naphtalina/iStock via Getty Images

Summary

It’s been quite an interesting year for U.S. equities to say the least. Rampant inflation, war, slowing growth, and rising interest rates have wreaked havoc through equity markets across the world, and the U.S. was no exception. This month’s latest CPI report came in hotter than expected at 9.1% in June, which reiterated investor concerns that inflation is not slowing down. Even J.P. Morgan’s CEO Jamie Dimon made some harrowing comments last month about the future outlook for the U.S. economy, citing a “hurricane” ahead.

He might not be wrong. The S&P 500 is now down more than 20% since hitting an all-time intraday high of 4,818 at the beginning of 2022. Given all the macro uncertainty, it’s not surprising that we have seen many investors flee higher-risk premium asset classes such as equities in hopes of finding better returns in the future. One area in financial markets where I believe this is evident can be found at the Federal Reserve’s Overnight Reverse Repurchase Facility, or ON RRP for short, which I’ll explain in further detail later on in this article. While the surge in usage of ON RRP can largely be attributed to the ongoing collateral shortage of treasury bills, I think it may be potentially revealing a deeper problem at hand: too much cash was printed over the last few years.

Since the S&P 500 recently entered a bear market given all of the macro uncertainties while inflation continues to run hot, I believe investors could begin to reevaluate their portfolio allocations to ensure their net worth does not decline. Holding too much cash or low-yielding fixed income assets isn’t going to cut it in this environment of high inflation. I believe we could see money begin flowing into assets that perform better against inflation such as equities (and continue seeing flows into commodities/real estate). On top of that, the speed at which this could occur may be faster than we’ve ever seen given how much cash is on the sidelines currently. Now could be a great opportunity to begin investing in a broad-based ETF or mutual fund that tracks U.S. markets and my vehicle of choice would be the Vanguard Total Stock Market ETF (VTI). This vehicle is highly correlated with the S&P 500 at 0.99 and provides additional diversification outside of just large-cap companies.

The ON RRP Hit New Highs, So What?

For background, the Overnight Federal Reserve’s Overnight Reverse Repurchase Facility (ON RRP) is one of the various lending facilities offered by the U.S. central bank. In simple terms, it’s designed to assist financial institutions that are struggling to find places to invest excess cash overnight. Whether you’re a primary dealer, bank, money market mutual fund, or a government-sponsored enterprise, sometimes you end up with excess client cash. This money needs to be invested (in this case just overnight).

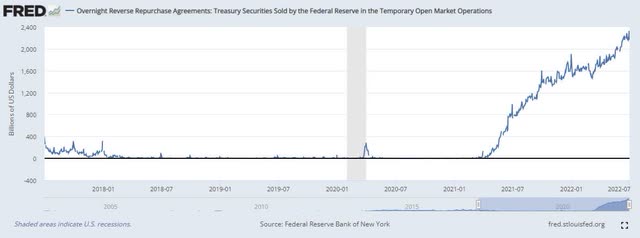

Unfortunately, there has a been collateral shortage of safe-haven assets such as treasury bills that have historically been used by money market funds to invest their excess cash. Since the Fed continues to reduce its Treasury General Account (TGA for short) balance, Treasury bill issuance has been low, causing a shortage. Rather than potentially earning nothing or even paying negative interest rates, institutions turn to the central bank which provides a floor to place excess cash. This has been a known problem for quite some time now and its evident by how much it has grown over the past year via FRED:

Figure 1: ON RRP Usage

Although the Fed is planning to reduce its mammoth balance sheet in the future and thus provide more collateral for money market funds, it does not mean markets are out of the woods yet. The ON RRP recently surpassed $2 trillion worth of cash being parked at the Federal Reserve overnight and while Wall Street expected this to happen due to the ongoing treasury collateral shortage, I still believe investors can interpret this as more than just a temporary issue. With inflation still elevated, any cash not invested at levels that exceed inflation will deteriorate in value. The ON RRP is only currently paying an annualized rate of 1.55% as of July 13th, 2022, implying that trillions of dollars continue to deteriorate every day.

At what point does the majority of this cash get reallocated to other asset classes such as fixed income or equities? And how much would flow into U.S. equity markets? Investing in fixed income is unlikely to earn above inflation currently given where 10-year and 30-year U.S. government bonds are trading. Equities have historically outperformed other asset classes such as fixed income and short-term money markets during periods of high inflation.

