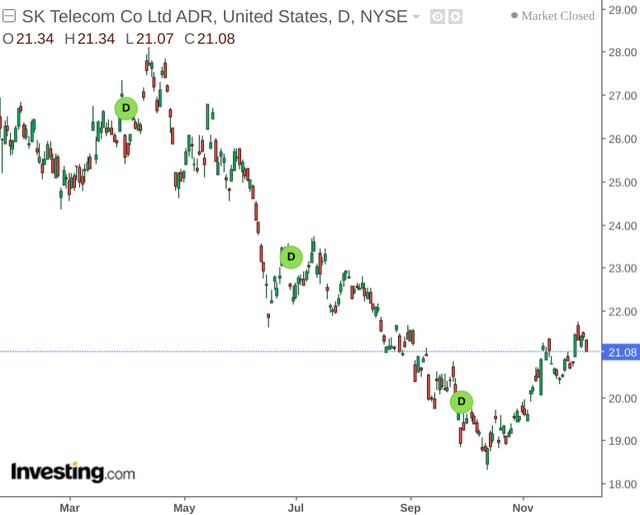

In a previous article back in May, I made the argument that while SK Telecom (NYSE:SKM) has seen impressive growth as a result of 5G uptake, inflation could pose a concern due to higher costs of capital investment. Additionally, I also cautioned that a further drop in equities may erode overall gains.

Since then, we have seen the stock continue to decline before seeing a slight rebound in the past couple of months:

The purpose of this article is to assess whether SK Telecom could have the scope to rebound further given the recent downside.

Performance

My previous article made the argument that in an inflationary environment – SK Telecom will need to prioritise cash flow in order to cope with rising costs.

I previously remarked that given the company’s cash to long-term borrowings and notes payable had increased to above 30% for December 2021 and March 2022 – continued growth in this metric should be an encouraging sign.

We can see that for June and September 2022 – cash and cash equivalents grew while long-term borrowings and notes payable declined significantly, resulting in a higher cash to long-term borrowings and notes payable ratio.

| (KRW bn) | 01/06/21 | 01/09/21 | 01/12/21 | 01/03/22 | 01/06/22 | 01/09/22 |

| Cash and cash equivalents | 211.9 | 315.7 | 407.7 | 436.7 | 649.4 | 583.6 |

| Long-term borrowings and notes payable | 1376.6 | 1403.8 | 1255.1 | 1326.3 | 1245.2 | 852.4 |

| Cash to long-term borrowings and notes payable ratio | 15.39% | 22.49% | 32.48% | 32.93% | 52.15% | 68.47% |

Source: Figures sourced from SK Telecom Investor Briefing: 2022 Q1 Results. Cash to long-term borrowings and notes payable ratio calculated by author.

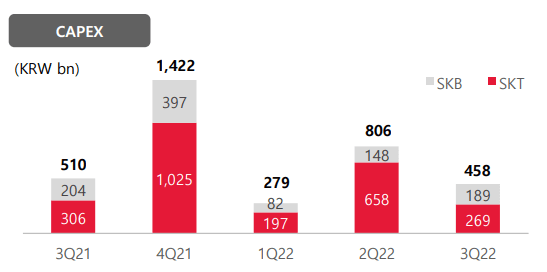

This has coincided with a lower level of capital expenditure as compared to last year:

SK Telecom Investor Briefing 2022 Q3 Results

In this regard, the fact that the company managed to increase its cash relative to long-term borrowings is an encouraging sign – as it means that SK Telecom has more liquidity to be able to cope with a potential drop in revenue and is not dependent on long-term debt to sustain its business.

In terms of performance metrics, we can see that churn has maintained a rate of 0.8% over the past year. Moreover, we can see that ARPU (or average revenue per user) has seen a slight decline from that of the same quarter last year. Additionally, 5G subscription growth continued to remain impressive, up by 44% from that of last year.

| Quarter | Monthly Churn | 5G subs | ARPU |

| 3Q20 | 0.9% | 4,263 | 30,051 |

| 3Q21 | 0.8% | 8,650 | 30,669 |

| 3Q22 | 0.8% | 12,468 | 30,633 |

Source: Figures sourced from SK Telecom Investor Briefing 2022 Q3 Results.

That said, growth on a percentage basis is down from 102% from 3Q20 to 3Q21 – which is expected as market demand starts to mature.

Additionally, while 5G subscriptions grew by 6.73% from 2Q22 to 3Q22, this was down from prior growth of 10.18% from 4Q21 to 1Q22.

In this regard, the cash position for SK Telecom continues to remain strong, but modest revenue growth appears to have led the stock lower since May.

Looking Forward

Going forward, aside from the effects of inflation potentially limiting customer demand – investors may continue to be concerned that the growth the company has been seeing in 5G demand could eventually level off.

While this is a concern, I take the view that the company’s balance sheet performance is highly encouraging, in that SK Telecom has reduced its long-term debt while continuing to bolster its cash reserves. Even if revenue growth remains modest in the short to medium-term, continued improvement in these metrics could mean further potential upside for the stock.

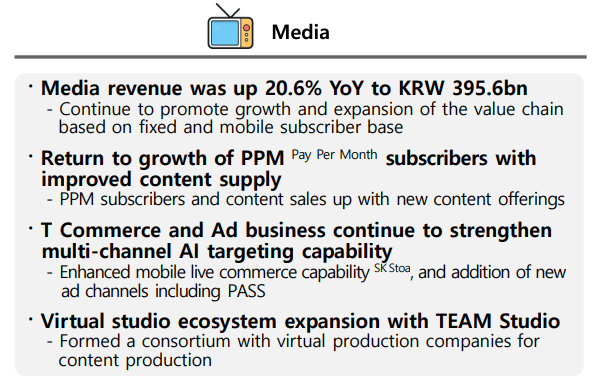

Moreover, SK Telecom’s performance across the Media segment has been quite impressive – up by over 20% year-on-year.

SK Telecom Investor Briefing 2022 Q3 Results

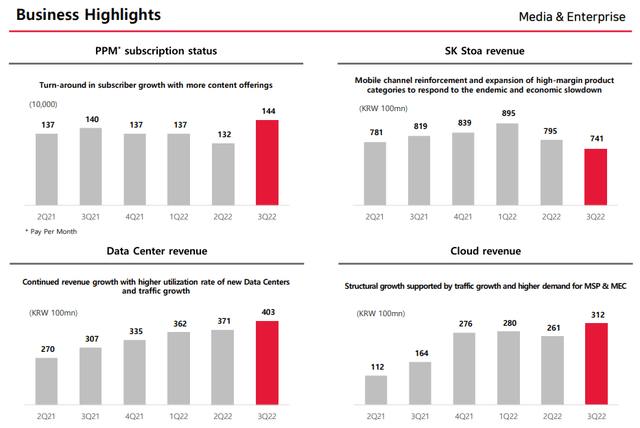

This is higher than the 10% growth that we saw for year-on-year Q1 2022 results, and we can see that growth in Data Center and Cloud revenue has been lifting the segment overall:

SK Telecom Investor Briefing 2022 Q3 Results

Conclusion

To conclude, SK Telecom has continued to show strong balance sheet metrics and while investors might have some concerns over modest revenue growth, growth across the Media segment continues to remain strong.

While the stock might see further downside if economic conditions deteriorate significantly, I take the view that the stock still has longer-term upside.

Be the first to comment