Zontica/iStock via Getty Images

Investment Thesis

Chewy (NYSE:CHWY) has seen its stock pick up interest in the past month, with its shares increasing more than 50% in the past month.

Investors and analysts now believe that Chewy’s profitability profile could notably improve. However, I’m not fully convinced that’s the case.

I explain I’m cautious on Chewy while highlighting both bullish and bearish scenarios.

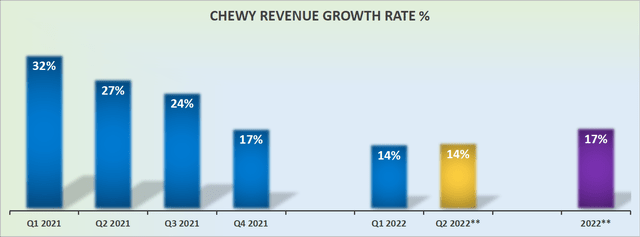

Revenue Growth Rates Will Slow Down, But

This is the setup that investors are facing. At the most surface level, investors have come to terms with the fact that Chewy’s fastest growth rates are now in the rearview mirror.

I believe that’s a generally accepted view. During the pandemic, there were multiple tailwinds coming together that lead to a period of elevated revenue growth rates. However, that’s now old news.

Moreover, Chewy is now more than lapping the ”stay at home period”, and what we start to see as Chewy approaches the second half of fiscal 2022 will be what could be perceived as a more normalized environment.

However, there’s a big but in the bullish investment thesis. Is H2 2022 truly a normalized environment? There’s high inflation, there’s recession fears, uncertain impacts from the rising interest rate environment, not to mention a slowing economy.

How does this all bode for a company whose business model is one of discretionary convenience?

I recognize that bulls would push back, noting that for many families, their pets are sometimes even more important than their children. There’s nothing discretionary about their pets.

While I recognize that insight, let’s also keep in mind that pet owners still have countless cheaper food alternatives to Chewy.

So again, yes, we are about to enter a more normalized period in H2. Yet, I’m still not sure that this normalized period is being fully factored into analysts’ expectations. For example, consider the following:

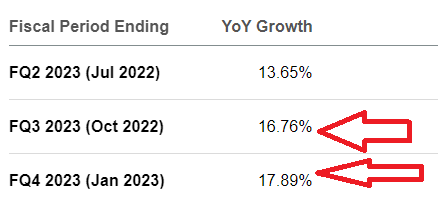

Analysts’ revenue estimates

As you can see above, analysts are still expecting that Chewy’s revenue growth rates will be reporting sequential accelerating revenue growth rates. While there’s little doubt that H2 2022 will be up against much easier comparisons than H1 2022 was up against, I’m not convinced of this setup.

On yet the other hand, I question if this matters? In essence, how much of these insights have already been factored into Chewy’s valuation? Something that I’ll soon address. But before that, let’s turn to discuss Chewy’s pricing power.

Thinking Through How Sticky Chewy’s Revenues Could Be

Any time one wishes to get insights into a company’s prospects, look no further than its customer adoption figures.

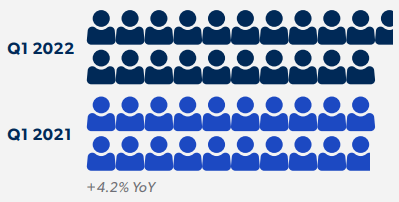

CHWY Q1 2022 shareholder letter

What you see above is that the number of customers was up 4% y/y. That’s hardly commensurate with a high-growth platform. Yes, that doesn’t speak of the pricing power behind Chewy’s convenient offering.

But I believe that when it comes to appraising a company’s business model, a business that resonates with a large and growing group of customers is more compelling than one that has to grow its revenues through bigger average ticket sales.

For their part, Chewy highlights that its Net Sales per Active Customer (”NSPAC”) was up 15% y/y during Q1 2022 stating that ”NSPAC is a powerful indicator and input to our long-term revenue growth”.

While I recognize this characteristic, pricing power, I don’t believe that is indeed reflective of Chewy’s value proposition. Simply put, I don’t believe that Chewy has all that much pricing power.