Why is so much money sitting at the front of the curve still? While I don’t have the answer to that, I believe it’s important to continue putting money to work in order to avoid your net worth declining as a result of high inflation. And I think the trillions of dollars losing value every day will eventually need to move into higher-yielding asset classes.

S&P 500 Vehicle Options

Whether you are looking to invest in an exchange-traded fund (“ETF”) or mutual fund, there are plenty of options that track the broader U.S. market or S&P 500. For a simple index-tracking fund, I think two important factors are 1) the provider’s reputation and 2) fee structure. Most low-cost funds will perform nearly identical to each other with minimal tracking error. It’s not something to overthink in my opinion, and investors should stick with the top providers such as Vanguard, Fidelity, State Street, and BlackRock just to name a few. As I mentioned earlier, my preferred vehicle choice currently is VTI, as it provides additional diversification, a reasonable expense ratio, has a strong reputation, and is down more compared to other S&P 500 ETFs YTD which could mean more upside potential. Figure 2 shows data for various ETFs and mutual funds as of July 13th, 2022.

Figure 2: S&P 500 Funds vs. VTI

| Name | Ticker | Expense Ratio | YTD Performance | AUM ($) |

| Vanguard Total Stock ETF | VTI | 0.03% | -21.53% | 235bn |

| S&P 500 Index | SPX | ——– | -20.33% | ——– |

| Fidelity 500 Index Fund | FXAIX | 0.01% | -20.32% | 340bn |

| Fidelity ZERO Large Cap | FNILX | 0.00% | -20.74% | 5bn |

| Vanguard S&P 500 ETF | VOO | 0.03% | -20.23% | 224bn |

| iShares Core S&P 500 ETF | IVV | 0.03% | -20.12% | 282bn |

| Schwab S&P 500 Index | SWPPX | 0.02% | -19.74% | 59bn |

Source: Author

Any of these options should suffice for an investor looking to gain exposure to U.S. markets or the S&P 500. ETFs could be a better option for investors who want the ability to trade intraday, which can be extremely useful in a fast-moving and volatile market like we’re in now. As I mentioned, the S&P 500 is now down 20% from its previous highs, making it unofficially in a bear market. Historically this is one of the best times to buy. Let’s see how that has paid off for investors who purchased after those declines. (Link here to see more information).

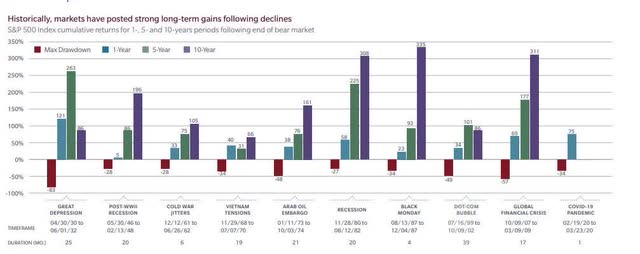

Figure 3: S&P 500 Performance After Bear Market

MFS Investment Management (MFS)

Historically speaking, the S&P 500 has performed very well following a bear market (defined as a more than 20% decline from previous highs). While most of these bear market recoveries took well over a year, that might not be the case in the future. For example, the March 2020 bear market recovery only took 1 month! Now while that time period was considered an unprecedented event with significant monetary help from the Fed, my point is that today’s (and future) markets will move much faster than in the past.

Conclusion

Timing in markets is always going to be one of the things we can’t control, nor should we try to do it with any precision. I don’t know when U.S. equities will hit new all-time highs. Neither does Warren Buffett or Jamie Dimon. It could be tomorrow or months before a turnaround begins. However, I can say with confidence that if history is any indicator, we will see the S&P 500 surpassed its previous high of 4,524 at some point in the future. U.S. markets have proven time and time again to outperform most asset classes despite the seemingly never-ending negative catalysts and bearish outlooks we’re experiencing now.

There are a lot of indicators out there that investor fear and risk-aversion could be close to peaking (ON RRP hitting all-time highs, S&P 500 entering a bear market, consumer sentiment at decade lows). While I expect volatility to remain high in the near term, this could be a great time to begin adding or increasing an allocation to U.S. equities. As I mentioned earlier, today’s markets can move at a speed most aren’t accustomed to. 20% moves in a primary index in a couple of weeks is not uncommon. Seeing a record amount of cash on the sidelines through the Fed’s Reverse Repo Program now could indicate that things will move even faster in the future. By the time you think it’s time to add to an asset class, it’s too late. Investors miss out on significant gains by trying to time markets and not adding at market lows.

Be the first to comment