On yet the other hand, Chewy’s Autoship service, its recurring revenues from repeat orders, now reaches 72% of total revenues. This is very bullish and this positively reflects a sticky revenue stream.

In fact, Chewy makes the case that its pricing power isn’t immediately obvious from the outside.

Chewy proclaims that newer customer cohorts spend significantly less than its older cohorts. More specifically, newer cohorts spend less than $200 per year on the platform while its oldest cohorts spend nearly $1,000.

That being said, even while recognizing the progression of older cohorts, I question whether, in a tougher economic environment, all groups will turn out to be more elastic with their spending? Could a period of tightening see reduced spending on Chewy?

Next, we’ll move on to discussing its profitability profile.

Bearish Consideration: Could Chewy Become Unprofitable In H2 2022?

Another blemish on the bull case is that Chewy’s profitability margins are very tight. For Q1 2022, its EBITDA margins stood at 2.5%.

Accordingly, not only is Chewy having to endure slowing revenue growth rates, but it has very little room from a margin perspective. For a business with very high fixed costs, this leaves Chewy on the receiving end of negative operating leverage.

What’s more, nearly needless to say but, EBITDA is not an accurate reflection of Chewy’s profitability. In fact, from a GAAP perspective, the business fares even worse, with a net margin of 0.8%.

Hence, if Chewy was reporting very tight profit margins during the recent favorable environment, I have to minimally question whether or not Chewy will end up turning unprofitable over the coming several quarters?

CHWY Stock Valuation – Difficult to Value

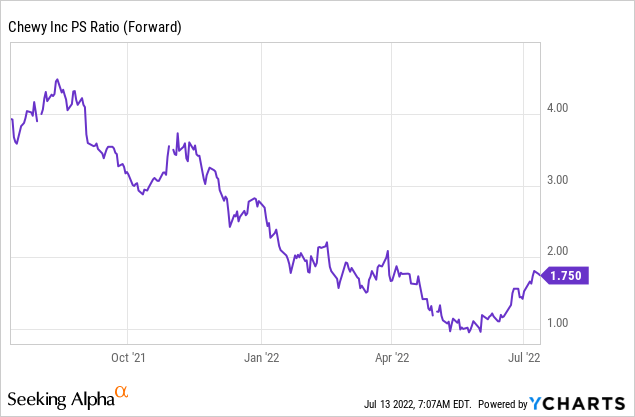

Chewy is priced at less than 2x forward sales. That’s clearly a very inexpensive multiple relative to where the business was getting valued last year.

As you can see above, previously, Chewy was being priced at 4x forward sales. However, knowing what a stock was previously being valued at in a very different environment is not instructive of what it should now be valued going forward.

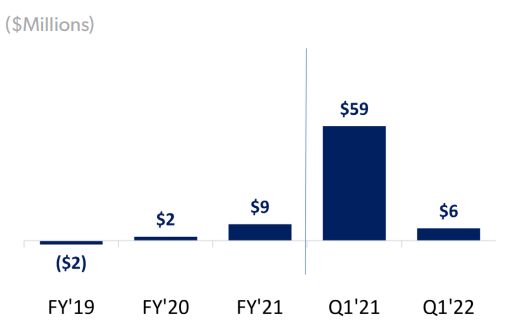

CHWY Q1 2022 shareholder letter

Ultimately, when it all boils down, it’s a question of how much free cash flow can Chewy’s sustainably make over the next one to two years.

Can Chewy get close to $100 million of free cash flow? I’m not sure. But assuming that it could, that would put Chewy priced at about 180x forward free cash flow.

The Bottom Line

The bullish case here has to be based on one of two elements. Some variation of what Needham puts as the bullish case for Chewy being an inexpensive stock given that ”profitability is inflecting higher”.

The other notable bullish aspect could be that Chewy has seen its share sell-off materially already in the past year, and much of the enthusiasm for the stock has already washed out.

On the bearish side, the stock clearly trades at a very high multiple to future free cash flow.

On balance, I’m neutral on this stock.

Be the first to comment